Tradesight Recap Report for 4/17/25

Today in the Markets:

Markets opened flat and closed flat on 6.8 billion NASDAQ shares for options expiration.

ES with Levels:

ES with Market Directional:

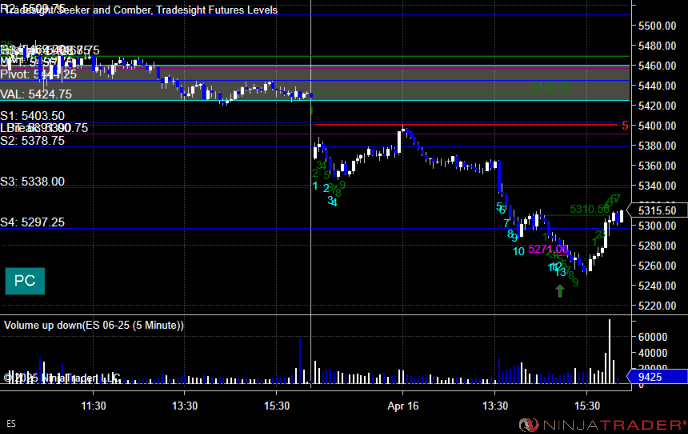

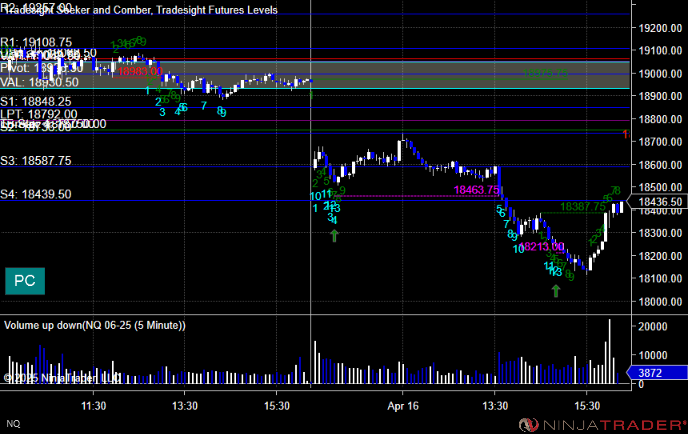

NQ with Levels:

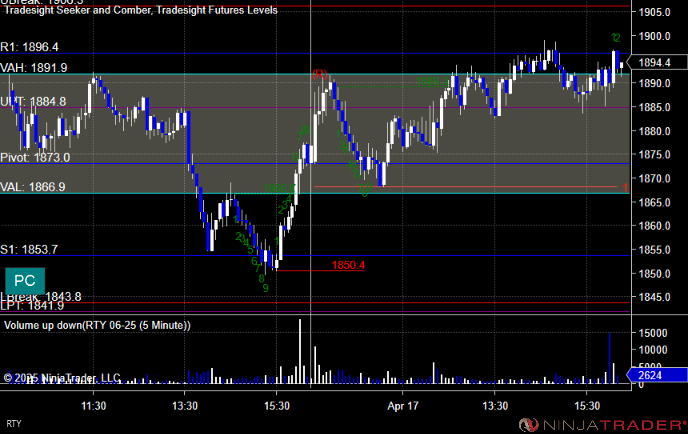

RTY with Levels:

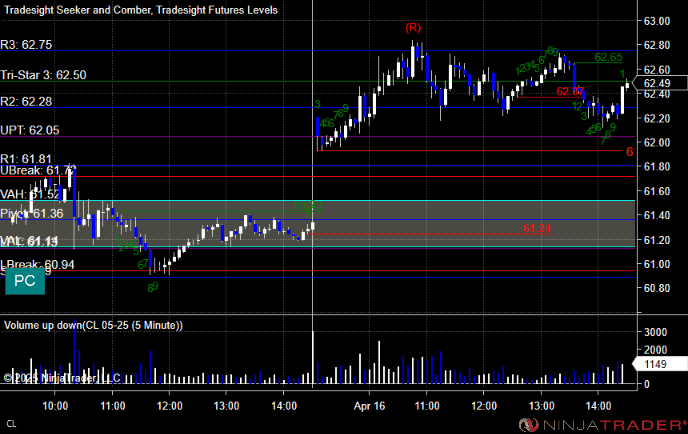

CL with Levels:

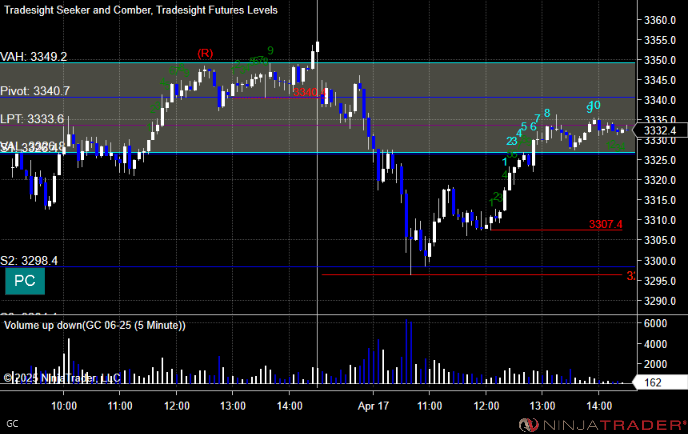

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short, at B was out of range to take long:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 4/16/25

Today in the Markets:

The markets gapped down and ultimately went lower on 7.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

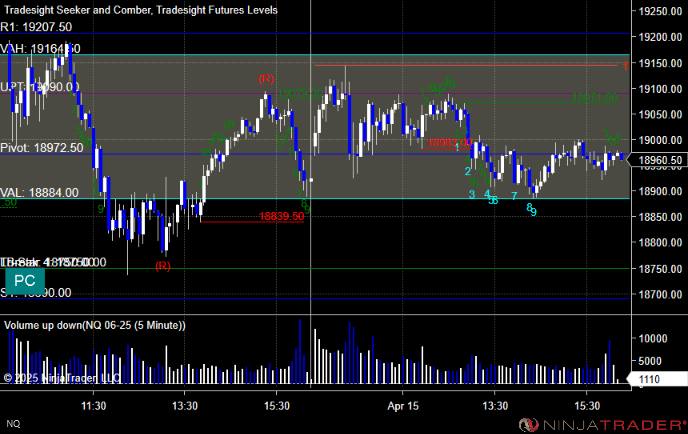

NQ with Levels:

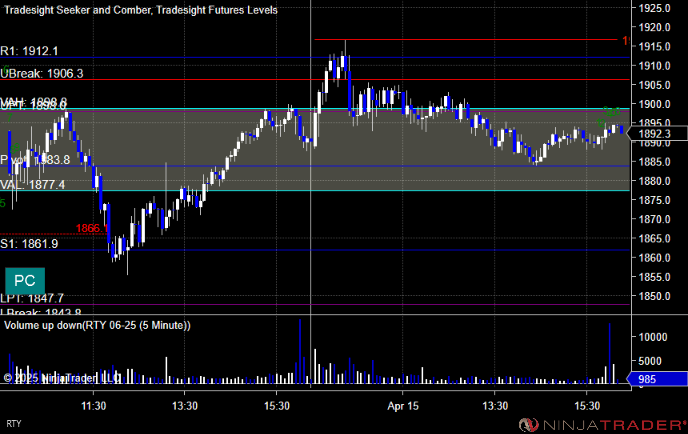

RTY with Levels:

CL with Levels:

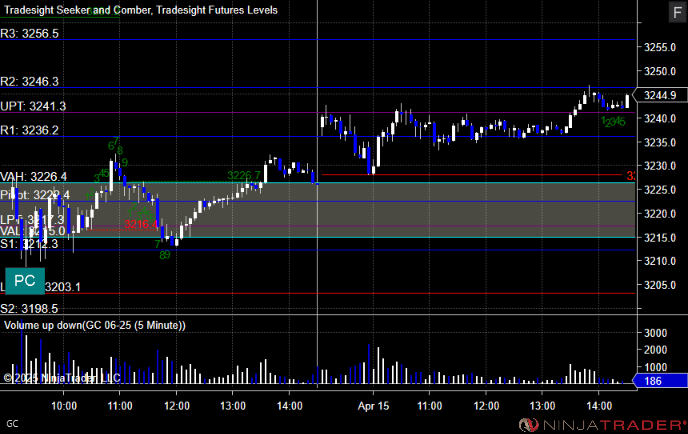

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take long, at B was out of range to take short:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's PLTR triggered long (with market support) and did not work:

That's 1 triggered with market support, and it did not work.

Tradesight Recap Report for 4/15/25

Today in the Markets:

Tax Day. Markets opened flat and did nothing on 7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was too far out of range to take long:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Two calls triggered.

These are the Tradesight calls that triggered, Rich's AAPL triggered short (with market support) and did not go enough to count:

Rich's RDDT triggered short (without market support) and did not work:

That's 1 triggered with market support, and it did not go enough to count.

Tradesight Recap Report for 4/14/25

Today in the Markets:

The markets gapped up and closed just under where it opened on 8 billion NASDAQ shares.

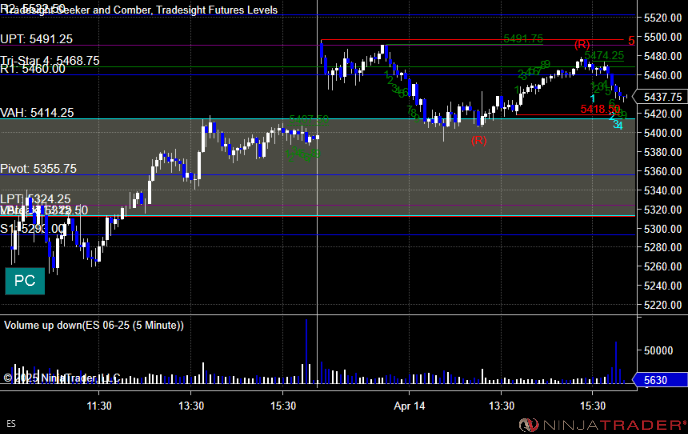

ES with Levels:

ES with Market Directional:

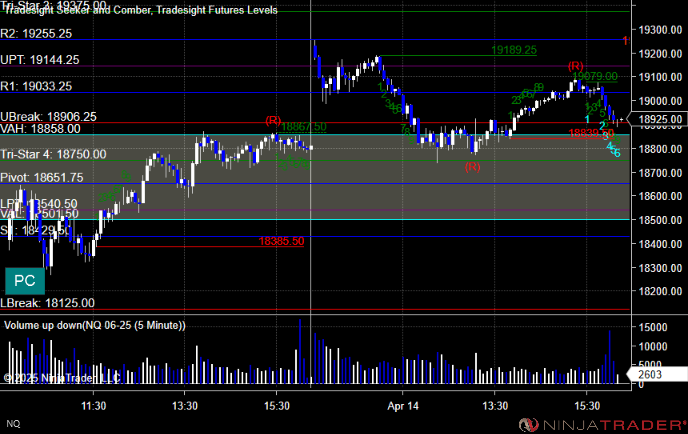

NQ with Levels:

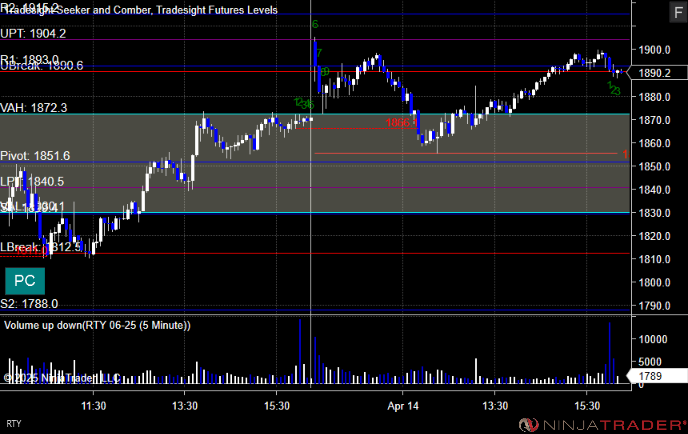

RTY with Levels:

CL with Levels:

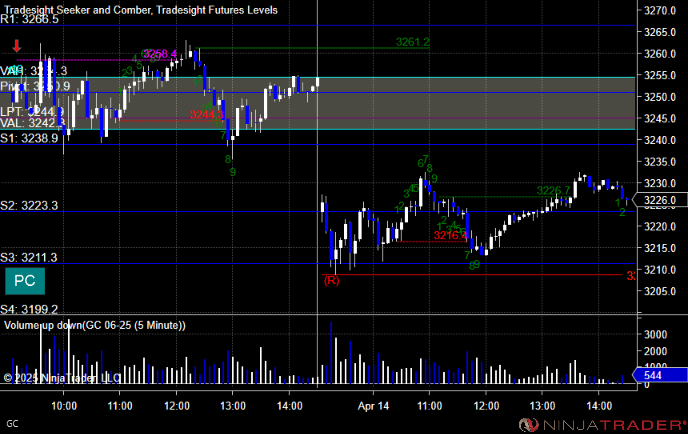

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's CSX triggered long (without market support) and did not go enough to count:

That's 0 triggered with market support.

Tradesight Recap Report for 4/4/25

Today in the Markets:

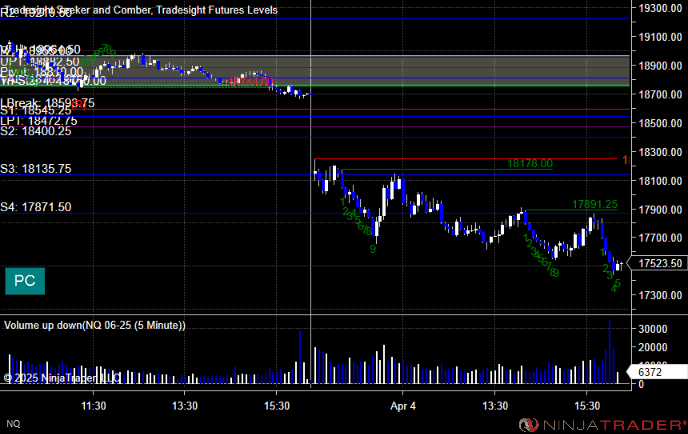

The markets gapped down and headed lower on 8.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short:

Additional Futures Calls:

None

Results: +0 ticks

Stocks:

No triggers.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 4/3/25

Today in the Markets:

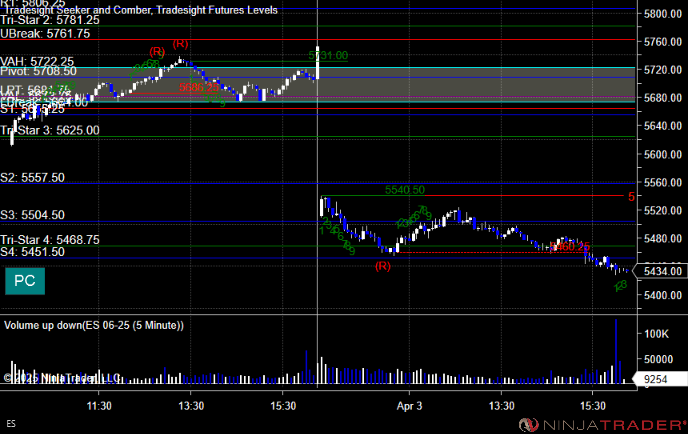

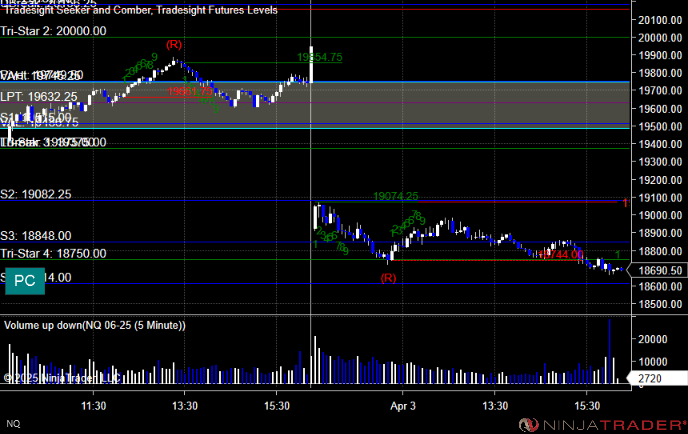

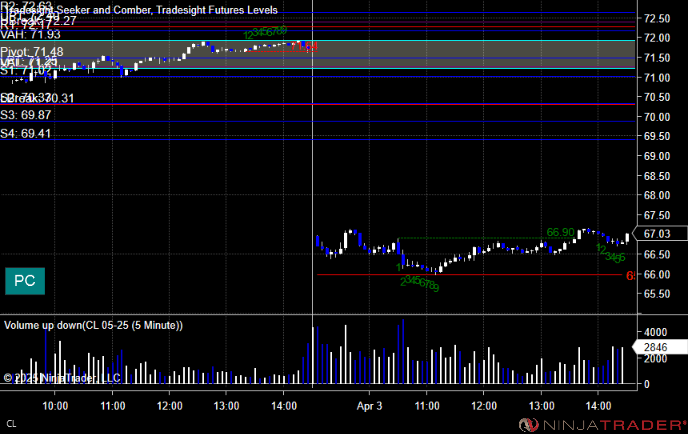

Markets gapped down and went a bit lower on 7.5 billion NASDAQ shares.

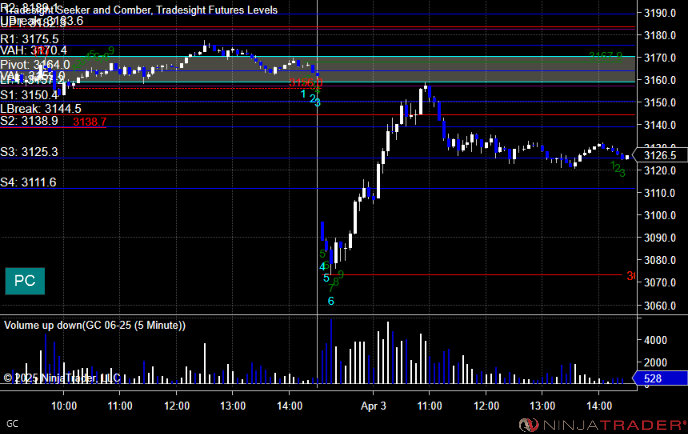

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

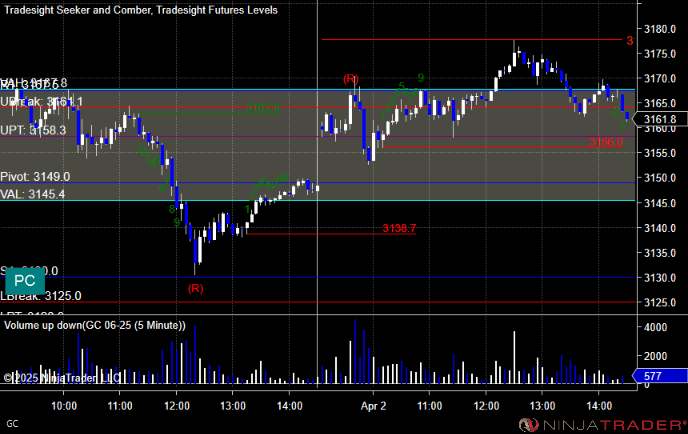

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take long, at B was out of range to take short:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's NVDA triggered long (without market support) and did not work:

That's 0 triggered with market support.

Tradesight Recap Report for 4/2/25

Today in the Markets:

The markets gapped down and rallied on 10 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

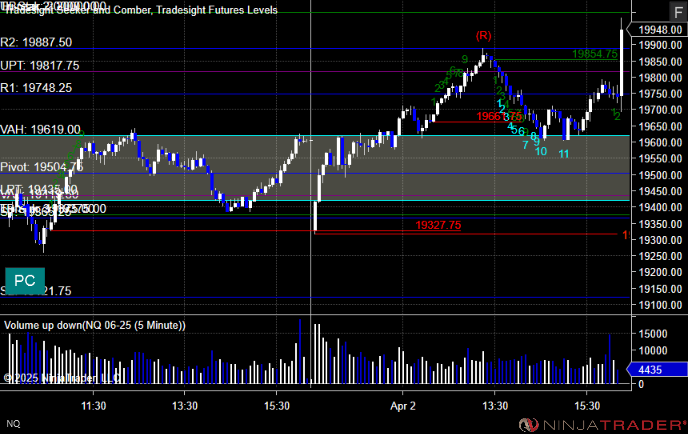

NQ with Levels:

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take long:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Three calls triggered.

These are the Tradesight calls that triggered, ROKU triggered long (with market support) and did not work:

Rich's NVDA triggered long (with market support) and worked:

Rich's GDX triggered long (support does not matter as this is an ETF) and did not go enough to count:

That's 3 triggered with market support, 1 worked and 1 did not and one did not go enough to count.

Tradesight Recap Report for 4/1/25

Today in the Markets:

The markets opened around flat and closed barely higher on 9 billion NASDAQ shares.

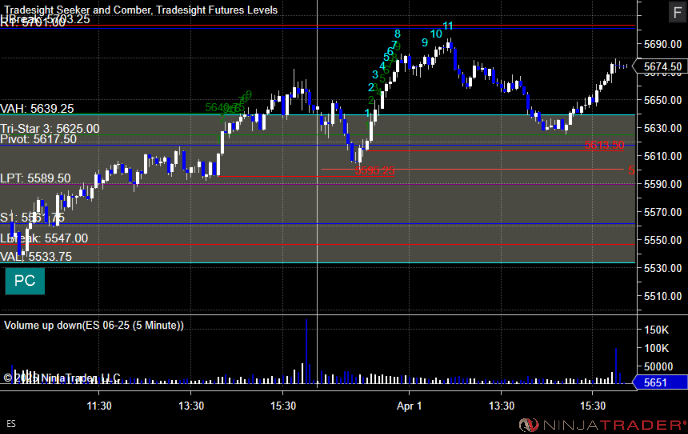

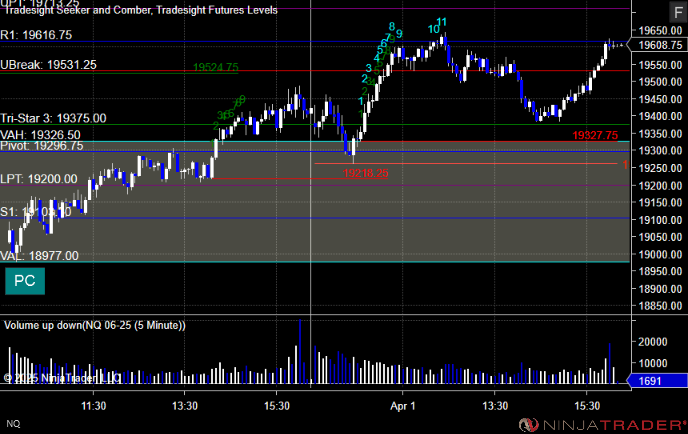

ES with Levels:

ES with Market Directional:

NQ with Levels:

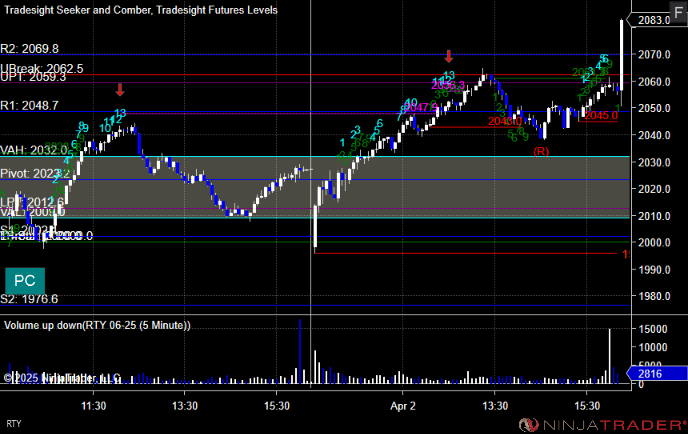

RTY with Levels:

CL with Levels:

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short, at B was out of range to take long:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

One call triggered.

These are the Tradesight calls that triggered, Rich's AVGO triggered long (with market support) and did not work:

That's 1 triggered with market support, and it did not work.

Tradesight Recap Report for 3/31/25

Today in the Markets:

The markets gapped down and spent the day filling the gap.

ES with Levels:

ES with Market Directional:

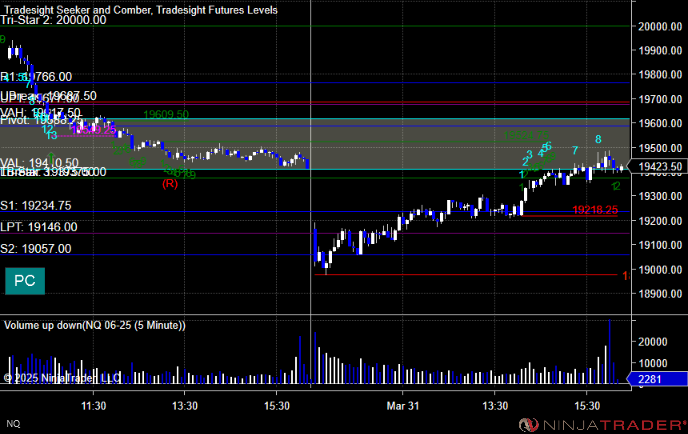

NQ with Levels:

RTY with Levels:

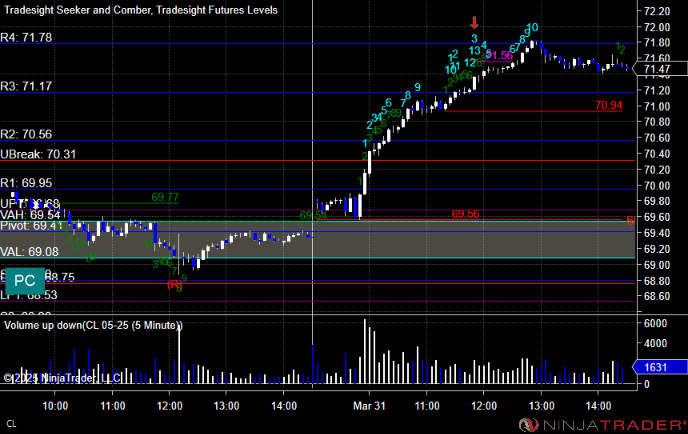

CL with Levels:

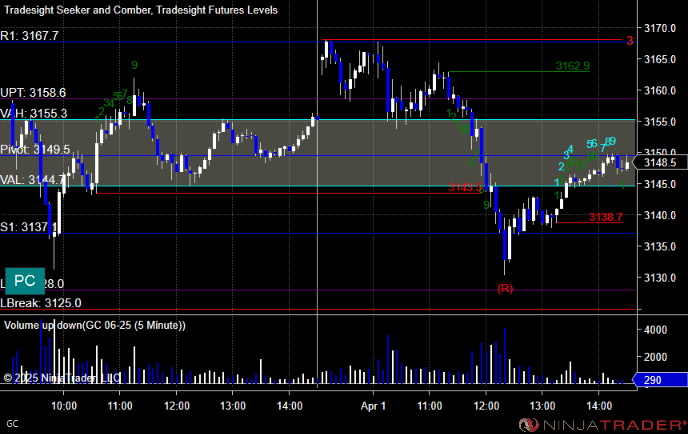

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

Zippo.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.

Tradesight Recap Report for 3/21/25

Today in the Markets:

The markets gapped down and eventually filled the gap on 7 billion NASDAQ shares.

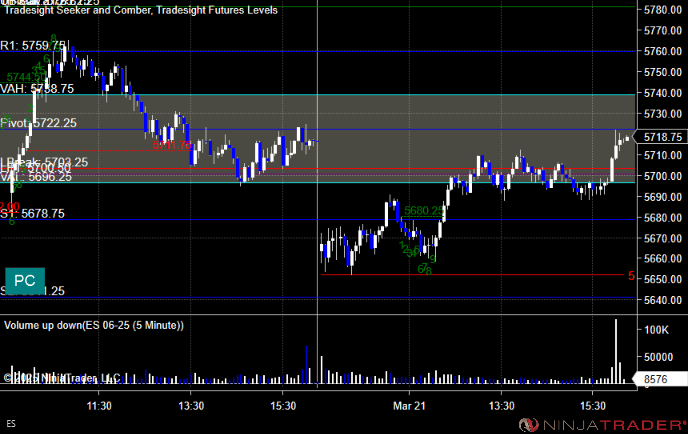

ES with Levels:

ES with Market Directional:

NQ with Levels:

RTY with Levels:

CL with Levels:

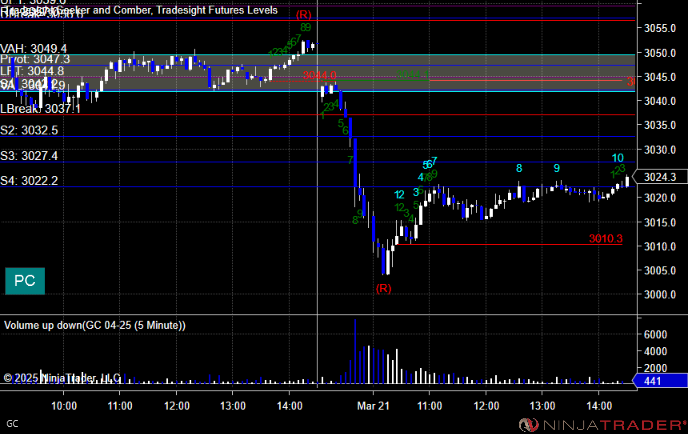

GC with Levels:

Futures:

Nothing triggered in range.

ES Opening Range Play, at A was out of range to take short, at B was out of range to take long:

Additional Futures Calls:

None.

Results: +0 ticks

Stocks:

None of our calls triggered.

These are the Tradesight calls that triggered:

None.

That's 0 triggered with market support.