The markets had a wild session today, driven by a variety of news and global economic concerns. While US data this morning was good, concerns about the oil spill in the Gulf and a widening debt problem out of Europe led to a big push for strength in the USD. Despite all of that, one of our most basic tools helped guide us on trade management today in the GBP/USD, our favorite pair.

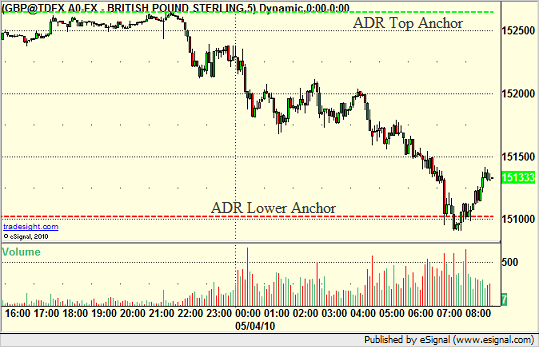

The tool is simply the Average Daily Range tool, which basically shows the six month range average on a pair. What is remarkable is how closely the market uses this point as a pause and potential reversal each day that it hits it. Currently, the GBP/USD trades an average of 162 pips per day (over the last six months). So, if you just take the GBP/USD trading in the current session and anchor the top of the range with the ADR High line, you’ll see where the lower line ends up (162 pips lower):

Quite simply, this area, within a few pips, was about all that the market had the strength to cover. It’s amazing how such a simply tool can help you qualify where exhaustion of a move might occur. How did that play out with our short trade today? Let’s have a look at the chart with some additional key support and resistance levels:

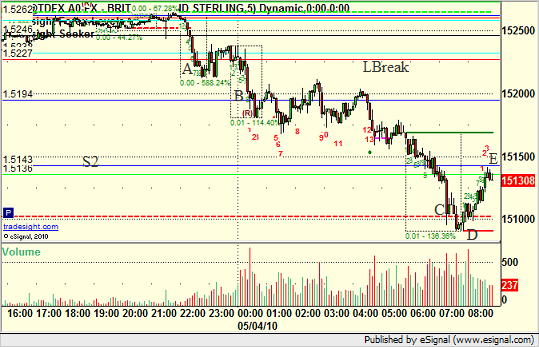

In this case, our short trigger was under LBreak (a Gann Level) at 1.5227 (triggered at point A) with a 25 pip stop that never hit. Our first target where we cover half was S1 (point B); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES and that hit fine. We proceeded much lower overnight, and then in the morning took off another quarter of the trade at C, which was the ADR line. In addition, our Seeker tool completed a reversal setup box at D, which represented the turning point off of the lows around the ADR. We move our stop over S2 and stopped the last quarter of the trade at E.

Note that understanding where the average daily range lines landed got us our best exit piece of the trade.

You can follow us on Twitter for more details by clicking here, or take a free trial to our daily FOREX trade calling and education service here.