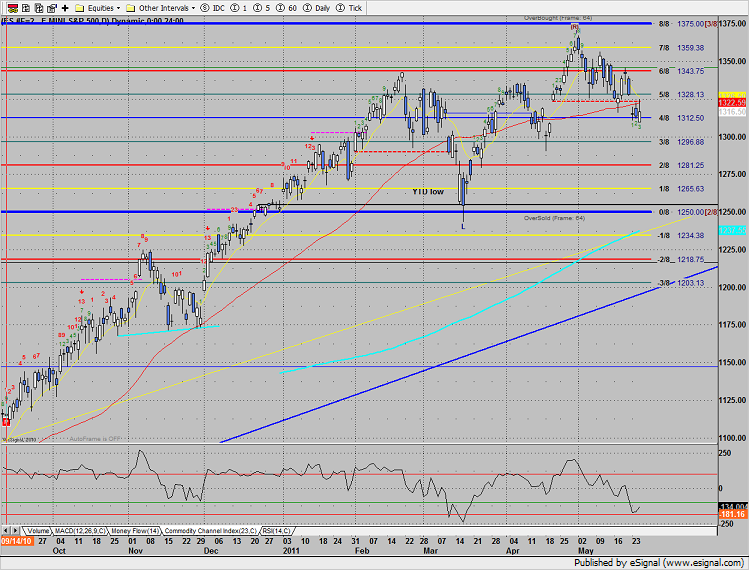

The SP closed near the midpoint of the session when you figure in the runoff after 4pm. Price was higher on the day by 3 but there was little accomplished by the bulls. Settlement was below the 10 and 50mas and the broken static trend line was resistance that price could not penetrate.

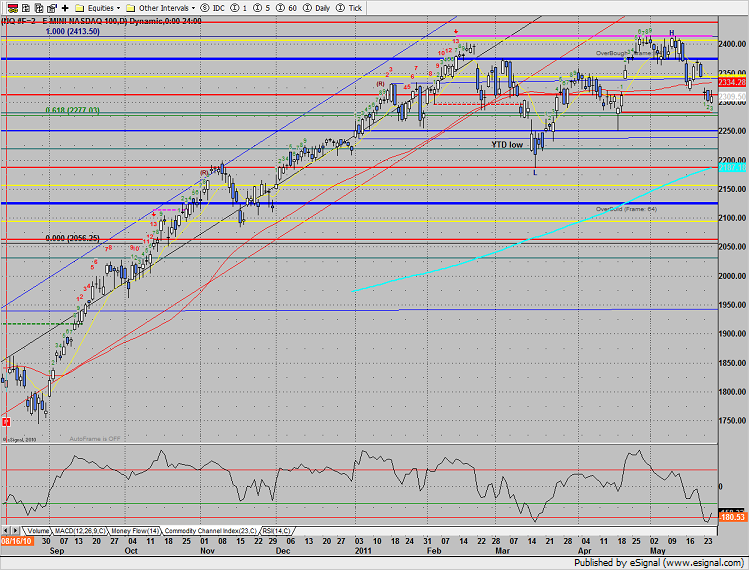

Naz was higher by 7 on the day with a similar design to the SP. Price on the day was almost inside the prior day’s range.

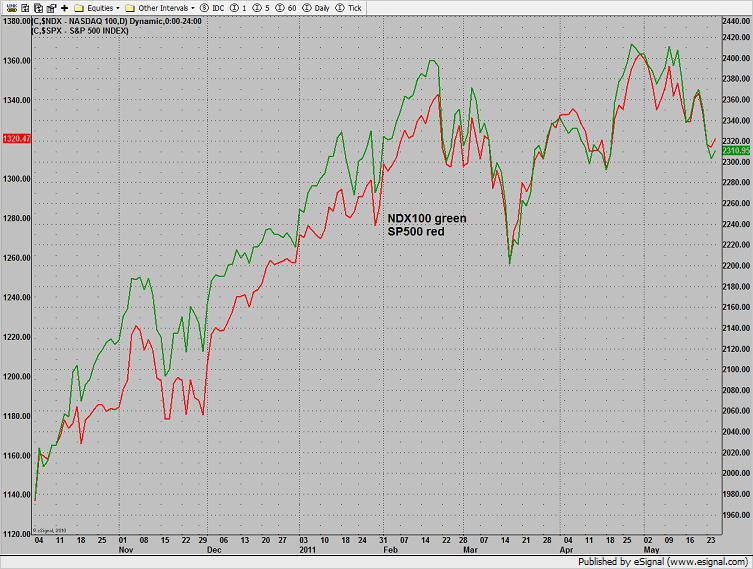

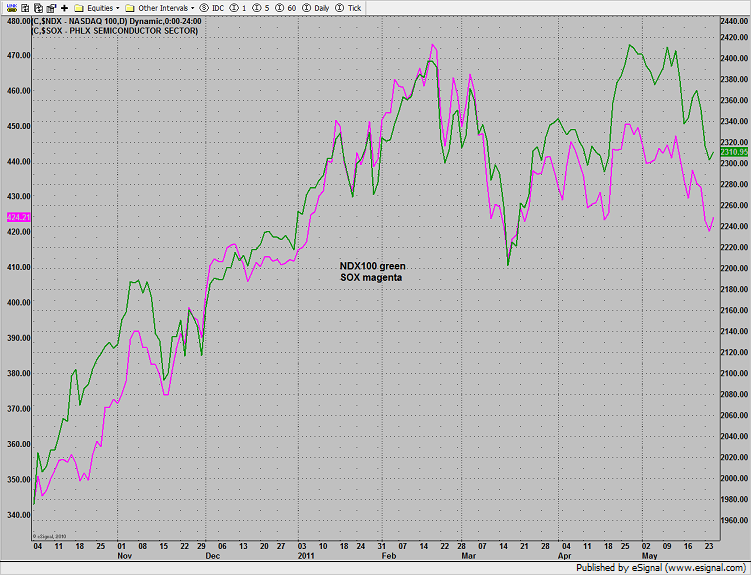

The Naz and SP are both in bounce mode but the Naz continues to underperform the SP which is almost never positive.

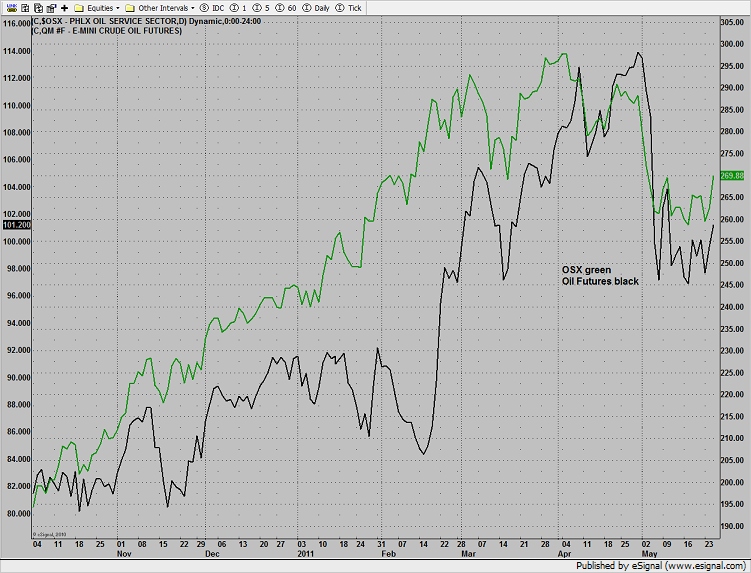

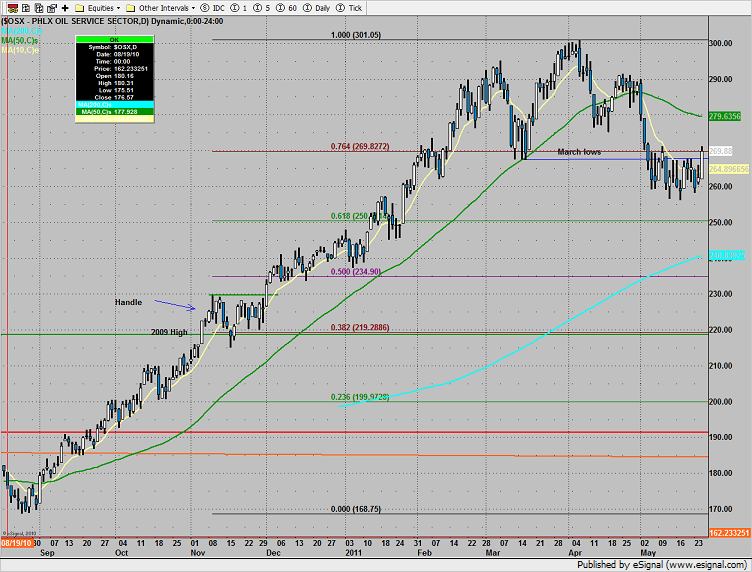

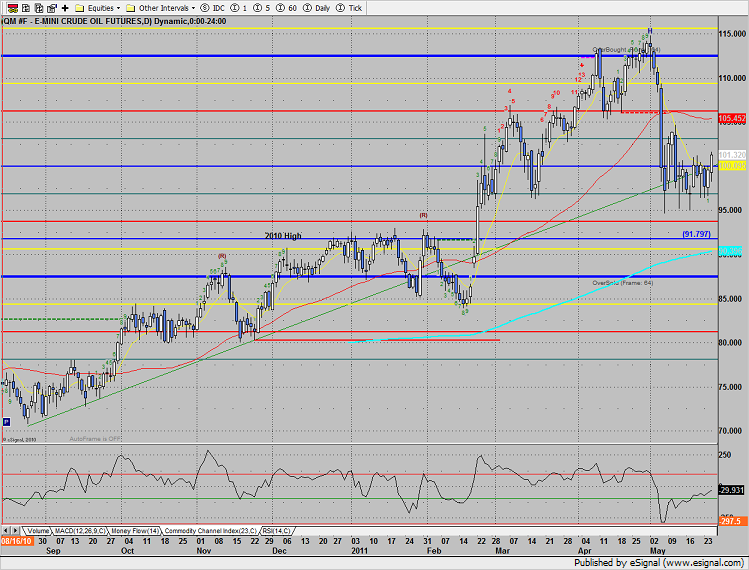

The OSX continues to outperform oil futures which is positive for the whole energy complex.

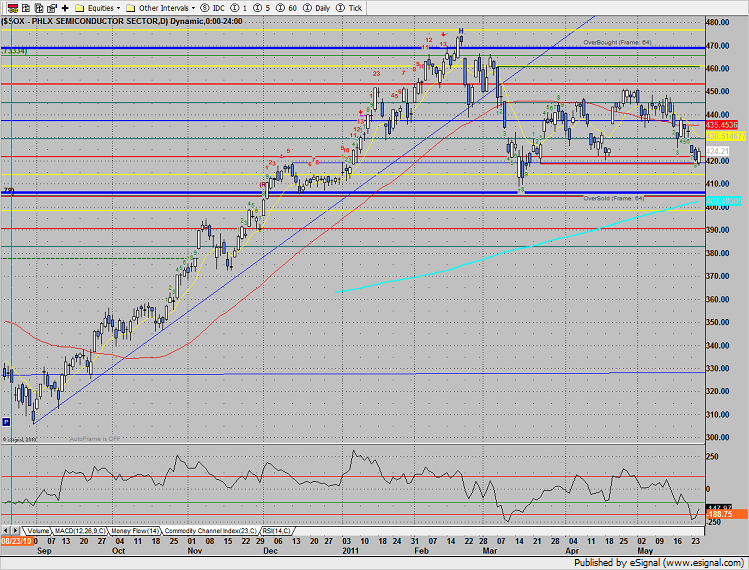

There is still a negative divergence between the SOX and the NDX. Until the SOX either reclaims leadership or trades inline with the NDX the market is technically in only a bounce.

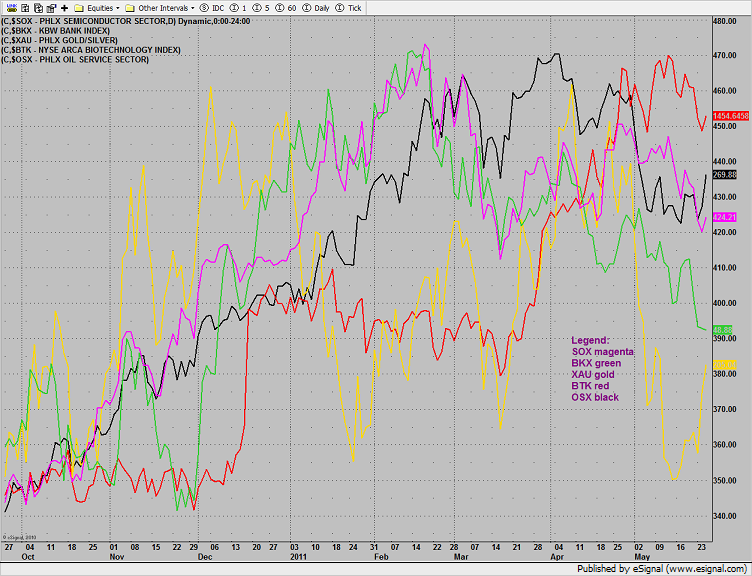

Multi sector daily chart:

The OSX was top gun closing at the high of the recent range. Set an alarm for a break over 271.50.

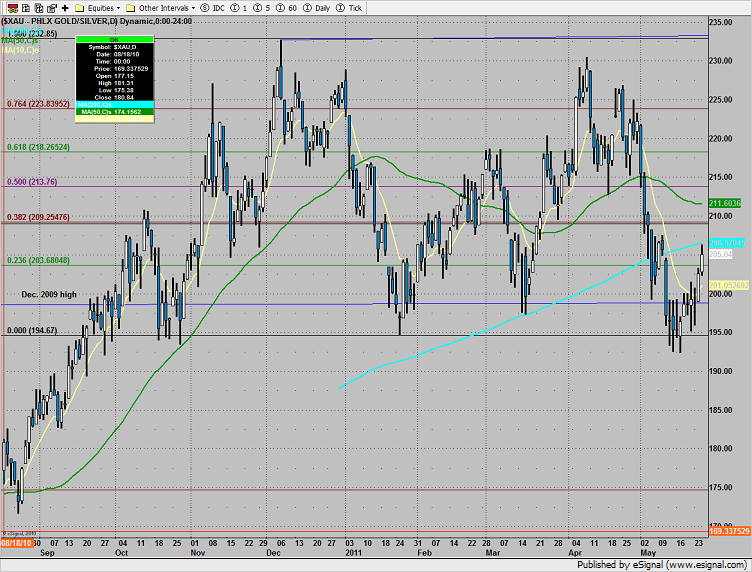

The XAU was up much more than the broad market and tested the 200dma.

The SOX used the static trend line for support but didn’t not exceed yesterday’s high.

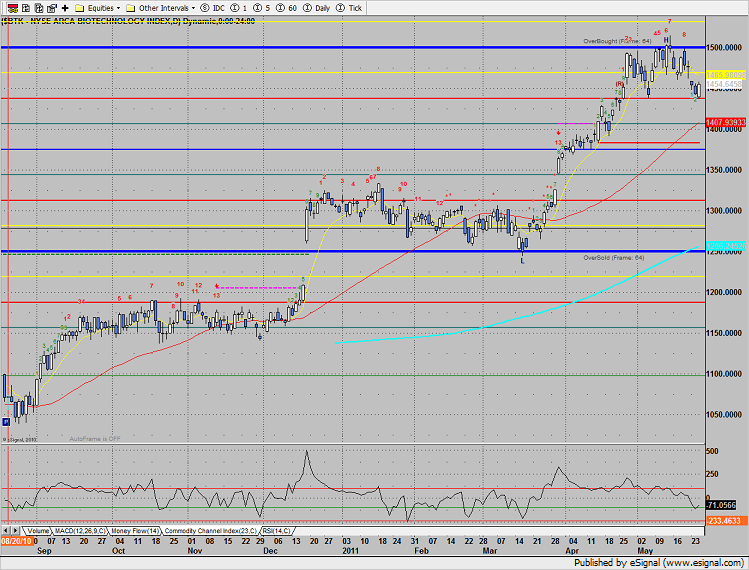

The BTK has bounce off the low of the recent range. Look in this sector for long DTL break setups.

The BKX was weaker than the broad market and was red by a small amount. The AIG re-IPO was not well received and the sector reflected it.

Oil was higher by $1.70.

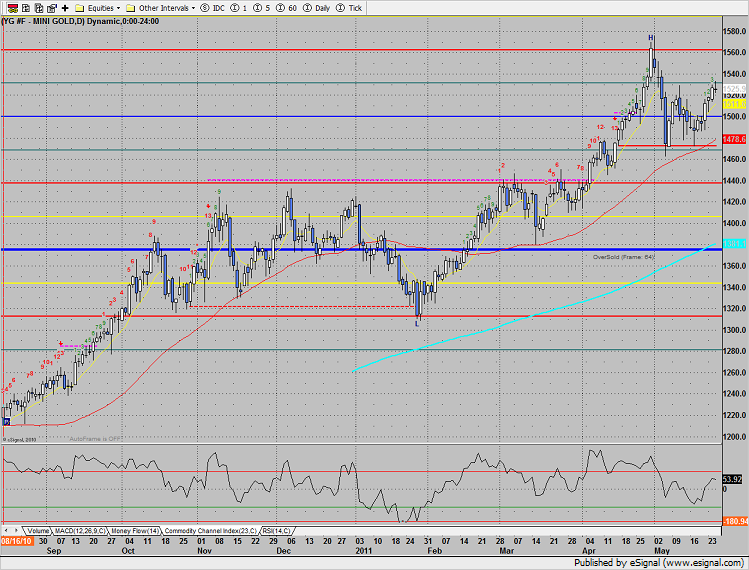

Gold: