Overview

The markets gapped down and sat all day until the Fed announcement, and then everything popped up to fill the gaps and more, with the S&P closing around even after all of that. Was that options unraveling? No way to know. NASDAQ volume was 5 billion shares at the close, so down a bit.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked, triggered long at B and worked:

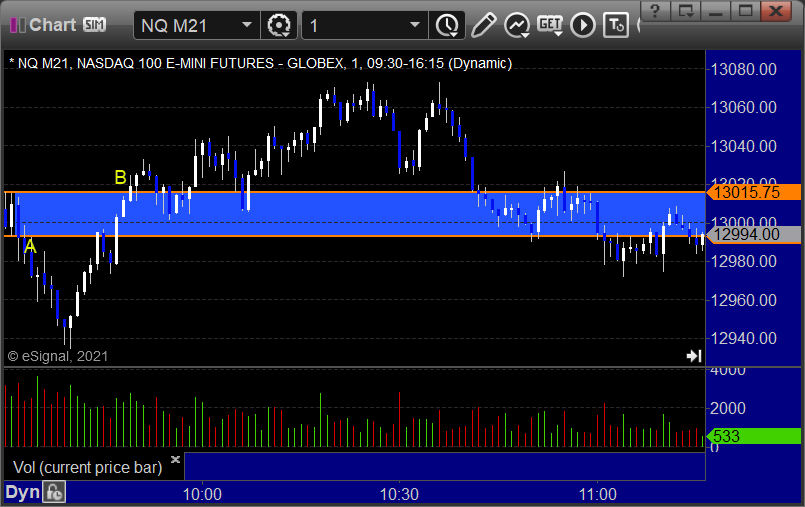

NQ Opening Range Play triggered short at A and long at B, both worked, but both just slightly too far out of range to take:

Results: +11.5 ticks

Forex:

GBPUSD triggered short at A, closed for about 10 pips ahead of the Fed announcement at B, which was a smart move:

Results: +5 pips

Stocks:

No calls in the report for the Fed meeting.

From the Twitter feed, Rich’s CRWD triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

AMGN triggered long (with market support) and worked great:

Rich’s X triggered long (without market support) and didn’t work:

His BABA triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.