Forex Calls Recap for 12/29/14

A small winner to start the Holiday-stunted week, but we're using half size anyway. See EURUSD section below.

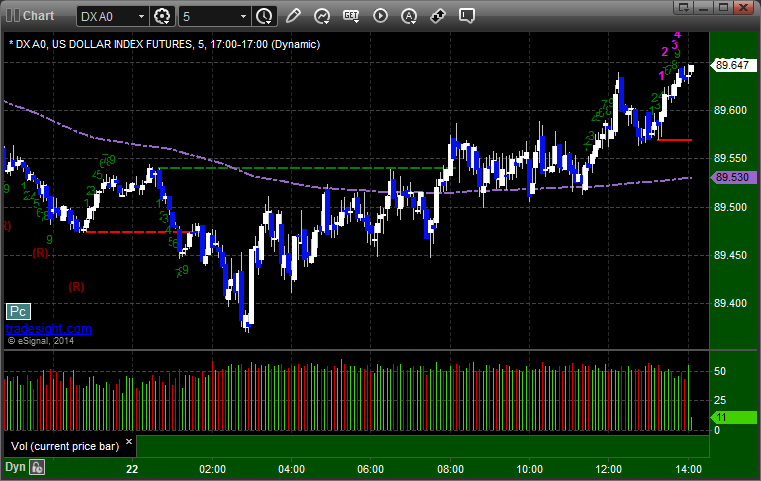

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and gave you until B to enter, hit first target at C and stopped second half under entry at D in the morning:

Stock Picks Recap for 12/26/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, a couple of calls early, but nothing triggered until late in the afternoon when we were already gone.

In total, no trades.

Futures Calls Recap for 12/26/14

Despite the fact that the ES traded in a 5-point range for the whole session (and NASDAQ volume was only 800 million shares), the Opening Range plays still worked on the ES and NQ. Other than that, no calls with the Holiday environment, and maybe no more this year. We will see about Tuesday and Wednesday.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 12/26/14

No calls for the session, and that's probably a good thing with the GBPUSD in a 25 pip range and the EURUSD not much better. I've posted all charts below.

I will record a preview for next week and we will post trades Sunday and Monday for sure, with Tuesday and Thursday evenings depending on what I see. The markets are closed Thursday day, so no calls Wednesday night.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

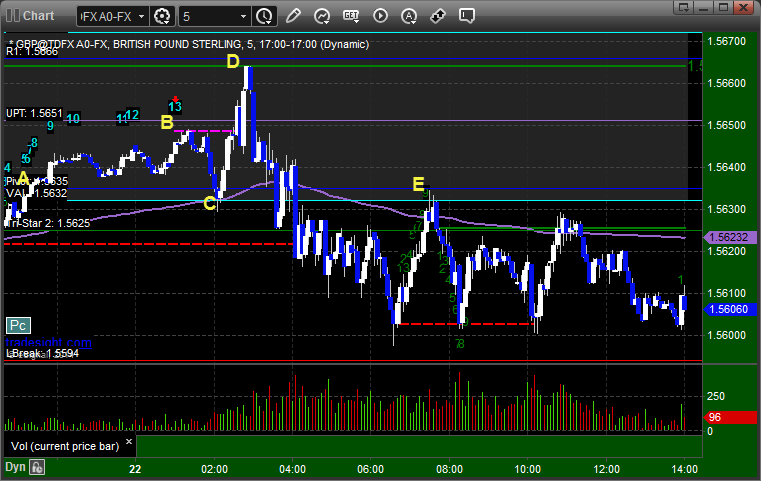

GBPUSD:

Stock Picks Recap for 12/23/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls triggered as PLCM gapped over.

From the Messenger/Tradesight_st Twitter Feed, TWTR triggered long (without market support) and didn't work:

Rich's PCLN triggered long (without market support) and didn't work:

His FB triggered short (with market support) and worked:

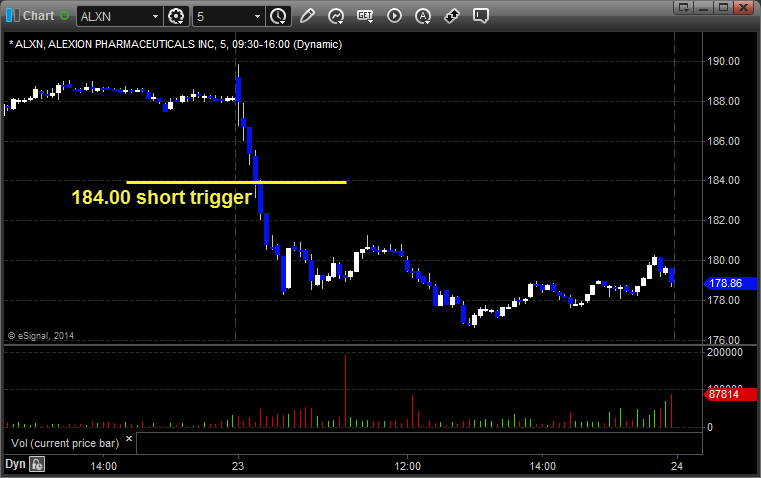

His ALXN triggered short (with market support) and worked:

His APA triggered long (without market support) and didn't work:

His TWTR triggered short (with market support) and didn't work:

His VXX triggered long (ETF, so no market support needed) and didn't work:

His FB triggered short (without market support) and didn't work:

His BABA triggered long (without market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

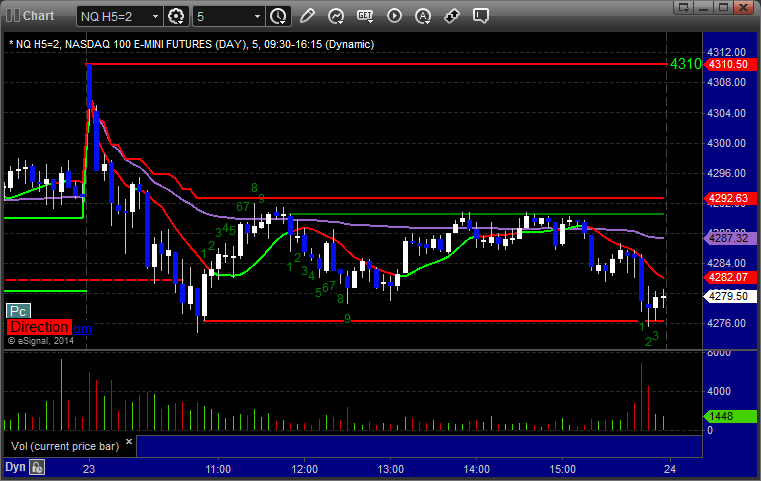

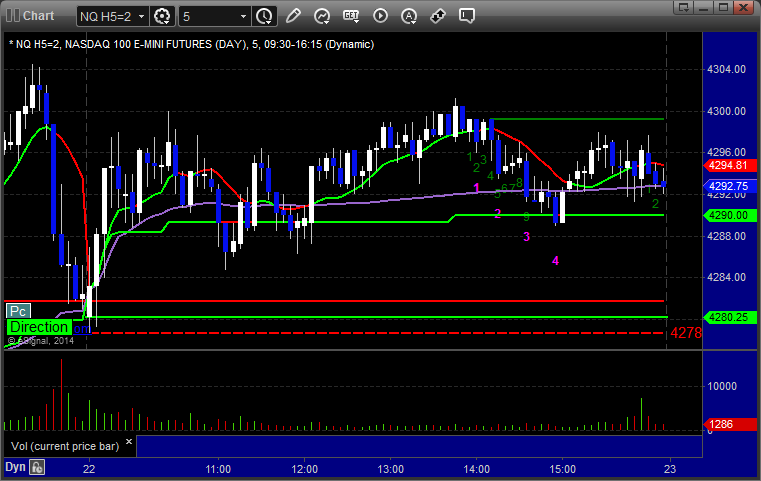

Futures Calls Recap for 12/23/14

The Opening Range plays worked again (we will actually take a look at them in the next section for once) on the ES and NQ, so that was enough in another light volume day ahead of the Holiday. Done for the week, although there will be Futures Levels for Wednesday's half day and then Levels Friday based on Wednesday's half day session.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Opening Range Plays:

Since we aren't really making other calls, let's look at the Opening Range plays on the ES and NQ for Tuesday. Again, the idea is to let the contract establish the opening 2 minutes of play, then go long if a 1-minute candle closes above that range or go short if a 1-minute candle closes below that range. You use the other side of the opening range as the stop and take a partial (half) off around 6-10 ticks. Once you have a partial, the stop goes over the closer side of the Opening Range.

So, on the ES, triggered short at A, took a partial at B, and closed second half at C breaking back into the Opening Range:

On the NQ, triggered short at A, took a partial at B, never really gave you another place to need to exit until either the first real bounce at C (20 ticks) or the Seeker Startup 9-bar count at D (around 44 ticks):

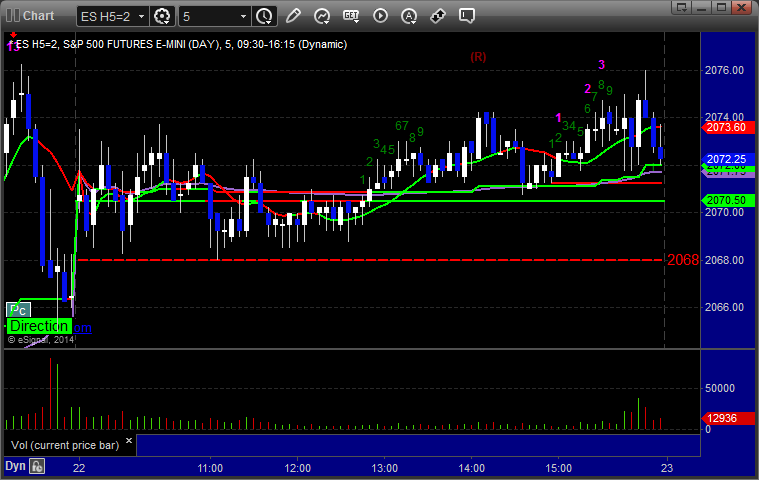

Futures Calls Recap for 12/22/14

Nothing worth taking as the markets gapped up and stuck in about a 5-point ES range for the session on 1.5 billion NASDAQ shares. We might be done with official sample calls for the year, although the opening range plays might still work.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 12/22/14

One loser for half size on the GBPUSD, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, and let's do the walk through here. The Comber 13 sell signal at B led to a rollover, but it never stopped the trade at C at the low. Ran up to R1 at D but that was not the first target or quite enough. It then stopped out and came back up to test the Pivot exactly at E but didn't retrigger. Lots of technical action, but all in a narrow range for the Holidays:

Stock Picks Recap for 12/19/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (without market support) and worked:

His NKE triggered short (with market support) and worked:

His NTAP triggered long (without market support) and worked:

His BABA triggered short (with market support) and didn't work:

His BIIB triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 12/19/14

No calls for expiration Friday. The markets did push up in the afternoon and you'll note the Comber 13 sell signal on the ES right at the high of the session, which led to a move back near the VWAP.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES: