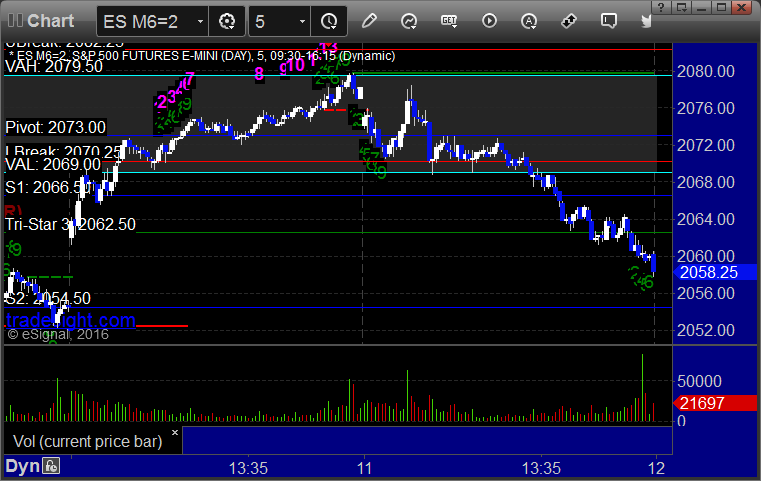

The markets gapped down and were very narrow (though split, NASDAQ more positive, ES more negative) for the first hour, the things spiked up to fill the gap on the Oil Inventory numbers, and then the rest of the day was to the downside, especially after lunch. NASDAQ volume was 1.7 billion shares. There weren’t any setups in the first half of the day. Opening Range plays were mixed but the stops were tight.

Net ticks: -26 ticks.

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped. Good example of when an OR is so narrow, you don’t have to risk much, but even a blip stops you out. It was only 6 ticks wide:

NQ Opening Range Play triggered short at A and stopped, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: