An amazingly dull day after Tuesday’s excitement, which leads me to believe that we did, in fact, see options unraveling on Tuesday. Hard to see how else the market goes from 2.2 billion NASDAQ shares to 1.7 billion in a day with CPI and options expiration due.

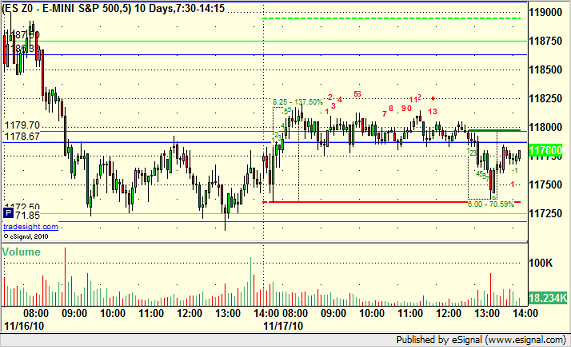

ES with Tradesight Levels:

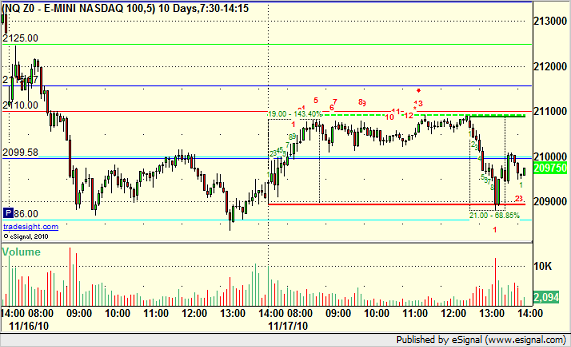

NQ with Tradesight Levels:

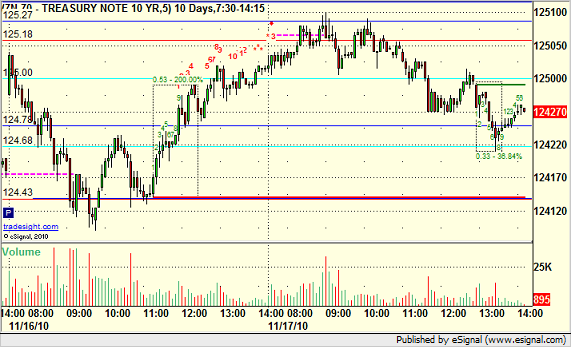

ZN (10-year Treasury Note) with Tradesight Levels:

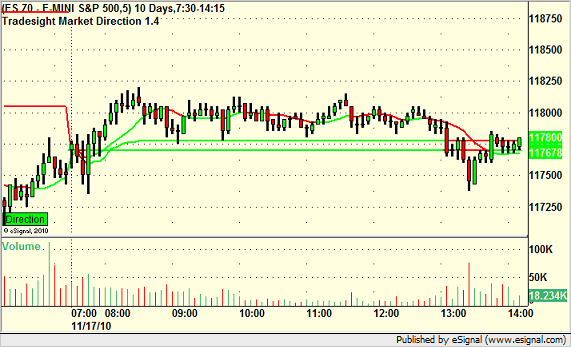

ES with Tradesight Market Directional Tool:

With each stock’s recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early.

In the report, CSIQ triggered short (without market support due to opening five minutes) and worked:

In the Messenger, RIMM triggered long (without market support) and didn’t work:

Rich’s BIDU triggered long (with market support) and didn’t work:

His BIDU short triggered (without market support) and worked:

That gives us only the 1 trade that actually triggered with our measurement of market support on a dead flat day, and it didn’t work.