Overview

For triple expiration in June, the markets opened flat to higher, pushed up, then down, then settled into the middle of the range as is typical. The closing print on the ES at 4:15 pm EST was the midpoint exactly. NASDAQ volume was 7.4 billion shares.

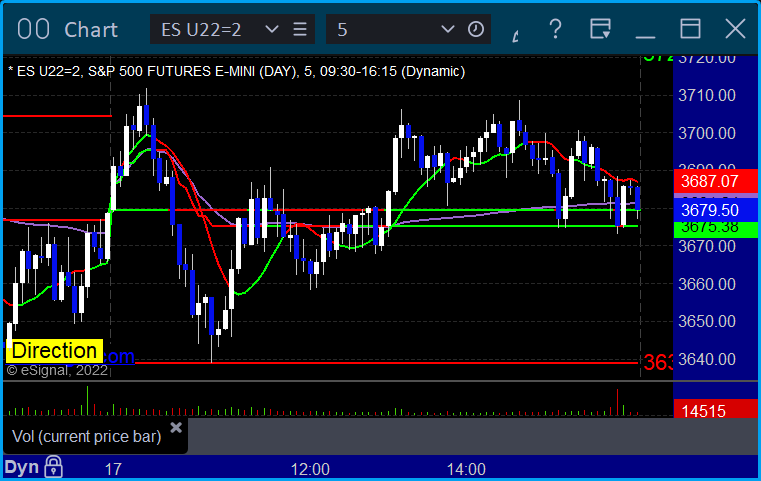

ES with Levels:

ES with Market Directional:

Futures:

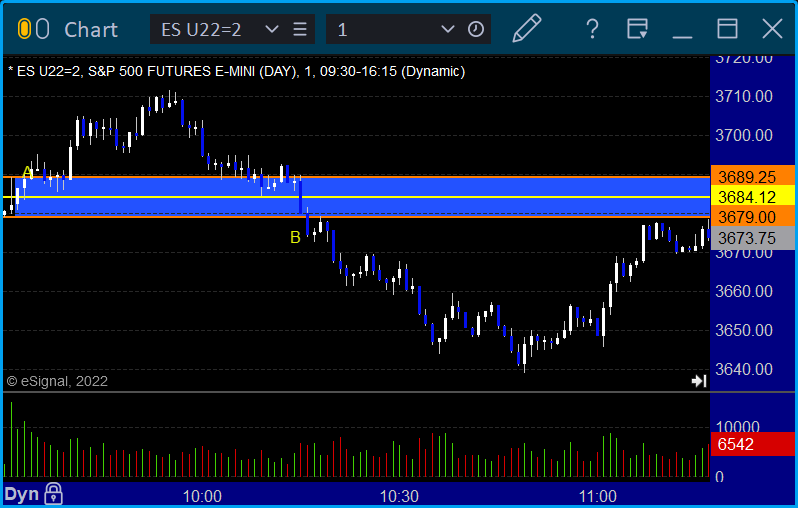

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

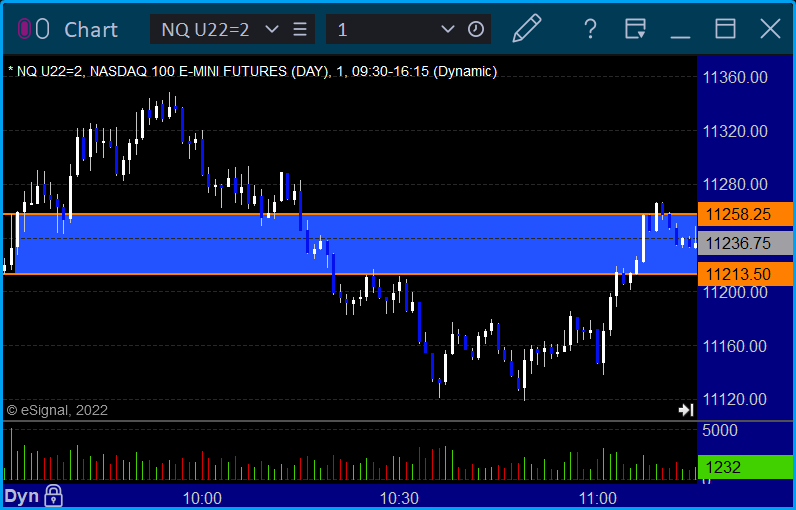

NQ Opening Range Play:

Results: +0 ticks

Forex:

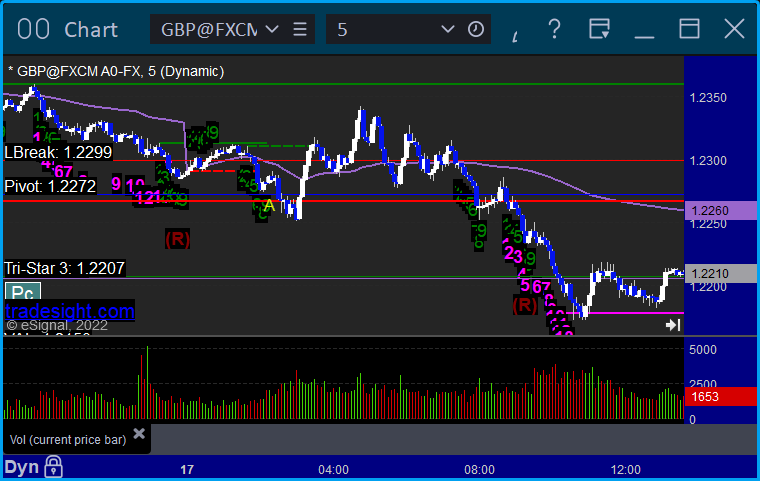

GBPUSD triggered short at A and stopped, worked later if you were around to take it again:

Results: -25 pips

Stocks:

Triple expiration is never much of a day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich’s FAS triggered long (ETF, so no market support needed) and worked:

His QCOM triggered short (with market support) and didn’t work:

His MTCH triggered short (with market support) and didn’t work:

That’s 3 triggers with market support, 1 of them worked and 2 didn’t.