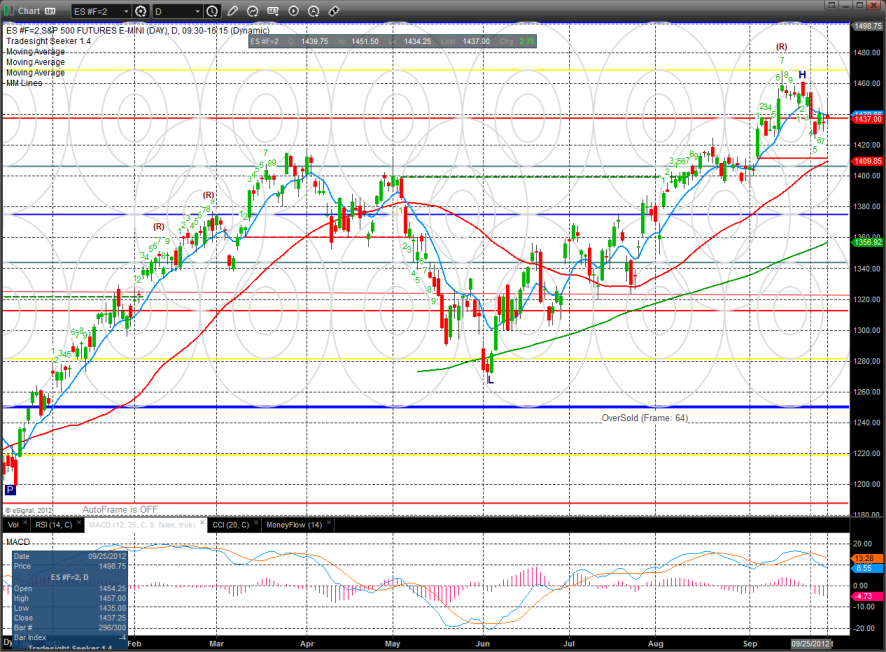

The ES settled higher on the day by 3. Since price settled below the open but up on the day it is a camouflage sell signal. Also on the chart is very tall tail which is never bullish at range high.

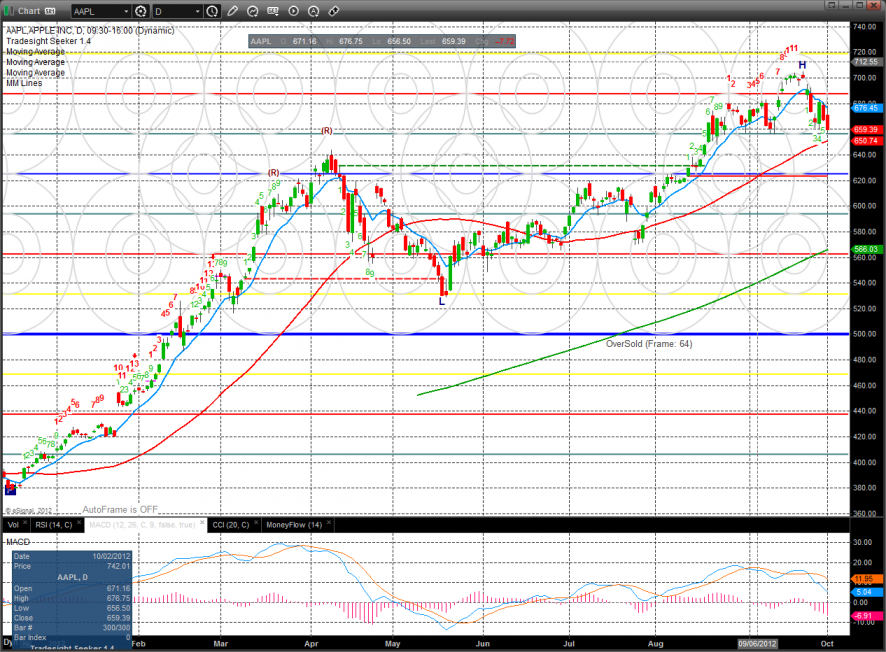

The NQ futures were much weaker than the broad market all day. Price closed below the open and lost a net 4 handles on the day. Keep in mind that the Seeker sell count is 12 days up.

AAPL is the locomotive engine that drives the NQ and today it closed below last week’s low and in fact it made a new low monthly close. We usually don’t talk about individual stocks in this part of the report but since AAPL has such a heavy weighting in the NQ’s and with its supply chain can really dictate which track the NQ train takes.

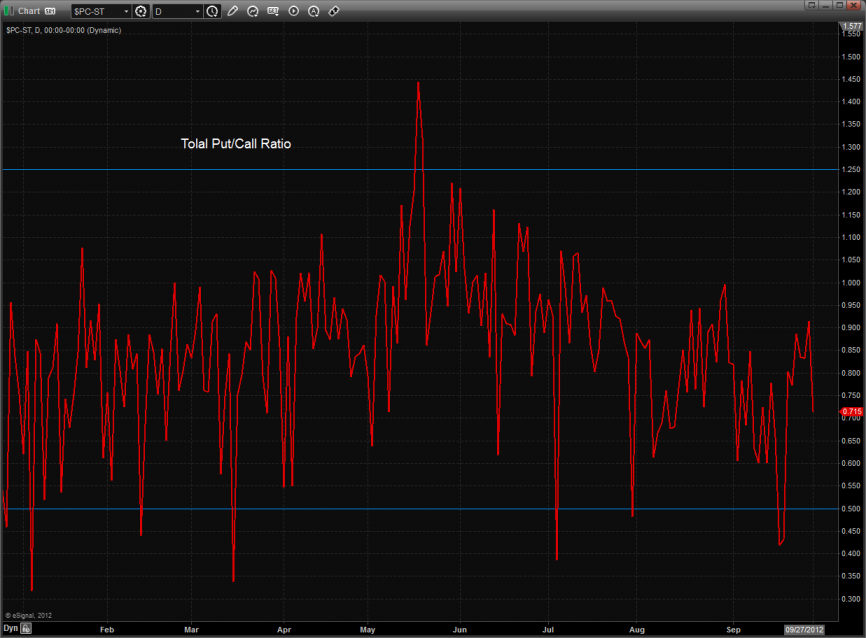

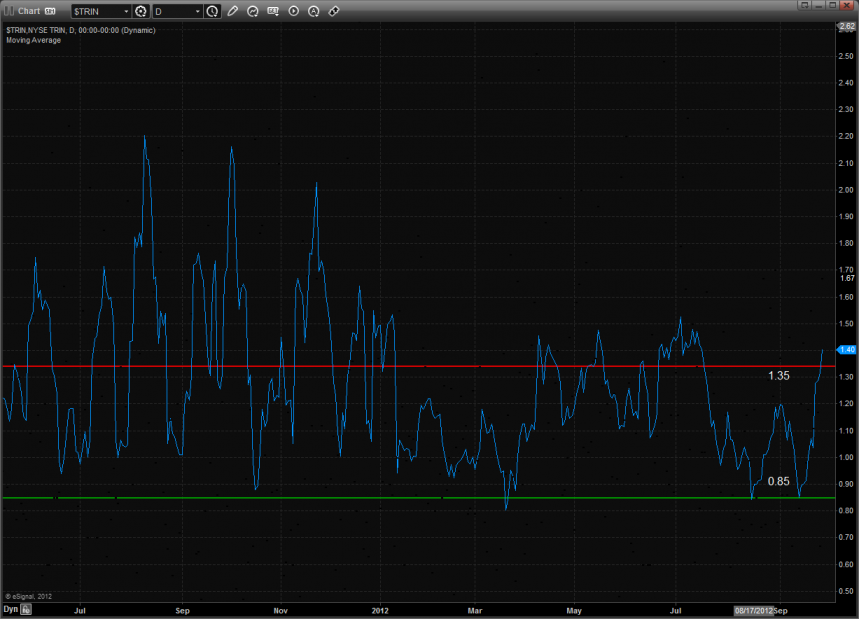

Total put/call ratio:

The 10-day Trin is still oversold which will provide the market upside fuel when it turns.

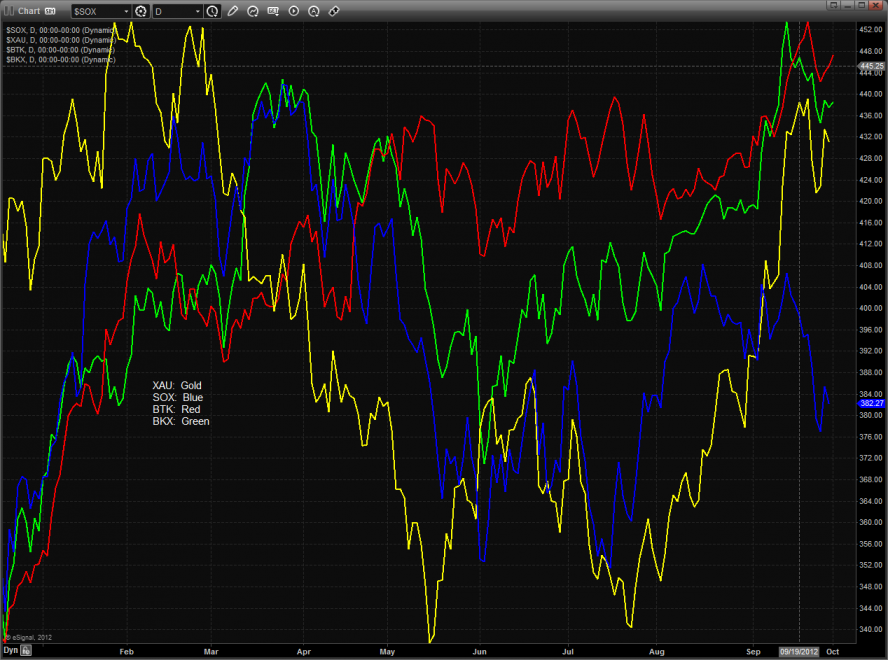

Multi sector daily chart:

The SOX was the last laggard on the day but posted an inside candle so we’ll have to defer to a break of Friday’s candle for any new technical development.

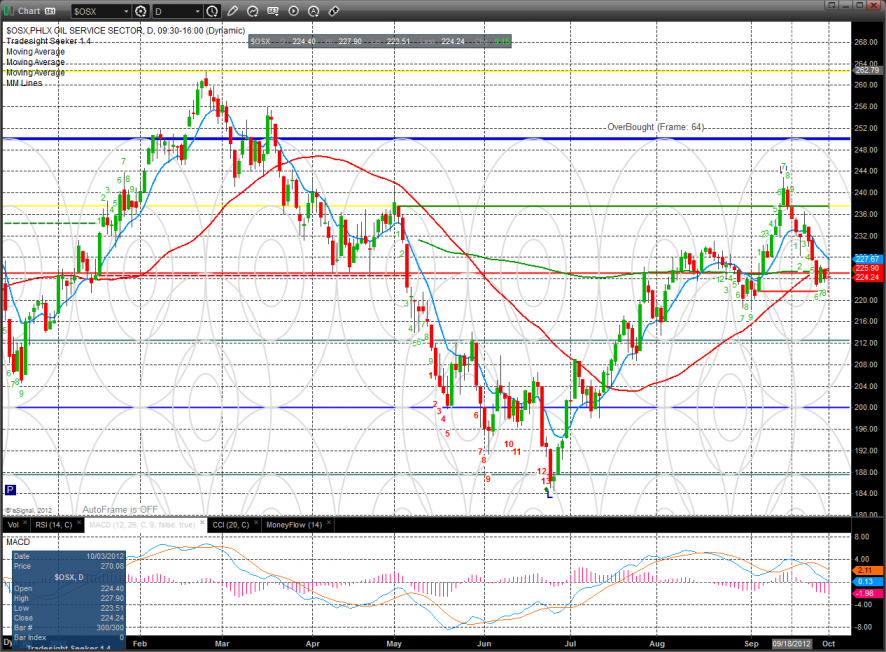

The OSX was unchanged:

The BKX posted a very narrow range day, staging below the 8/8 level.

The BTK was the strongest sector and still has a bullish formation with price above all major moving averages.

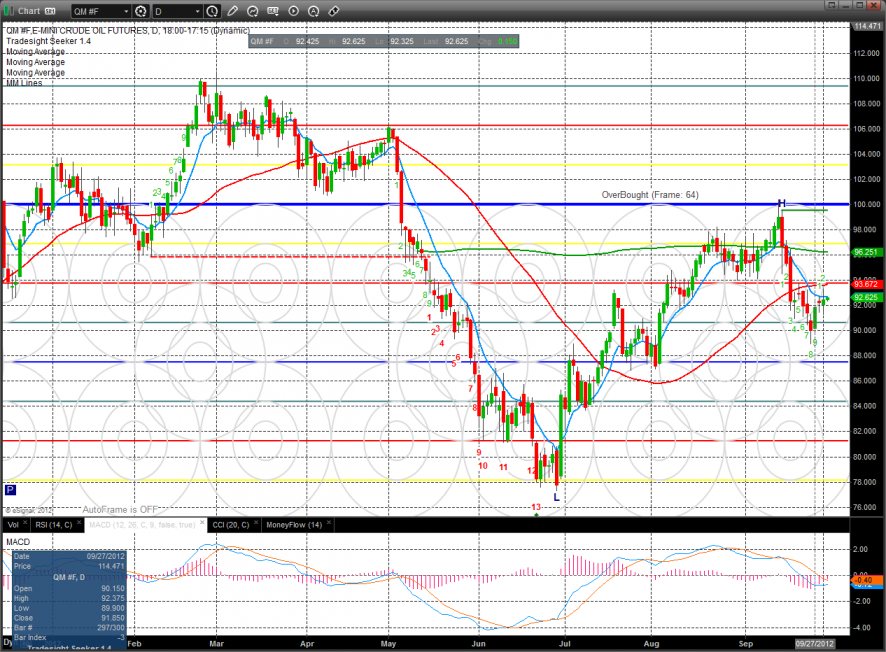

Oil:

Gold:

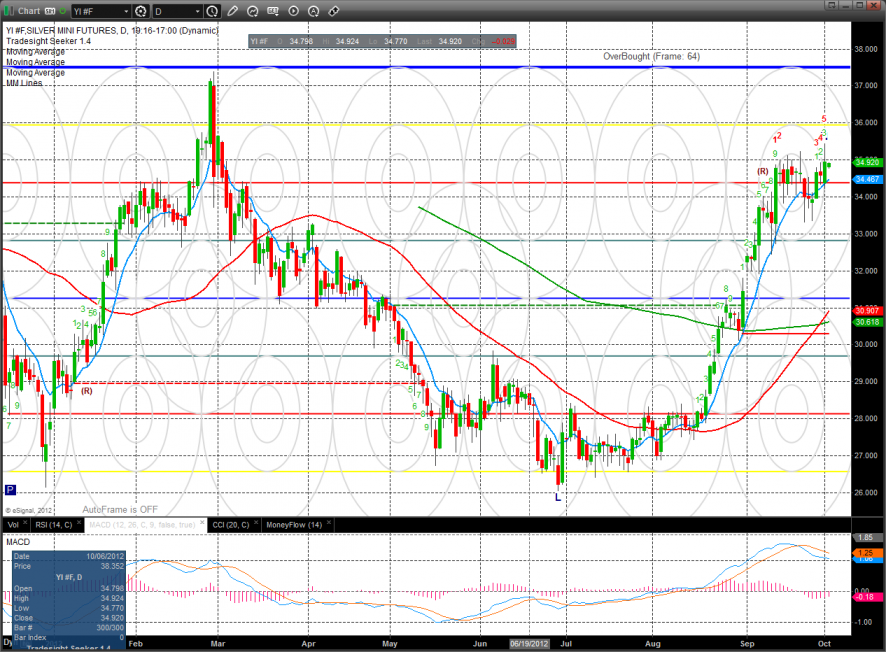

Silver: