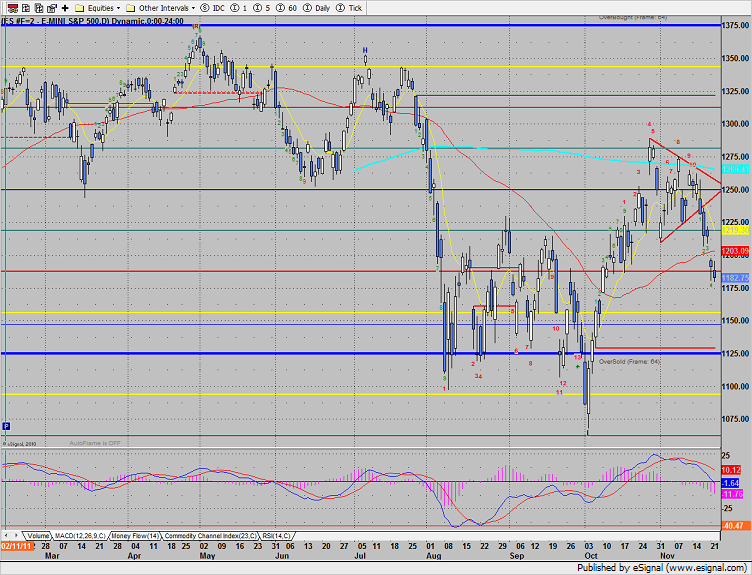

The ES lost 8 on the day, mostly trading inside yesterday’s range. Note that the MACD has broken the zero line.

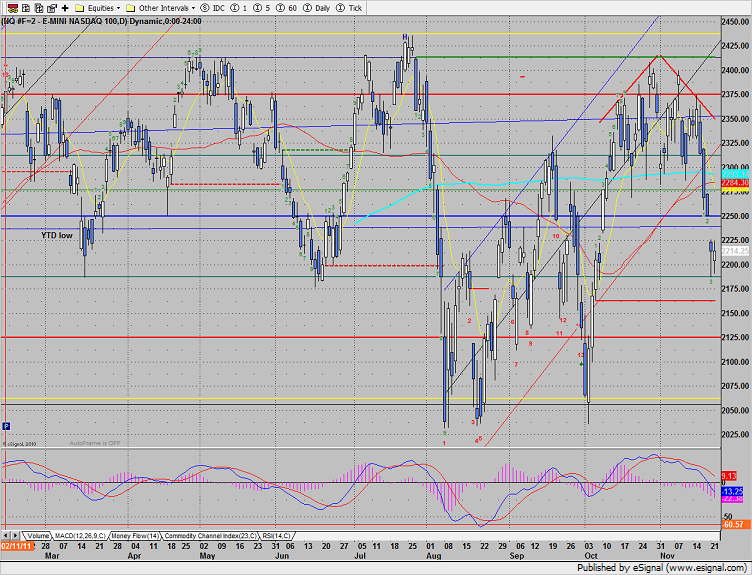

The NQ futures traded with relative strength vs. the ES posting a true inside day. The bias is lower and the gap window at 2225 is key.

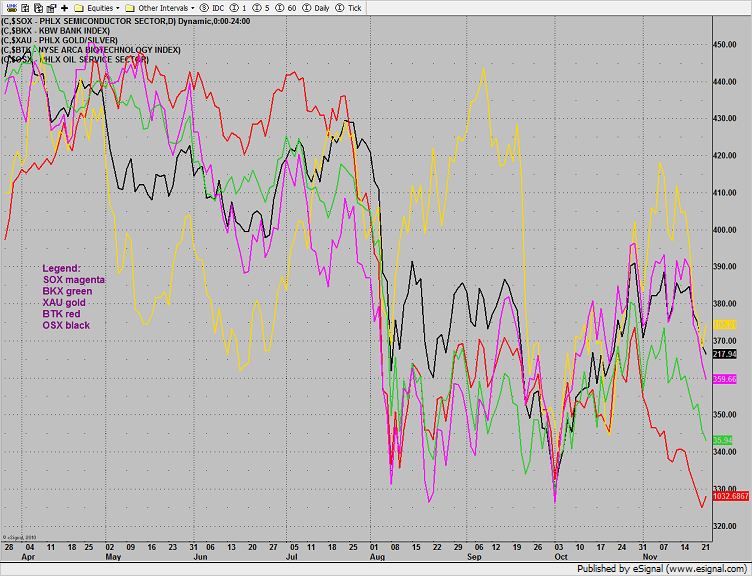

Multi sector daily chart:

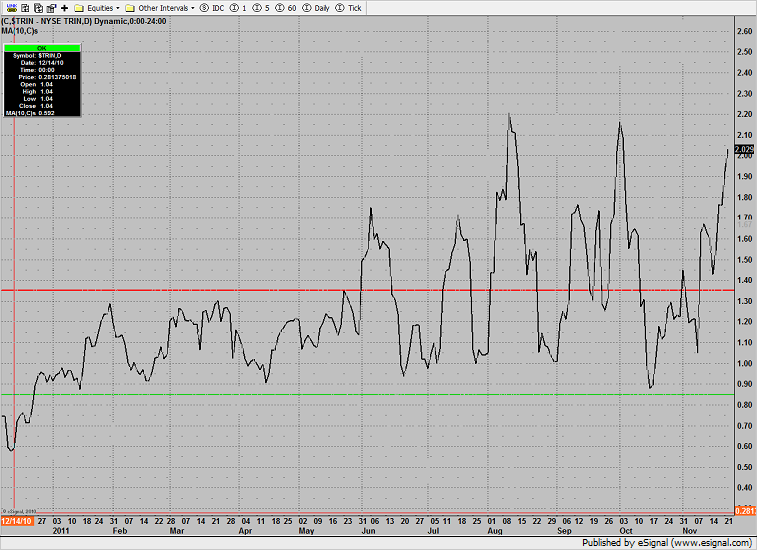

The 10-day Trin pushed higher making the third highest close of the year. This loads the market with oversold energy.

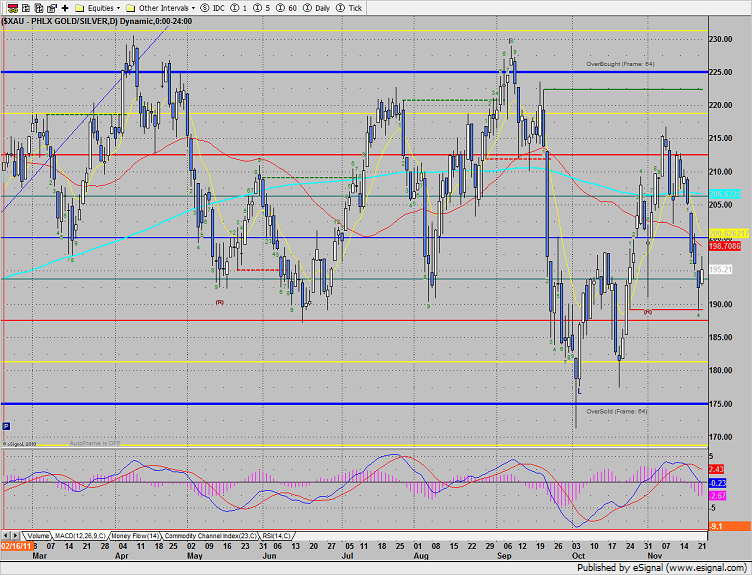

The defensive XAU was top gun on the day:

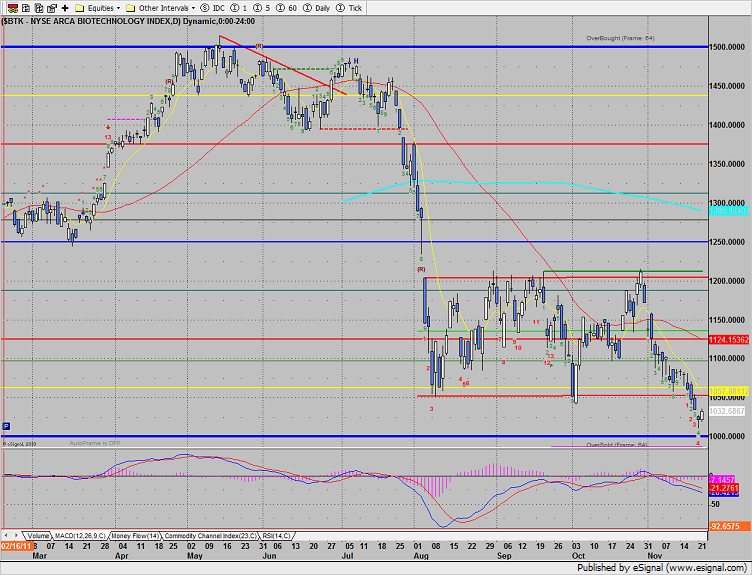

The BTK was the only other major sector up on the day which is a small consolation because this is just an oversold bounce.

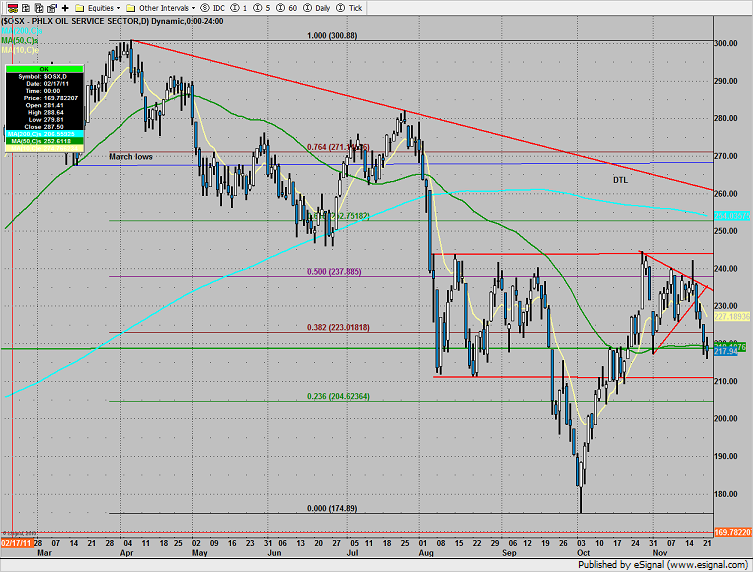

The OSX was down 1% and continues to game the 50dma.

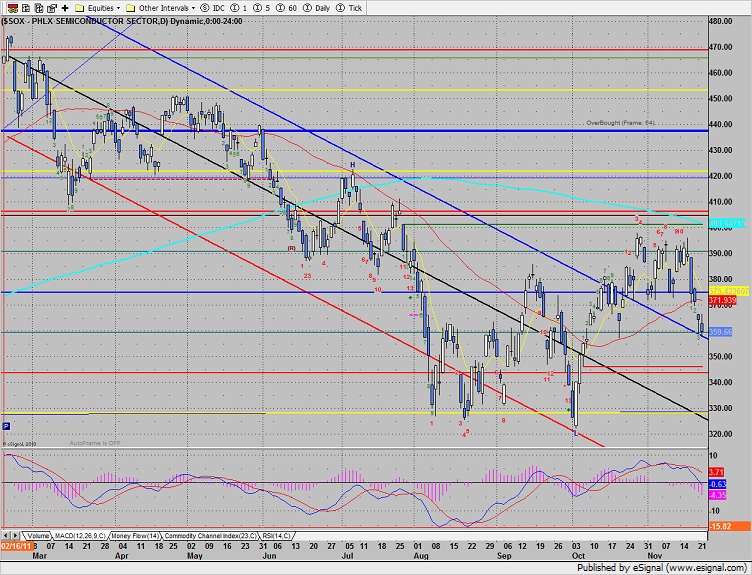

The SOX is right at last support. If this level is lost the door is open for downside momentum to develop. Note that the MACD is right at the zero line.

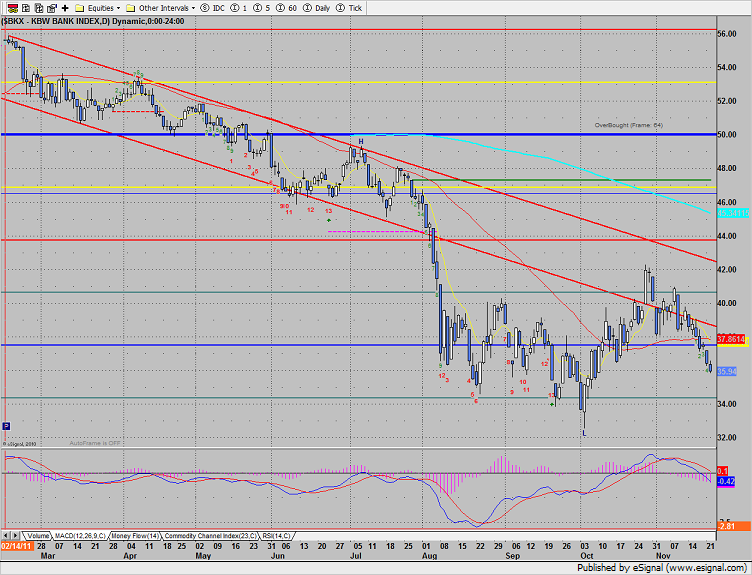

The BKX expanded the range to the downside. The bias remains negative.

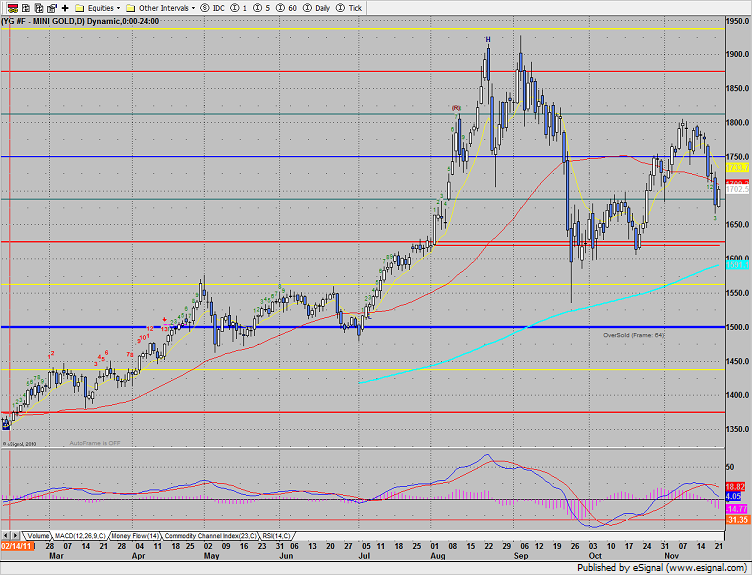

Gold was higher by 21:

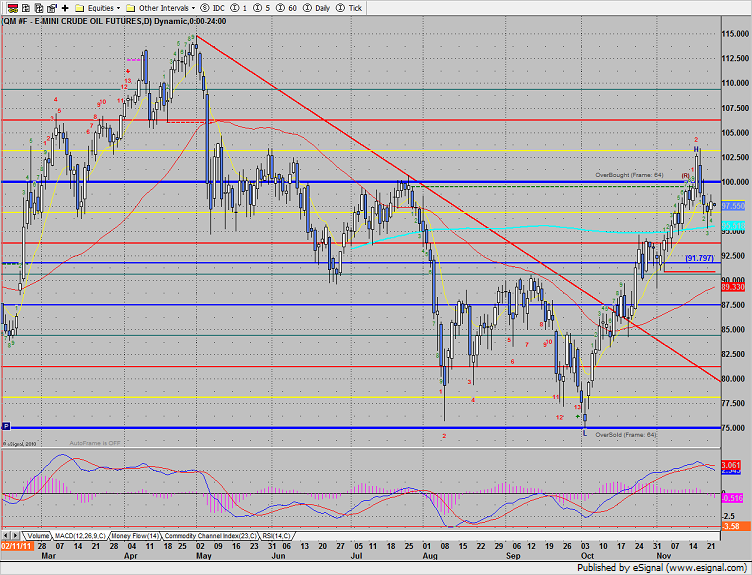

Oil is still holding above the 200dma: