Not much for options expiration, although the Opening Range plays worked yet again (1 stop out and 2 winners) and the extra trade call was set up nice but didn’t work on the ES. The ES left a small gap above and traded in a narrow range. Triple expiration was only 2.2 billion shares, which is obviously up (and not real) but not as big as a usual triple expiration.

Net ticks: -7 ticks.

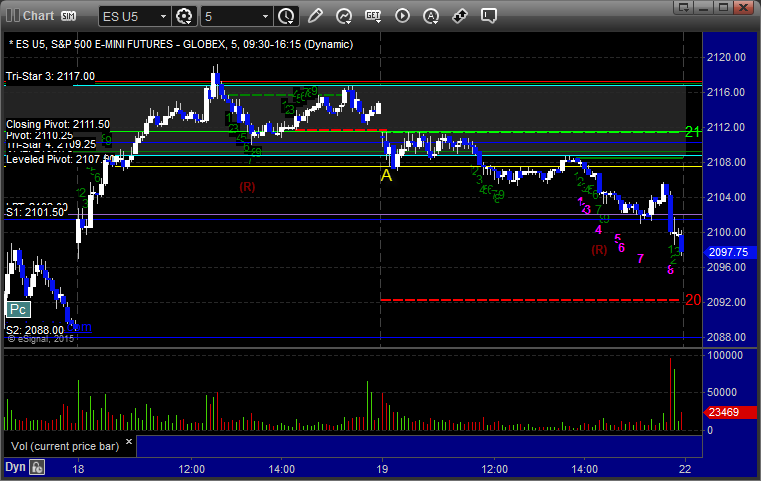

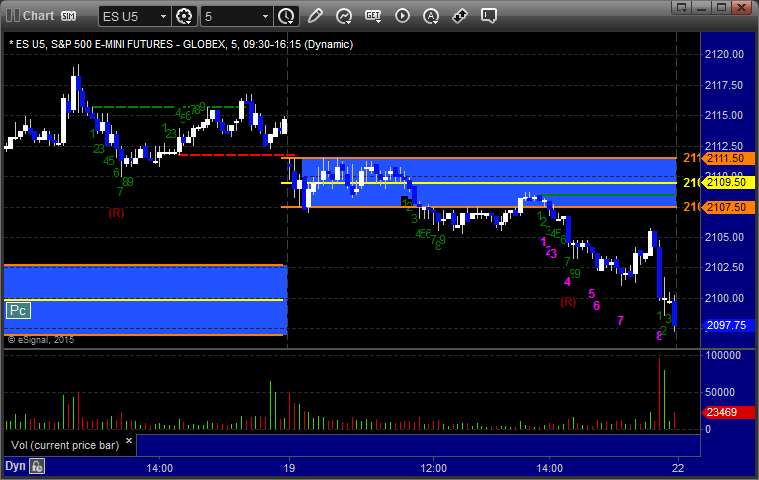

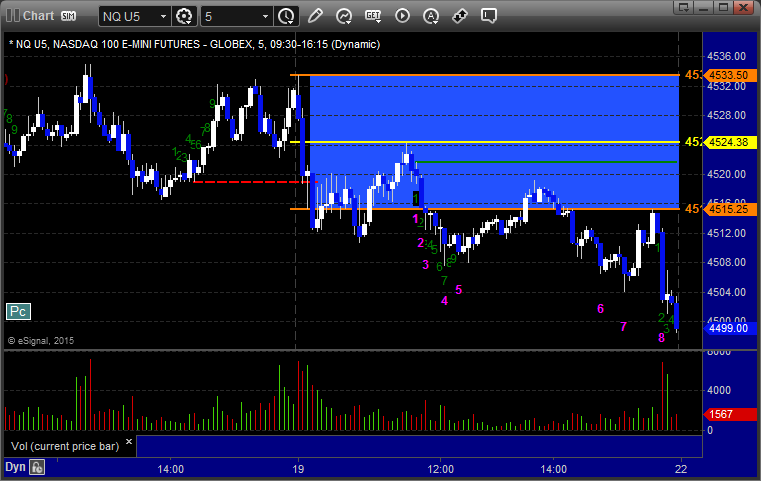

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and worked big:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 2107.25 and stopped for 7 ticks. Did not re-enter on triple expiration Friday: