Futures Calls Recap for 10/7/14

It started out boring, but the Fed minutes got things moving in the afternoon. Two calls for the session, a winner and a loser in the NQ. See that section below.

Net ticks: +12 ticks.

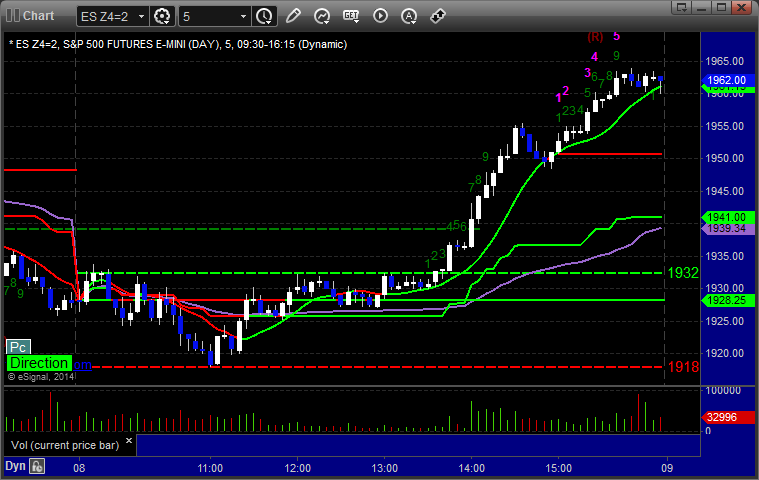

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

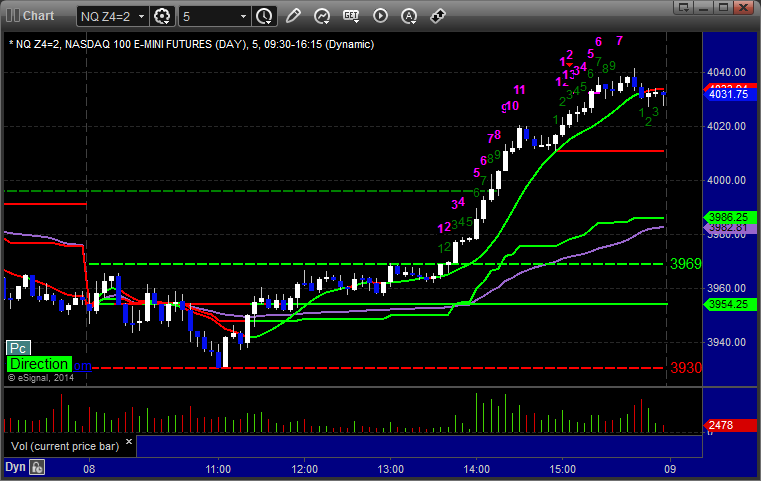

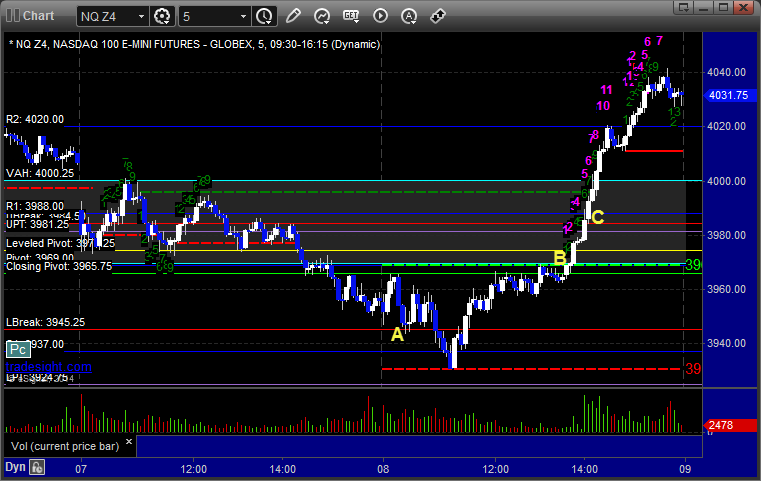

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3945.00 and stopped. I did not re-enter but it would have worked the second time. Triggered long at B at 3969.50 from my call. Mark adjusted the stop a couple of times and stopped the final piece at 3985.00:

Forex Calls Recap for 10/7/14

Nothing triggered for the session in a narrow, contained range.

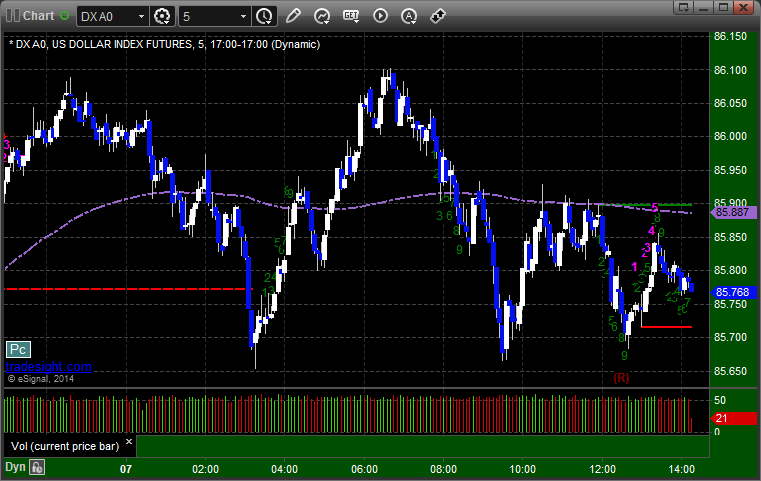

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 10/6/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GGAL triggered short right at the close, doesn't count.

From the Messenger/Tradesight_st Twitter Feed, Rich's NUS triggered long (with market support) and worked enough for a partial:

His MYL triggered long (with market support) and worked:

TWTR triggered short (with market support) and worked enough for a partial:

Rich's GLD triggered long (ETF so no market support needed) and worked:

In total, that's 4 trades triggering with market support, all of them worked.

Futures Calls Recap for 10/6/14

Nice Value Area setups on the ES and NQ as the markets gapped up to start the week. Volume was poor, but both the ES and NQ had Value Area Plays that worked. We only posted the NQ to the Messenger and it stopped once before working. See that section below.

Net ticks: -4.5 ticks.

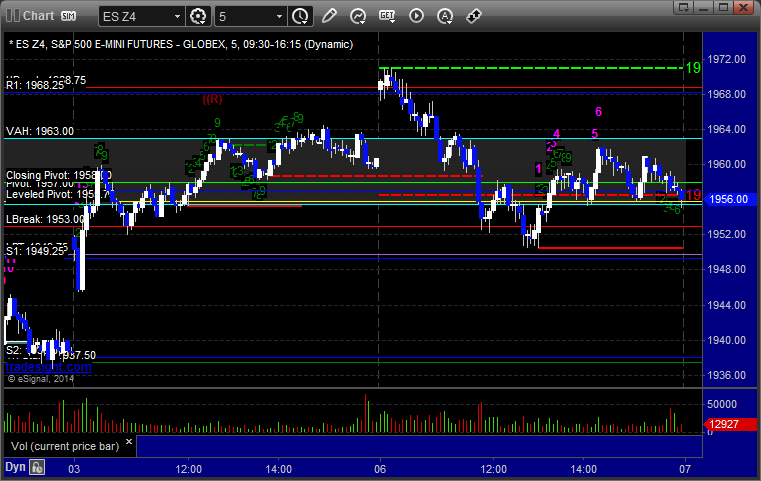

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Touched the Value Area High perfectly and then broke in to fill the gap:

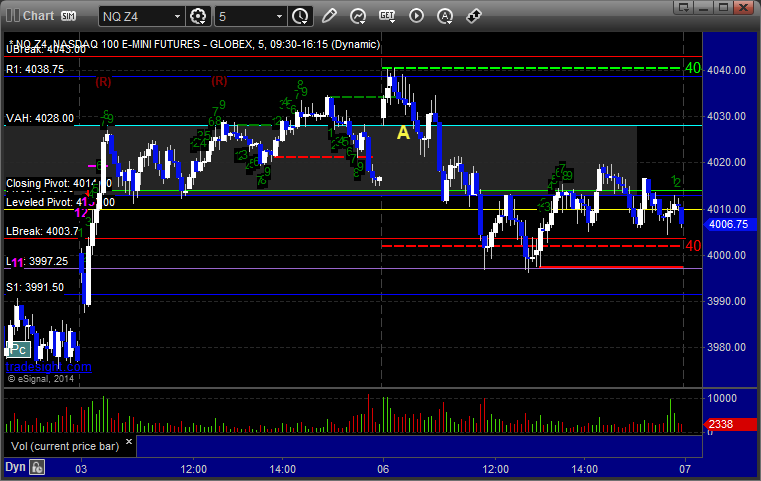

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4027.50 and stopped exactly to the tick before triggering again, working to the first target, and then stopping the second half at the entry before crossing the Value Area:

Forex Calls Recap for 10/6/14

A nice winner on the GBPUSD that is still going to start the week. See that section below.

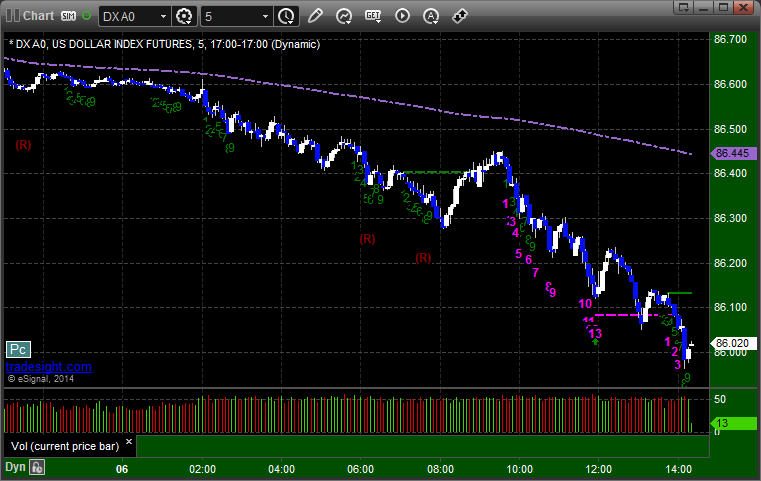

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, never stopped, hit first target at B, still holding the second half with a stop under the Pivot at C:

Tradesight September 2014 Futures Results

Before we get to September’s numbers, here is a short reminder of the results from August. The full report from August can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for August 2014

Number of trades: 20

Number of losers: 8

Winning percentage: 60%

Net ticks: -9.5 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for September 2014

Number of trades: 16

Number of losers: 4

Winning percentage: 75%

Net ticks: +57.5 ticks

A super solid month, and these results don't even count a couple of fabulous Value Area plays. Market volume came roaring back after the usual August dip, and it showed not only in the movement of the markets but also in their use of technical levels, which is what gives us our trading system. I look forward to entering the best six months of the year.

Tradesight September 2014 Forex Results

Before we get to September’s numbers, here is a short reminder of the results from August. The full report from August can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for August 2014

Number of trades: 21

Number of losers: 8

Winning percentage: 61.9%

Worst losing streak: 2 in a row

Net pips: -20 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for September 2014

Number of trades: 23

Number of losers: 9

Winning percentage: 60.8%

Worst losing streak: 2 in a row

Net pips: +30 pips

The Forex market did pick up in September as the US Dollar finally started heading up. However, intraday ranges didn't start to expand until the end of the month. The start of the month was still fairly slow. It looks like things are really improving late in September and with the start of October, so we may finally be heading back to normal size. Either way, the win ratio was good, but there still weren't a lot of trades that followed through.

Stock Picks Recap for 10/3/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, HAIN triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's NTAP triggered long (with market support) and worked:

Rich's PANW triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 10/3/14

We had a great Value Area setup on the NQ for a gap fill after the gap up, but it swept once and never retriggered as the market volume slowed down and things went dead for the last 5 hours as expected for the Yom Kippur Holiday.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3988.00 and stopped. Put it back in but it never retriggered:

Forex Calls Recap for 10/3/14

A nice close to the week and a big winner for the first time in a while as the USD was moving in the right direction and kept going on the news. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered short at A, hit our first target at B ahead of the number, then spiked down on the number and worked well. We closed at C for end of week for 130 pips: