The ES found support at the 10ema and closed unchanged. Keep in mind that changes in trend take time as both the bulls and bears take measure of each other.

The NQ’s showed relative strength gaining 7 on the day which was good enough to match the high close of the move. Keep in mind that the bulls have major overhead at the 8/8 level 2812.50.

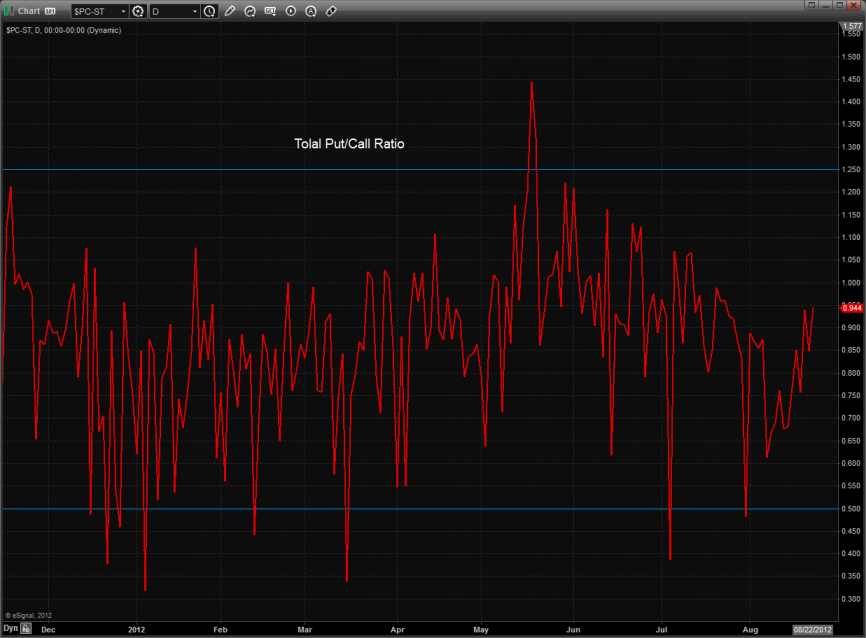

The total put/call ratio is climbing but nowhere near climatic.

Multi sector daily chart:

The Dow/gold ratio took a good sized hit which is a defensive development.

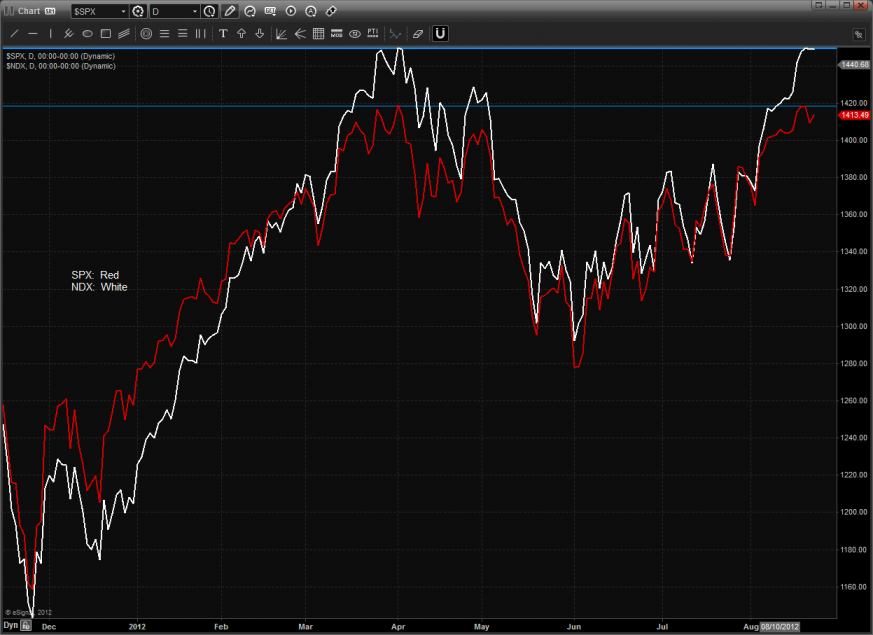

The double tops are still in place for both the SPX and NDX.

The defensive XAU was the top gun on the day. This is a new high close on the move and qualifies the higher low.

The OSX was little changed on the day. There is a critical convergence of the 10ema and the 200dma which will quickly turn the chart negative if they are lost.

The SOX was bearishly much weaker than the NDX and broad market. Price settled below the 10ema and a downside follow through will weigh heavily on all the key averages. Be on guard for the MACD to confirm a turn.

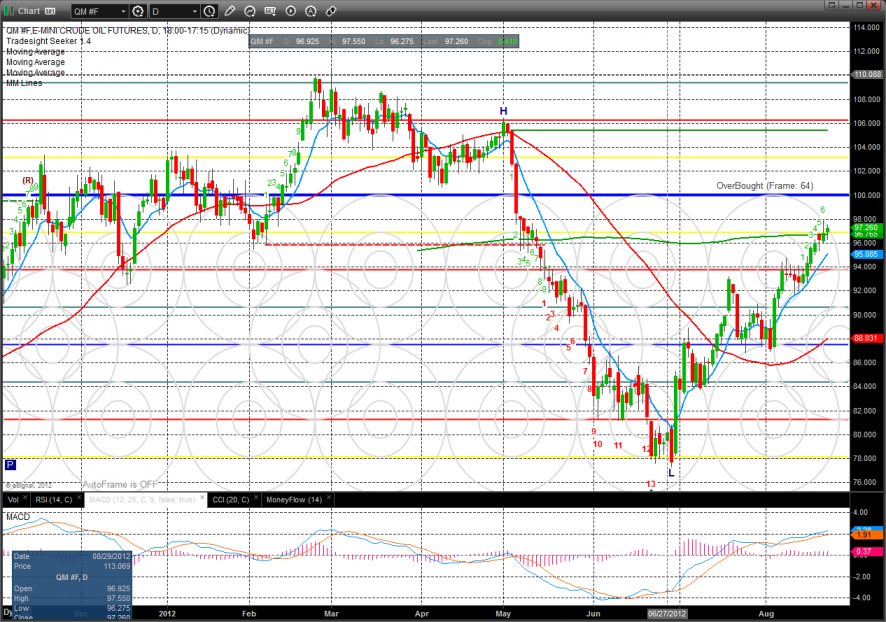

Oil:

Gold:

Silver:

Bonds: