Let’s examine from a technical perspective what happened today on AAPL as it relates to Gap Fill Thresholds, Seeker Counts, and index rebalancing. AAPL lost size in the NASDAQ index, which rebalances over the weekend, which means that funds have to sell some of their shares.

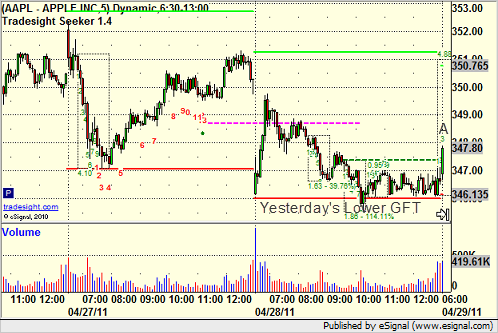

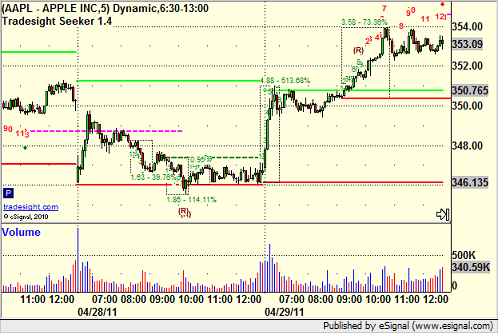

First, here is how AAPL starting Friday, with an A over the first 5-minute bar. Note also that the red line from the prior session was the lower Gap Fill Threshold from that day, which the market used very specifically:

AAPL gets off to a strong start in the morning and runs up toward the upper Gap Fill Threshold (green line) in the first 30 minutes or so:

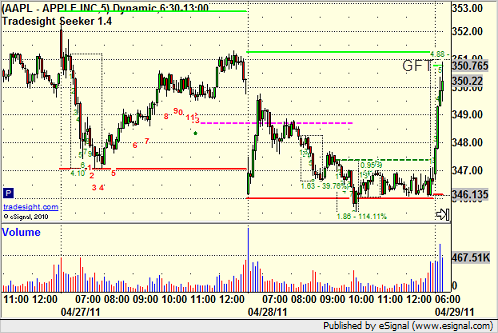

This is first resistance after that move. As trading continues, that level becomes more solid resistance:

And even moreso after a couple of hours:

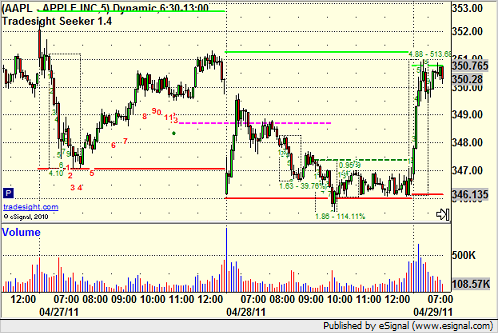

When it finally does break through, we get an upside move that leads to a 9-bar Seeker setup count, although that doesn’t have to be the high of the move:

In fact, as long as the 4-bar lookback mechanism remains in place, the energy can continue, which it does until we break the lookback and close the Seeker setup box, which produces the high:

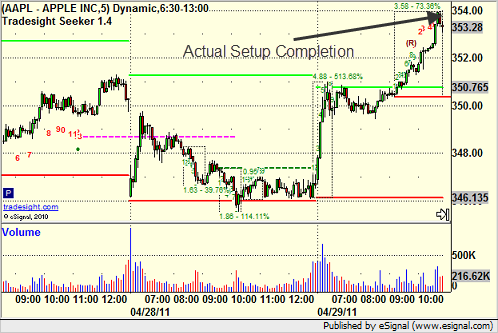

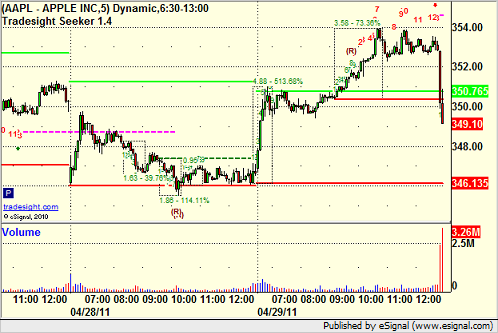

Note that the actual 1 to 13 Seeker count is now well underway (which starts after the 9 ends); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES and this ultimately leads to a 13 bar sell signal late in the session:

How well does that line up with what happens? Pretty well, as AAPL crumbles on late selling due to the rebalancing:

All of this was led by our technical tools for the session, even if the rebalancing situation is a little unusual.