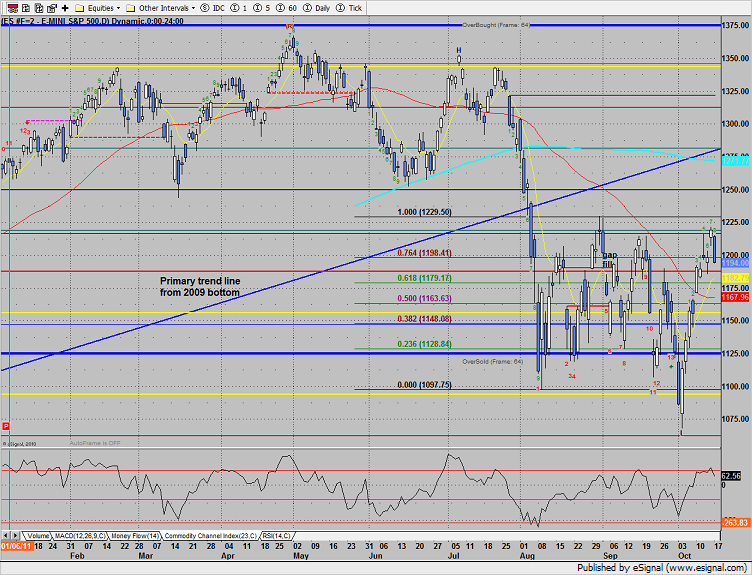

The ES recorded a first day down off the formidable 1225 level losing 25 on the day. There was no new high recorded on the move thus far. Expect choppy action through earnings season and a 3 candle pullback that may take more than 3 days to trace out.

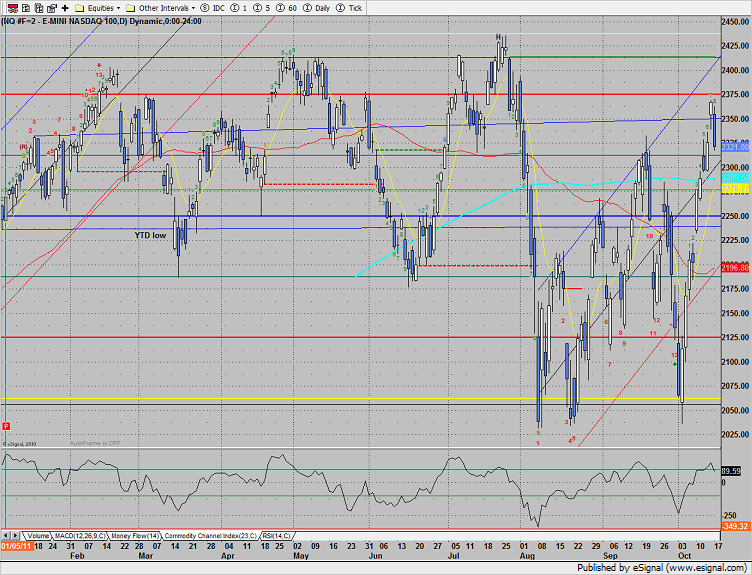

The NQ futures were lower by 46 on the day. Key support is just below where the 200dma and 10ema converge.

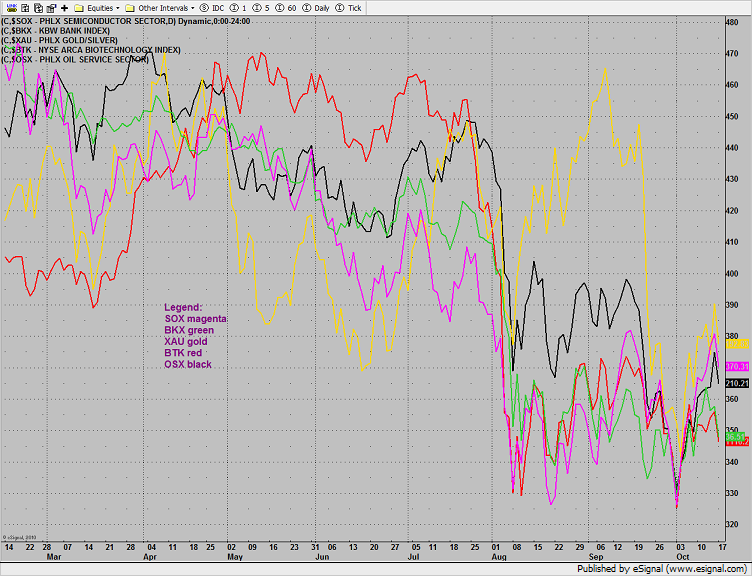

Multi sector daily chart:

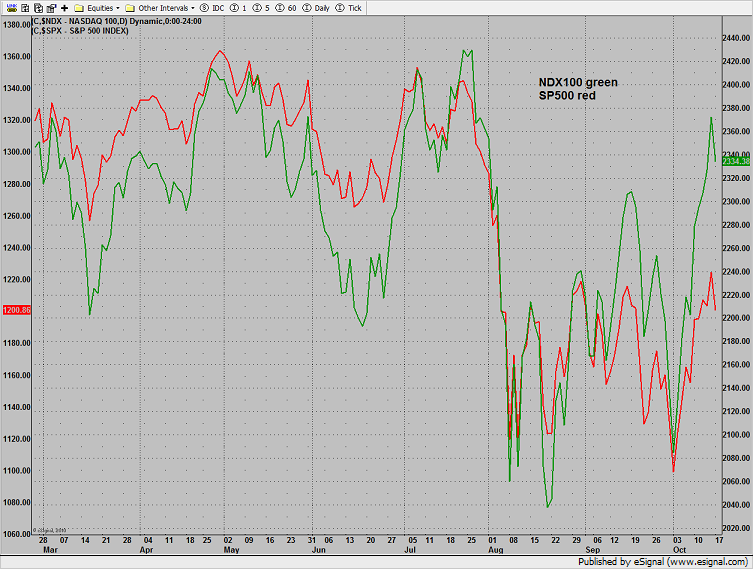

The NDX100 continues to bullishly lead the broad market SP500.

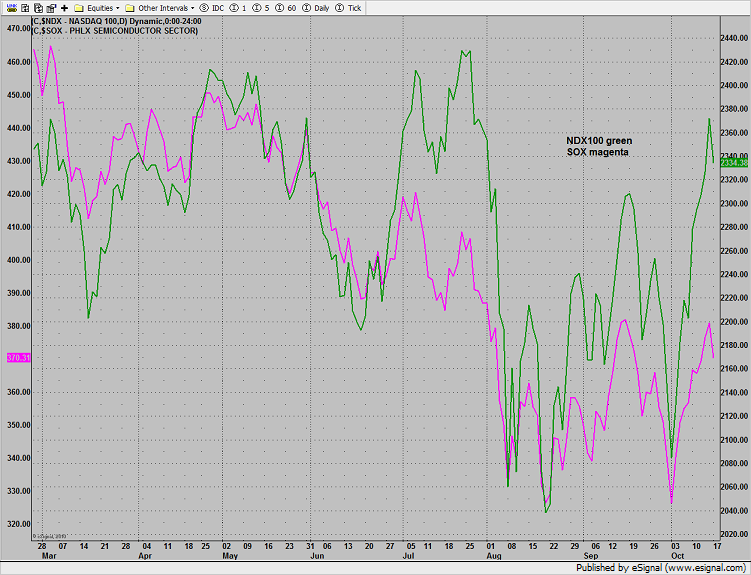

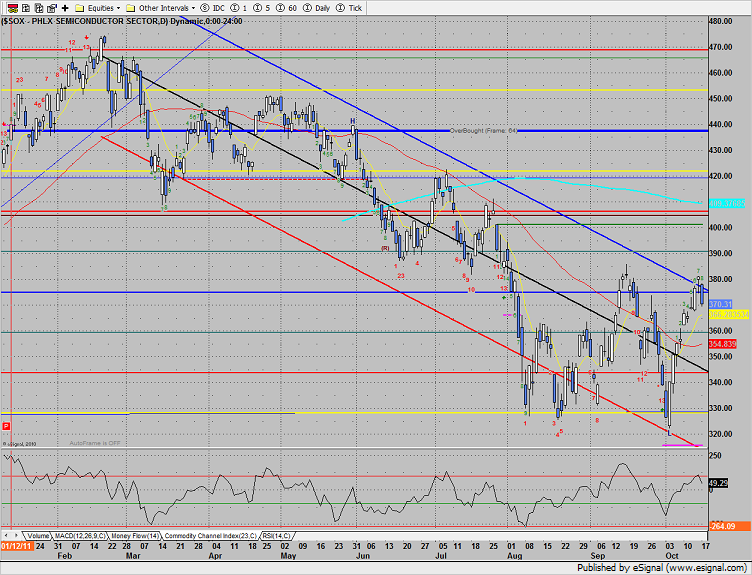

The SOX is still lagging the NDX which is cause for concern. So between the strength of the NDX vs. the SPX, and the SOX lagging the NDX one positive washes out the other negative and there is no clear advantage.

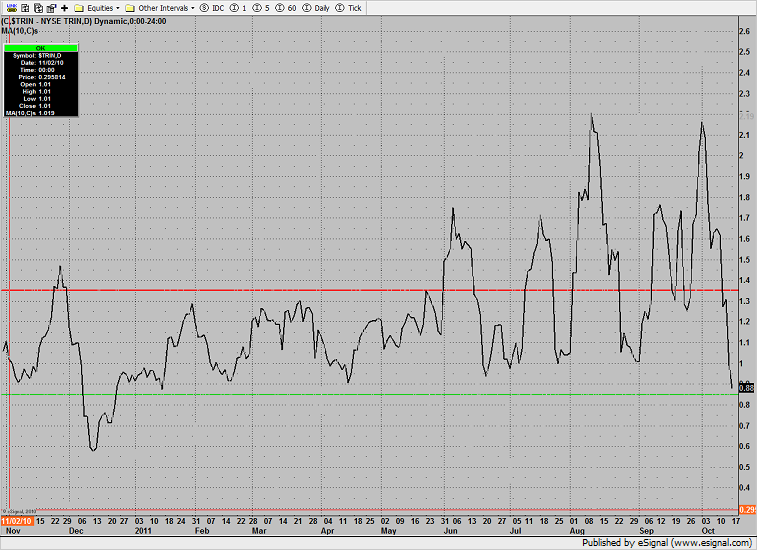

The 10-day NYSE Trin dropped to just above the 0.85 overbought threshold. Note that this is the most overbought that the market been since January.

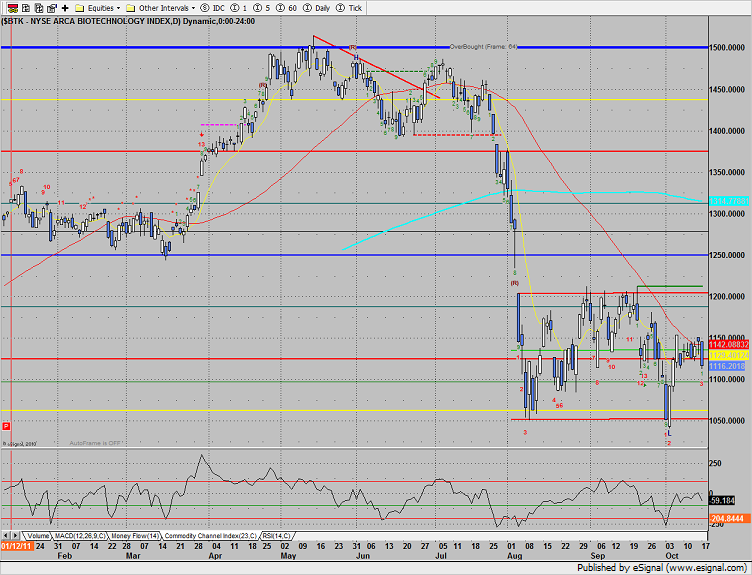

The BTK recorded a one week low and yet was one of the stronger sectors on the day.

The SOX was weaker than the NDX and unable to make good on the unqualified channel break.

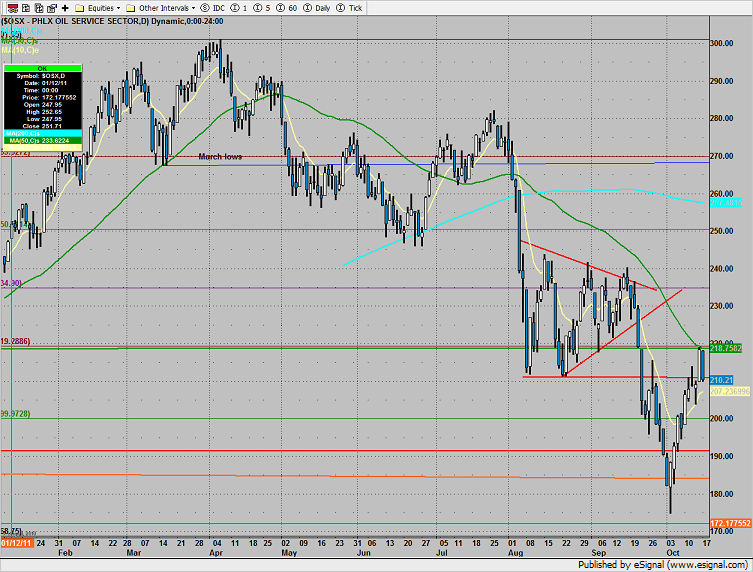

The OSX was rejected at the 50dma. Key support is at the 210 level which is the August low.

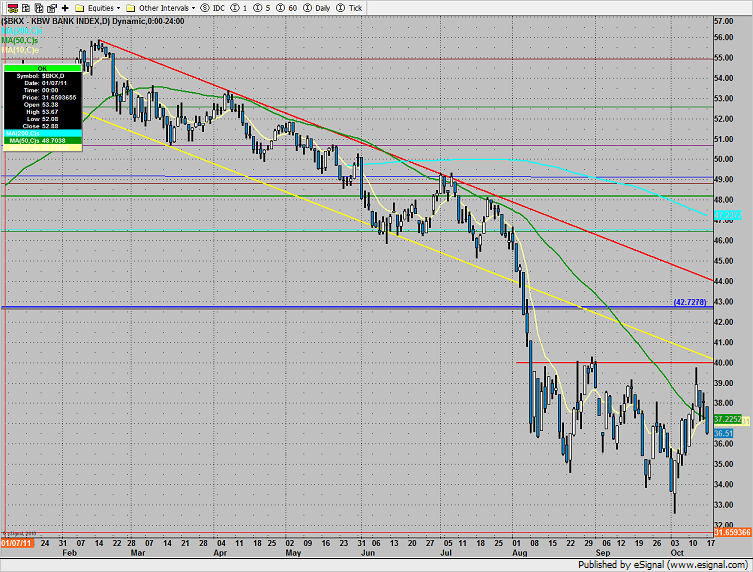

The BKX was the last laggard on the day down 4%. The trend does not change until 40 is reclaimed.

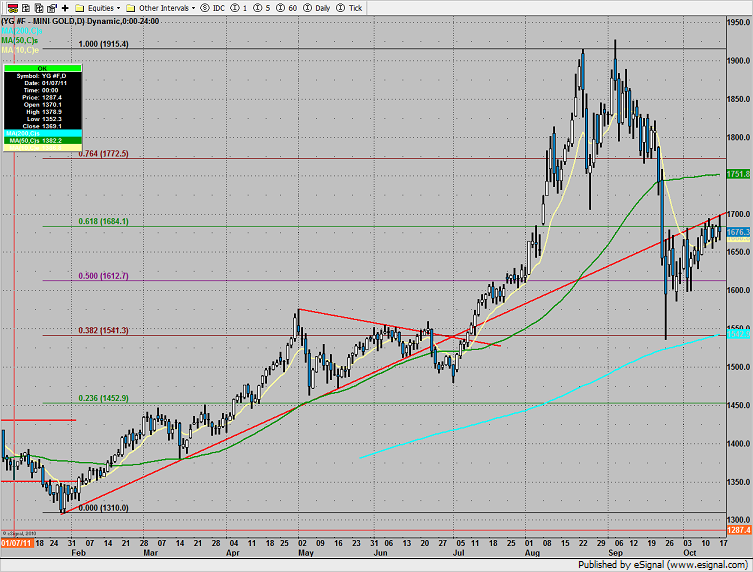

Gold is still grinding on the DTL, expect a resolution soon.

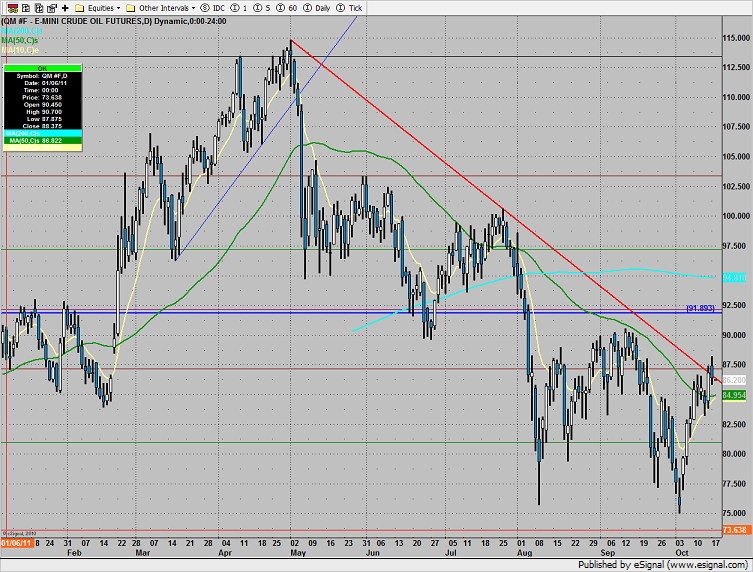

Oil broke above but closed below the active DTL so there is no change in trend yet.