Overview

The markets gapped down, filled, and spent most of the day dead flat until a rally with 30 minutes left. NASDAQ volume was 7.4 billion shares.

ES with Levels:

Note how the ES Institutional Range was such precise support at A and B:

Futures:

ES Opening Range Play triggered long at A which was just enough to keep the stop under the midpoint instead of the ORL, so we barely stopped out, otherwise it would have worked:

NQ Opening Range Play triggered short at A and long at B, but too far out of range to take:

Results: -14 ticks

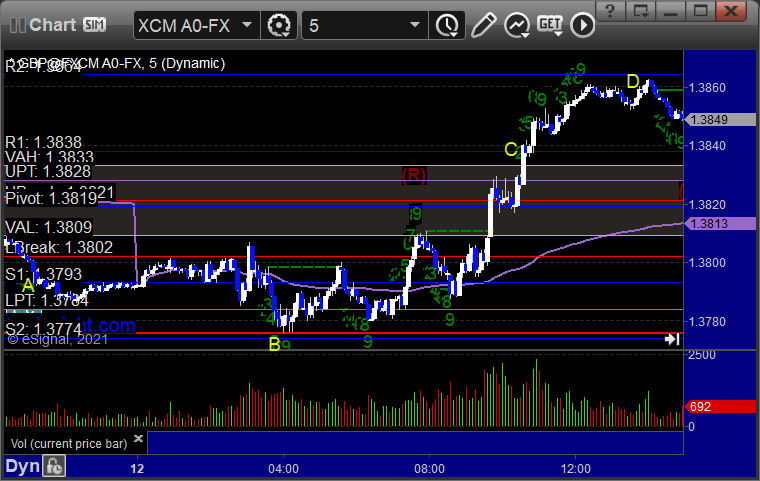

Forex:

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry. Triggered long at C, hit first target at D, closed in the money for end of week:

Results: +15 pips

Stocks:

Not a very interesting day, but one super nice call from Rich. AMAT triggered long (with market support) and worked nicely:

That’s 1 trigger with market support, and it worked.