The markets gapped down on the Unemployment data, then pushed up most of the day and closed green. NASDAQ volume was 2 billion shares.

Net ticks: +7 ticks.

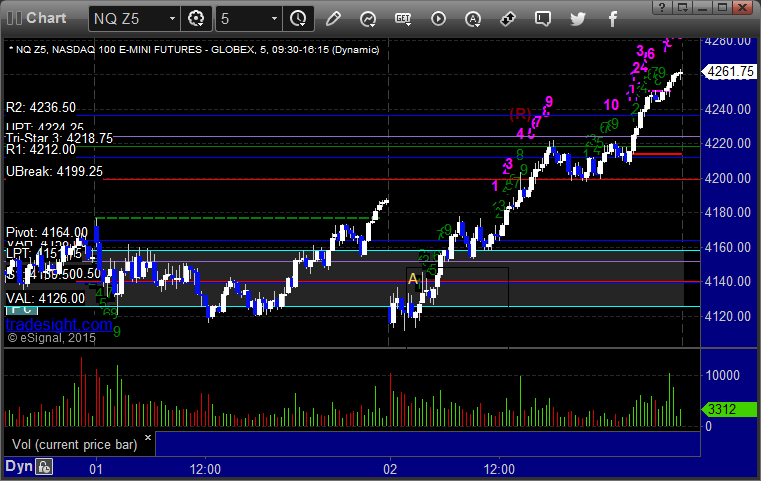

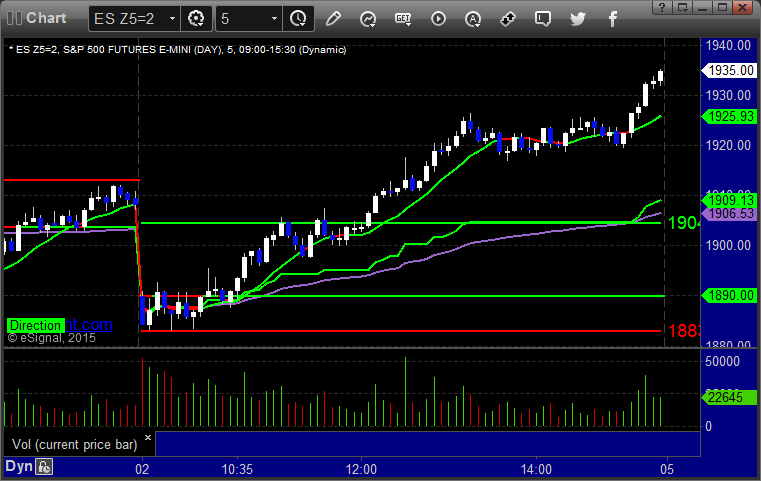

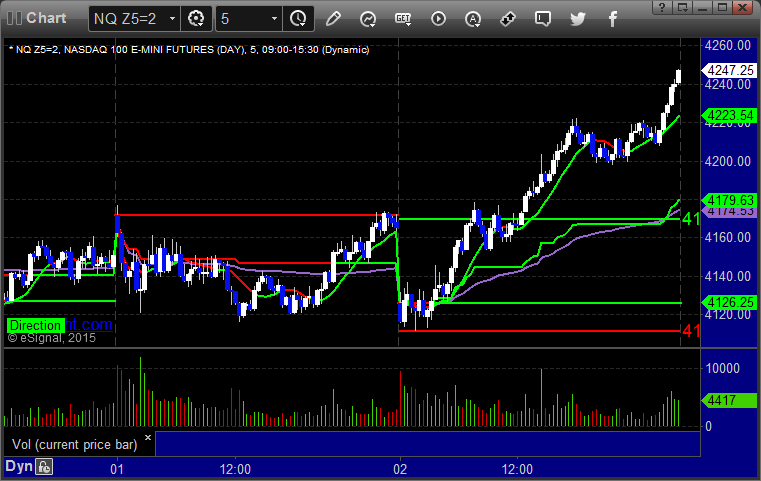

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

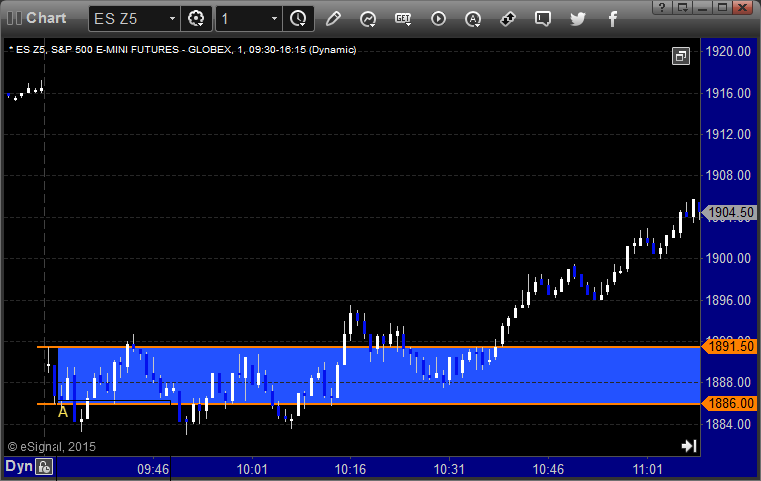

ES Opening Range Play triggered short at A and didn’t work:

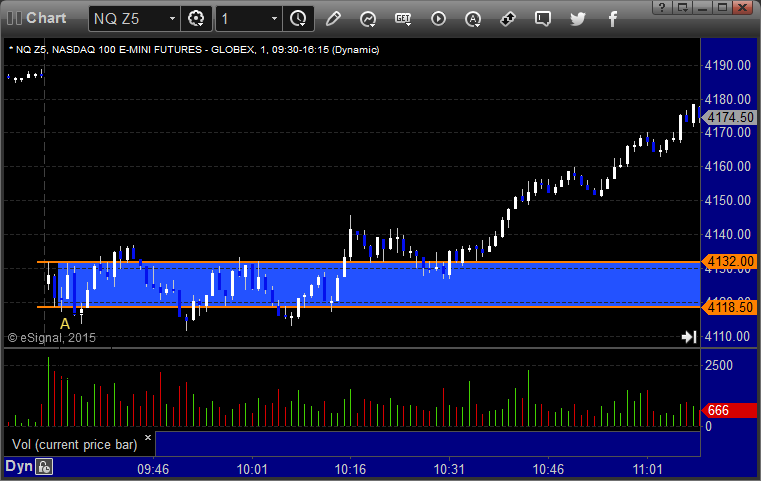

NQ Opening Range Play triggered short at A and didn’t work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A at 1899.00 and stopped the first time. Put it back in, triggered, hit first target for 6 ticks, raised stop twice and stopped in the money at 1903.25:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark’s call triggered long at A at 4141.00, hit first target for 6 ticks, stopped second half under entry: