Let’s get a few things out of the way up front. We love to trade Apple’s stock at Tradesight. We trade it just about daily. We go long. We go short. I love the stock as a trading device. I’ve made more than 600 points on the stock over the last few years, which, by definition, means that I have a better “cost basis” than anyone that just buys and holds Apple. When you trade it both ways, you can do extraordinary things.

I also hate AAPL products. I want to be clear about that. Can’t stand iTunes (too limiting). Hate the computers. Hate the phones (never owned one). Had an iPad when the first one came out because I wanted to see if I thought it would be a form factor that I would use. Turns out, it was. Got rid of it as soon as a good Android tablet came out. Currently using a Motorola Xyboard on Verizon 4G contract. Love it. Great device, everything a tablet should be.

Don’t take my negativity above to mean that we have a “negative outlook” on AAPL stock in general. Like I said, as a trading stock, it is one of the best. Very technical, very predictable with our tools. Now, it isn’t the only trading stock that works well for us. GOOG, AMZN, NFLX and others have been and/or still are great traders. I just wanted to be very clear before I continued. I love AAPL’s stock. I don’t love Apple’s products. The two are totally separate things to me. Frankly, I think AAPL is a better marketing company than they are a tech company. They’ve stolen and settled out more pieces of tech than they have designed (right down to the original iPod touch controller, which came from Creative Labs, who got a hefty check after the fact).

Apple has a decent vision. They know where technology currently is and what it can realistically fabricate in large quantity. The beauty of Apple as a company is not that they “innovate.” They know what is capable of being produced, and they do whatever they have to to get there first, and then they market it up into a package that makes people feel like they are a good and cheerful person if they own one of the products.

Let’s take Siri, for example, the new feature where you can say just about anything to the phone, and it will come back with an answer that is about 90% relevant. Android folks have had this for years. It’s called Voice Search, which isn’t a very inviting name, but it does most of what an iPhone does, and it did it before the most recent iPhone and iOS did it. But when Apple does it, they give it a name, and they make cute commercials of people having positive moments throughout their day with their phone. Heck, if that isn’t enough, let’s get that cute new girl from New Girl (Zooey Deschanel) to make commercials of her all happy walking around her house using Siri.

See the point? The tech isn’t new. AAPL didn’t have it first. I still don’t think they even have it better. But the MARKET it better, for sure. And marketing goes a long way.

Anyway, the point of all of this is not that I’m up or down on AAPL’s stock. I’ve been very bullish on the stock in the past. I approach stocks completely neutrally to whatever the company does. The two are not related, typically. So when I come here to tell you that AAPL’s stock could be in some trouble, I don’t do it because I don’t like their products. I do it because there are bad signs in the charts.

Before we dig into said charts, let’s consider one other key point about AAPL. The stock has run from $400 to $650 since January 1. That’s 62%. Most of the best (and recently upgraded) analyst forecasts for late 2013 put is in the $700-800 range. From 600 to 700 is only a 16% increase. That’s not really worth holding onto for high-growth funds that already caught a big move of 62% in five months. Even if they still like the company’s future prospects, the reality is that owning it up here isn’t as necessary as it was back at $400. It might be AGAIN, if it gets back to $400.

So, let’s move to the charts.

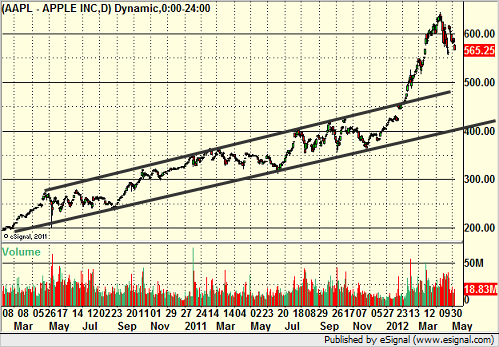

Here’s the AAPL daily chart over the last year. There is a very clear channel that it was moving along, and then it exploded out of that channel to the upside this year and went crazy:

It even left a key big gap as low as $425 on the chart, which you can see here, and which an AAPL fanboy will say will never fill:

That doesn’t even count the one around $560 after earnings two weeks ago, which is already about to fill.

The thing that you have to focus on is that the funds can’t just snap their fingers and be out of their AAPL positions in a day. They have to do it over time. And if you understand that the upside risk/reward is no longer very solid, you might assume that they would want to get out while all of the hype of recent earnings, the NEW iPad, and other factors, have the stock in the stratosphere.

So what would that look like? Well, it would look like a lot of volume trading with no real progress being made at some point. Do we see that at all recently?

Here’s the last six months:

Ooooops. Anyone that bought the stock two months ago is even. We have a massive head formation on heavy volume despite the earnings, which they allowed to cause a 60 point gap up in the stock…and then proceeded to dump it hard for 8 days so far.

This doesn’t even take into account the forward-looking concerns about the company after the unfortunate and untimely death of Steve Jobs. When the analysts look down the road at AAPL, they see about three years of “Jobs” still at work. After that, it’s on someone else’s shoulders.

Bubbles are bubbles. They happen in all markets. They don’t affect traders that are good traders who watch market direction and the futures carefully. They do affect investors. When a stock goes parabolic like AAPL and then fails to make progress over an extended period on the heaviest volume it has seen in a long time, gravity tends to take hold.

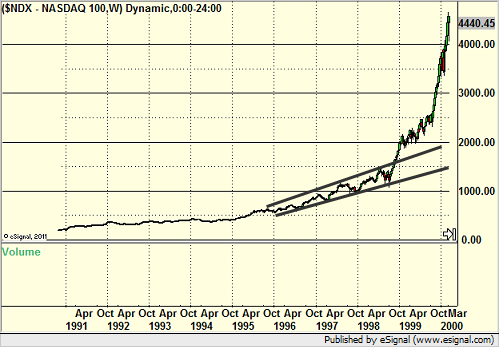

Just remember that the NASDAQ broke out of a channel in the late 1990s and looked like this:

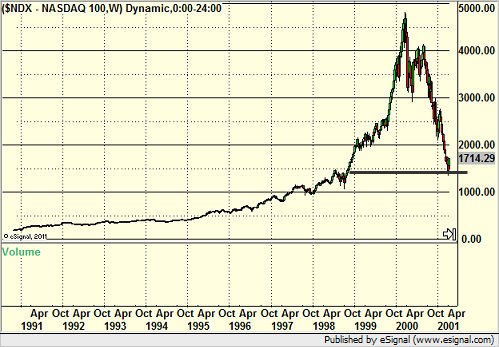

Right before it looked like this:

And yeah, there was a gap to fill back there that no one thought ever would.