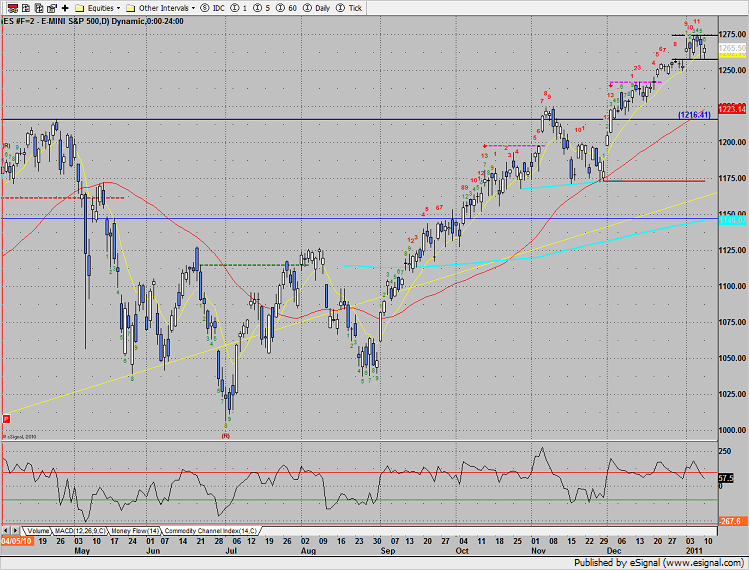

The SP saw a small loss Monday, losing just 2 points from Friday’s close. The current technicals are a mixed bag. On the positive side, price settled above the 10ema and the days open but on the negative side, settlement was negative on the day. Also, note that Monday’s rage was contained within Friday’s range which makes for an inside day and loads the pattern with energy. Lines have been added to the chart to delineate the current trading range.

Naz was higher by 9 handles on the day making both a new high and new high close on the move. The markets were bifurcated from the opening, with Naz, powered by AAPL, outperforming the broad market early and holding the relative performance advantage. Naz leading the broad market is always a favorable condition for the bulls. That is until a new high recorded in the Naz and then the SP ultimately cannot. This is often where key inflections are found. Monday, the Naz made a new high but the SP did not which is not a problem unless the SP just cannot muster a fresh push higher. There is also another interesting technical development from the latest candle on the chart. The dreaded 4 bar Trend Termination Pattern has completed. If price settles below Monday’s low, expect follow on selling.

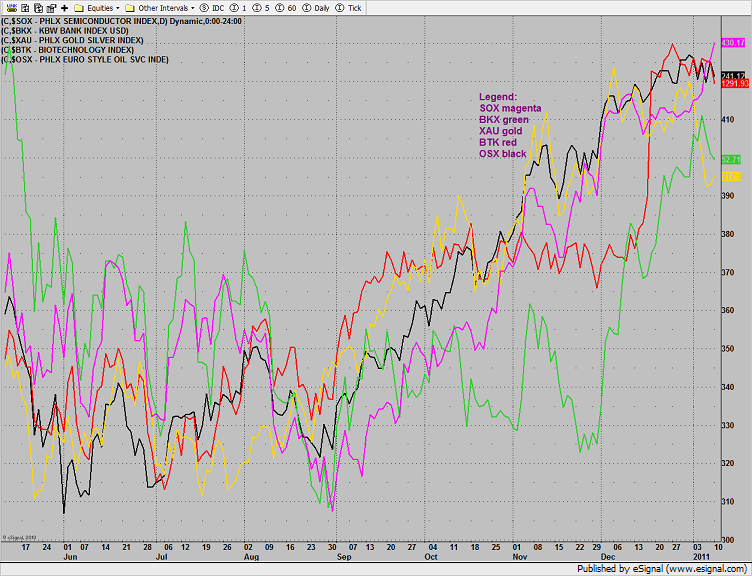

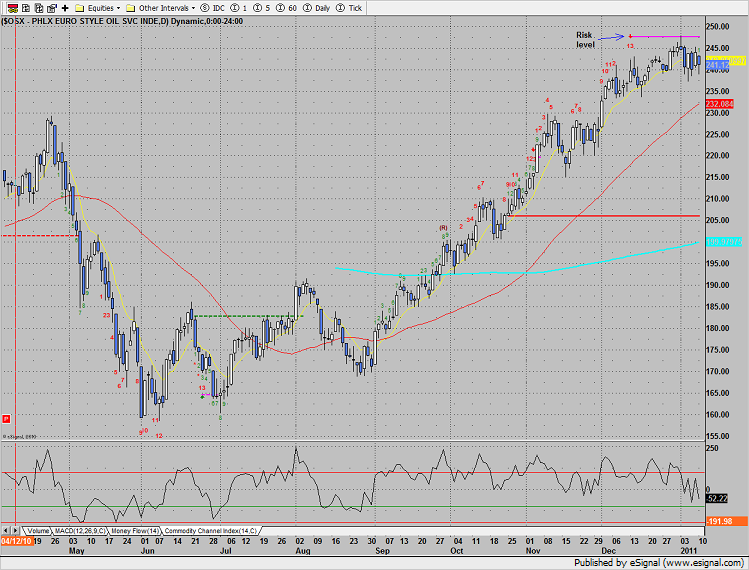

Leadership in the multi sector daily chart is coming from the SOX:

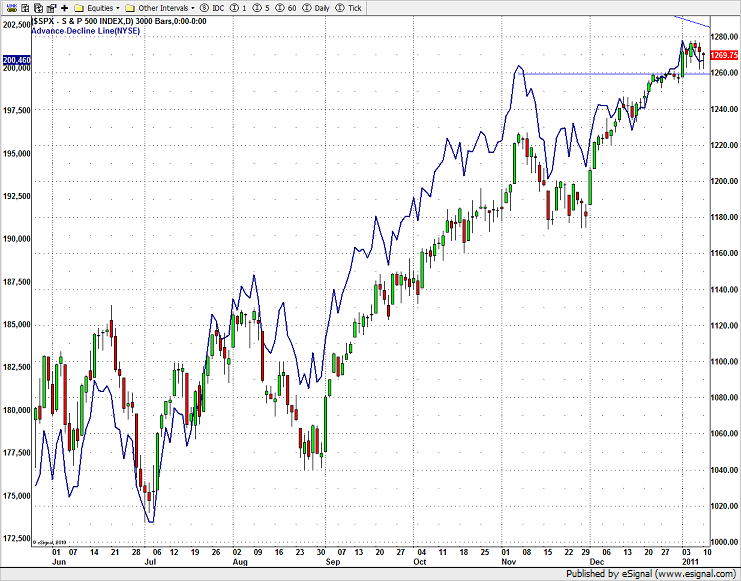

The NYSE cumulative A/D line has slipped below the current price of the SP500. Traders need to keep on top of this because the cumulative A/D LEADS price.

The SOX was top gun leading all other key sectors. Note that Monday’s candle completed the Seeker 1-13 exhaustion run.

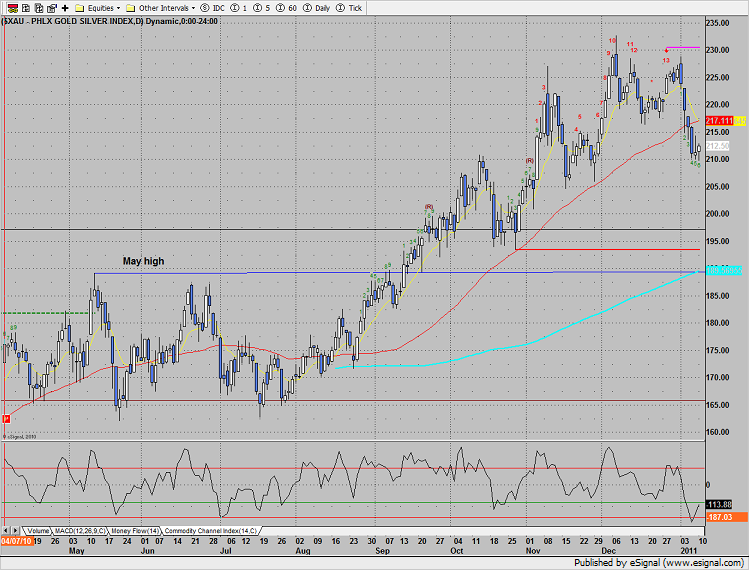

The XAU outperformed the broad market but is only 5 days down. Set an alarm under the recent lows for the completion of the 9 bar drop.

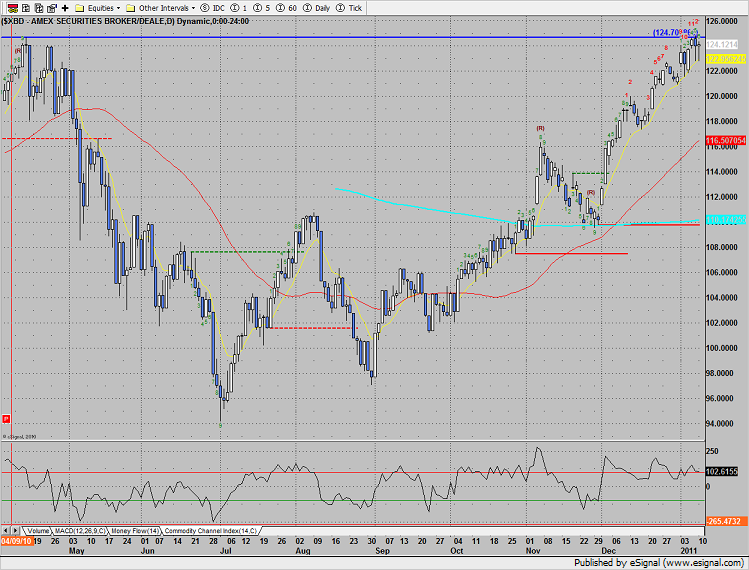

Broker-dealers are at the prior high water mark and only bone day away from a Seeker exhaustion signal. Pay special attention to the next couple of closes in the XBD, a 13 exhaustion signal at a double top would be a very high probability inflection point. The pattern is currently 12 days up.

BKX traded inside the Friday’s range, closing right at the 10ema. Set an alarm for a break under 52.07 which would turn the momentum negative.

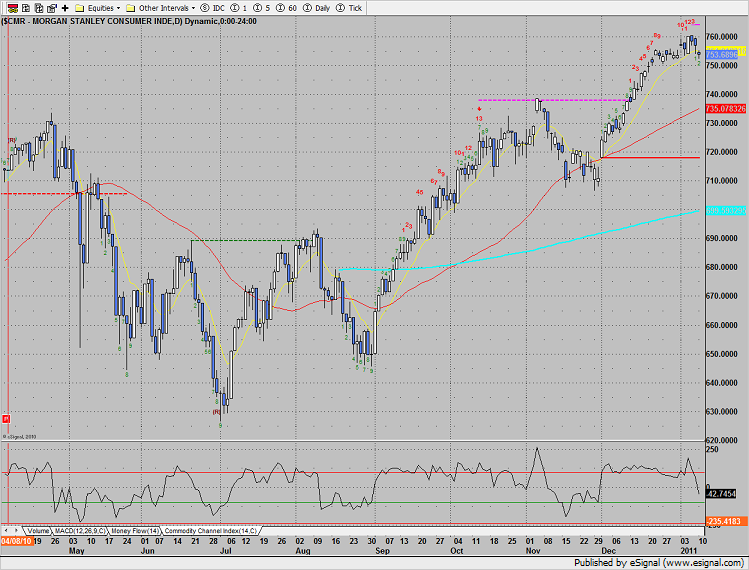

Consumer durables broke below the prior low, keep in mind that he Seeker 13 exhaustion signal is active.

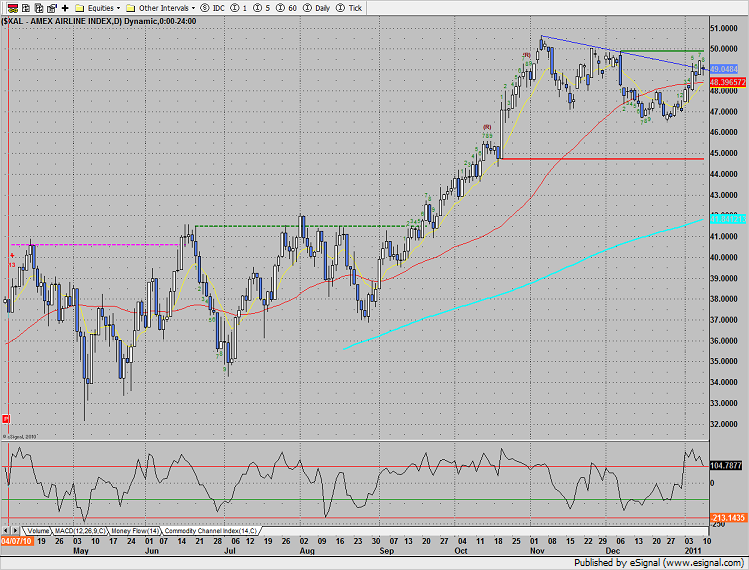

The XAL is gaming the rising wedge break level but is now 8 days up.

The OSX underperformed the broad market and contines to move laterally under the Seeker exhaustion risk level. This can only be characterized as a distribution day especially in light of the strength in crude.

The BTK was the last laggard closing under the 10ema.

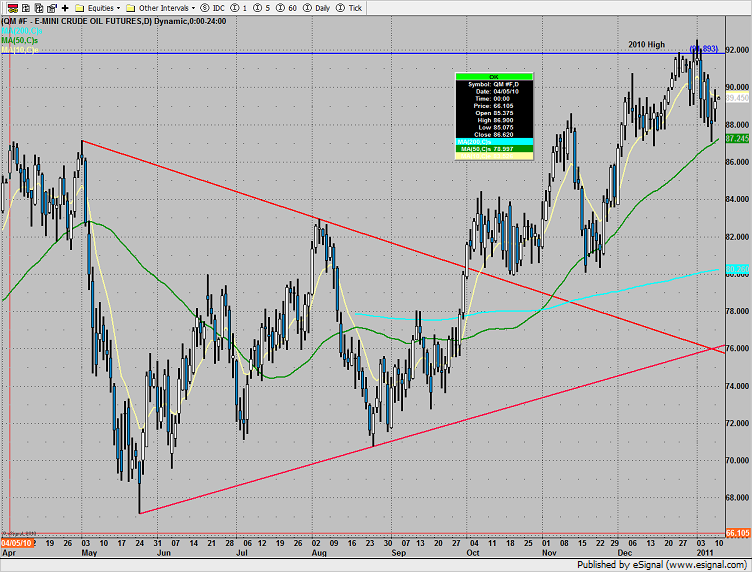

Oil remains under the 2010 high:

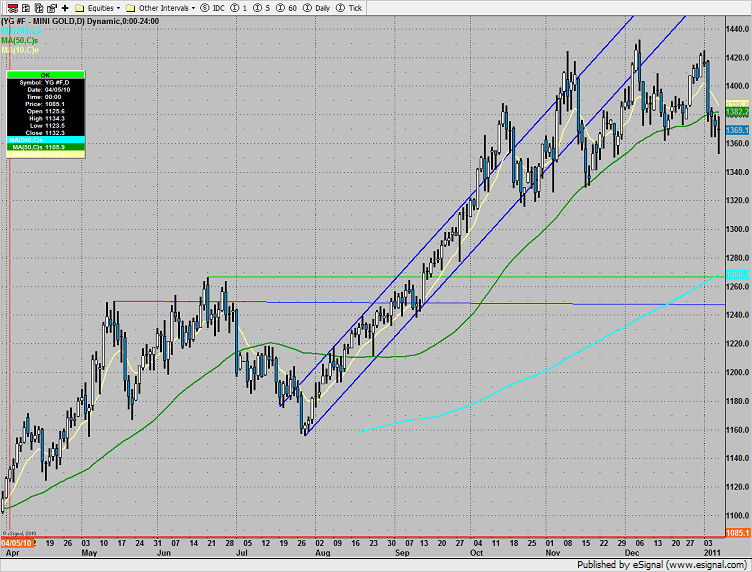

Gold was slightly lower on the day and made a lower low on the move: