Mixed results in the Opening Range plays today finally (they don’t seem to do as well on Fridays on average), and the ES long over R2 call never triggered. We did have a call under the Pivot in the late afternoon that set and worked great. See that section below. NASDAQ volume closed at 1.8 billion shares. The markets gapped up, went higher, went flat pretty quick, and then came back in over lunch and sold off in the last hour.

Net ticks: +6 ticks.

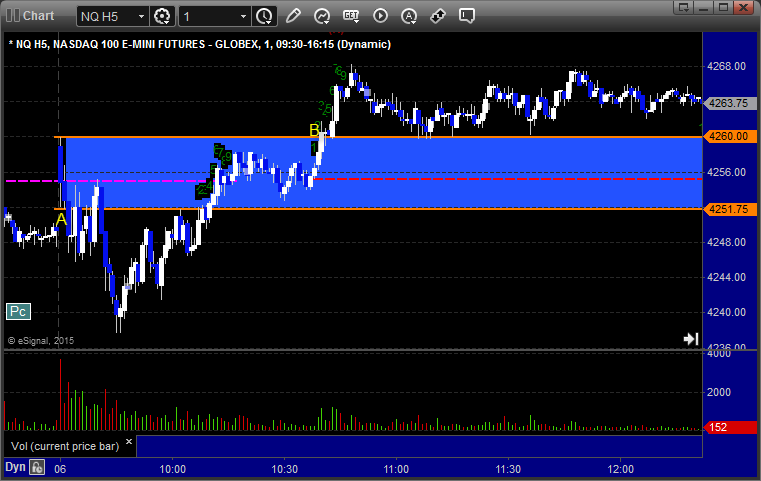

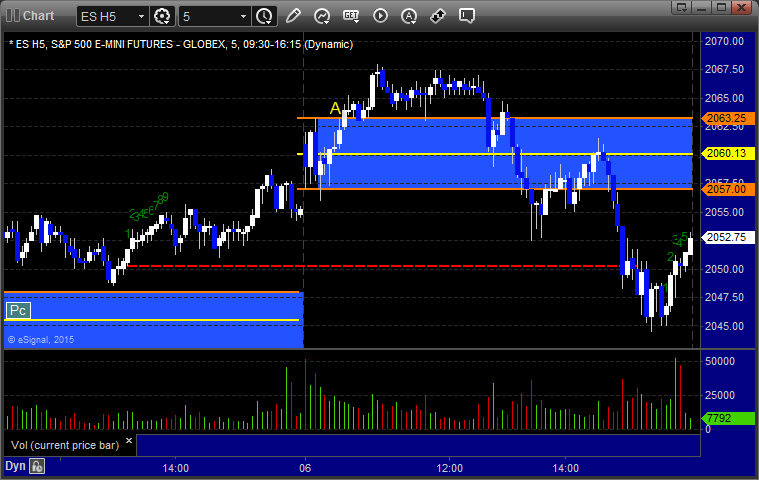

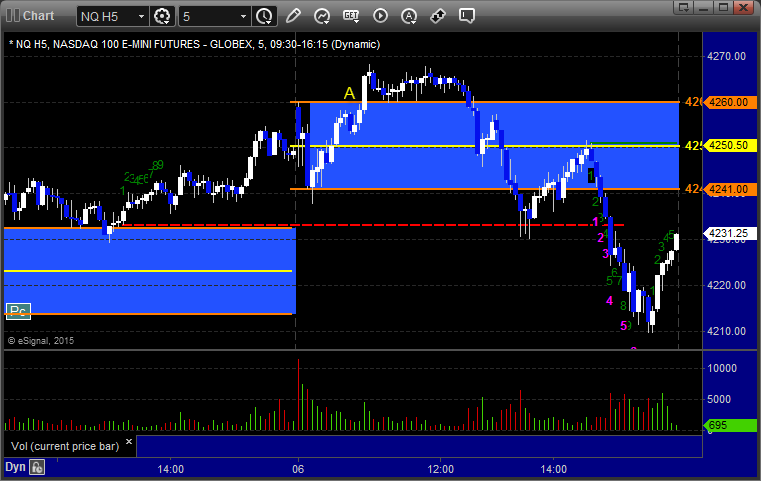

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn’t work. You’ll note that it triggered long at B but this was also a Comber 13 sell signal on that timeframe, so not something to take. It later triggered long at C and worked:

NQ Opening Range Play triggered short at A and worked and also triggered long at B and worked:

ES Tradesight Institutional Range Play triggered long at A and worked:

NQ Tradesight Institutional Range Play triggered long at A but was over 6 points above the range boundary in the one bar, so too extended:

ES:

Triggered short under Pivot at 2051.75 at A, hit first target for 6 ticks, lowered stopped twice and stopped the second half also for 6 tick: