Tradesight Forex Pick Review for 10//27/10

Not too many triggers off of our calls today, but here is the review from the Tradesight Forex report of the GBPUSD short, which triggered twice:

Triggered short at A, went 45 pips exactly to B and reversed. We tend to take our partial at the 45-50 pip area if there is that much room between the Levels, so you might have covered a piece depending on where you put the order. But, for counting purposes, we'll say that it just stopped. I then said to re-enter in the morning, and it triggered at C and hit first target at D and more. Holding short with stop over LBreak at the moment:

Tradesight Stock Picks Review from 10/26/10

Off the report, ROST triggered (with market support) and went enough for a partial but that was it:

GPRE (with market support) did a little better and stayed in the money all day:

AVGO (with market support) also worked fine:

TIVO (with market support) didn't work:

GSIC (with market support) worked:

XRAY (with market support) didn't work:

MBFI (without market support) didn't work:

In the Messenger, COST (with market support) worked:

FSLR (with market support) didn't work:

AIG (with market support) triggered very late, worked, but didn't have time to do much:

AMZN (with market support) worked enough for a partial:

As usual, we sum it up comparing the win/loss ratio on the trades that triggered WITH market support. Ten trades triggered with market support. Seven of them worked, three did not. Only a couple of the trades went far in a dull day in the market after the first hour.

Tradesight Stock Market Preview for 10/26/10

The SP gained 2 points on the day. Some possible technical damage was done because the day’s candle settled under the opening price. This is always a cause for concern at range high which is the current condition. The 13 exhaustion signal is still active since the risk level (magenta line) remains unchallenged.

Naz advanced 4 handles but like the SP, it has the same potentially bearish condition. Price was higher on the day but settled below the open. This price pattern is sometimes known as a camouflage sell signal.

Multi sector daily chart, note the relative weakness of the banks:

The XAU was top gun, up 3 on the day. Since the price channel has suffered a downside beak, the chart is short-term bearish until new highs are recorded. The May highs would be a reasonable retracement objective.

The SOX was the standout performer for the Naz side. Price broke above the recent highs and held most of the gains on the day. The 2009 high is the next price objective.

The OSX remains trapped the recent price range. There is nothing new technically but the lack of performance in light of Monday’s weakness in the $US is of concern.

The BKX continues to feel the wrath of the weak dollar. This group continues to be a source of funds. Index member and financial leader BAC recorded an new 52 week low.

Oil remains boxed up:

Gold has retreated back into the price channel but has yet to settle below it. Until the price channel is broken, the recent price action is corrective and not a reversal.

Tradesight Stock Trigger Recap for 10/25/10

It was one of those sessions where everything that triggered worked, even without market support.

Off the report, our Top Pick ADSK (with market support) worked great:

ATHR gapped over the trigger, no play.

In the Messenger, RIMM (with market support) worked great:

AMZN (without market support) short worked great for the gap fill:

There were several other calls made, but none of them triggered in what ended up being a flat afternoon. So that's 2 for 2 nice winners that triggered WITH market support.

Tradesight Forex Calls Recap from 10/25/10

Now THAT'S what we like to see!

Including the three Value Area plays that we pointed out in the Messenger yesterday, we had five winning trades to start the week just as we went back to full size. That's good stuff. See GBPUSD, EURJPY, GBPCHF, and USDJPY below. All Value Areas triggered at the correct time for the pair.

New calls tonight and Chat. Still working on the last pieces of the new site to get everything connected.

EURUSD:

USDJPY:

Clean Value Area in the Asian session from A to B, entry was under the Pivot (dark blue line) which was just under VAH:

GBPUSD:

Main call triggered early at A, hit first target at B, raised stop and stopped higher, but all of that was pre-European session. I therefore made additional calls and the short triggered at C, hit first target at D, lowered stop in the morning and stopped last piece at E, right over the entry:

USDCAD:

AUDUSD:

NZDUSD:

GBPJPY:

EURJPY:

Value Area worked here from A to B on the European session for about 30 pips, and look how precisely it hit the VAL:

GBPCHF:

Same here, very precise, right at the start of the European session from A to B for 50 pips:

Tradesight Stock Triggers Recap from 10/21/10

As usual, this section of the report reviews yesterday's trades. We note whether each triggered with or without our market support guidelines, and we recommend that people focus on trades that trigger with market directional support as those have the highest probability of working. We then summarize the results of those trades at the end of this section.

The top five long ideas off of the report all came within five cents of their triggers and DID NOT trigger, which is interesting and unusual.

BMRN (without market support because of first five minutes) triggered out of the gate and went enough for a partial, but would have been hard to get:

VLTR (with market support) triggered short, a partial, no risk, not much there:

Rich's AAPL (without market support) triggered short out of the gate, went a point, so worked, but then reversed sharply:

Rich's AMZN (with market support) triggered long and worked great:

FSLR (with market support) triggered long and worked great:

AMGN (with market support) triggered short and worked:

Rich's FCX (without market support) was a slightly different style of play as he discussed in the Lab, triggered short and worked:

Rich's second AAPL (with market support) trade triggered short and worked fine:

Rich's FAS (with market support) didn't work:

Rich's WYNN (with market support) short worked fine:

Rich's CREE (with market support) short, no risk, barely enough for a partial:

In total, that's 7 triggers with market support. 5 worked great. 2 worked a little, no risk, just didn't go anywhere. Not a bad week.

Tradesight Futures Calls Update

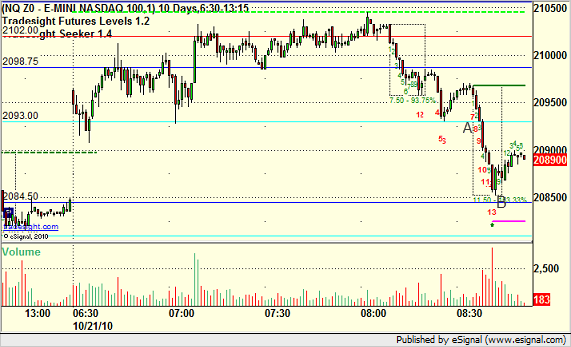

Our futures calls service continued to deliver this week with another 3 out of 3 winners Thursday morning, bringing the total for the week to 8 winners out of 10 triggers. I'd like to focus on one of today's calls from an educational perspective, which was an NQ using a key Value Area level in a unique way.

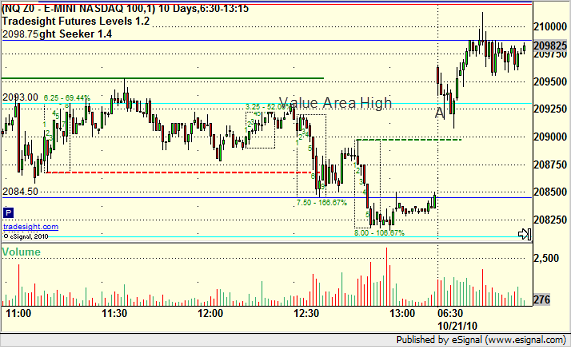

Typically, in the futures and Forex markets, we use Value Areas for entry the first time of the day that the Value Area is breached. However, that doesn't mean that the levels can't be useful later in the session, particularly if the number is addressed by the market. Let's go through four charts that outline today's NQ call in 1-minute bars. In the early action, the NQ opened above the light blue (cyan) Value Area High line and breached into the Value Area at A:

This was not a trade call that we made. However, about 15 minutes later, the market again address the Value Area High level almost exactly and bounced off of it:

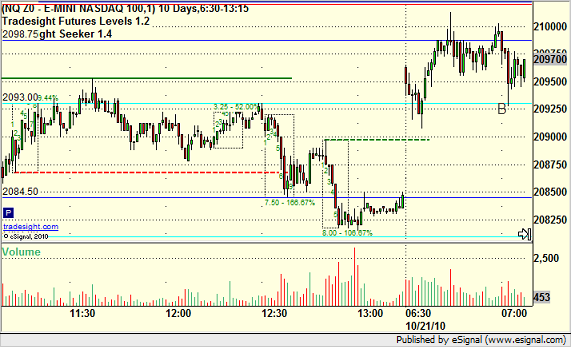

This means that the market has once again identified this key Level, which we had coming into the session, as support or resistance (in this case, support). From there, we made a call that is good for the rest of the day, which was to sell short the NQ at 2092.50 with a stop over 2095.50 and a first target to cover half at 2088.50.

More than an hour later, the NQ came back and again EXACTLY addressed the Value Area High level at point C on this chart:

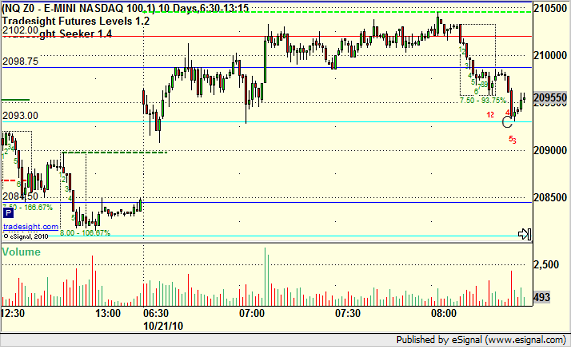

These are the types of trades that you don't want to miss if they trigger, and here's how it went once it did:

The move from A (trigger) to B (around S1) was more than enough to hit our first target and adjust our stop on the second half of the trade. Note that the low was also called precisely by the 13 count off of our Tradesight Seeker tool.

As usual, you can get a two week trial of the calls. Come back this weekend for the launch of our brand new website, Tradesight 4.0!

Tradesight Stock Market Preview for 10/21/2010

SP bounced back 11 handles on the session. The exhaustion signal is in place and the burden of proof is on the bulls. The MACD remains extended and is waiting to release some downside energy.

Naz was up 16 and managed to fill the Monday-Tuesday gap. This could be a key technical development since there are now no gaps left overhead.

Multi sector daily chart:

The top sector on the day was the XAL airline index, up more than 5%. Like the XAU a few days ago, price has accelerated up and away from the channel and is getting extended.

The XAU outperformed the broad market and was up 3 on the day. Technically this was just a bounce since price settled in the lower half of yesterday’s range. Also, price settled under the 2009 high.

The OSX has the same condition as the XAU settling in the bottom half of the prior trading range. One notable feature is that today the $US was almost as weak as it was strong yesterday. One could make the leap that equity traders pricing in $US strength, not more weakness that has been the dominant trend.

The SOX pivoted around the 200dma--nothing new technically.

The BKX was the real laggard on the day. This key index was much weaker then the broad market and settled below all the major moving averages.

The biotechs closed right at the recent range low. Monday’s advance could wind up being a wrong way break and an indication of failure. The next two candles will be key.

Oil still trapped in the recent range:

Gold bounced but never penetrated the upper half of the prior day’s trading range. The short term price action remains negative. If the lower price channel is penetrated, look out below.

Tradesight Stock Trigger Review for 10/20/2010

Here's a list of all of our picks for the stock service from Wednesday, October 20. Each is denoted as triggering with or without market support. Tradesight recommends taking trades with market support. We were 7 for 7 today in those trades.

Off of the report, only NDAQ (with market support) worked, no risk, but barely made it $0.20:

In the Messenger, RIMM (with market support) worked:

Rich's CREE (with market support) worked:

Rich's AAPL (without market support) short didn't work:

Rich's GOOG (with market support) worked for 3 points:

My AMZN (without market support) didn't work:

My AMGN (with market support) went enough for a partial:

Rich's WYNN short (without market support) worked for over a point:

Rich's AMLN (with market support) worked enough for a partial:

Rich's AAPL short (without market support) worked for over a point:

And GS long (with market support) was working but ran out of time, so just enough for a partial:

All told, that's seven triggers with market directional support, which are the ones that we take. Three worked great, four worked enough for partials. None of the seven didn't work.

Forex Trade Recap 10/20/2010

EURUSD:

Perfect Value Area in the European session triggered at A and crossed to the Value Area High at B for 120 pips:

GBPUSD:

This one is unfortunate. There was a very early short trigger at A. Then after B but before C, we stopped out of the last half of our short from the prior session for 150 pip winner. Then the new long call triggered at C, and unfortunately stopped out on the dip to D (which also triggered part of the short again). This is unfortunate because without the dip to D, the long would not have stopped, and the trade ended up working beautifully for almost 200 pips. If you were awake, you could have retaken, but I was not:

NZDUSD:

Value Area triggered at A and almost covered Value Area to B: