Overview

The markets gapped down, went lower, came back to almost fill the gap (NASDAQ did) and then drifted into the middle of the range on 7.6 billion NASDAQ shares which was options expiration related.

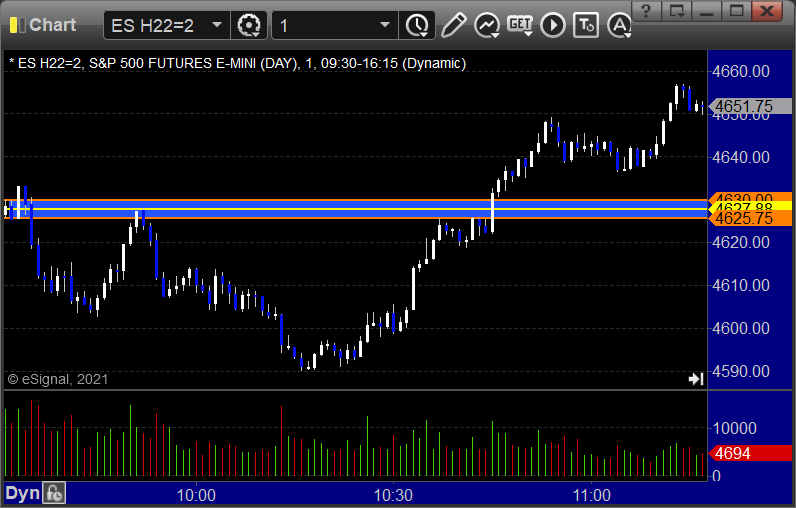

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

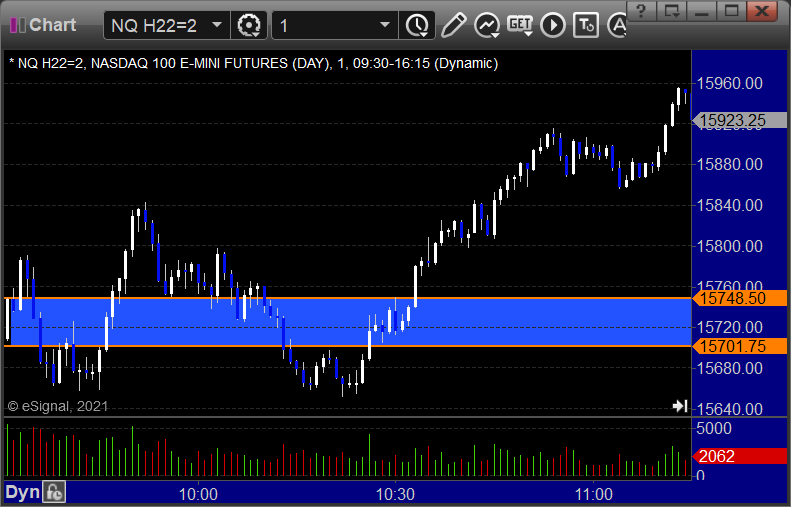

NQ Opening Range Play:

Results: +0 ticks

Forex:

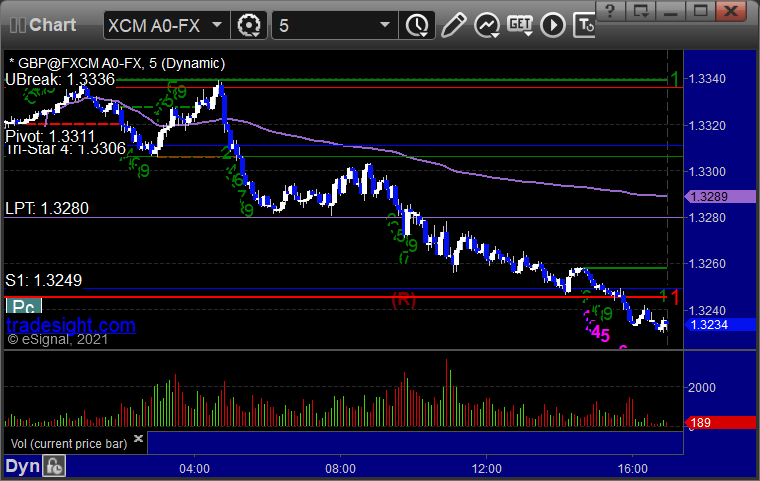

GBPUSD, nothing triggered in time:

Results: +0 pips

Stocks:

A couple of winners for triple expiration.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich’s ATVI triggered long (with market support) and worked enough for a partial:

His REGN triggered short (with market support) and worked:

That’s 2 triggers with market support, 2 of them worked.