The markets gapped down and held for a bit, then made a slight effort to break into the gap but failed. We then rolled to the downside and started what could have been a minor options unraveling move, but that ran out of steam over lunch and the markets just drifted up and stuck to the VWAP. Volume was 1.5 billion NASDAQ shares. Looks like the week is over and options have everything in place for expiration.

Net ticks: +6 ticks.

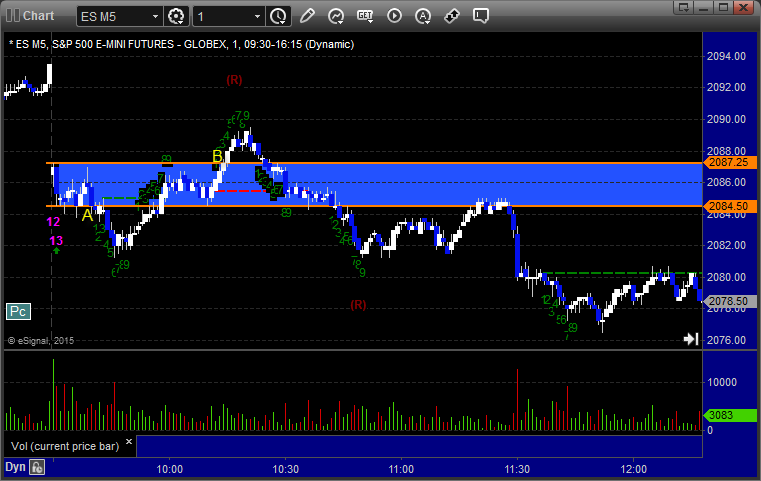

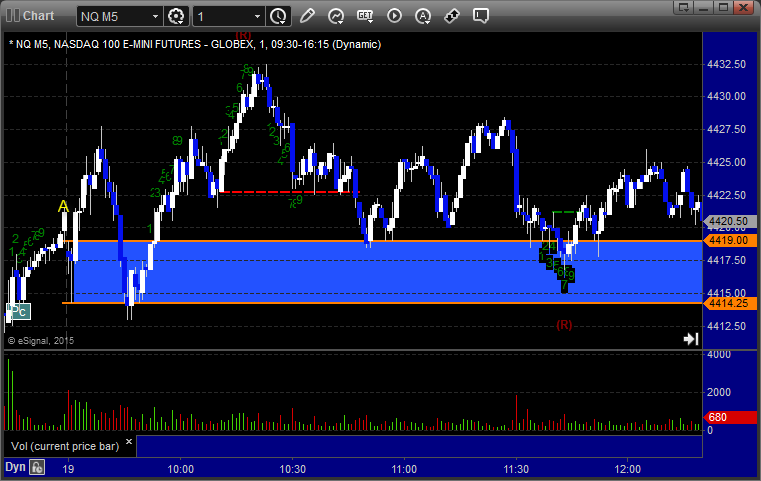

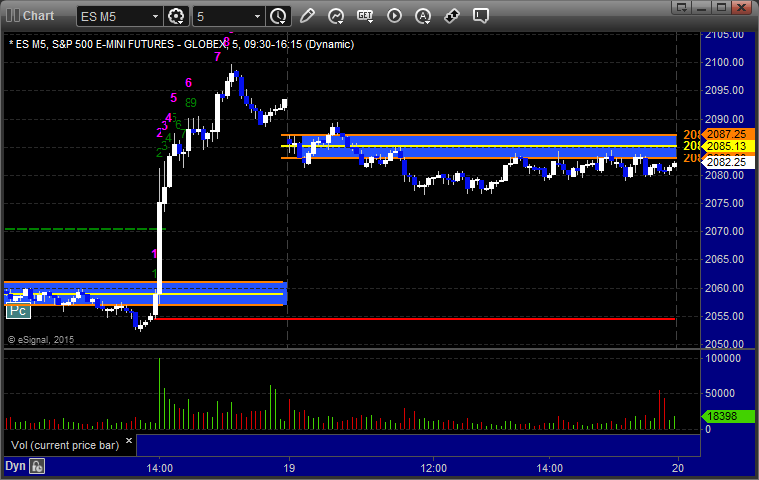

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked, triggered long at B and didn’t work:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play did not work either way, but we already had the volume warning by the time it triggered:

NQ Tradesight Institutional Range Play did not work either way, but we already had the volume warning by the time it triggered:

ES:

ES triggered short at 2080.50, hit first target for 6 ticks, and lowered the stop twice and stopped the second half 6 ticks in the money: