Futures Calls Recap for 12/19/14

No calls for expiration Friday. The markets did push up in the afternoon and you'll note the Comber 13 sell signal on the ES right at the high of the session, which led to a move back near the VWAP.

Net ticks: +0 ticks.

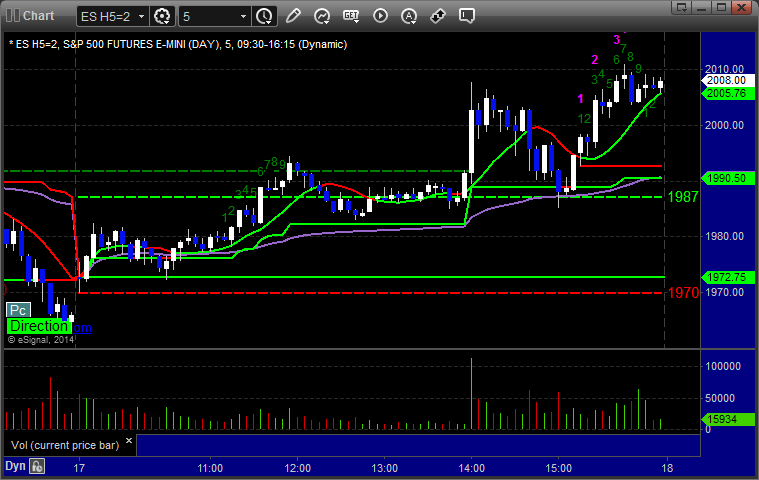

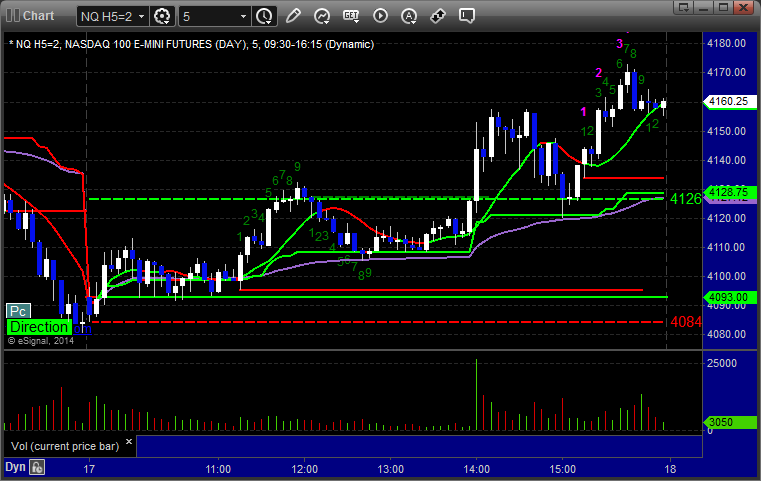

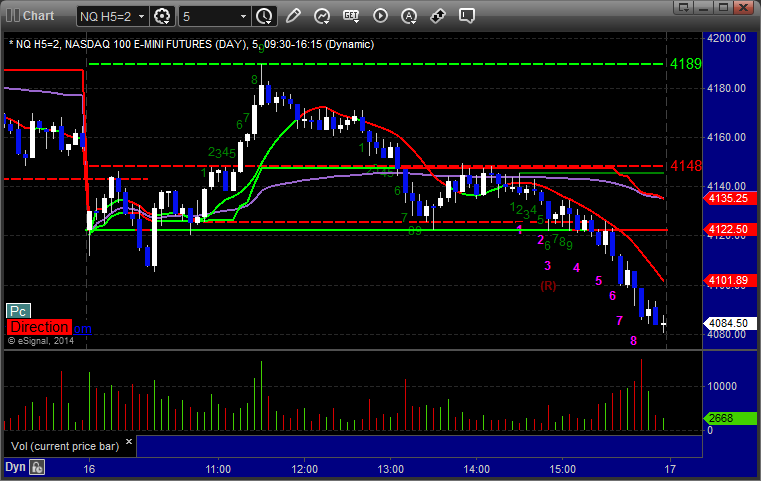

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 12/19/14

After looking at the setups carefully and not seeing much, I decided not to post calls due to triple expiration, which usually slows down Forex as well as everything else. It ended up being the right move, as the GBPUSD and EURUSD stuck in 40-50 pip ranges for the overnight session. However, the EURUSD was lined nicely against the Pivot from that trading, so I went ahead and put a call in in the morning, which ended up being a waste. See that section below. We will be going to half size for the rest of the year for the Holidays as things are going to slow down.

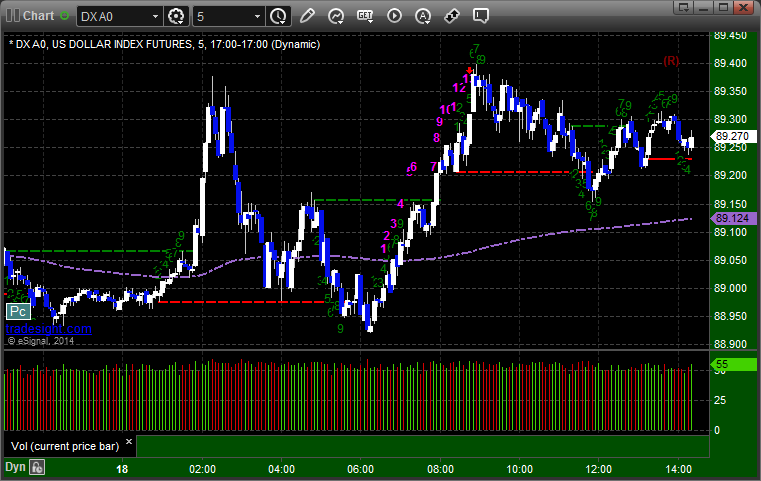

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

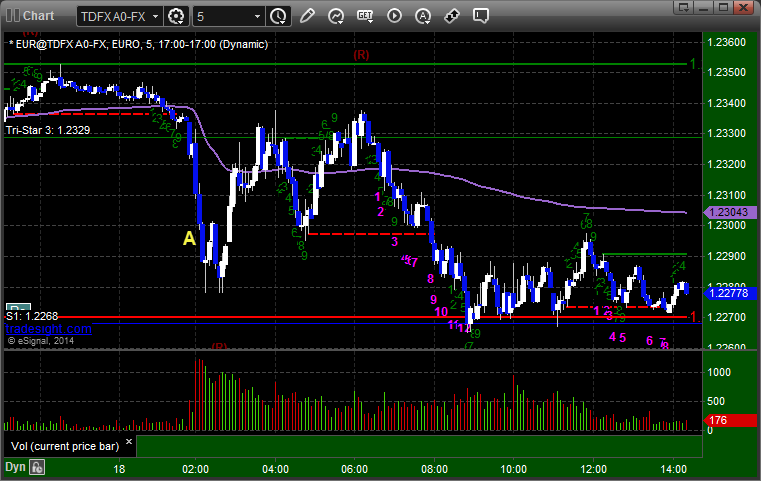

EURUSD:

Triggered long at A and stopped:

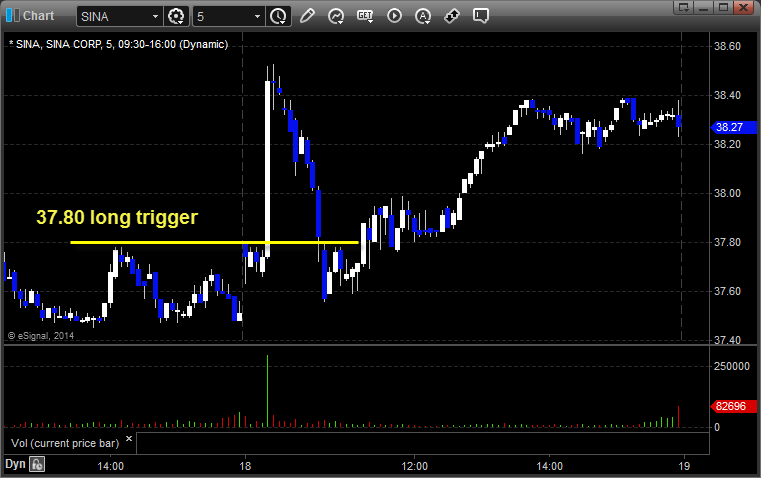

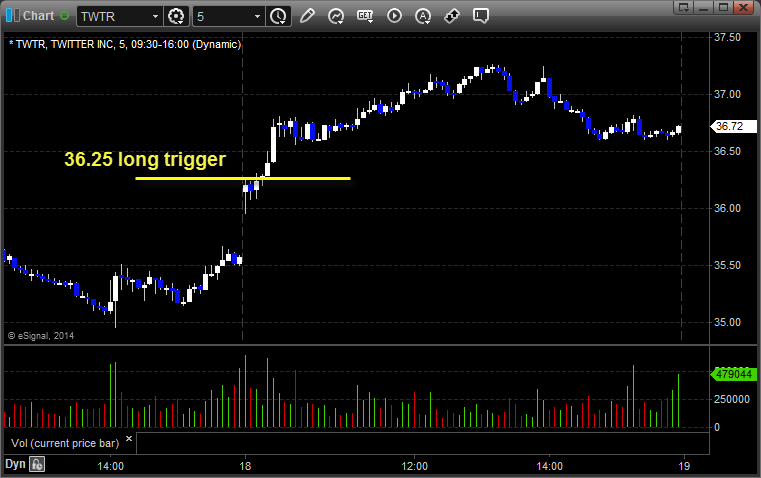

Stock Picks Recap for 12/18/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, SINA triggered long (with market support) and worked:

Rich's RIG triggered long (without market support) and didn't work:

His NFLX triggered long (without market support) and worked:

TSLA triggered long (with market support) and worked:

TWTR triggered long (with market support) and worked:

Mark's BABA triggered long (with market support) and didn't work:

Rich's BABA triggered short (with market support, which changed in the 15 minutes after the long trigger) and worked:

GILD triggered long (with market support) and worked:

Mark's MYL triggered long (with market support) and worked:

Rich's FB triggered long (with market support) and didn't work (worked later):

His FSLR triggered long (with market support) and worked:

His AAPL triggered short (with market support at low of day) and didn't work:

His APA triggered short (without market support) and worked:

His REGN triggered long (with market support) and worked enough for a partial:

In total, that's 11 trades triggering with market support, 8 of them worked, 3 did not.

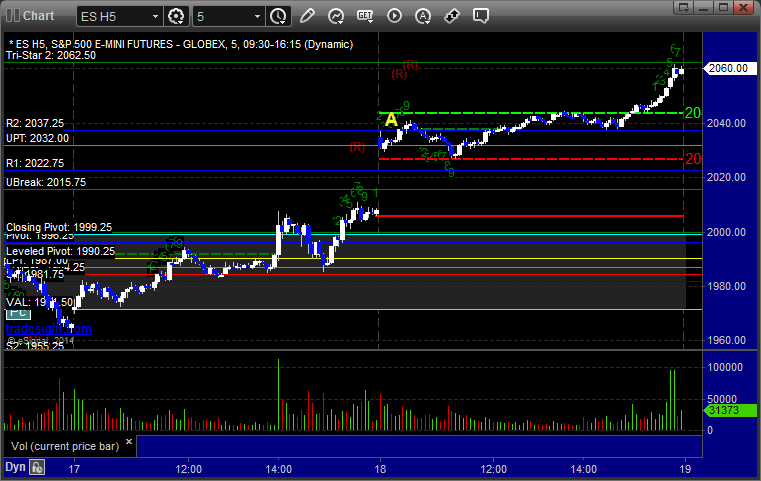

Futures Calls Recap for 12/18/14

Two winners to the first targets only, one on the ES and one on the ER/TF. We also had winners on the ES Opening Range play again. The markets gapped way up and ended up pushing higher, never really breaking the opening level all day, so a classic "Gap and Go" session. NASDAQ volume closed at 2.0 billion shares, down a bit from the last couple of days. Friday is triple expiration.

Net ticks: +6.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 2039.00 and hit first target, stopped the second half under the entry:

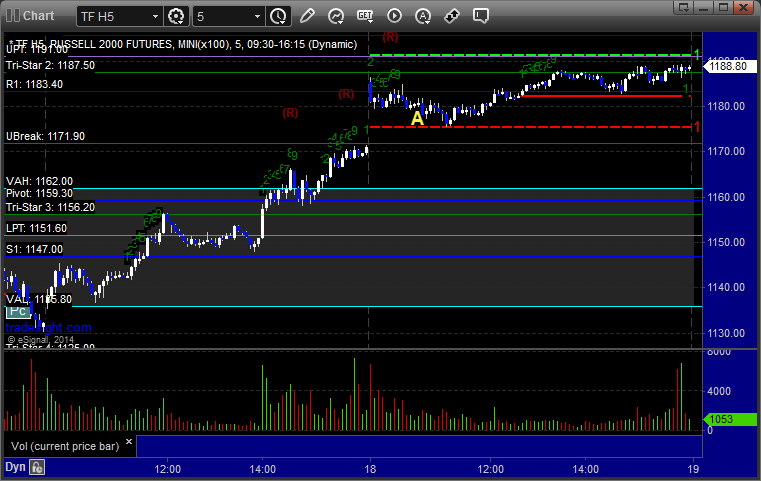

ER:

Triggered short at A at 1179.10, hit first target for 9 ticks, stopped second half over the entry:

Forex Calls Recap for 12/18/14

Two losers for the session and it really feels like Forex is slowing down for the Holidays here as well. Tomorrow is triple expiration, and even though it doesn't mean anything directly for Forex, currency futures do expire, so Forex is generally slow.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped:

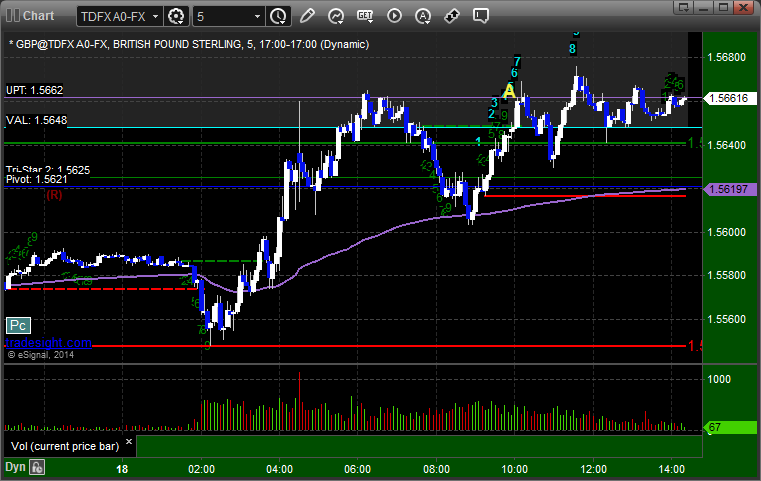

GBPUSD:

Threw in an extra call as the year is winding down. Triggered long at A and stopped:

Stock Picks Recap for 12/17/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CSIQ triggered short (just barely without market support...but you take this pattern for something anyway) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (with market support) and worked great:

BIDU triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

FSLR triggered short (without market support) and worked enough for a partial:

Rich's SLB triggered long (with market support) and worked:

Rich's TSLA triggered long (with market support) and worked:

His YHOO triggered long (with market support) and eventually worked:

Rich's NFLX triggered long (with market support) and worked:

His AMZN triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not, and the best pattern of the day, CSIQ worked without market support.

Futures Calls Recap for 12/17/14

The opening range play on the ES and the Institutional Range Play both worked well, didn't need another call. Markets gapped up and kept going, spiked on the Fed and then retreated, and then rallied into the close on 2.1 billion NASDAQ shares.

Net ticks: +0 ticks.

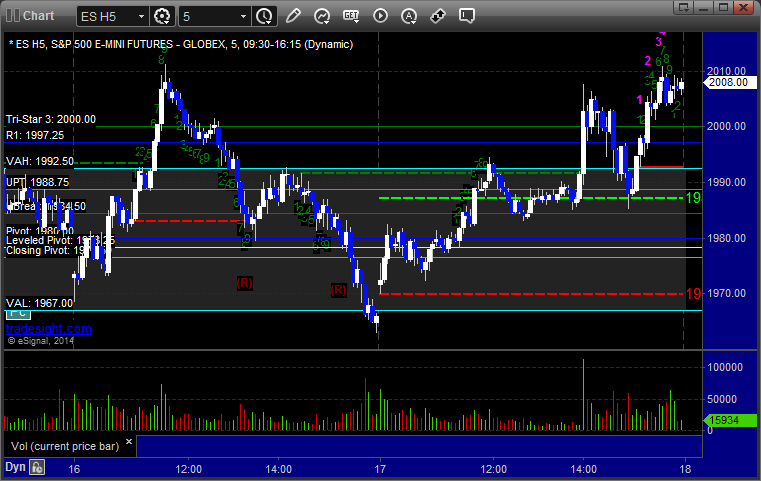

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 12/17/14

Another winner for the session on the GBPUSD, although we lowered our size ahead of both the CPI and the Fed announcement. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, closed second half at entry at C in the morning when it was there (if you were awake, you move the stop over entry long before):

Stock Picks Recap for 12/16/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, OUTR triggered long (with market support) and worked enough for a partial, but was pretty thin at the trigger:

OREX triggered long (with market support) and didn't work:

PLCE triggered long (with market support) and didn't work, but was also strangely thin at the trigger:

SGEN triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

KNDI triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (without market support due to opening 5 minutes) and worked:

His YHOO triggered long (with market support) and didn't work:

His PXD triggered long (with market support) and worked great:

Mark typo'd the SNDK, it had already hit 98.52 when he posted the long over 98.50, if you used the breakout number it worked:

Rich's TSLA triggered long (with market support) and didn't quite work enough for a partial, although the actual trade call was meant for a much earlier play in the first 30 minutes for a gap fill:

His SLB triggered long (with market support) and worked:

Mark's ISIS triggered long (with market support) and worked:

Rich's AAL triggered short (with market support) and worked:

In total, that's 9 trades triggering with market support, 5 of them worked, 4 did not.

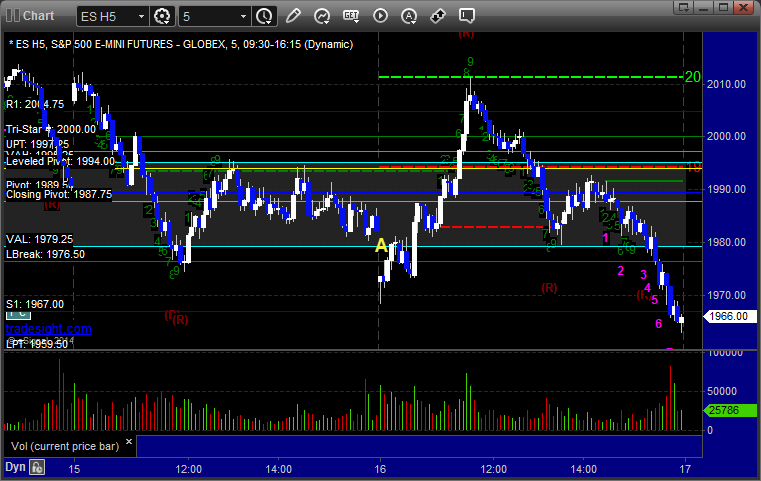

Futures Calls Recap for 12/16/14

A trade that stopped twice on the ES, but then would have worked the third time. Markets gapped down, headed up slowly, bounced hard over lunch when oil recovered sharply, but then came all the way back to the lows on 2.1 billion NASDAQ shares.

Net ticks: -14 ticks.

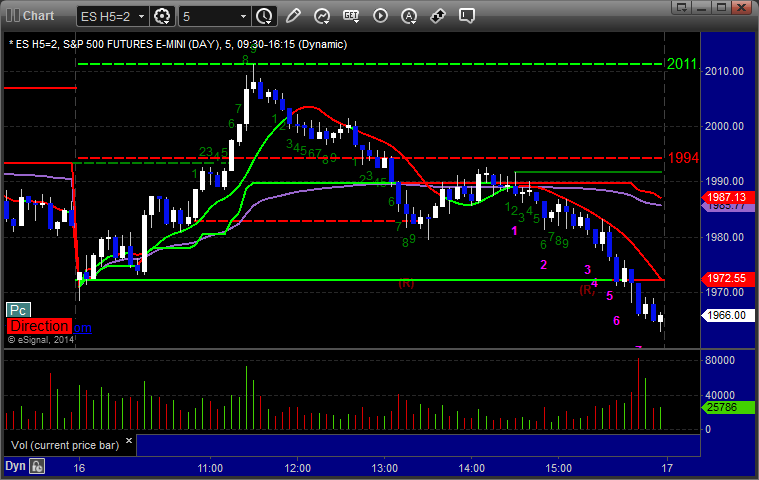

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1977.00 and stopped (twice). Third time would have worked but we usually officially cap it at two: