The markets gapped up a little and then finally rolled and filled the gaps. Unfortunately, the Opening Range plays swept one way and then worked the other or we would have had a nice session. The markets really sold off badly and gave us what appears to be an options unraveling move in the process, strangely to the downside. We also had an ES call that worked on its own. NASDAQ volume was 2.3 billion shares.

Net ticks: -7.5 ticks.

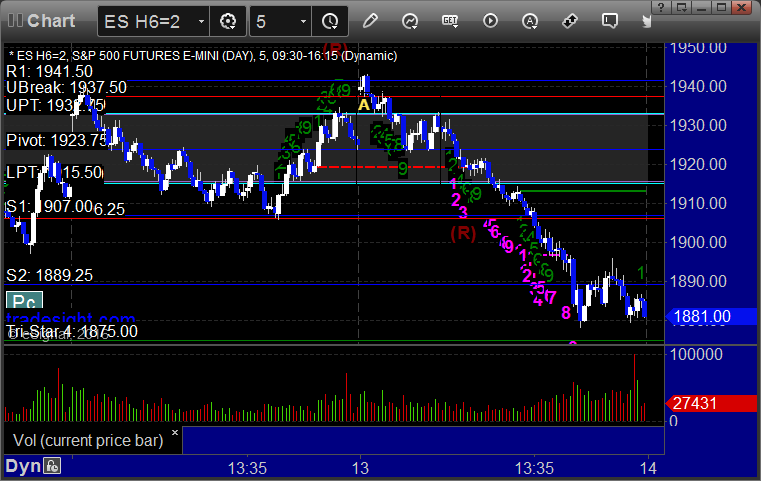

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 1937.25, hit first target for 6 ticks, and stopped second half 4 ticks in the money: