Stock Picks Recap for 10/2/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ALKS triggered short (with market support) and worked enough for a partial:

DISCA triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's X triggered long (with market support) and didn't work:

FB triggered long (with market support) and didn't work:

Rich's PCLN triggered long (with market support) and didn't work:

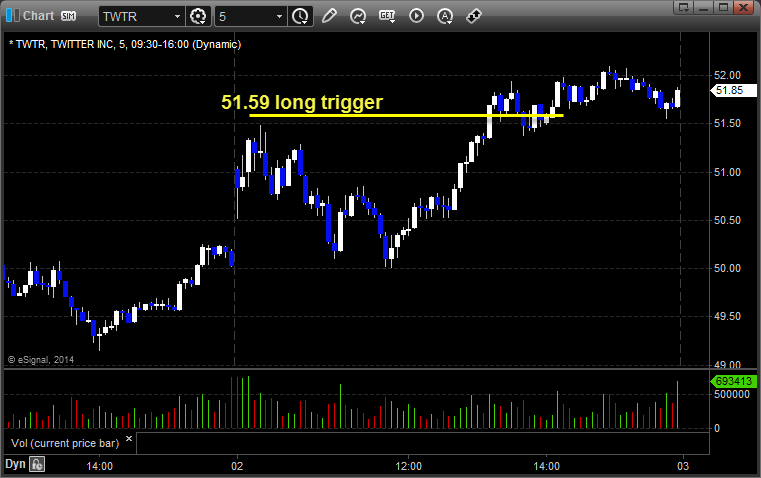

TWTR triggered short (with market support) and worked for the gap fill:

Rich's TWTR triggered long (with market support) and worked:

Rich had two calls on QIHU, the first one for a partial entry triggered long (with market support) and didn't work, the second never triggered (the adder):

In total, that's 8 trades triggering with market support, 4 of them worked, 4 did not.

Futures Calls Recap for 10/2/14

The most boring opening hour of trading in a while, but then things did move a bit even though volume was poor early. Strangely, the pace of volume increased all day, which is unusual, and we closed at 2.0 billion shares (albeit, right back where we opened, which was flat from the prior session to begin with). See ES and NQ sections below for the trade recaps.

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1936.00 and stopped for 7 ticks. I did not put it back in although that would have worked, but volume was just dead:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered log at A at 3982.00, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 10/2/14

Calls went up a little late so I missed the original trigger, but see EURUSD below.

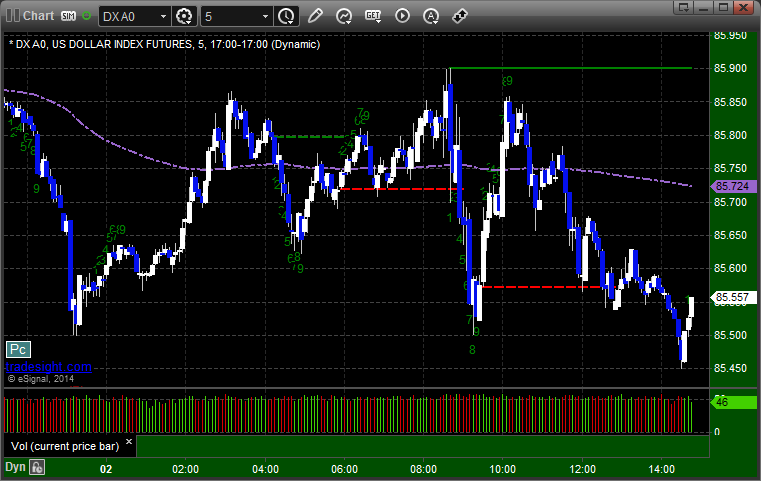

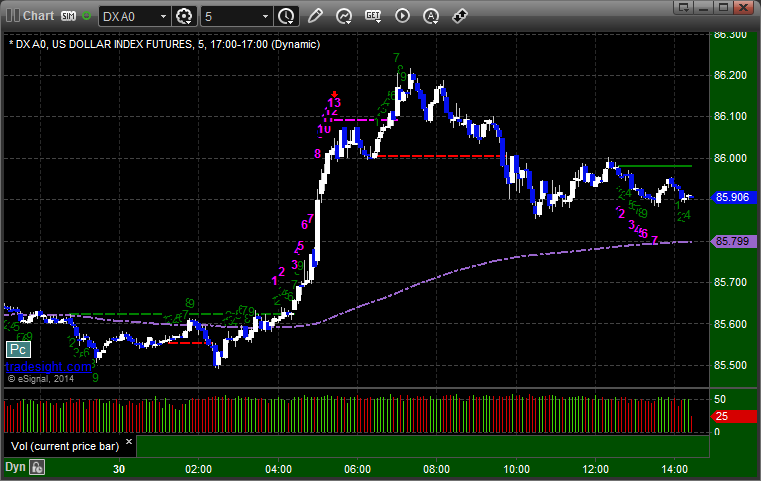

Here's a look at the US Dollar Index intraday with our market directional lines:

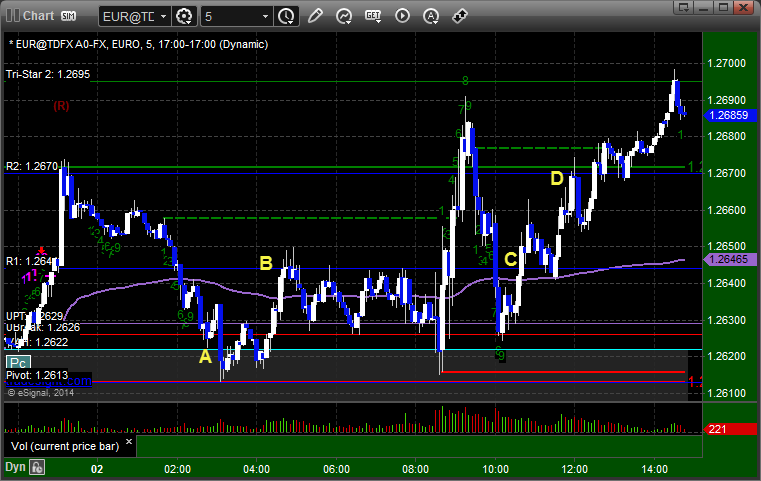

EURUSD:

Triggered short at A and stopped. Triggered long at B and stopped. Triggered long again in the morning at C, hit first target at D, still holding second half:

Stock Picks Recap for 10/1/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NWSA triggered short (without market support due to opening 5 minutes, but still easy to take and you should always take the top picks) and worked:

IRBT triggered short (with market support) and we closed for a small loss:

ENOC triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

GWPH triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FSLR triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked:

GS triggered short (with market support) and worked:

Rich's SYNA triggered long (without market support) and worked enough for a partial:

His FDX triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 10/1/14

The markets gapped down and shot lower, never setting a level, giving a gap fill setup, or coming near the Value Areas. In short, there weren't any of our usual futures setups. Good news though. NASDAQ volume was 2.1 billion shares to start the fourth quarter.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 10/1/14

A bad end to the official calls of September as we stopped twice on the GBPUSD for the session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

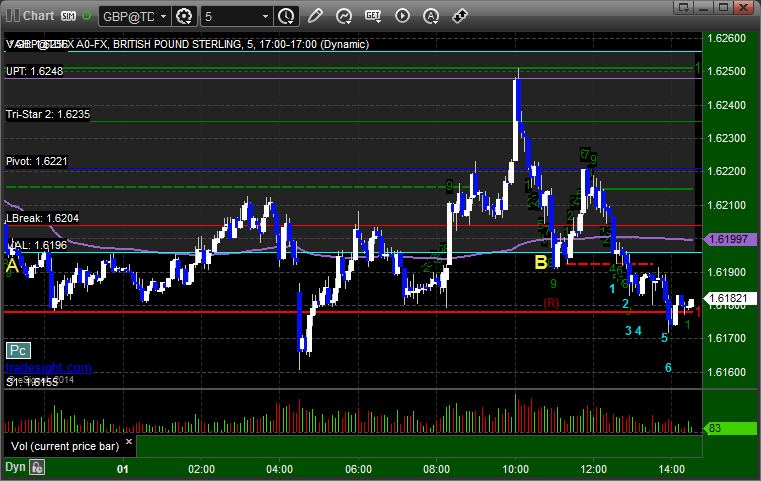

GBPUSD:

Triggered short at A and stopped. Triggered short at B and stopped:

Stock Picks Recap for 9/30/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SMCI triggered long (without market support) and worked enough for a partial:

CSOD triggered short (with market support) and worked:

IRBT triggered short (with market support) and the market started curling back up so I posted a close just above the entry:

From the Messenger/Tradesight_st Twitter Feed, SINA triggered short (with market support) and worked nice:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 I closed early for a dime loss.

Futures Calls Recap for 9/30/14

No futures calls for the last day of the quarter, although Value Area players could have made an easy gain on the NQ when it opened above the VA. The markets gapped up small, filled the gaps, then the ES headed up to fill the prior session's gap, and that was the high. We closed about even as was expected for end of quarter window dressing on 1.7 billion NASDAQ shares. Free to move again tomorrow.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Forex Calls Recap for 9/30/14

Basically a wash as we had a loser and a winner but at least we got some movement and saw some range as the Forex market looked more like it used to. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, and stopped out of the second half over the entry at D:

Stock Picks Recap for 9/29/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCD triggered long (with market support) and didn't go far enough either way to count, closed right around the trigger:

SONC triggered long (with market support) and had the same issue:

SINA gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's FDX triggered long (with market support) and worked:

Mark's GILD triggered long (with market support) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not. GILD and SONC never went $0.20 against and closed at their triggers, but I closed them long before the end of the session for minor losses when they didn't go anywhere.