Another light volume day with a narrow start (we were in a 5-point ES range still over lunch) that closed with only 1.7 billion NASDAQ shares again.

Net ticks: -2 ticks.

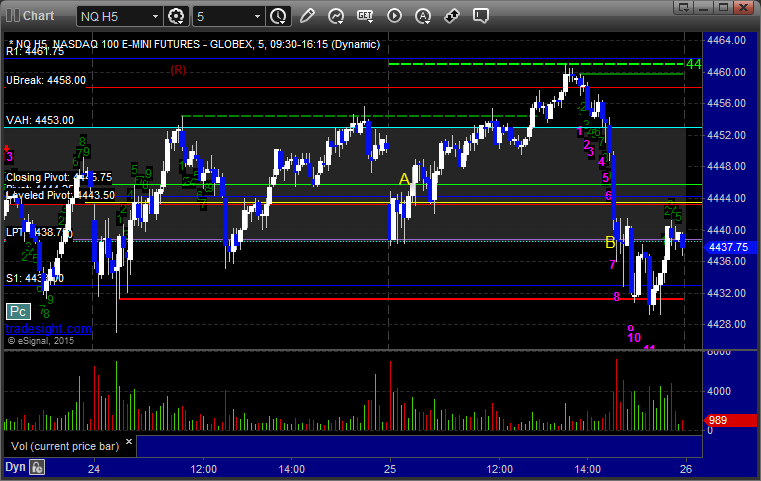

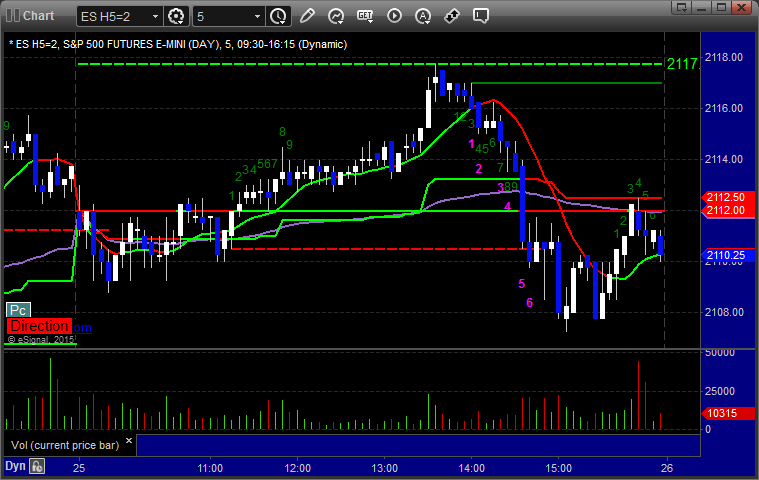

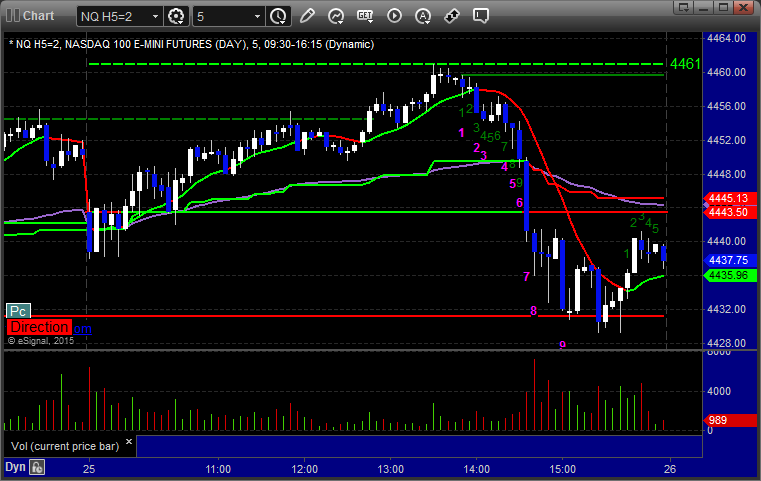

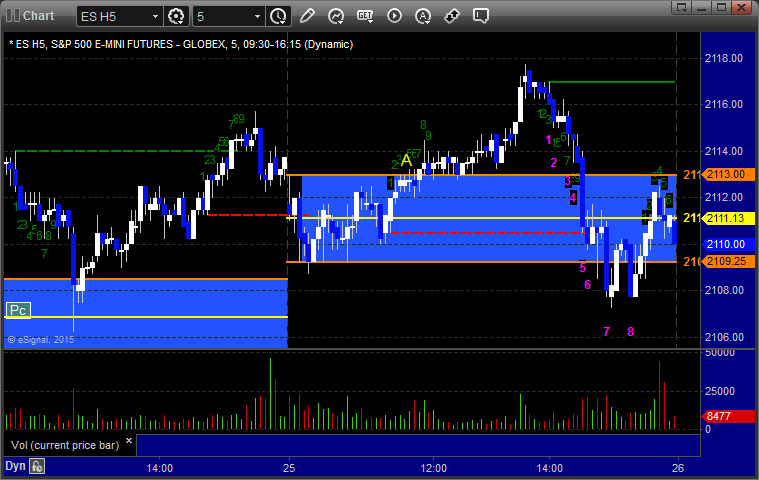

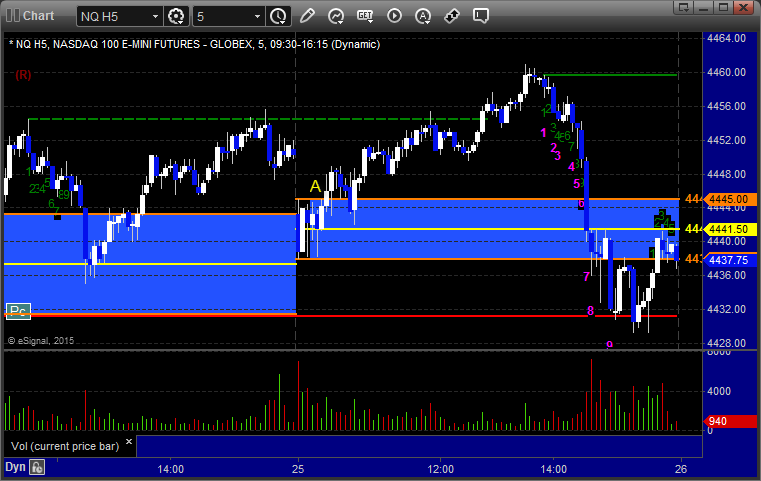

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ with Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play triggered long at A and worked nice:

NQ Tradesight Institutional Range Play triggered long at A and worked nice:

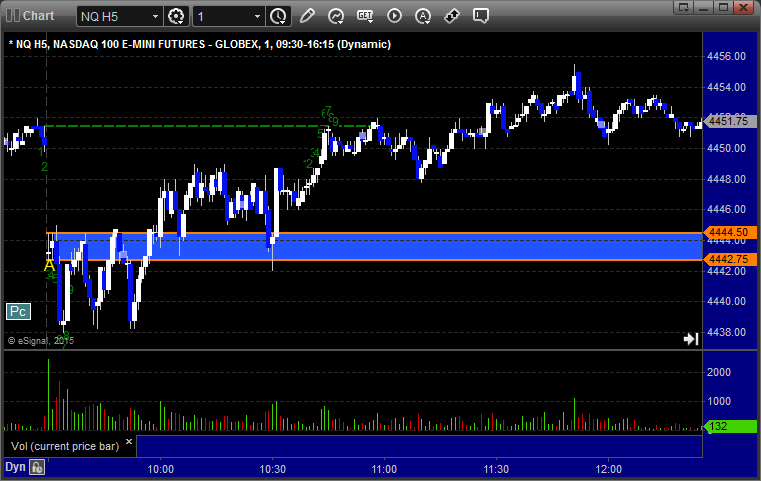

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 4446.00 and hit first target for 6 ticks, stopped second half under the entry. Triggered short at B and stopped for 7 ticks on a sweep, then put it back in and it retriggered, hit first target for 6 ticks and stopped second half over the entry: