Today in the Markets:

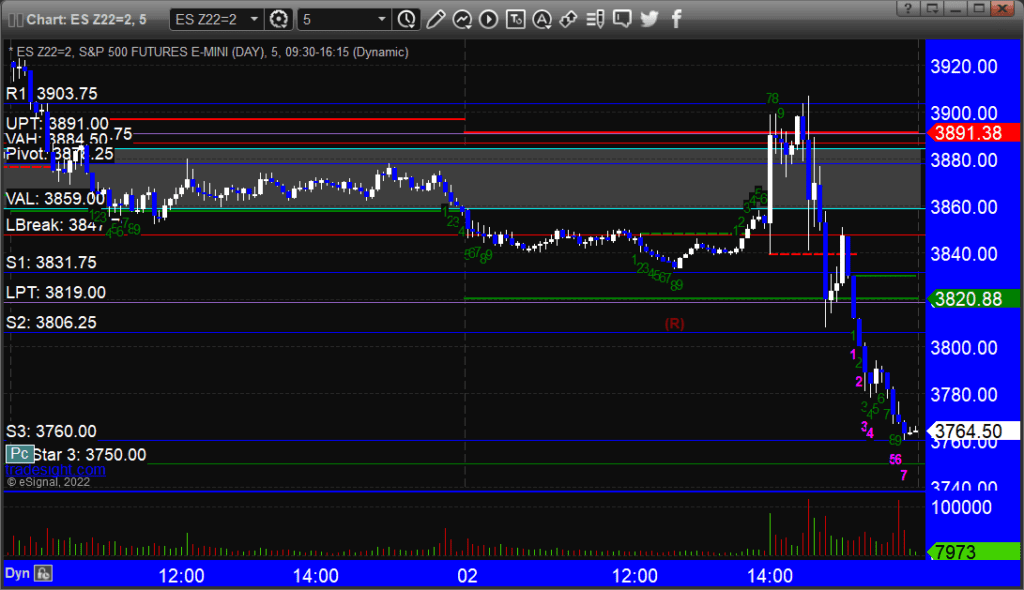

The markets opened flat and stayed flat until the Fed, then spiked up and sold off hard on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

Additional Futures Calls:

None.

Results: +4 ticks

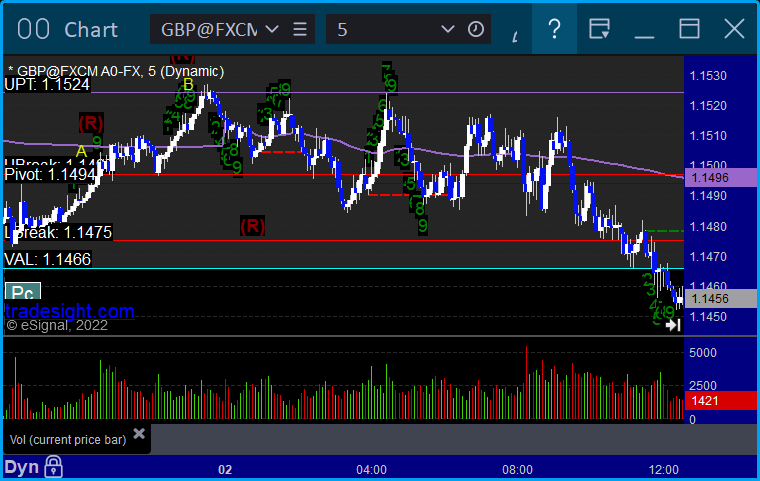

GBPUSD triggered long at A, hit first target at B, stopped second half under the entry:

Results: +10 pips

Not a great day, but should have been trading light size for the Fed announcement.

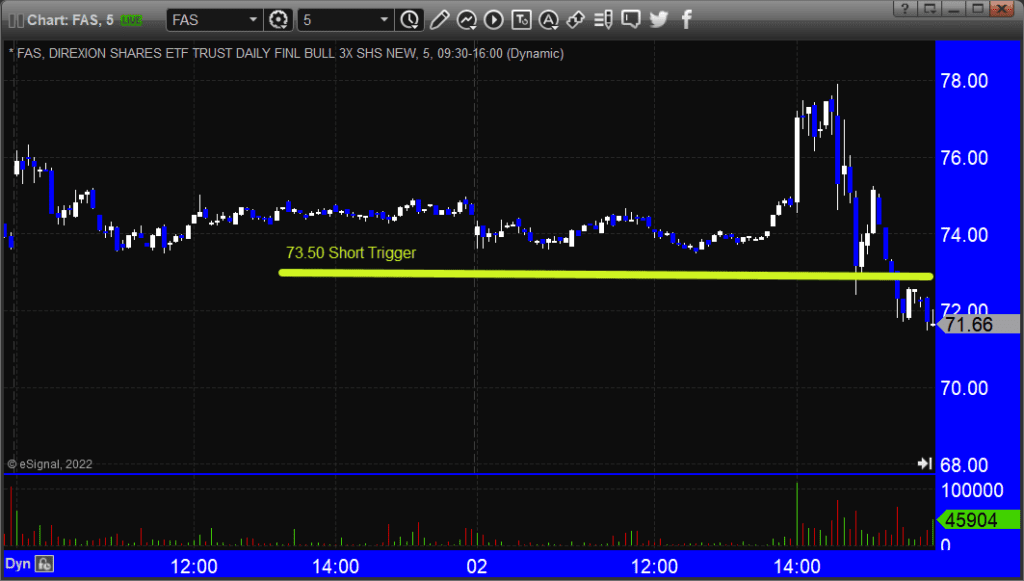

These are the Tradesight calls that triggered, Rich’s FAS triggered short (with market support) and worked enough for a partial:

Rich’s X triggered short (with market support) and did not go enough to count:

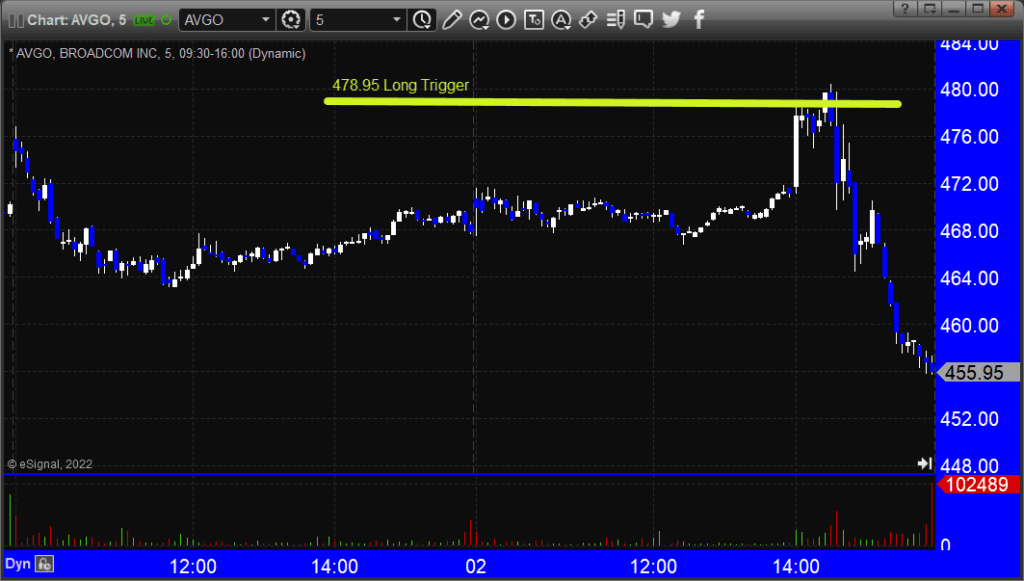

Rich’s AVGO triggered long (with market support) and did not work:

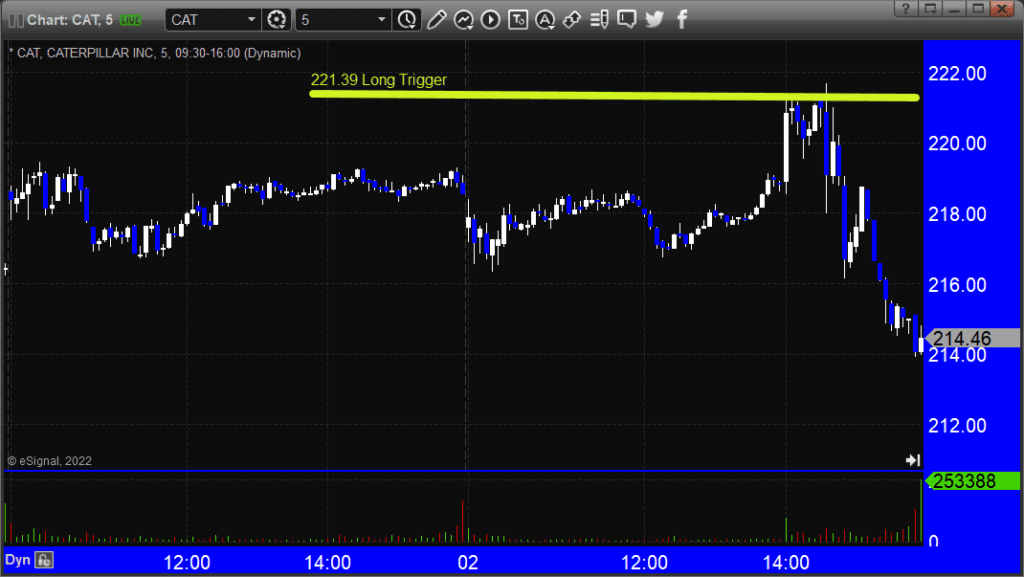

Rich’s CAT triggered long (with market support) and did not work:

Rich’s NVDA triggered long (with market support) and did not work:

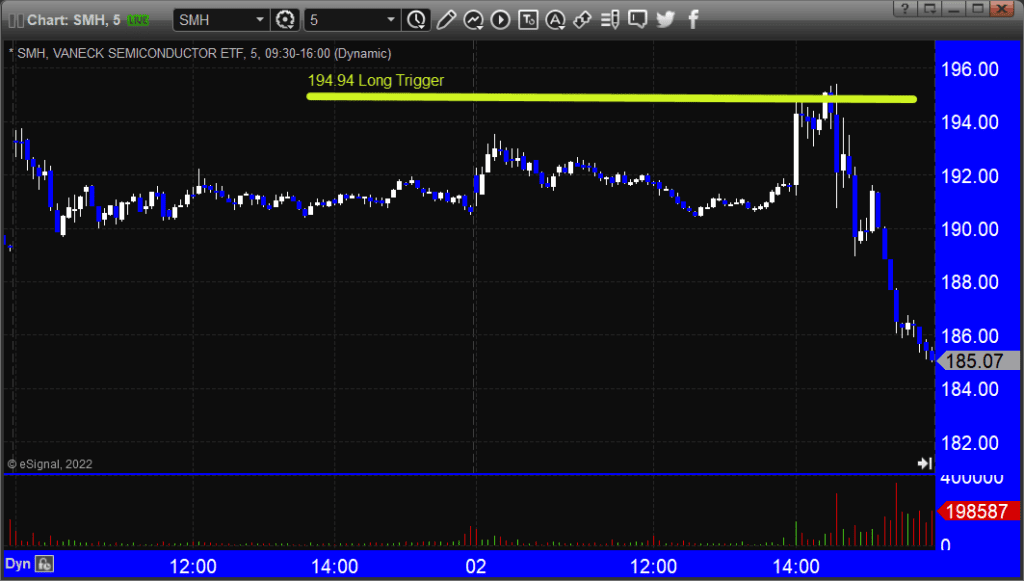

Rich’s SMH triggered long (with market support) and did not work:

Rich’s SPOT triggered short (with market support) and did not work:

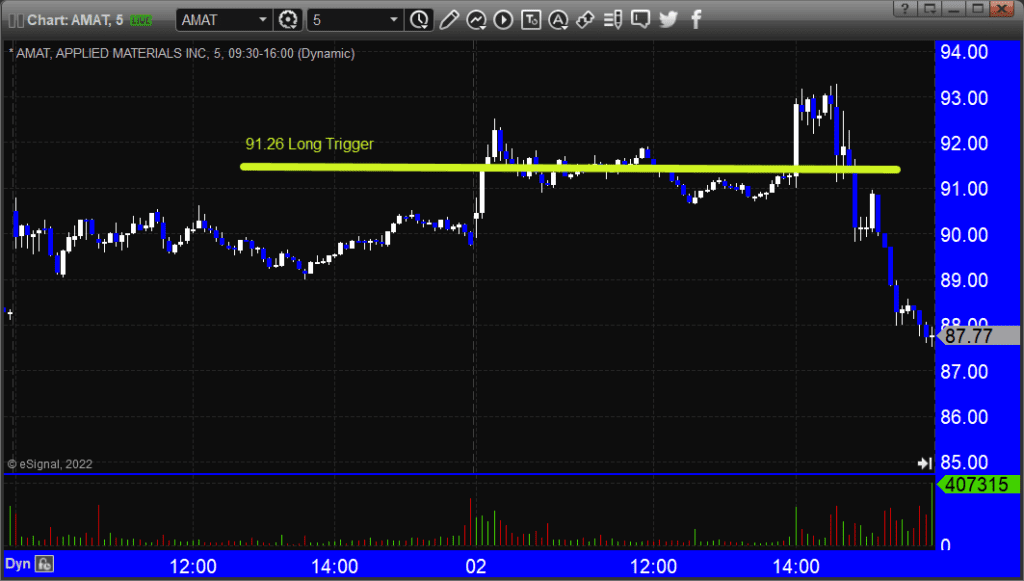

Rich’s AMAT triggered long (without market support) and worked enough for a partial:

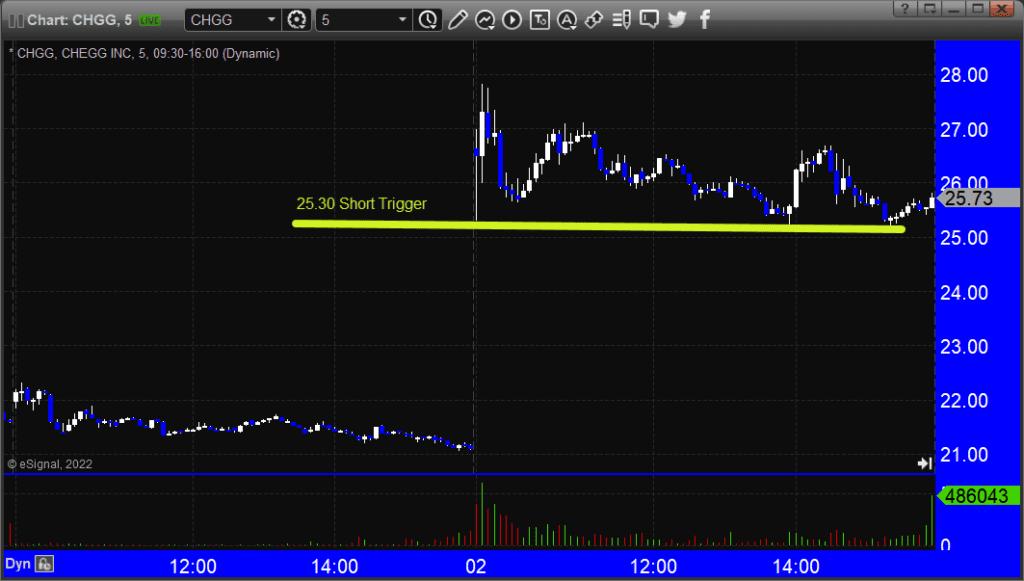

Rich’s CHGG triggered short (without market support) and did not work:

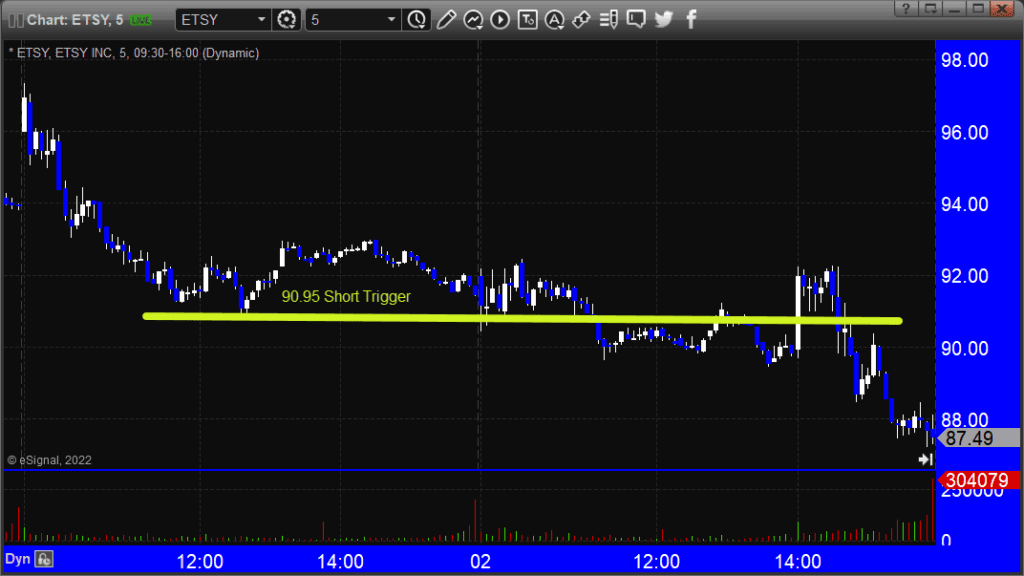

Rich’s ETSY triggered short (in the first 5 minutes so no support) and did not work: