Tax Day 2011 is upon us (April 15). What are some of the implications about Tax Day in general from the market’s perspective?

Here’s a few, statistically.

1) If the market has been moving in one direction for the last couple of month, Tax Day is a turning point over 75% of the time.

2) IRA money pushes into the market for 2010 until Tax Day, so that has a better chance of pushing the market higher in the early part of the year.

3) Sometimes, we get a feature, especially based on the prior year, where people owe money and pull money out of the market leading up to Tax Day, and then the market releases to the upside.

Let’s take the last three years as examples.

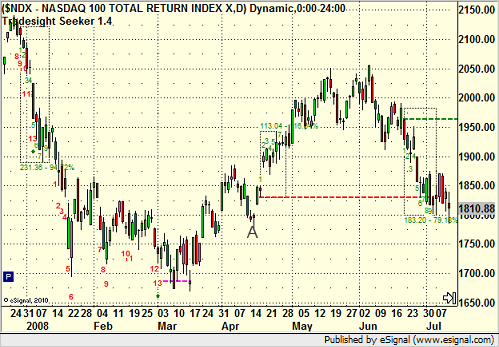

In 2008, the market had a quick pullback at the start of April, which makes it look like people needed to pull money out of the market to pay their taxes, and then the market headed up right after Tax Day (point A):

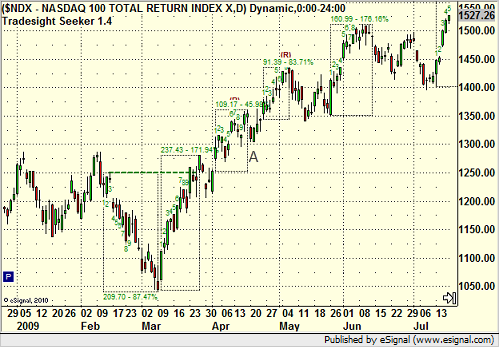

In 2009, we did rally leading up to Tax Day, but given the market collapse of 2008, it’s likely that most people didn’t need to sell stocks to pay for gains. Also, remember that 2009 is unique in that the Fed’s QE had just hit full effect from the market collapse, which means that the market was in the early stages of being pushed higher:

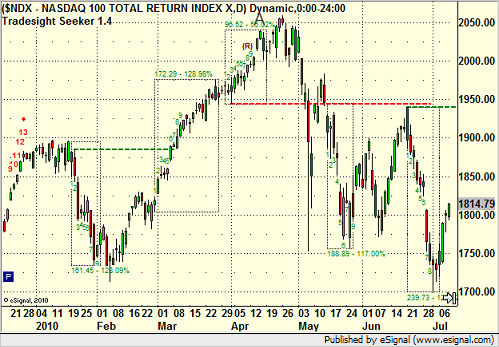

In 2010, the market had been on a run to the upside leading into Tax Day, and the top of the market for the first half of the year was right around this point:

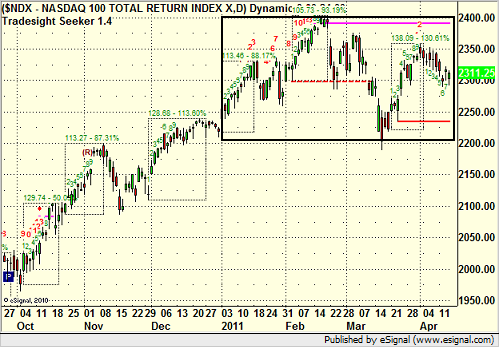

So, what does that mean for 2011? This year is also different. First of all, volume has been horribly light, especially the last three weeks, and the market is sitting in the middle of a 4-5 month range instead of trending up or down. There doesn’t appear to have been any selling to raise money to pay for taxes, but the IRA funding rally didn’t materialize either. Here a current look:

So, at best we could say that there has been a slight bias to the downside the last two weeks. Given the fact that the market usually pivots after Tax Day, we do need to focus on what happens next week, which is core earnings reporting for Q1. Is the pressure off stocks with Tax Day behind? Or are things going to pull back now that whatever IRA buying pressure is over? Time will tell, but one thing is certain. In the last 15 years, the week AFTER Tax Day has been an important one in determining the market’s direction for a while.