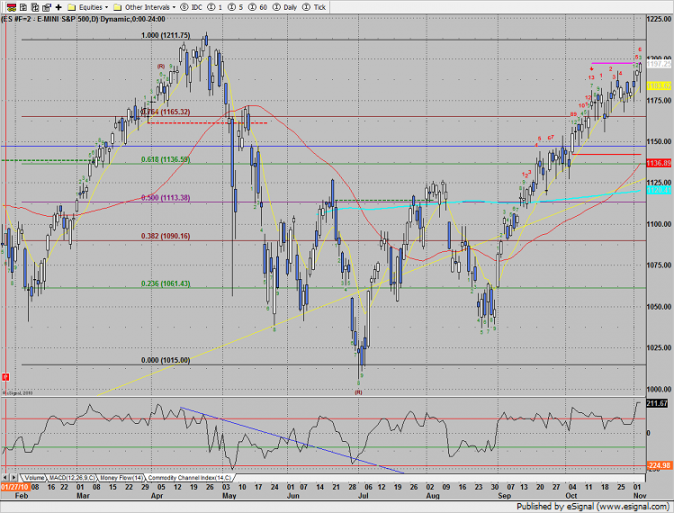

The SP moved to another new high adding 4 on the day. Price settled right at the risk level from the exhaustion signal. If that level gets taken out, then the April high of 1216.50 is in play.

Naz was higher by 14 decisively closing at a new high. As of today’s close, the pattern is 9 days up completing the 9-13-9 pattern.

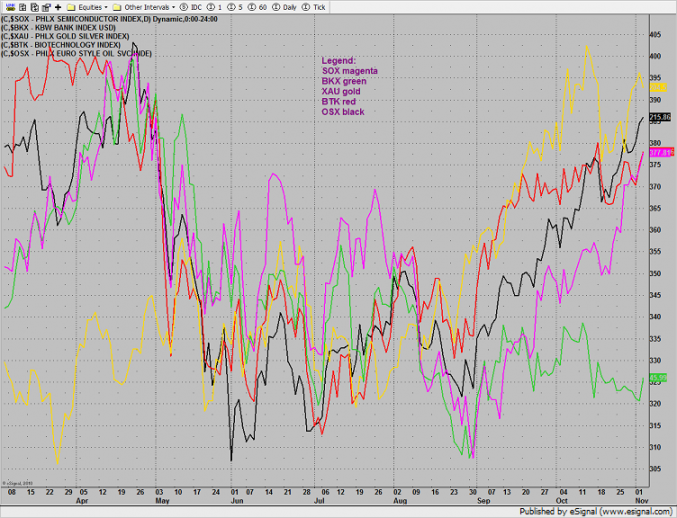

Multi sector daily chart:

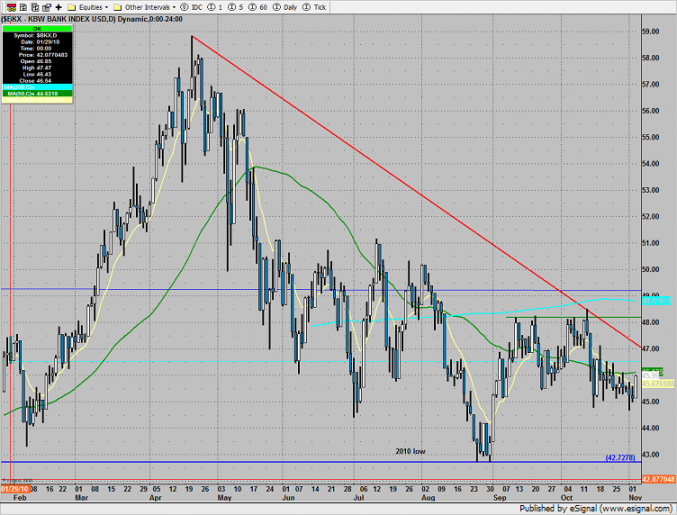

The BKX was top gun up 2% on the day. A DTL (red) had been added to the chart. This defines the current down trend. A close above the DTL will be the first indication of a reversal. Confirmation would be a settlement above the 200dma (aqua).

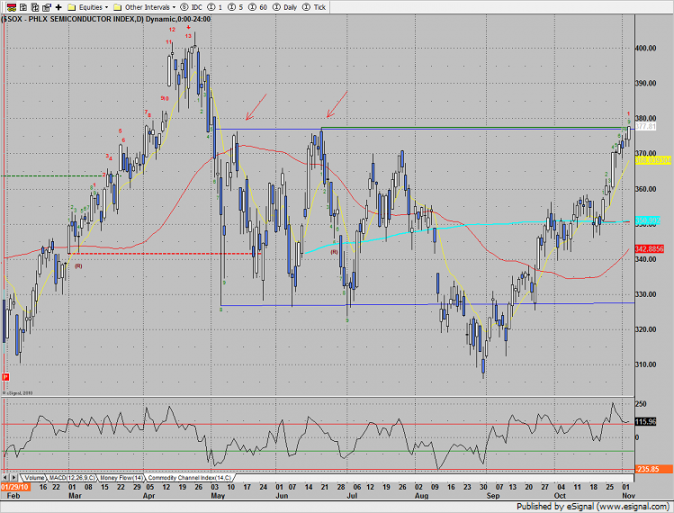

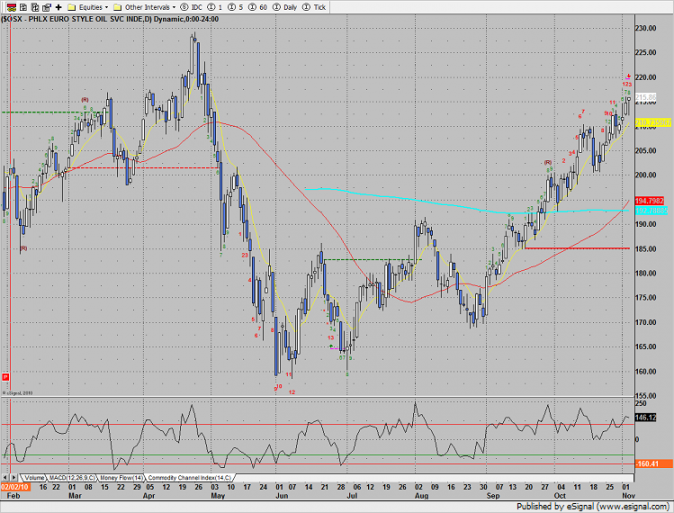

The SOX settled right at the static trend line. The pattern is at key resistance an has just completed a 1-9 setup.

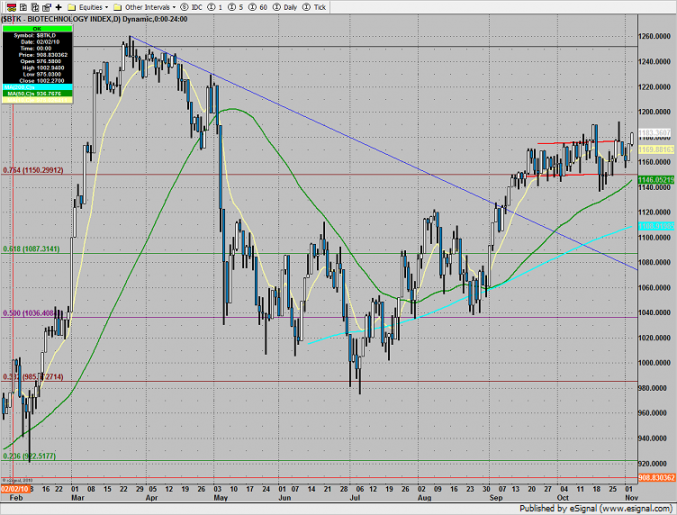

BTK was slightly stronger than the broad market but remains range bound. There is nothing new technically because it didn’t close above the prior high of the move.

The OSX was higher on the day but didn’t trade above Tuesday’s high. Today’s candle recorded the 13th bar of the exhaustion run. A price flip or close under the 10ema will validate the sell signal.

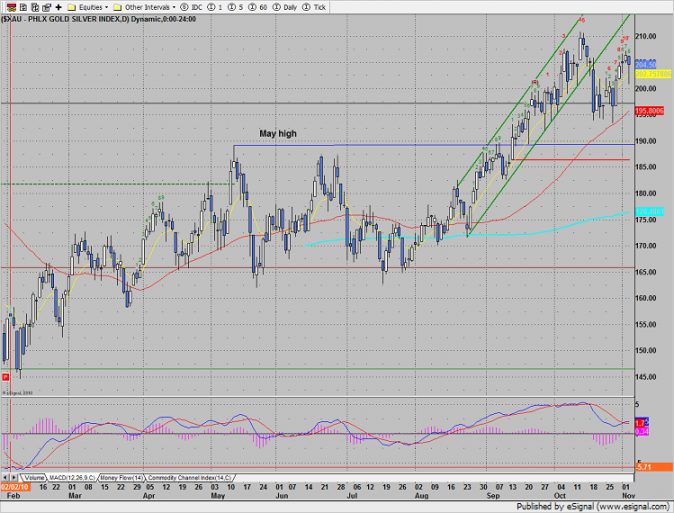

The XAU was last laggard and was a source of funds. This is a very crowded long trade and needs to be monitored for short opportunities.

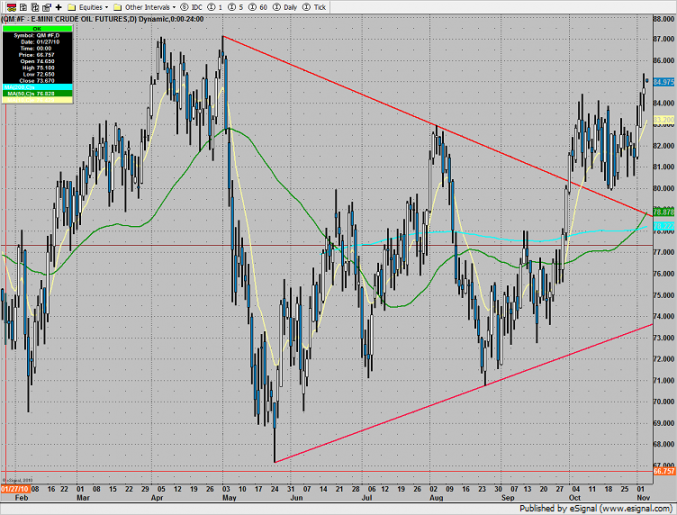

Oil broke above the prior high:

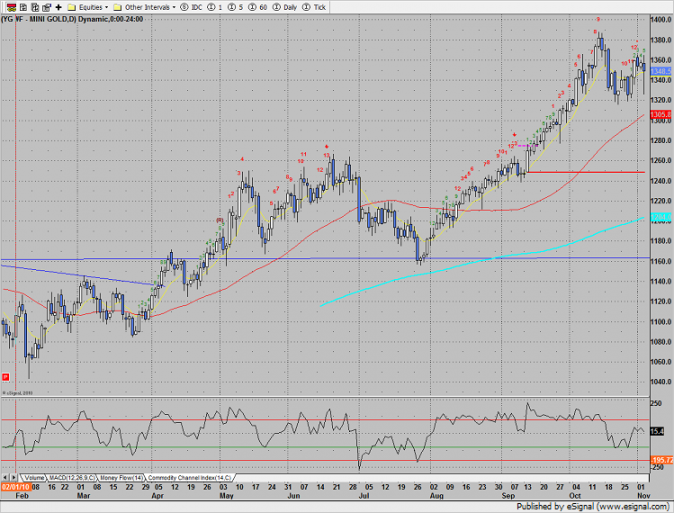

Gold was lower on the day with the 13 exhaustion signal still on deck.

The big action on the day was in the bond market. Following the FOMC announcement, the bonds got hit very hard. In the chart below the TLT which is etf for the long dated US Treasury bonds broke to new lows and had a huge volume spike. Money rotating out of the bonds and into stocks would be a very important development. The money flows into bonds has been huge while there has been no money flowing into stocks.