The markets gapped down a little ahead of the Fed and gave us the least volume after the first hour of the year at only 321 million shares, which basically meant everyone was waiting for the Fed and there wasn’t much point in trading. The Fed news caused a big spike and things just kept going. We did not get the usual 3-wave phenomenon to trade.

Net ticks: +0 ticks.

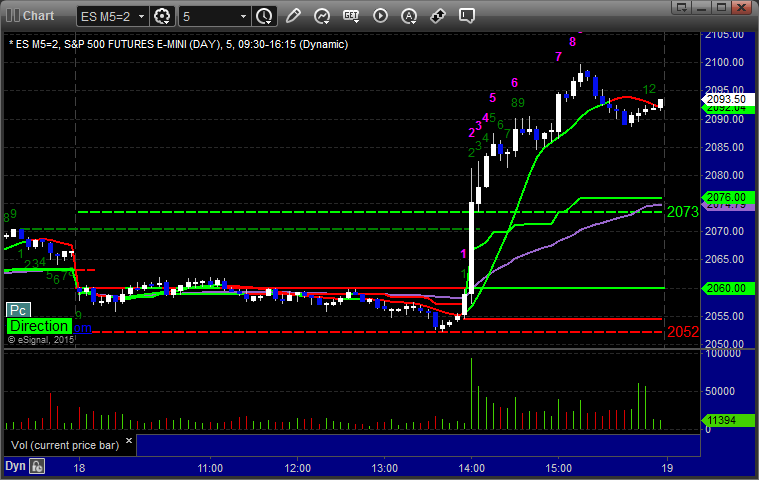

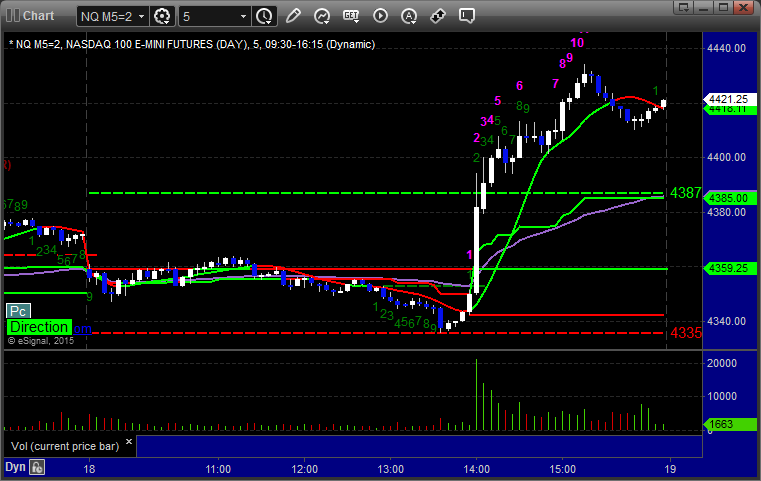

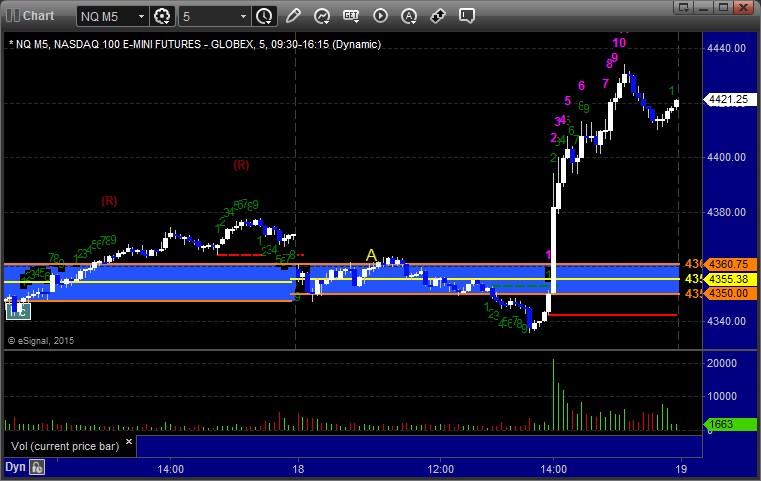

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

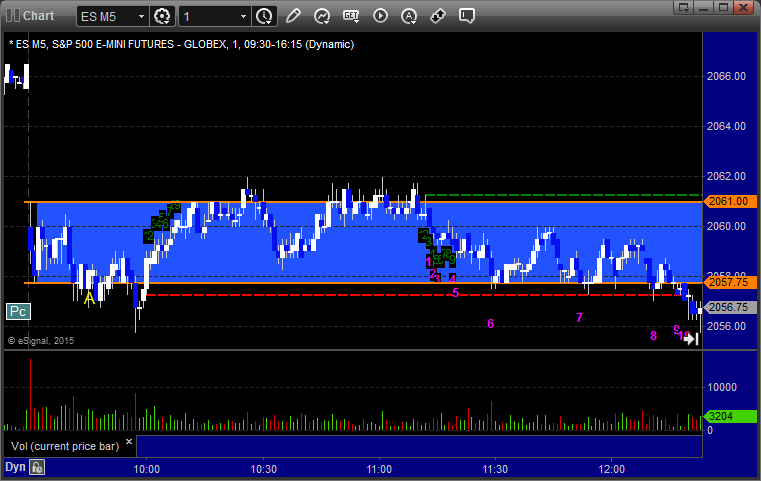

ES Opening Range Play triggered short at A and worked enough for a partial, the long didn’t trigger until an hour in:

NQ Opening Range Play triggered short at A and worked enough for a partial, the long didn’t trigger until 90 minutes in:

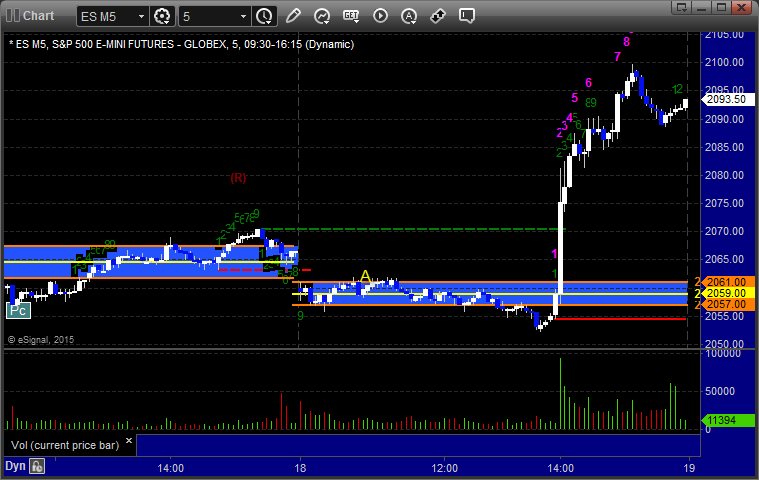

ES Tradesight Institutional Range Play triggered long at A and didn’t work, triggered short over lunch at B and did:

NQ Tradesight Institutional Range Play triggered long at A and didn’t work, triggered short over lunch at B and did:

ES: