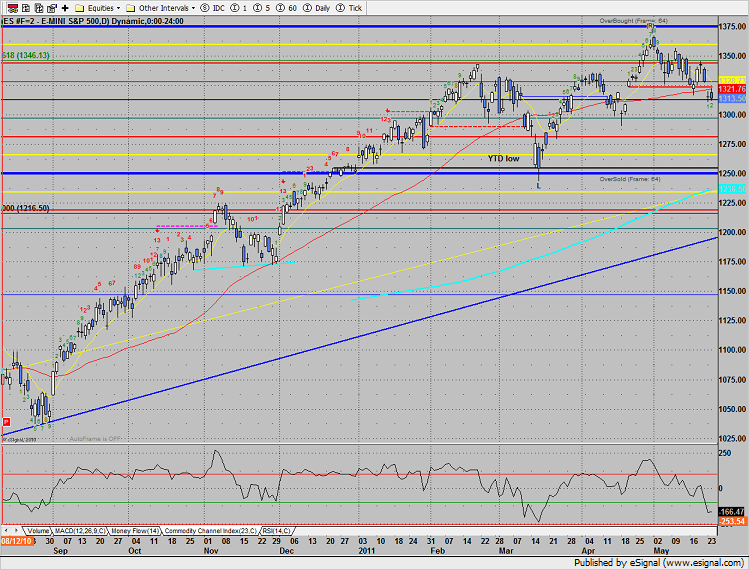

The SP closed about flat on the day on low volume. Price attempted a push higher but left the gap open from Monday. This is the second settlement below the static trend line and the 50dma.

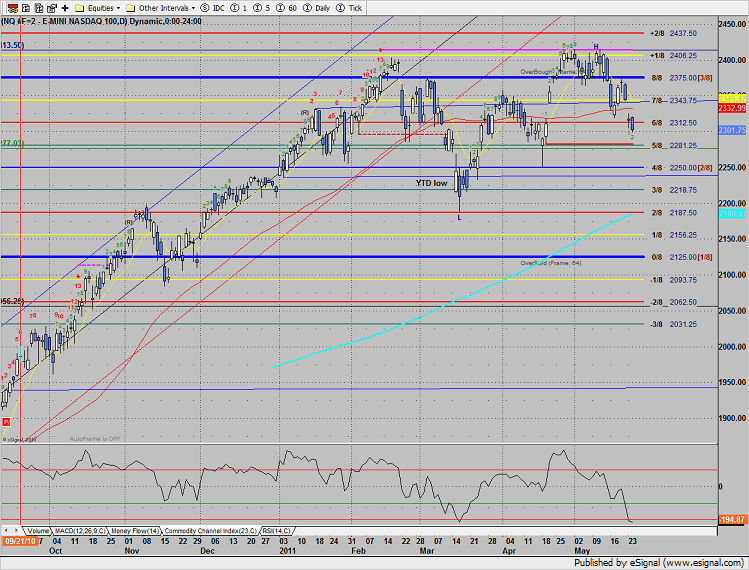

Naz was much weaker than the broad market losing 14 on the day. Tuesday’s price action undercut Monday’s range and close. Key support remains at the static trend line at 2280, next support is the 4/8 Gann level at 2281. Note that the CCI has recorded the lowest reading of the year and is loaded with oversold energy.

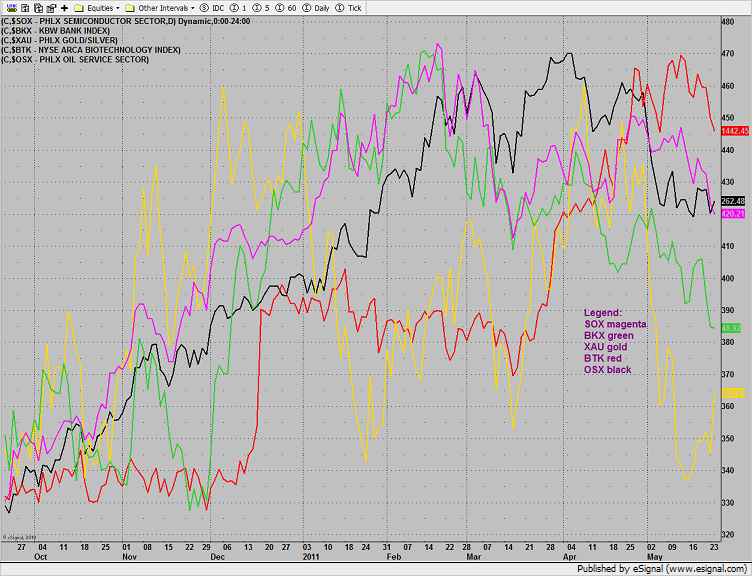

Multi sector daily chart:

The sometimes defensive XAU was the top performing sector on the day, +2.5%.

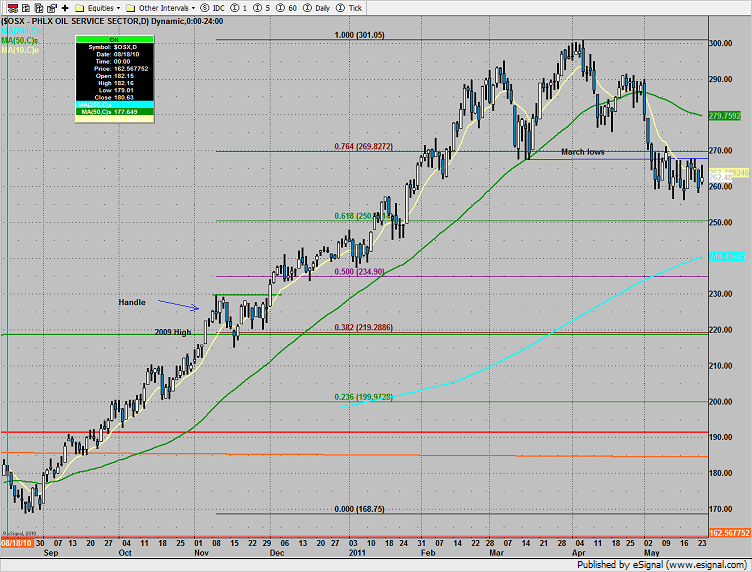

The OSX was higher on the day but remains range bound.

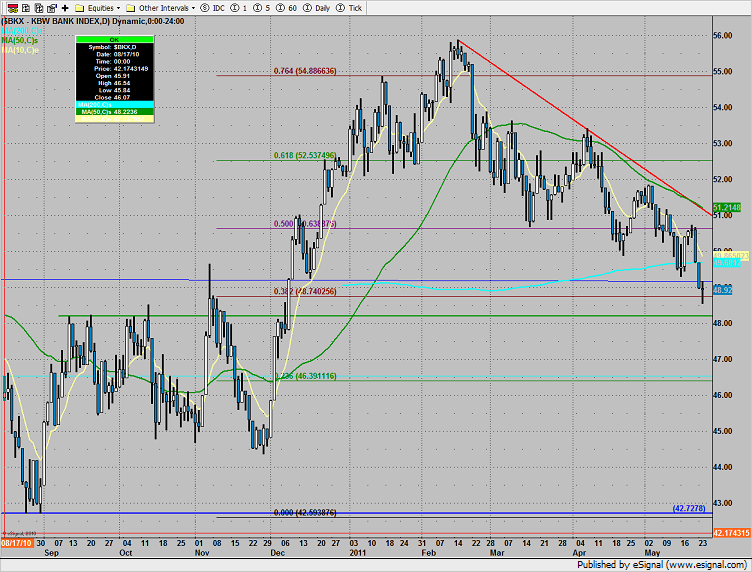

The BKX broke to new lows but closed mostly unchanged. The last line of defense for the bulls is the 38% fib at 48.75.

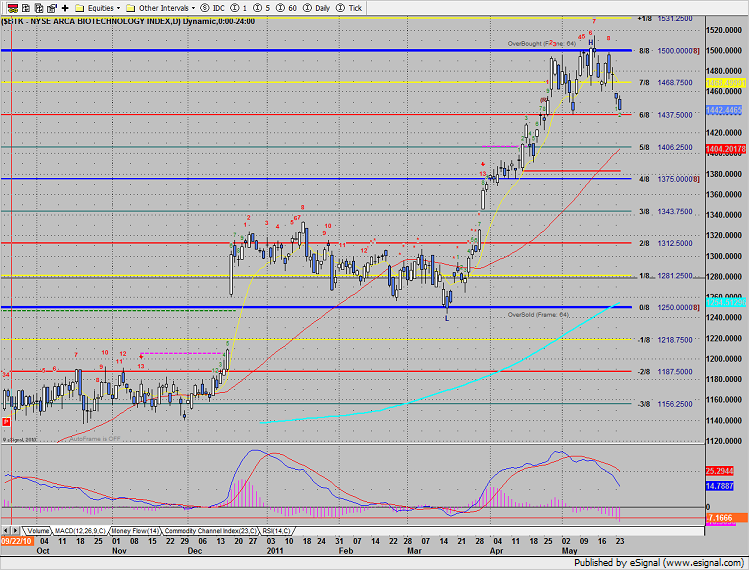

The BTK is very close to breaking down below the 6/8 level that is the current low of the recent range. Note that the MACD is already moving lower and will gather momentum if 1437.50 is lost marking a qualified lower high.

The SOX was weaker than both the broad market and the Naz. The 2010 December highs are the last line of defense.

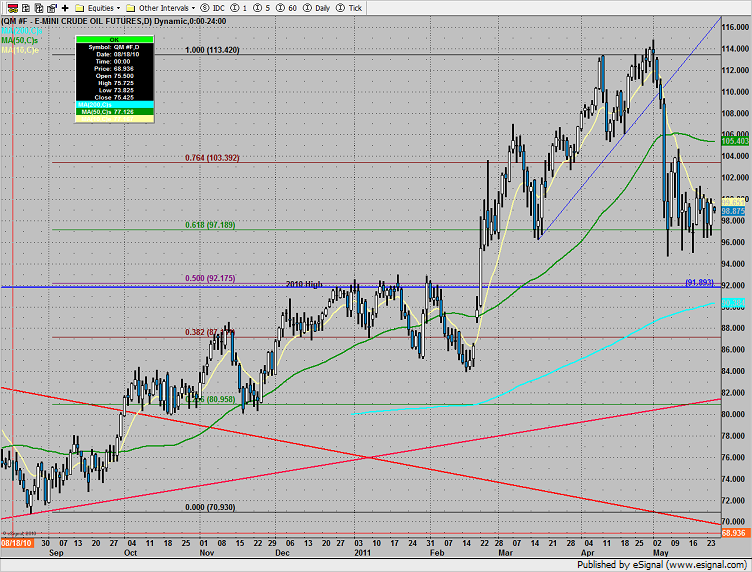

Oil:

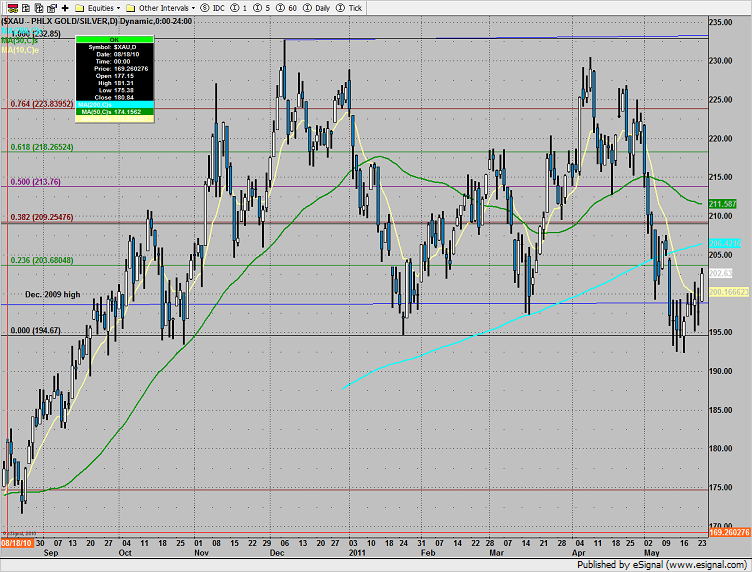

Gold: