Overview

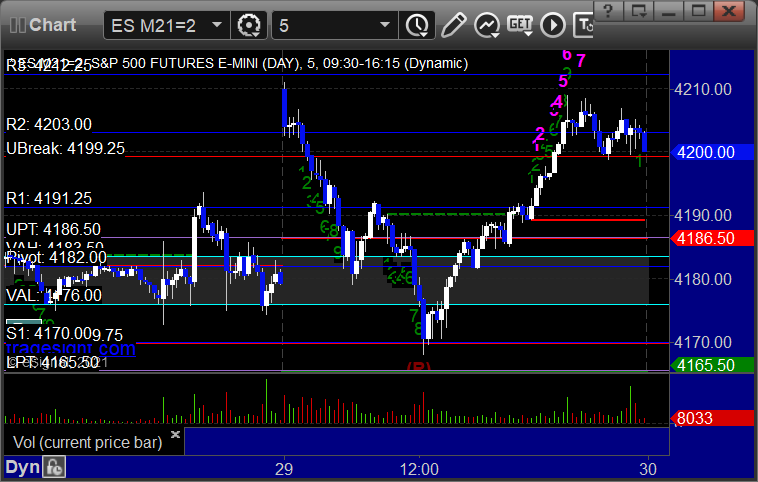

Thursday was a day that was looking really great early and then turned into a nothing burger. Markets gapped up on earnings, sold back off into the range we have been stuck in, but looked to finally have the momentum to breakdown. Instead, we bottomed heading into lunch, came back up, and then rallied back to the open. The main point to take away as we wrap up earnings for the season after the close and then print statement Friday is that the 10-day moving average of the TRIN is now 0.82, which is a sell signal on the broad market. So if we had kept dropping into the close, we would have been in a really great shape for some huge trades going forward. That doesn’t really mean the drop won’t happen, it just means that we are waiting for it to start instead of completing Thursday with that move in motion. NASDAQ volume was 4.8 billion shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked but too far out of range to take unfortunately or it would have been a nice winner:

NQ Opening Range Play triggered short at A and worked:

Results: +0 ticks

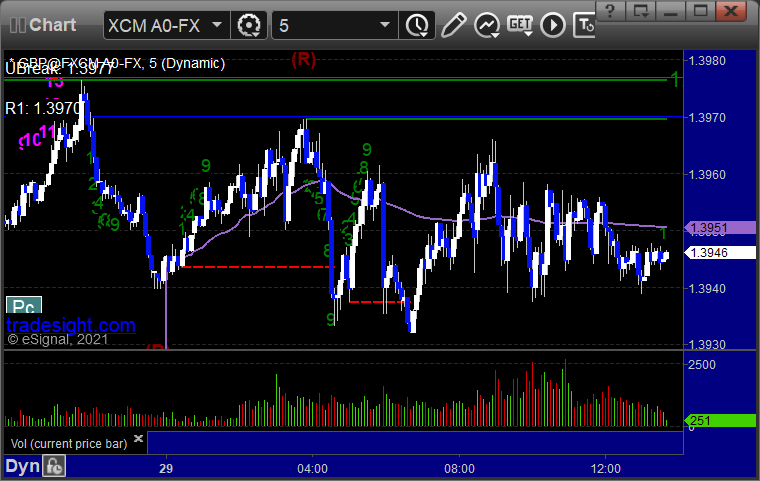

Forex:

No triggers for the session.

GBPUSD:

Results: +0 pips

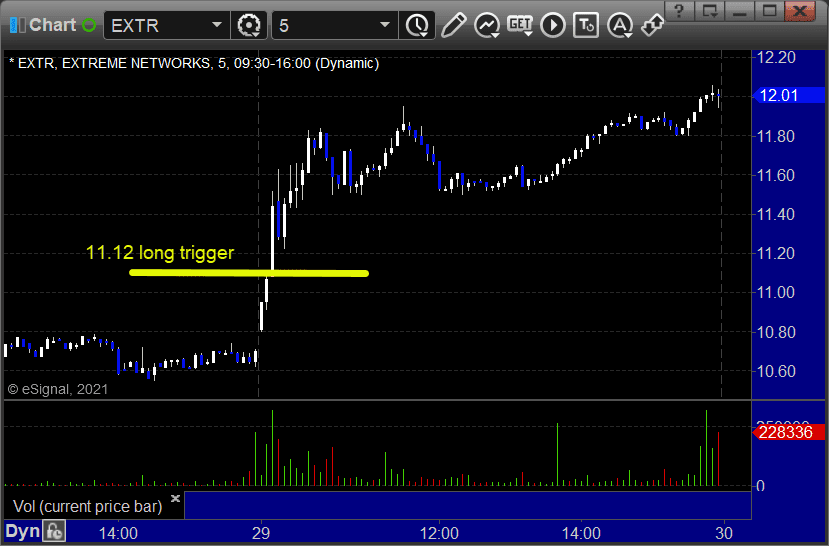

Stocks:

From the report, EXTR triggered long (with market support) and worked:

AMZN gapped over, no play.

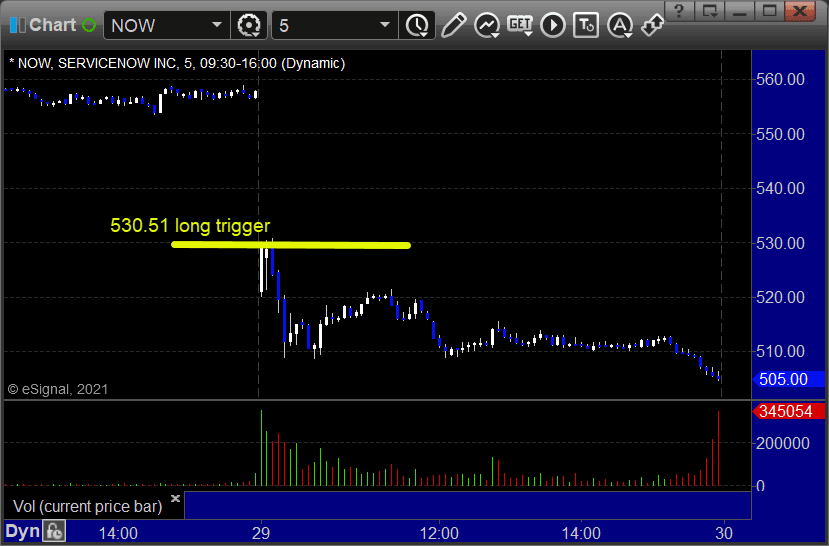

From the Twitter feed, Rich’s NOW triggered long (with market support) and didn’t work:

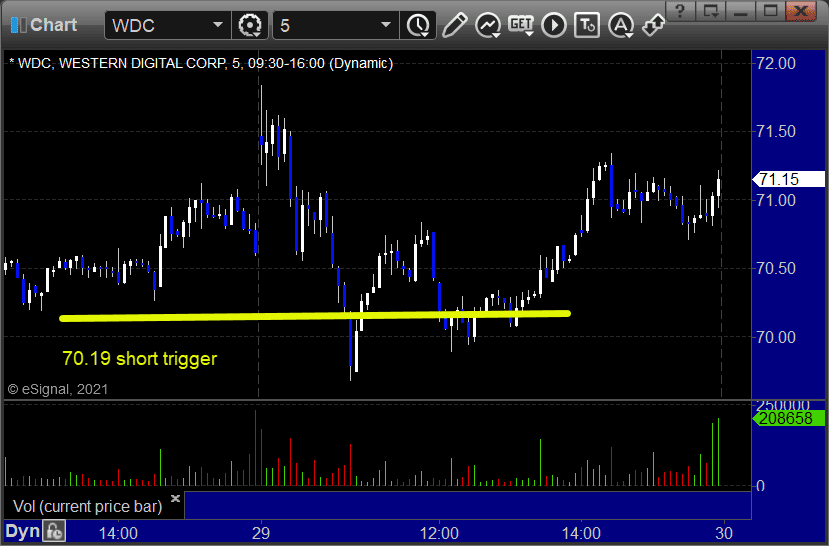

WDC triggered short (with market support) and didn’t work:

INTU triggered short (with market support) and worked enough for a partial:

NFLX triggered short (with market support) and didn’t work:

That’s 5 triggers with market support, 2 of them worked and 3 didn’t.