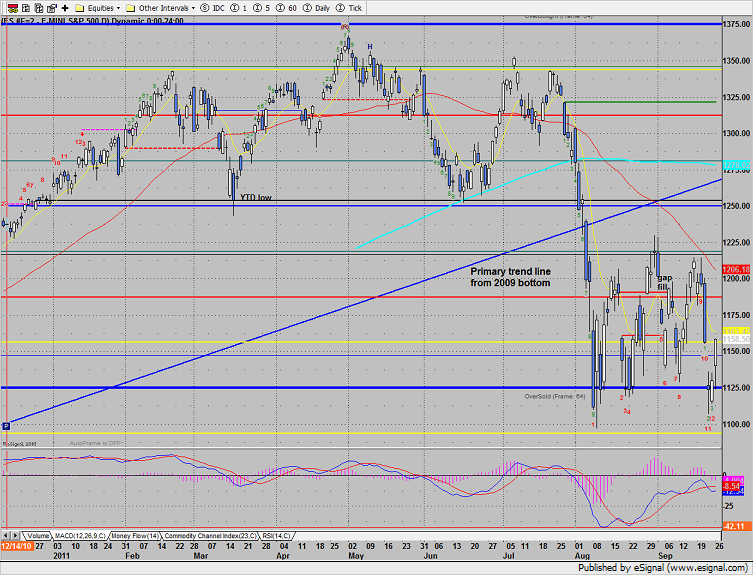

The SP gained 28 on the day filling the gap form last week. Note that the pattern is 12 days down with a Seeker exhaustion signal on deck.

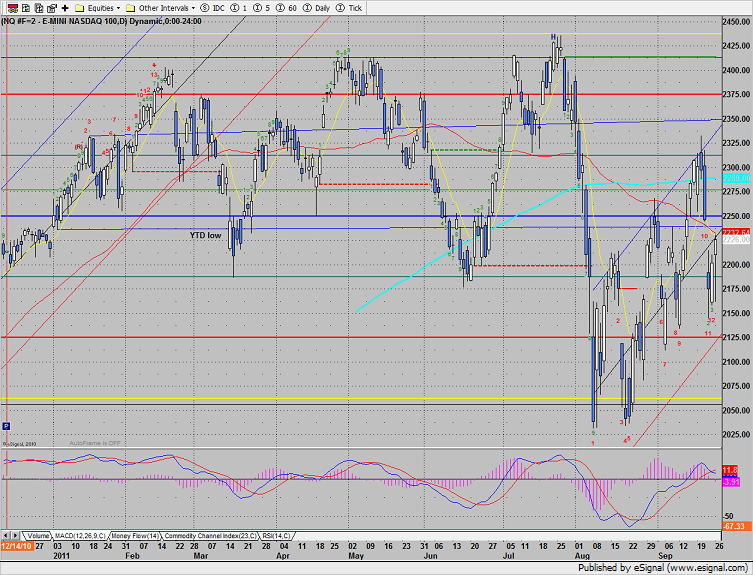

The NAZ is also 12 days down but much stronger than the SP because the trend channel is still intact.

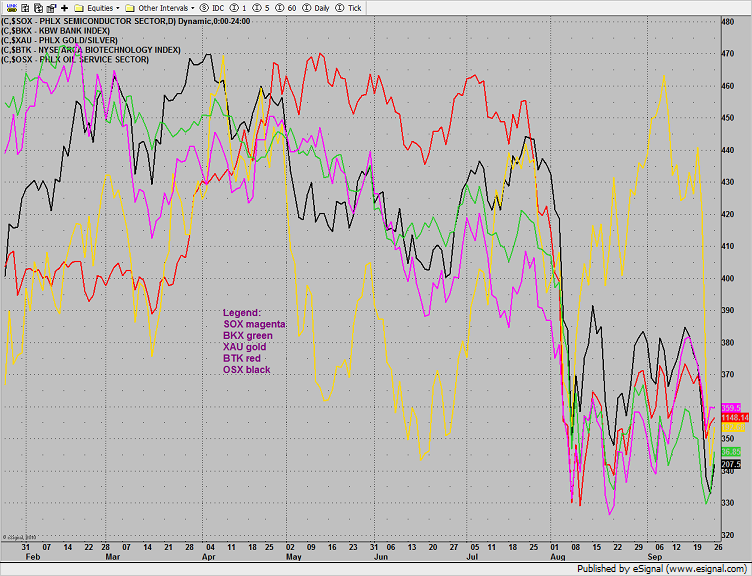

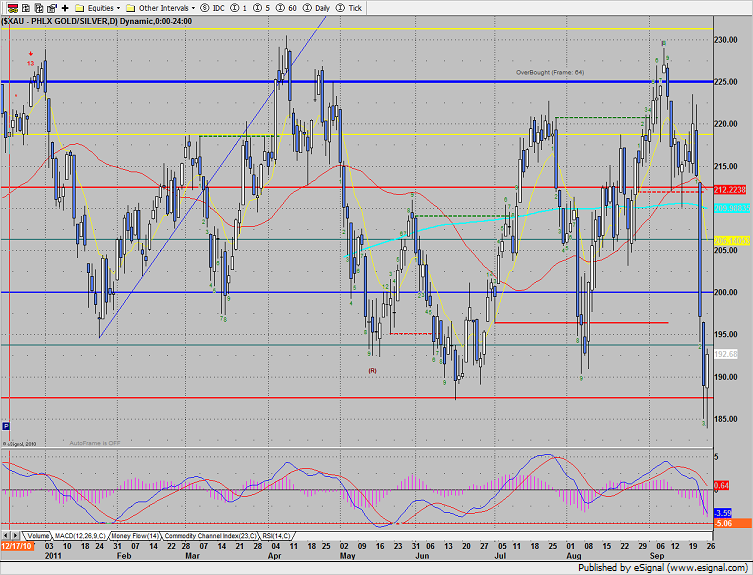

The XAU has lost all its relative strength:

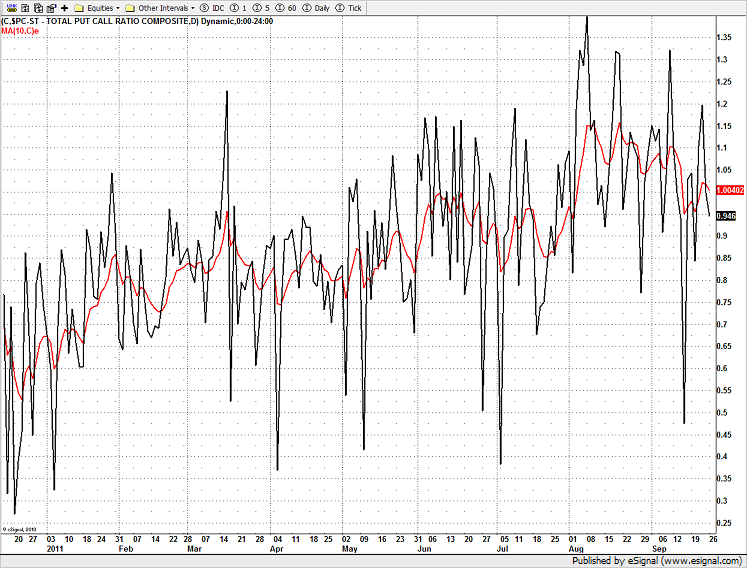

The put/call ratio is back into the neutral area.

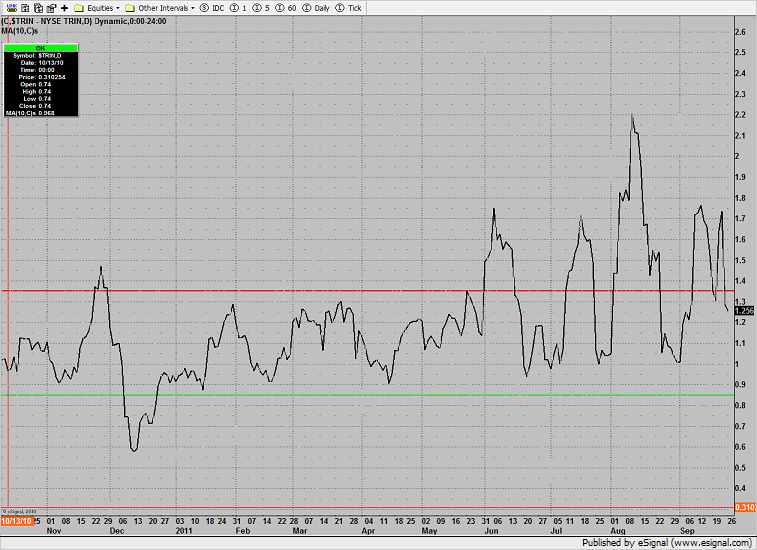

The 10-day Trin is back down into the neutral area but still has oversold energy in it to be released.

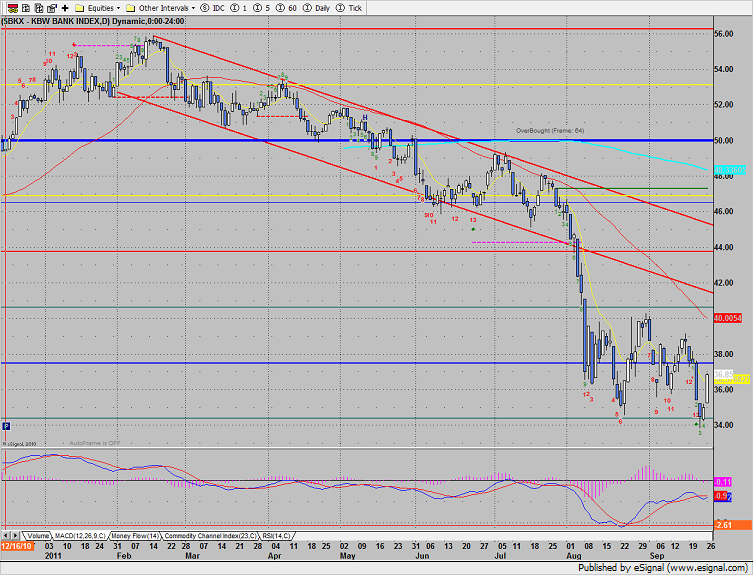

The BKX was higher by an impressive 5%. Note that the Seeker exhaustion signal is active.

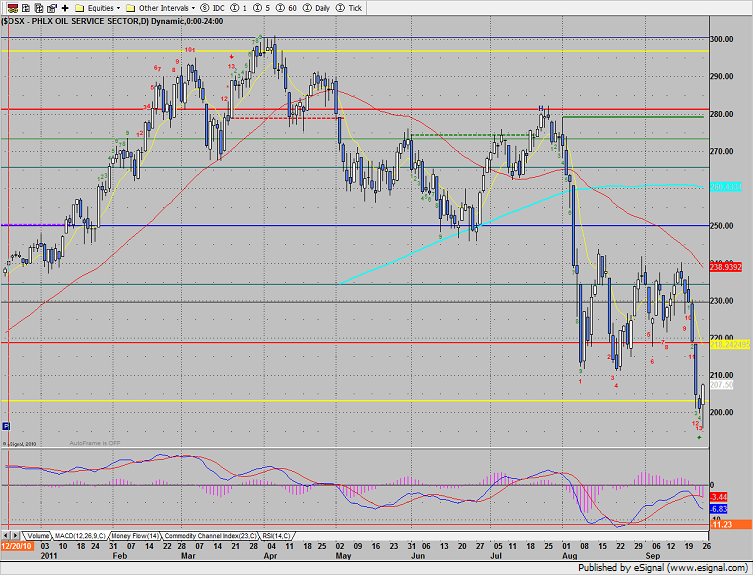

The OSX outperformed the market and also has an active Seeker buy signal in place. Note that Monday’s candle was a classic range low outside up day.

The XAU printed new YTD lows and did not post a reversal candle.

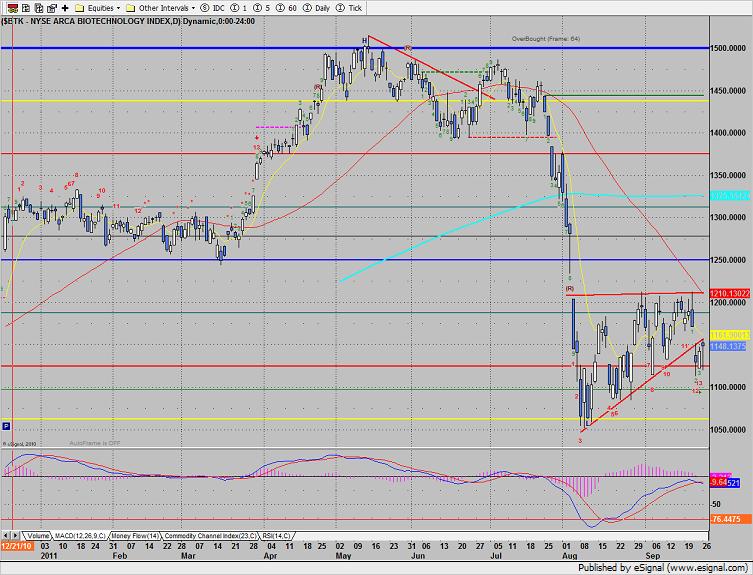

The BTK has an active Seeker exhaustion signal. Look for a reclamation of the triangle pattern.

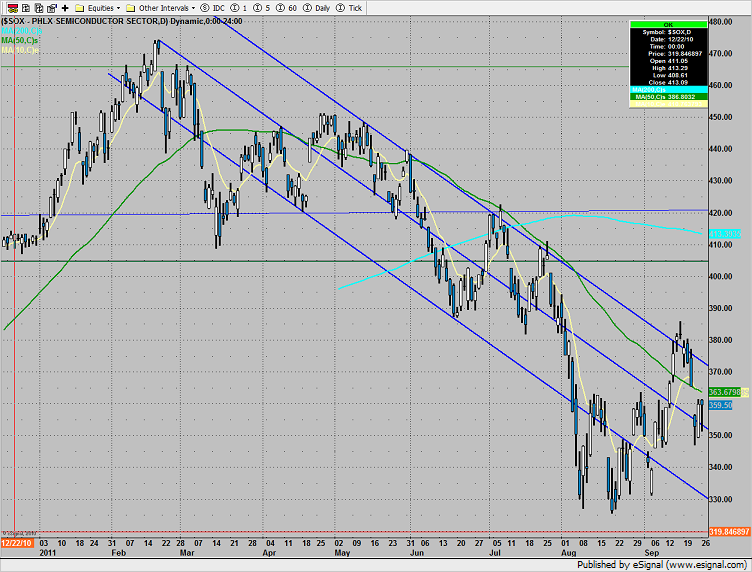

The SOX was a huge laggard on the day and is a source of concern for the bulls. Price needs to break decisively above the trend channel high.

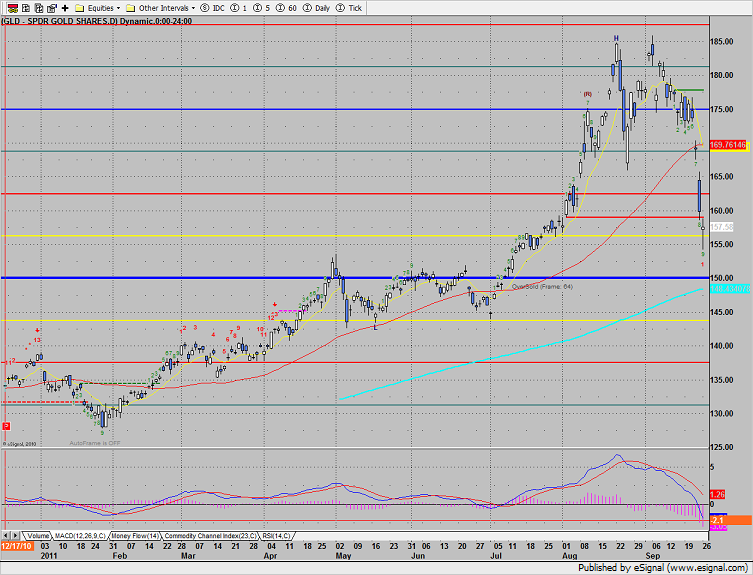

Gold made a new low on the move as the liquidations continue. There was an erroneous print in the overnight futures so below is the GLD etf.

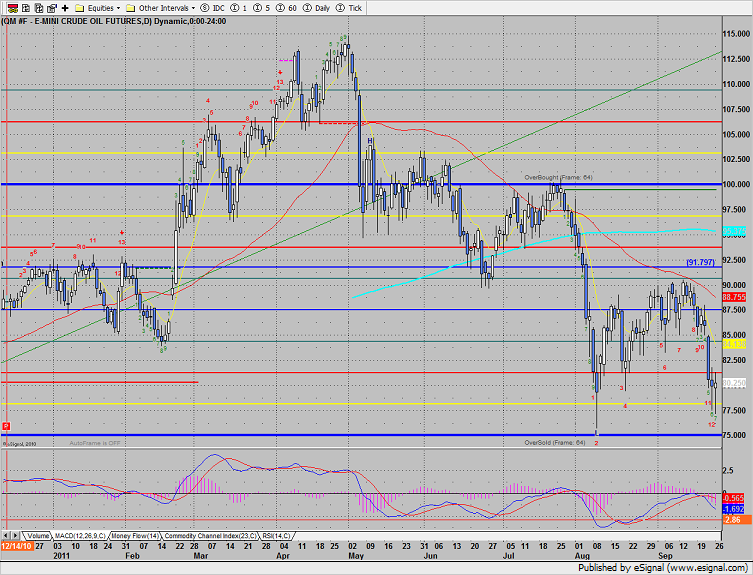

Oil was little changed on the day and did not make a new low on the move. Note the nice long tails that the last 2 candles have formed.