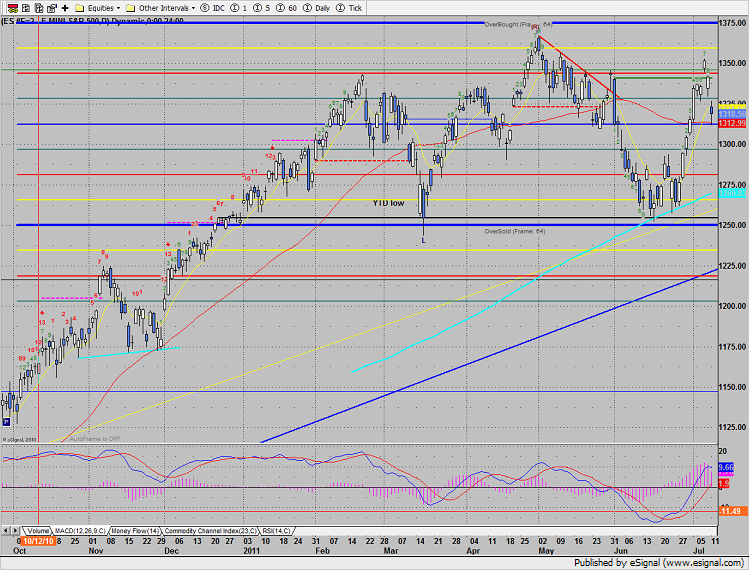

The SP gapped sharply lower and never recovered, losing 23 handles on the day. Intraday price used the 4/8 Gann level and 50dma for support. The MACD is far from a cross over but the CCI is overbought. A settlement below the 50 and the 4/8 will possibly put in place a failing retest of the high.

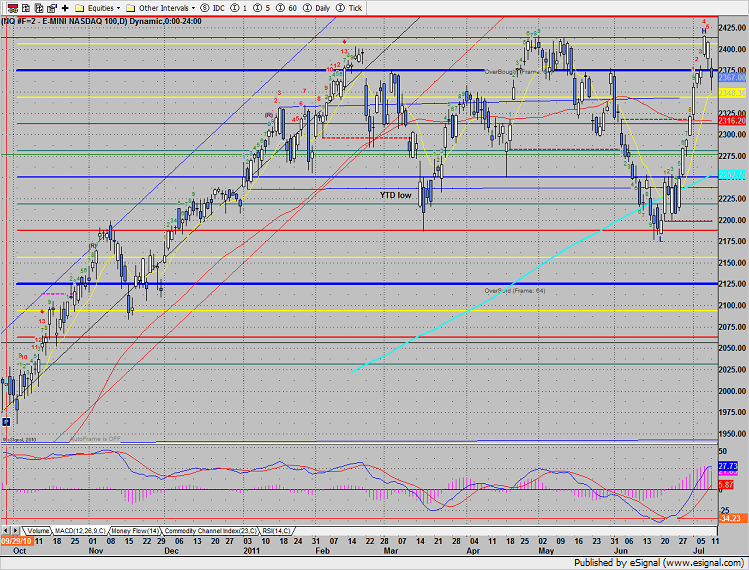

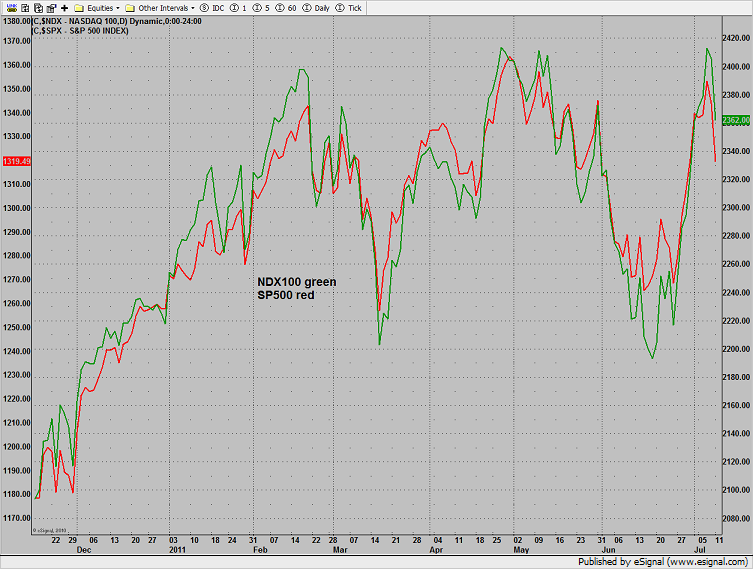

Naz lost 42 on the day after recording a new high late last week. Note that the Naz is relatively strong vs. the SP, price is well above the 4/8 level, the 50dma and even the 10ema. Tuesday, the FOMC will release the minutes from the prior meeting which should shed some light on the prospects of any further quantative stimulus and could be a key catalyst.

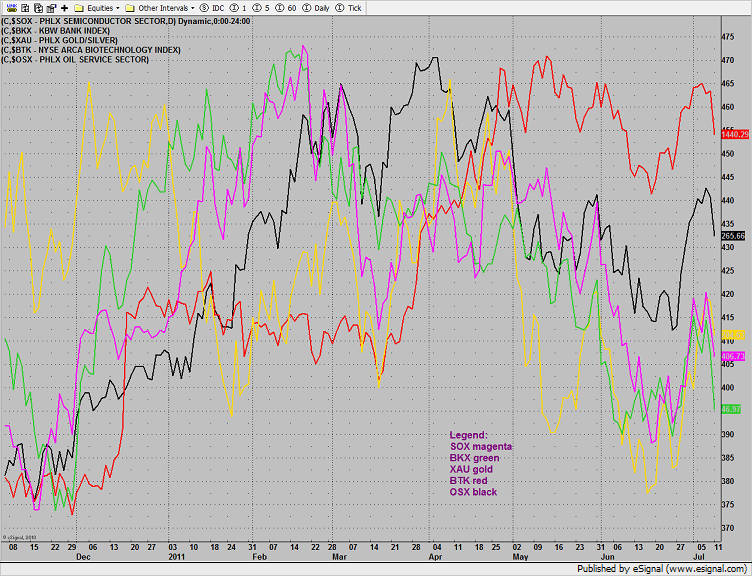

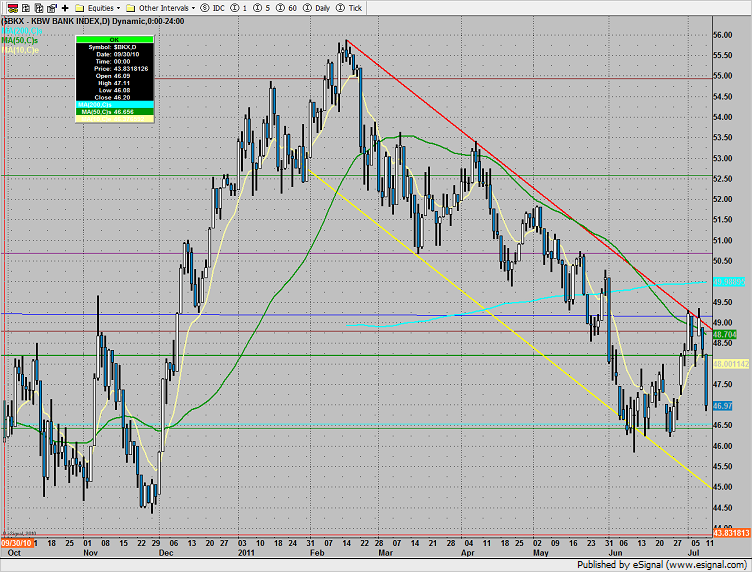

The banks continue to be the laggard on the multi sector daily chart;

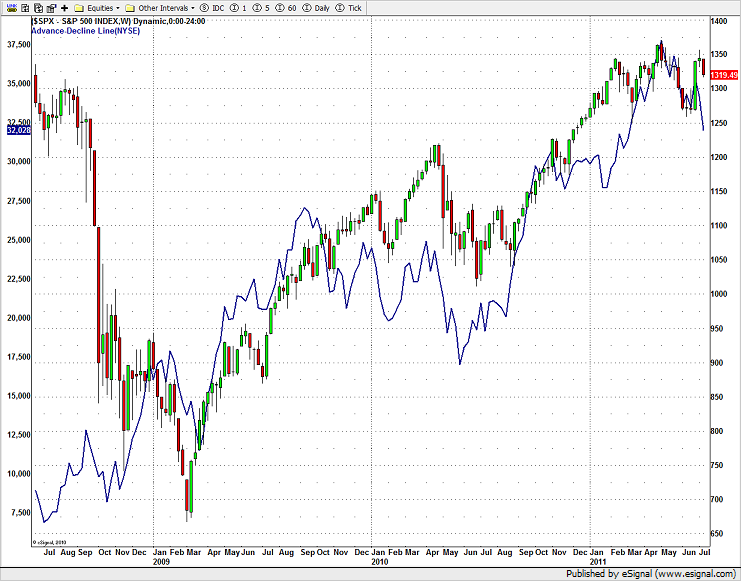

The NYSE weekly cumulative advance/decline line was lower on Friday even though the market was higher on settlement. This is a very, very concerning divergence and should be monitored very closely. If the A/D line falters regardless of what the short term equity prices are doing they are ultimately headed lower. Please read the prior sentence again.

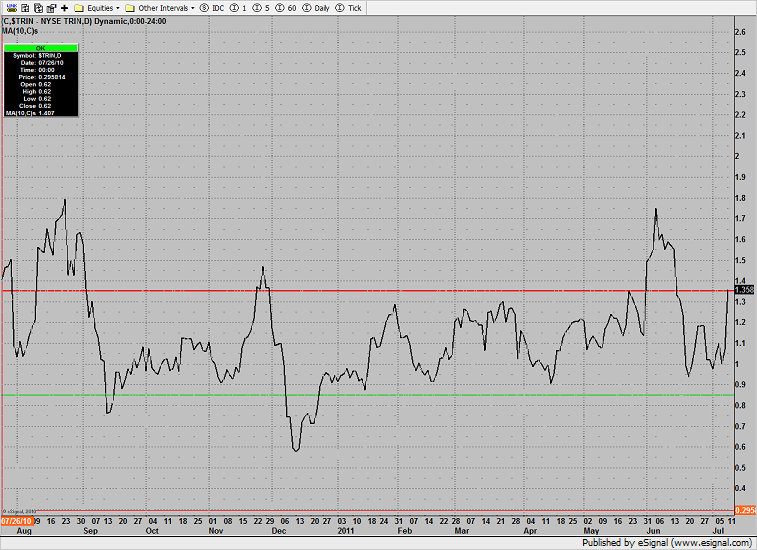

The Trin closed at 5.14 which was elevated enough to record an oversold reading of 1.358 for the 10-day Trin.

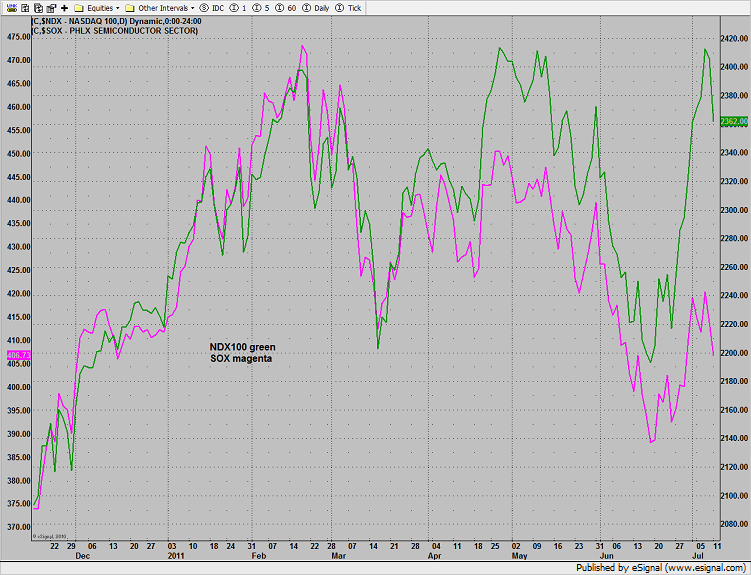

The Naz is leading the SP which is a bullish condition:

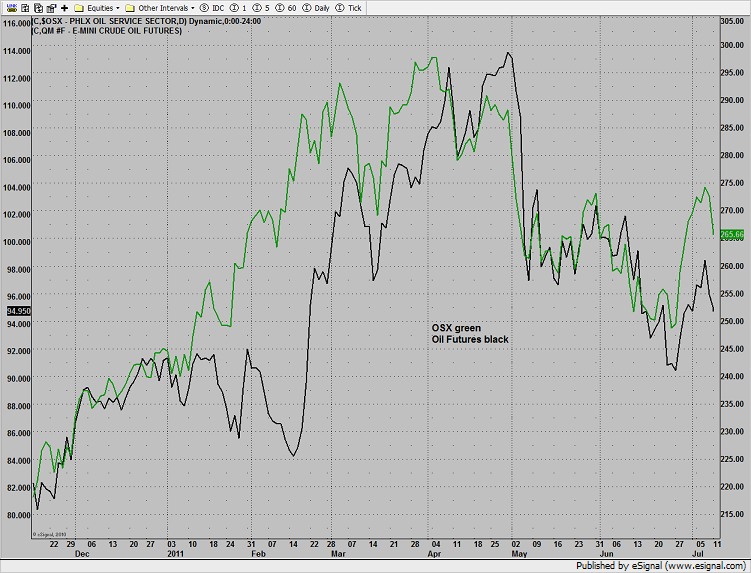

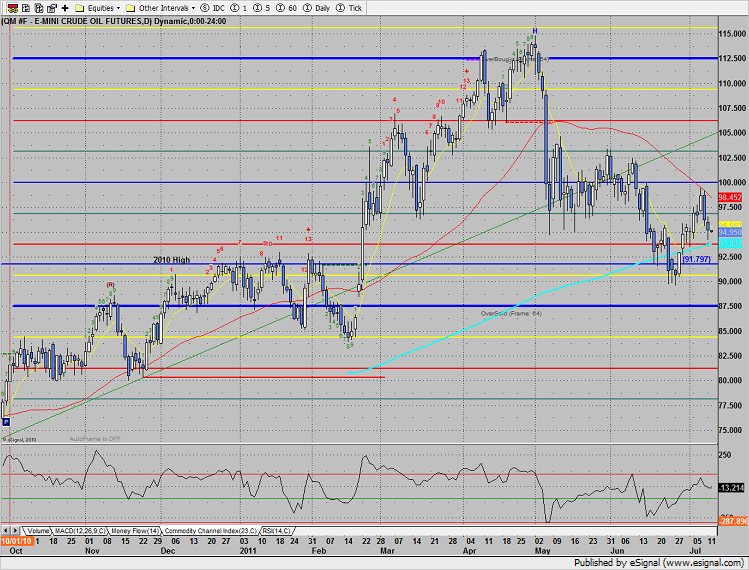

The OSX still has relative strength vs. crude futures which is bullish for oil:

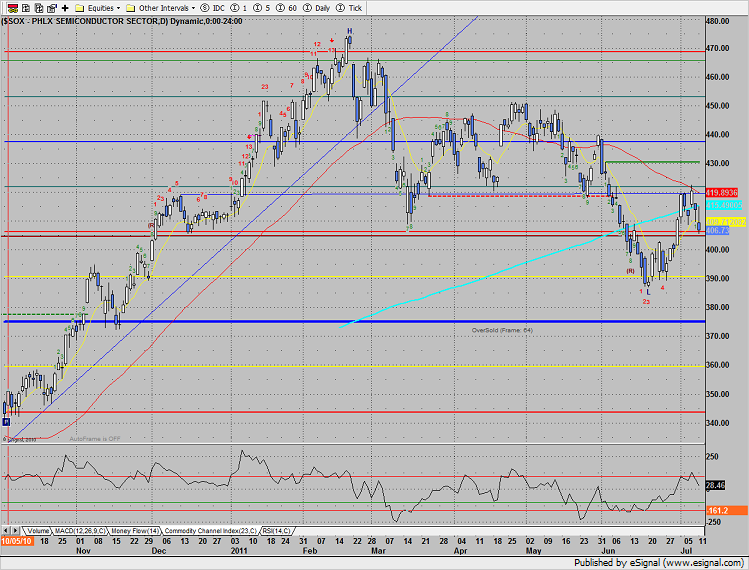

The SOX is still grossly underperforming the NDX, a classic bearish divergence.

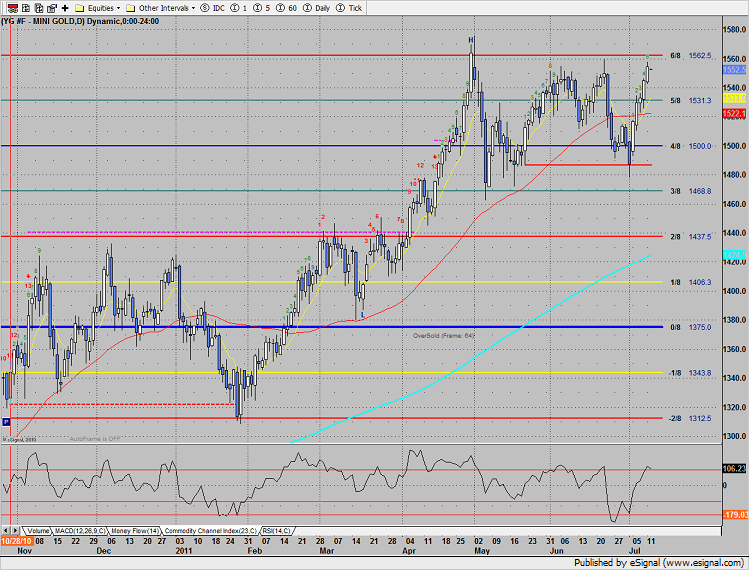

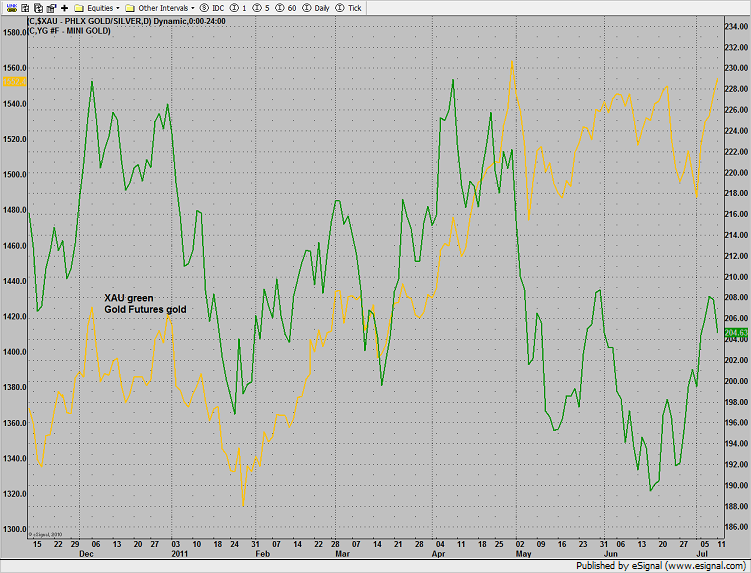

The XAU continues to, well, “suck eggs” vs. the underlying commodity. This is a very wide disconnect. Note that even with the strength of gold futures on Monday, exceeding the May and June highs the XAU did not.

The SOX was lower by 7 on the day, settling below the 200dma.

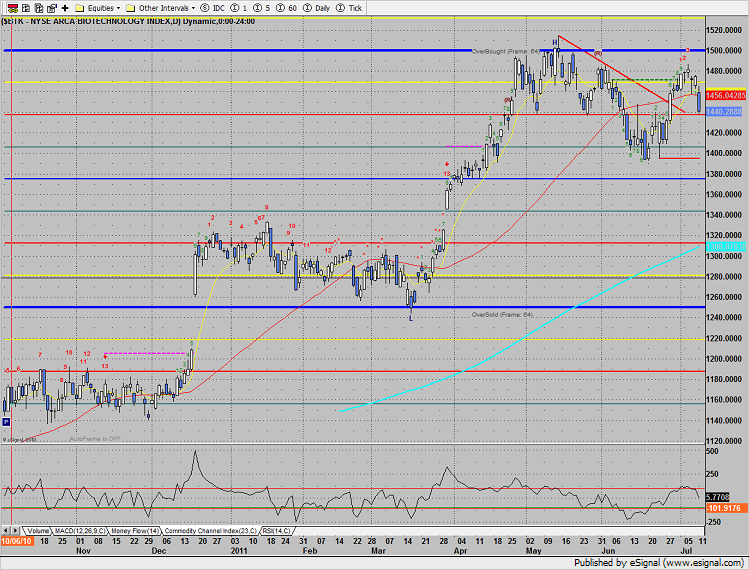

The BTK was weaker then both the Naz and the SP;

The OSX closed right at the 50dma;

The BKX was the weakest sector on the day, rejected by the upper boundary of the trend channel.

Oil:

Gold settled at the second highest level of the year.