Computer Setup 2024

Every year or two, I reassess my technology and upgrade my equipment to make sure that I have what I need to be a successful trader. There are a lot of components to a machine, your Wi-fi, your Internet Connection, and more that have an impact on your chances of success.

This year, I made a major leap across the board and everything I have is now basically instant.

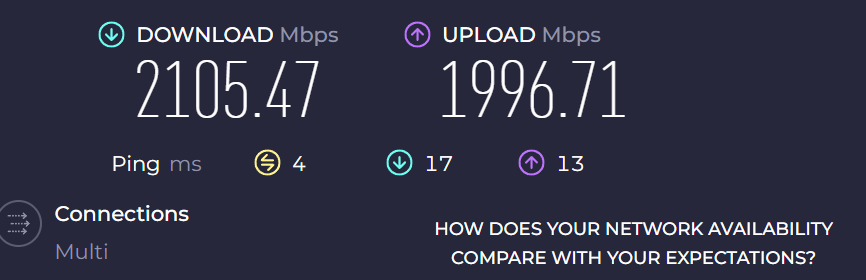

Let's start with the Internet Connection. If it is available in your area, Cox or any cable modem Gigabit FIBER connections are the best. Sometimes, you can only get 1 GB, and that might even just be download, not upload, if it comes over Coax, but the reality is that 90% of what you do is download. You request something and then it drops the data/file on you and that's the bigger piece. However, this year, I had Cox run the Fiber line to the house and now I have 2 Gigabit both ways:

Having said that, is that overkill? It can be. I have kids at home that stream constantly (and let's face it, a wife that bing watches TV when she's home), but yes, this could still be overkill. Having said that, if I loaded NinjaTrader with my Market Analyzer before when I had 1 Gigabit download and 80 MB upload, it took about 5 minutes during market hours to populate the Seeker/Comber signals in three columns. Now it takes 20 seconds. So that's a win. That's mostly about the Internet speed, and I have no hiccups at all in pulling data in real time.

To make that work, I upgraded my Wi-fi router to version 7. I got the TP-Link Deco mesh router with two points: https://www.tp-link.com/us/deco-mesh-wifi/product-family/deco-be85/

This allows any device in the house that has Wi-fi 7 built in to reach the 2 Gigabit both way speeds. Even if the device has 6E, you can get 800 MB both ways, which is plenty.

I have the main unit that is connected to the cable modem and then a second unit in the laundry room as part of a mesh network. My house is 5000 square feet, so one unit won't cover the range. Now, I cover my house, my backyard, and some of my neighbor's space (they don't have my password). It's unreal. I have tested it on my phone (Google Pixel 8 Pro) at the furthest reaches of my backyard, and I still get 800/800 up and down. It's nuts. Now, keep in mind, you won't get the 2 Gigabit speeds on devices that don't have Wi-fi 7 functionality. For example, my son has an Xbox Series X, and he only gets about 18 Gbps download because that device is Wi-fi 5. The new version coming out this year has Wi-fi 6E. That will nearly 20x the download speed and still not be Wi-fi 7 levels.

Final step. The computer.

You don't want data to bottleneck and you don't want a machine that can't crunch data. So, what I have is the following:

12th Gen Intel i7-12700k 3.60 Ghz chip (stay away from AMD, but you also don't need an i9 unless you are gaming or doing graphics)

64 GB of DDR5 RAM. This is also overkill, but I don't care because I used to have 32 GB of RAM and sometimes hit 95% usage and that would clog the machine. No longer an issue.

1 TB Solid State hard drive and a 2 TB regular hard drive (that I don't need). You need to have Solid State to make things work.

Windows 11 Pro, obviously, for NinjaTrader and stuff. We aren't at a point yet that good software for traders is available on non-Windows machines or web browsers. We can do that with MarketGear and TrendSpider, but not for NinjaTrader.

Some kind of decent sound card obviously, but this is the least important thing.

Video Card matters a lot. I have a NVIDIA GeForce RTX 4070 that powers three 32" curved 4k monitors flawlessly. Great card. There are better, but I'm not gaming on this thing.

I use Logitech mice and keyboards over their dedicated wireless network.

I have a Fingerprint-based USB login device for security and a Logitech Brio MX camera for voice and video for my Zoom/Google Meet calls.

I use a Logitech Deskmat for a cleaner experience.

The motherboard also matters a lot, and this MSI motherboard handles everything: https://www.amazon.com/dp/B0CJSJ9TB3?psc=1&ref=ppx_yo2ov_dt_b_product_details

With it, you get Wi-Fi 7 built in or a wired 2.5 Gigabit port, which is what I use. In your walls, you need Cat 6 cables, not just Cat 5, to get the best throughput and get the results I showed.

With that setup, you end up with a 2 Gigabit Fiber connection both ways around the house and also to the machine start to finish back and forth with high speed DDR5 RAM and enough processing power to get nearly instant results.

In the modern world, this is the setup (or close to it) that people that want to be professional traders should strive to have. If you are a more casual (options) trader, then you don't need as much. But I can tell you that I see a significant different and sometimes 10x load times versus the machine and Internet and Wi-fi that I had two years prior.

Tradesight Recap Report for 11/11/22

Today in the Markets:

The markets opened flat and went higher for Veteran's Day bank Holiday on 5.2 billion NASDAQ shares.

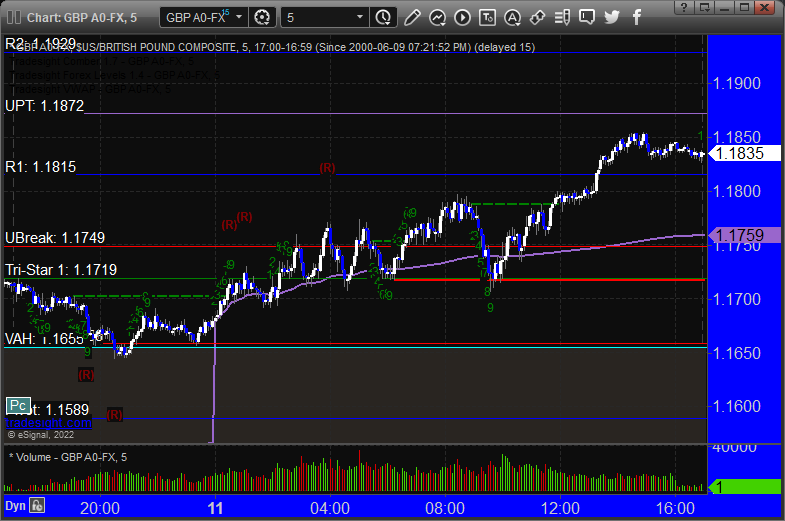

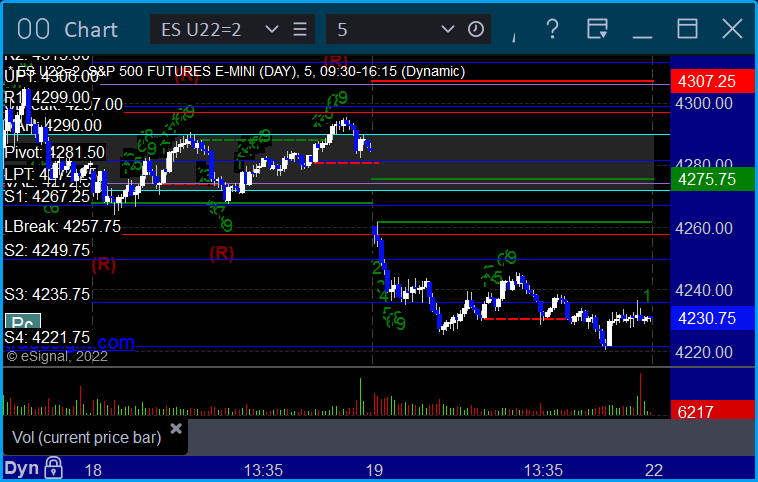

ES with Levels:

ES with Market Directional:

Futures:

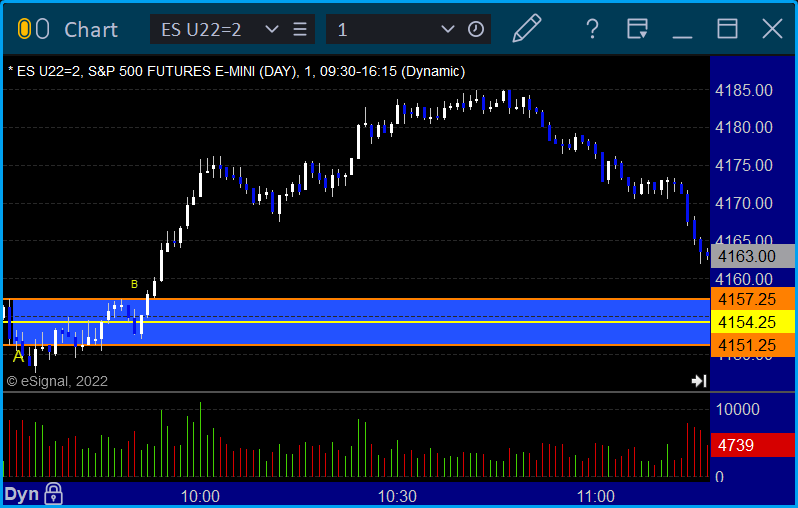

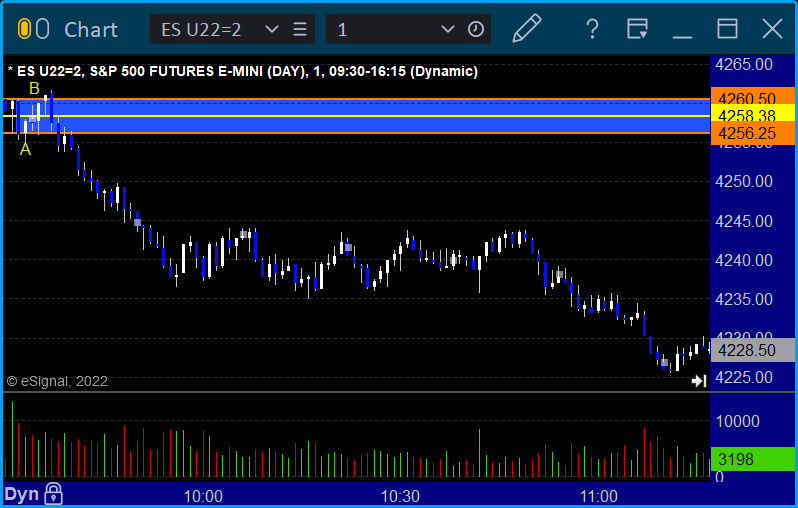

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks

GBPUSD:

Results: +0 pips

Some winners for the session.

These are the Tradesight calls that triggered:

Rich's META triggered long (without market support) and worked nicely:

NFLX triggered long (with market support) and worked nicely:

Tradesight Recap Report for 10/31/22

Today in the Markets:

The markets gapped down small and went dead flat for Halloween on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B but too far out of range to take:

Additional Futures Calls:

None.

Results: +4 ticks

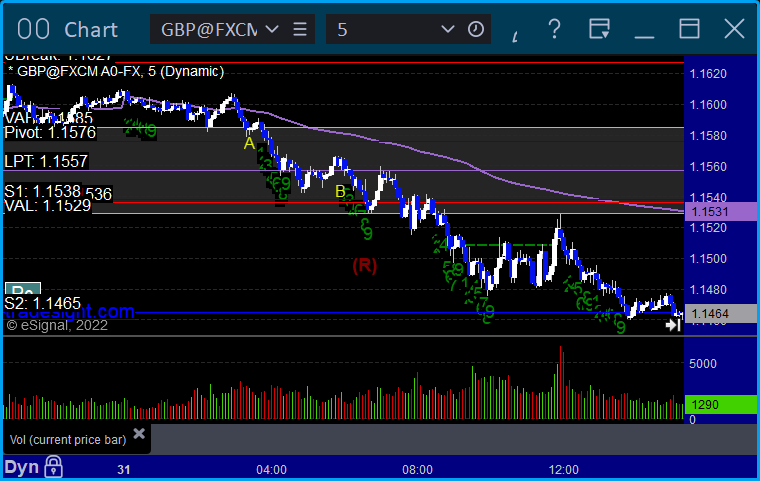

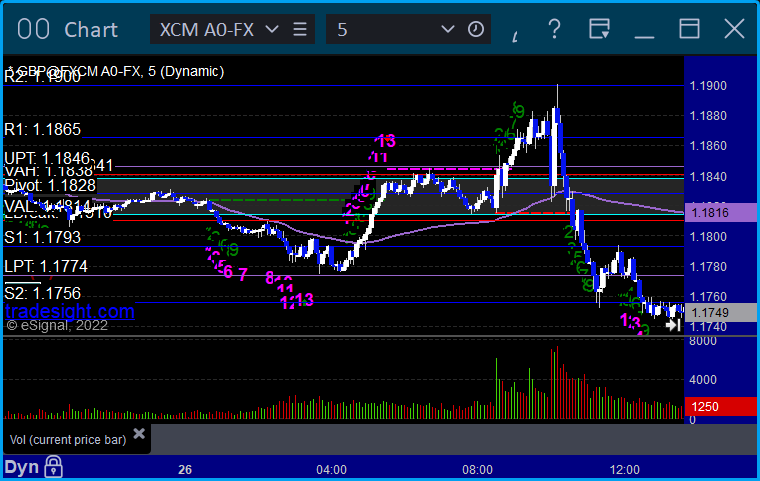

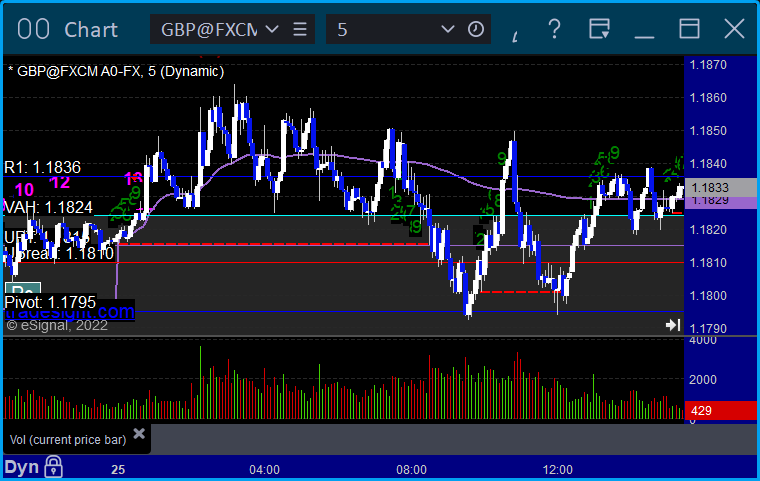

GBPUSD triggered short at A, hit first target at B, still going with a stop over VAL:

Results: Trade still going.

Stocks:

Not much of a day.

These are the Tradesight calls that triggered, Rich's TSLA triggered long (with market support) and didn't work:

His HOOD triggered long (without market support due to opening 5 minutes) and worked:

Tradesight Recap Report for 8/26/22

Today in the Markets:

The markets opened dead flat, did nothing for 30 minutes, shook down and then back up on Powell's comments, and then sold off the rest of the day on 4.5 billion NASDAQ shares.

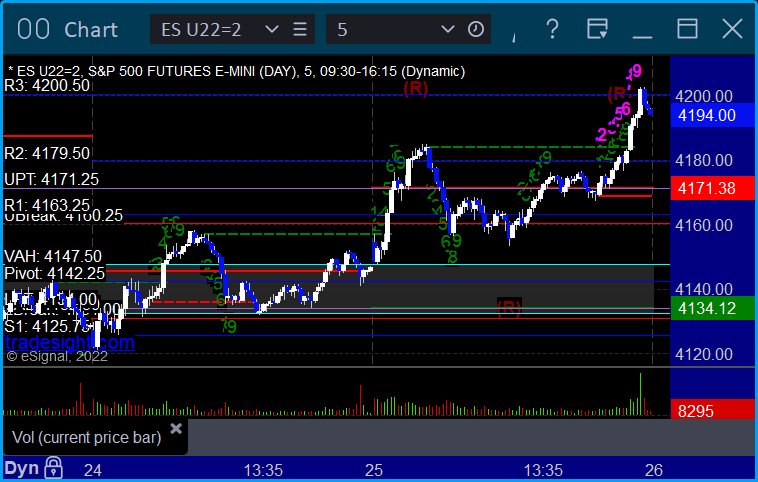

ES with Levels:

ES with Market Directional:

Futures:

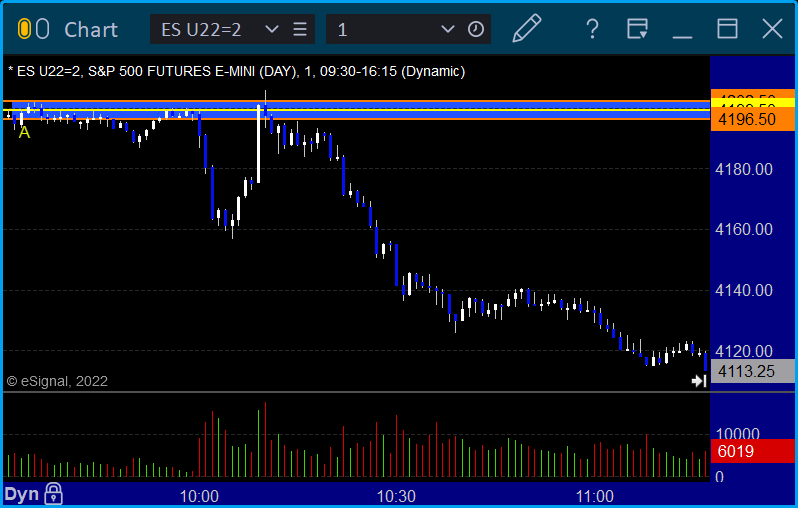

ES Opening Range Play triggered short at A and stopped:

Additional Futures Calls:

None

Results: -12 ticks

Results: -25 pips

Stocks:

A good day.

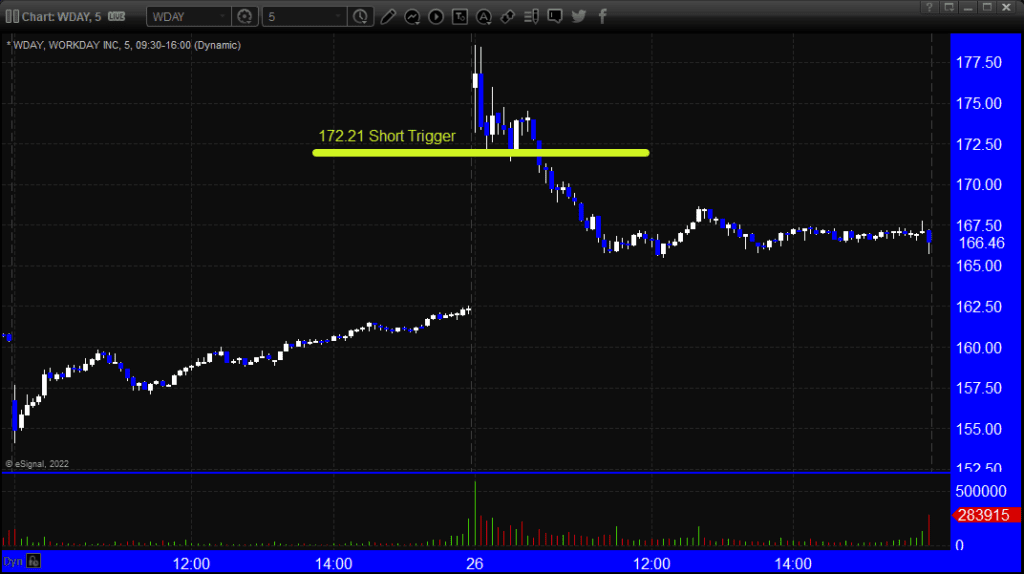

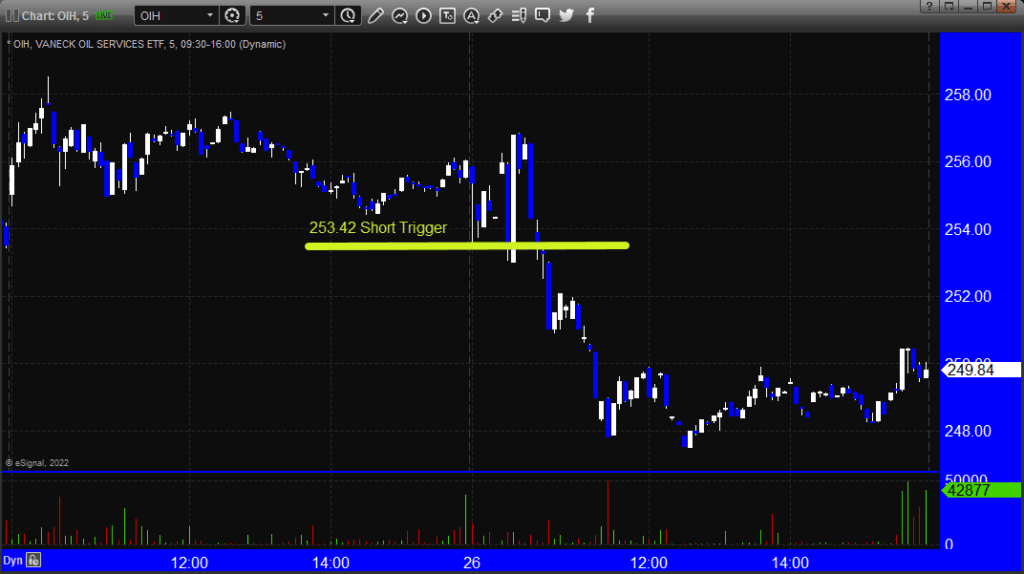

These are the Tradesight calls that triggered, Rich's WDAY triggered short (with market support) and worked great.

Rich's OIH triggered short (with market support) and did not work.

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 8/25/22

Today in the Markets:

The markets gapped up a little, pushed higher after 20 minutes, came back to the open, and then rallied in the afternoon on 4.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

Additional Futures Calls:

None

Results: +38 ticks

Results: -25 pips

Just one winner for the dead session.

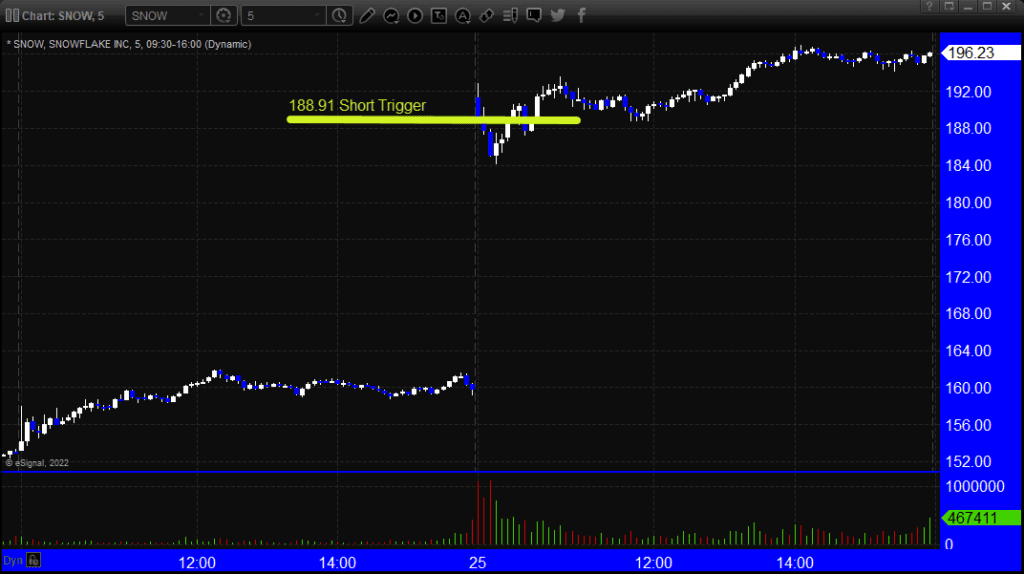

These are the Tradesight calls that triggered, Rich's SNOW triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 8/24/22

Today in the Markets:

Another dead day as we head into the end of summer. NASDAQ volume was only 3.9 billion shares. This isn't a setup for a breakout/breakdown, this is just summer. At this point, assume we could stay like this without major news until Labor Day. This Friday in particular should be a bust.

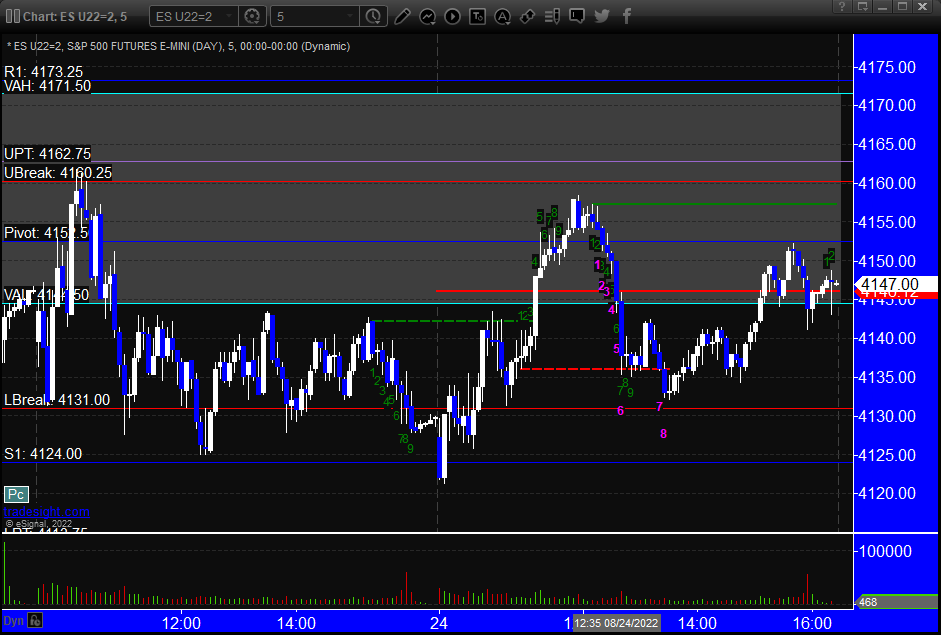

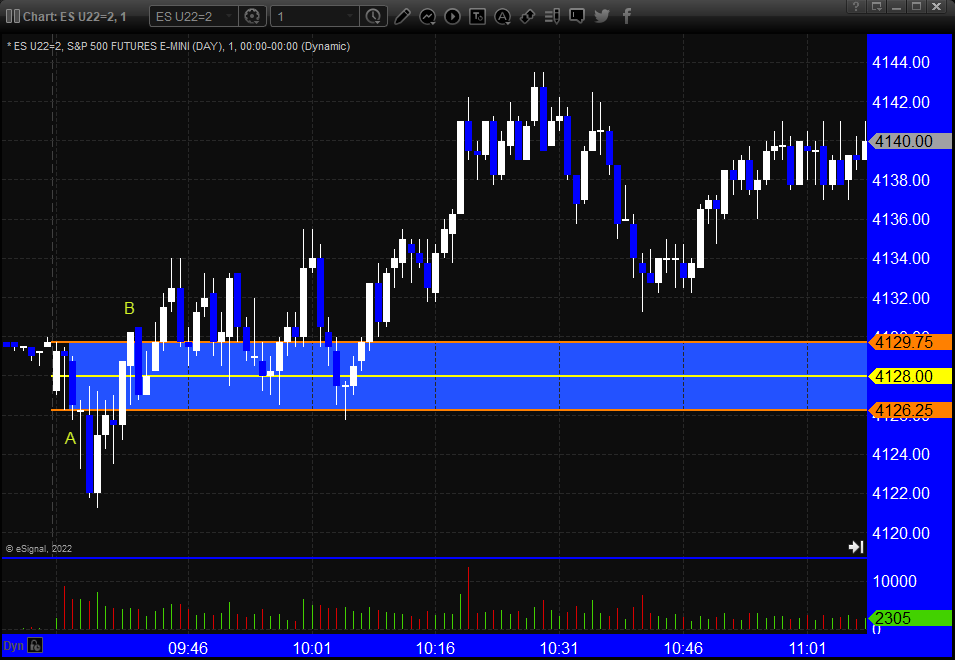

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and worked:

Additional Futures Calls:

None. So dead.

Results: +4 ticks

Results: pips

Stocks:

These are the Tradesight calls that triggered, Rich's PTON triggered long (with market support) and worked.

Rich's CSIQ triggered long (with market support) and worked.

Rich's AAPL triggered short (without market support) and did not work.

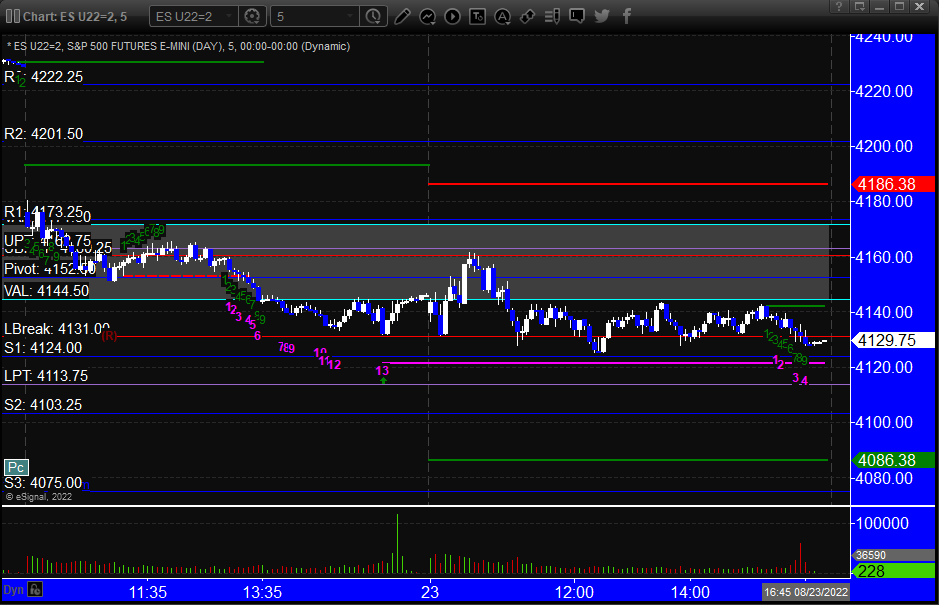

Tradesight Recap Report for 8/23/22

Today in the Markets:

What a waste of a day on 3.8 billion NASDAQ shares. Move along.

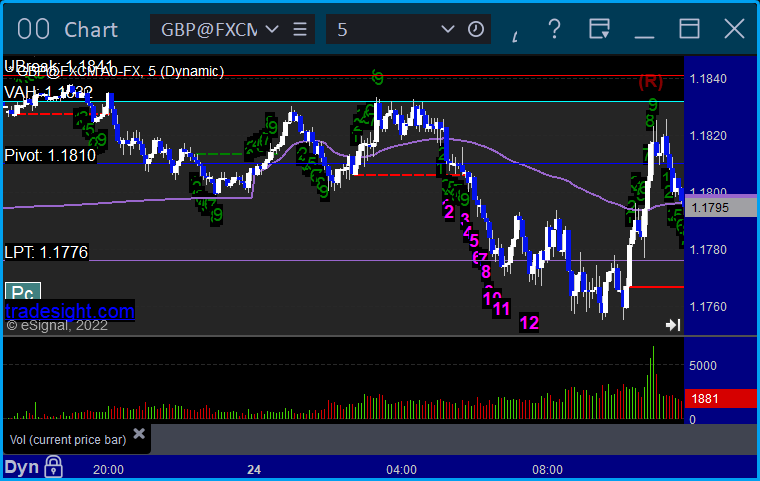

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B but too far out of range to take:

Additional Futures Calls:

None

Results: +4 ticks

A winner for the session, still going.

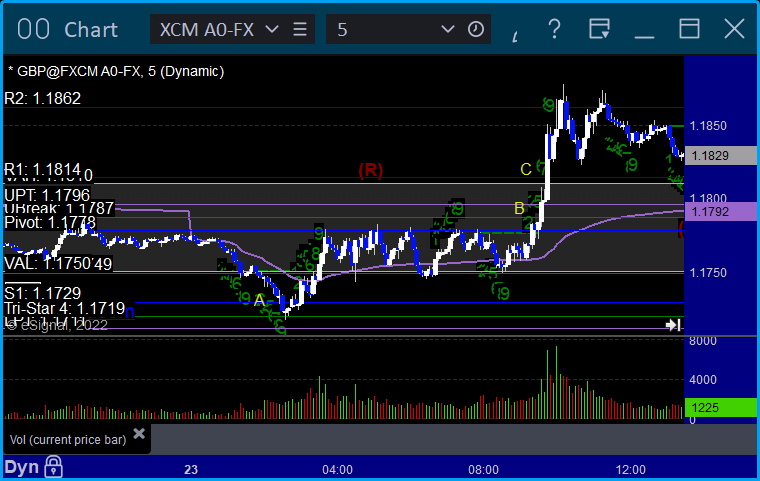

GBPUSD triggered short at A and stopped, triggered long at B, hit first target at C, still holding second half with a stop under UBreak:

Results: -25 pips and second trade still going

Stocks:

A couple of calls but probably the slowest day of August so far so not much to trigger.

These are the Tradesight calls that triggered, Rich's ENPH triggered long and did not work:

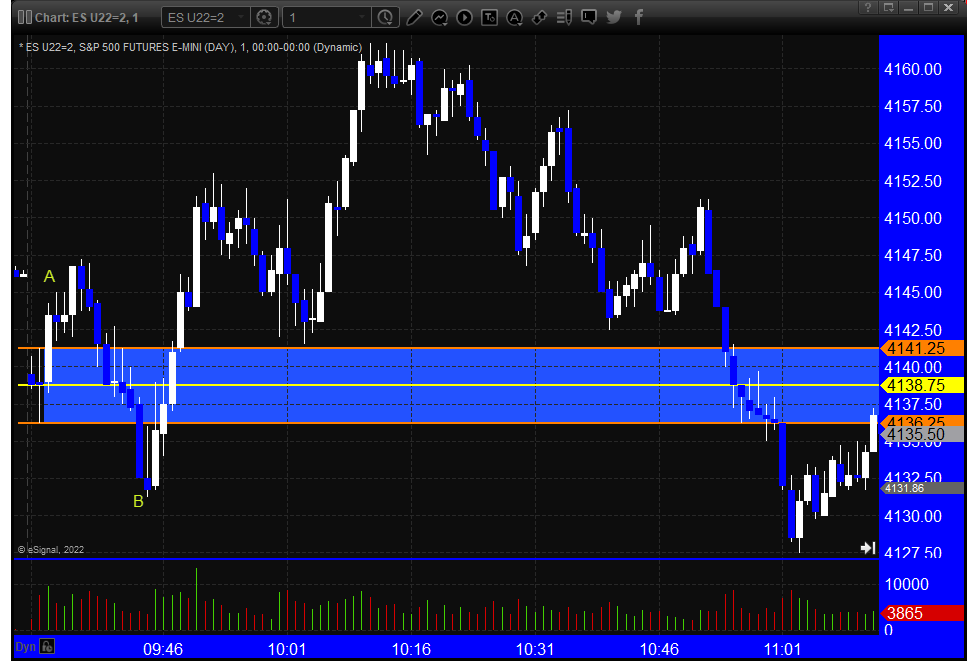

Tradesight Recap Report for 8/22/22

Today in the Markets:

The markets gapped down and drifted lower on 4.2 billion NASDAQ shares.

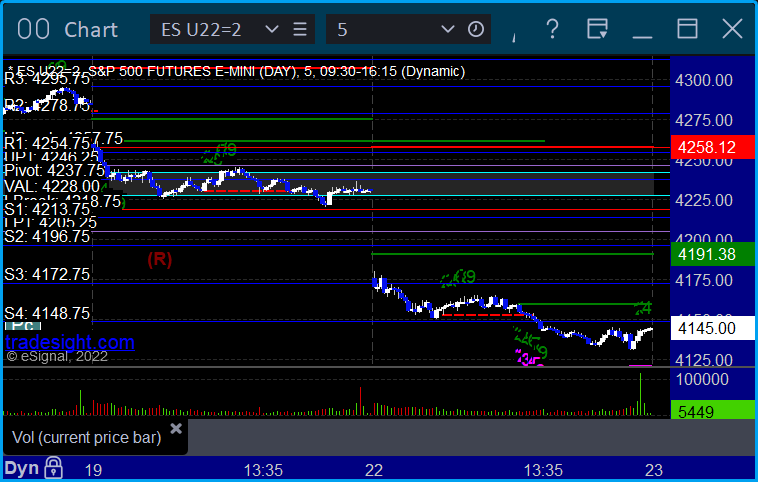

ES with Levels:

ES with Market Directional:

Futures:

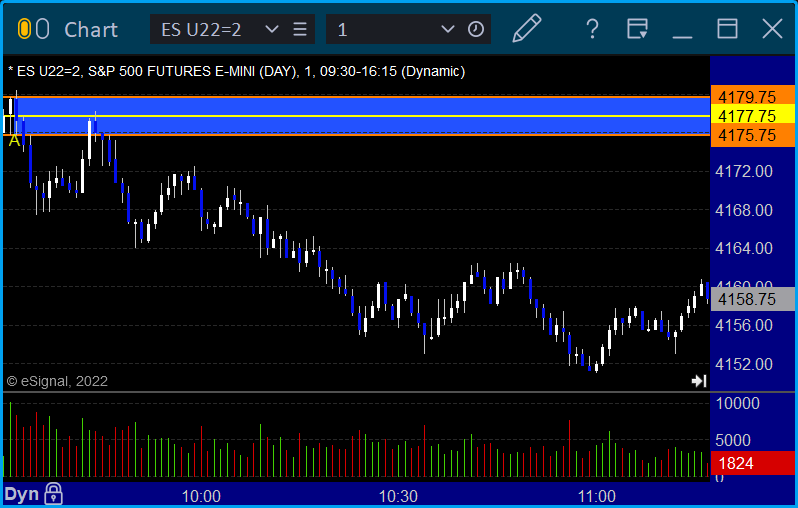

ES Opening Range Play triggered short at A and worked:

Additional Futures Calls:

None

Results: +10 ticks

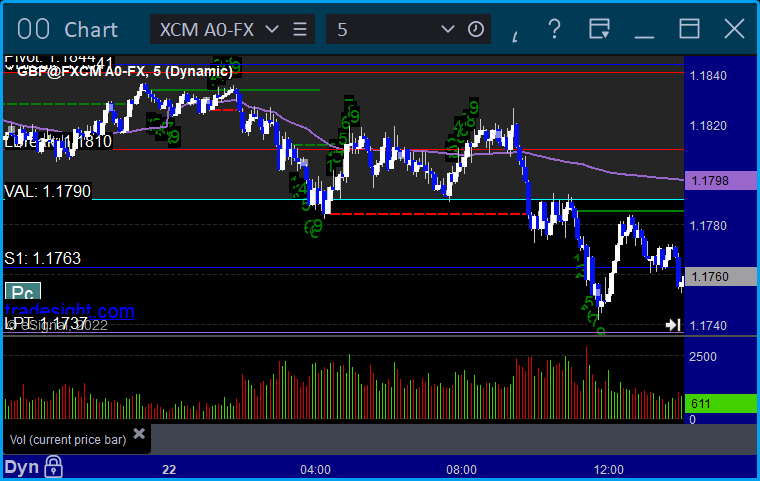

GBPUSD triggered short at A and stopped:

Results: -25 pips

A boring day after the big gap.

These are the Tradesight calls that triggered, Rich's ROKU triggered short (with market support) and did not move enough either way to count:

Tradesight Recap Report for 8/19/22

Today in the Markets:

The markets gapped down and pushed a little lower and then just went sideways for options expiration Friday on 4.6 billion NASDAQ shares, which is light for an options expiration.

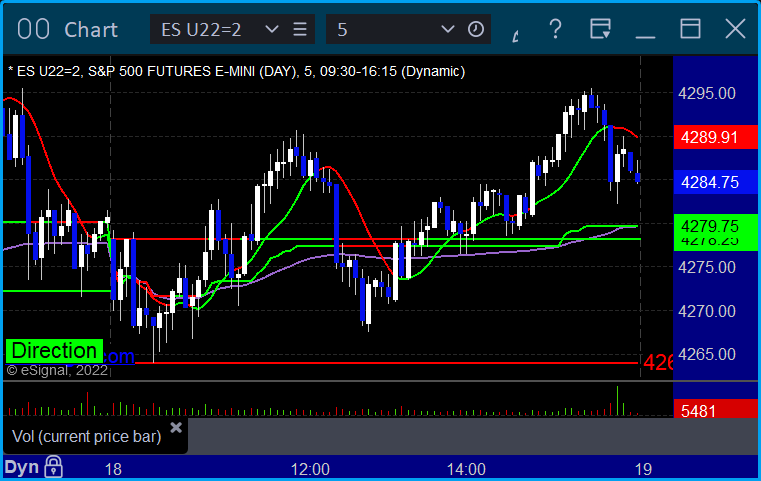

ES with Levels:

ES with Market Directional:

Futures:

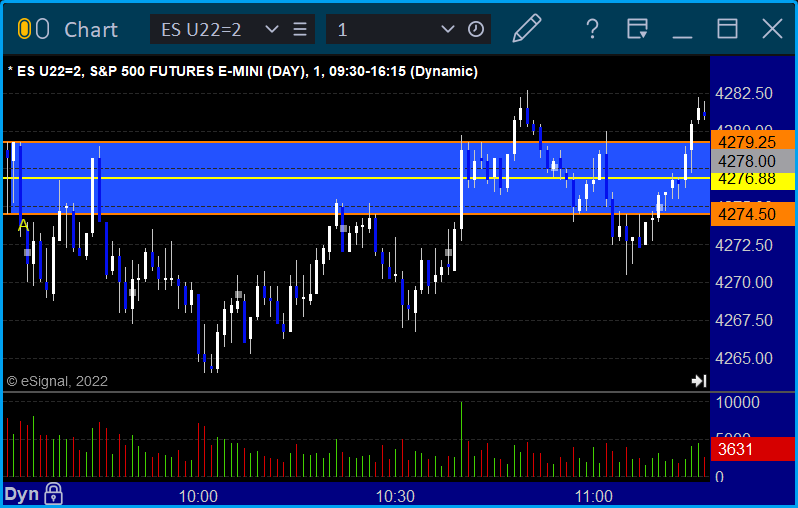

ES Opening Range Play triggered short at A and long at B, both stopped:

Additional Futures Calls:

Not yet.

Results: -36 ticks

GBPUSD triggered short at A, hit first target at B, closed second half at C for end of week:

Results: +55 pips

Wasn't expecting much to do for options expiration, and nothing triggered.

Tradesight Recap Report for 8/18/22

Today in the Markets:

The markets opened flat and closed slightly positive with no real action as it is clear that options expiration in August is in effect. NASDAQ volume was only 4.6 billion shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

Additional Futures Calls:

None

Results: +4 ticks

Results: +20 pips

Not a very exciting day as we head into options expiration.

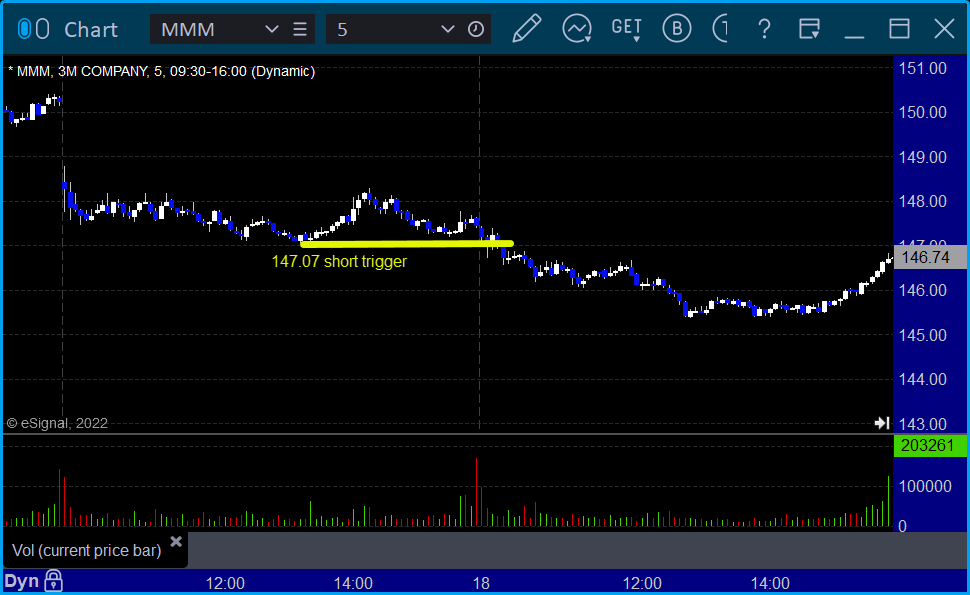

These are the Tradesight calls that triggered, Rich's MMM triggered short (with market support) and worked:

His AMC triggered short (without market support due to opening 5 minutes) and worked:

His META triggered short (with market support) and didn't work:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.