Once again with the light volume, the Opening Range plays were a mixed bag (one stop out, two that worked). Then volume picked up later and we had a nice setup in the ES that worked. We may have gotten dual direction options unraveling, although we did not trade average range today like we did Tuesday. Volume was better at almost 1.8 billion NASDAQ shares, but that’s options unraveling.

Net ticks: +2.5 ticks.

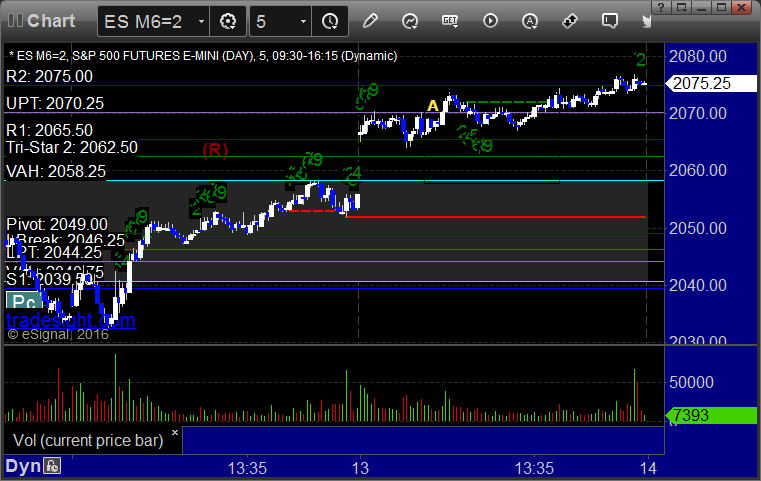

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and didn’t work, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A at 2070.75, hit first target for 6 ticks, and stopped second half under the entry: