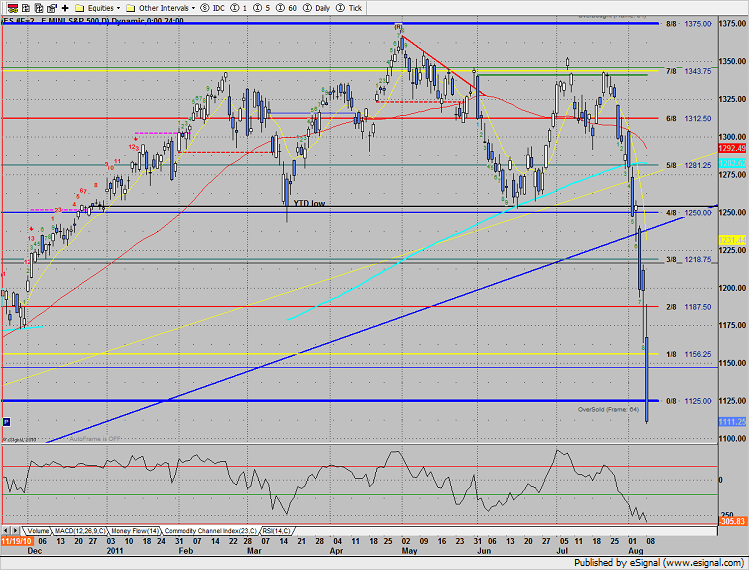

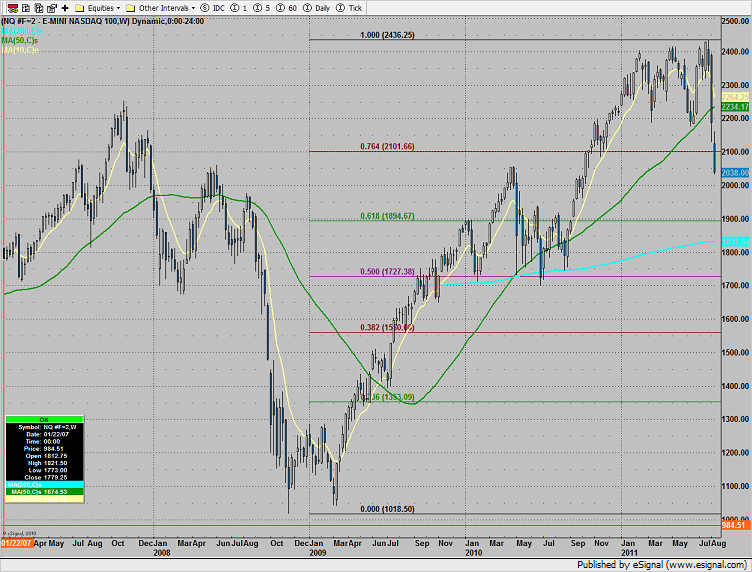

Following the S&P downgrade of the US debt rating the SP gapped lower made an attempt to fill then was sold all day long. The futures lost 86 on the day settling below the 0/8 Gann level. All of the price oscillators are extremely oversold. 1100 is the 38% fib retracement from the 2009 low to the 2011 high. This is a very key area of support.

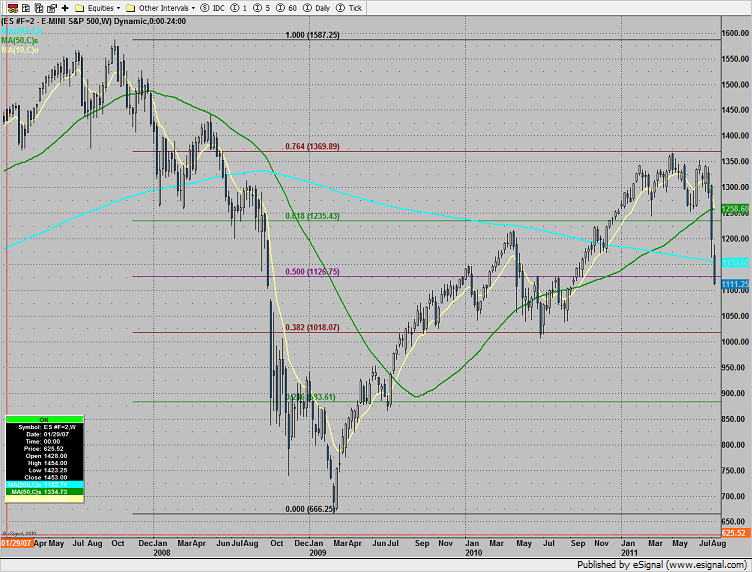

Below is the weekly SP chart with fibs off the 2008 high:

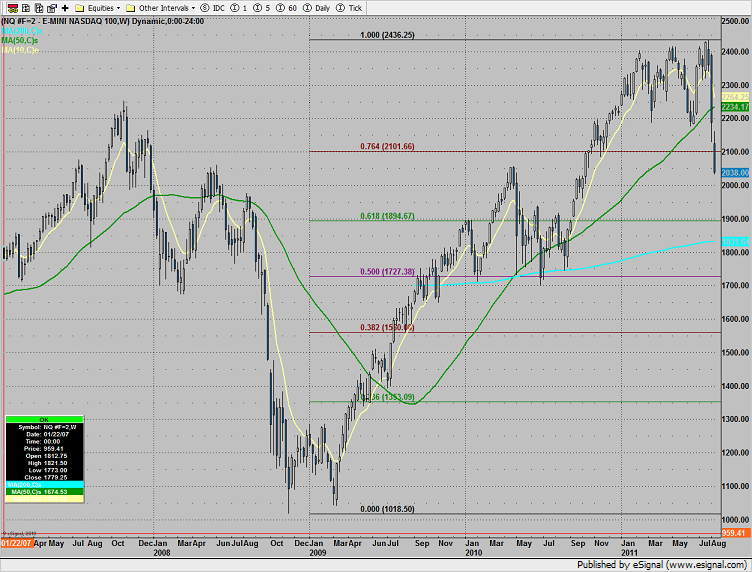

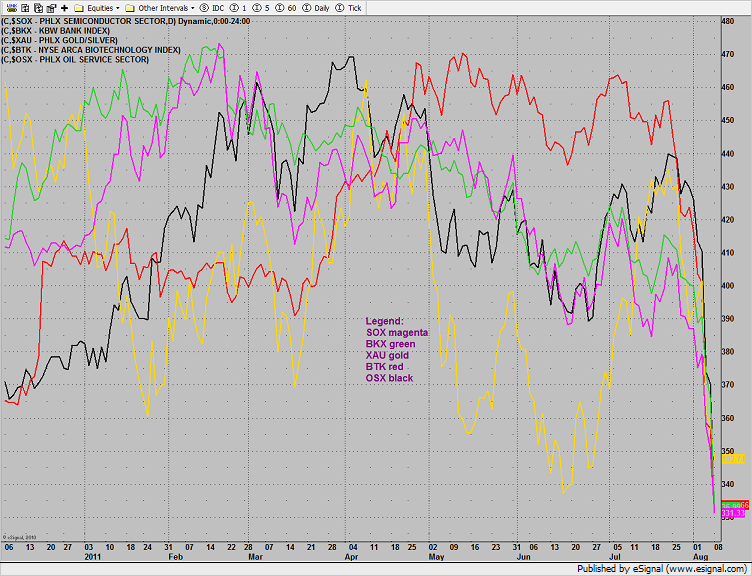

Naz lost 149 handles, settling below the -2/8 level with will shift the Gann frame lower. Like the SP, all the technical indicators are flashing oversold signals.

Below is the weekly Naz chart with fibs:

The multi sector daily chart looks like all the components fell down an elevator shaft. Seasoned traders know that when the margin clerks call, everything can be a source of funds.

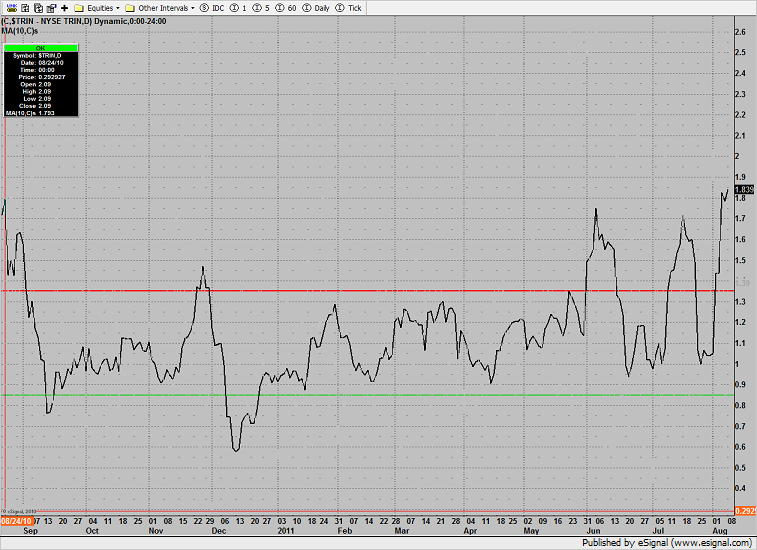

The 10-day Trin is solidly in oversold territory.

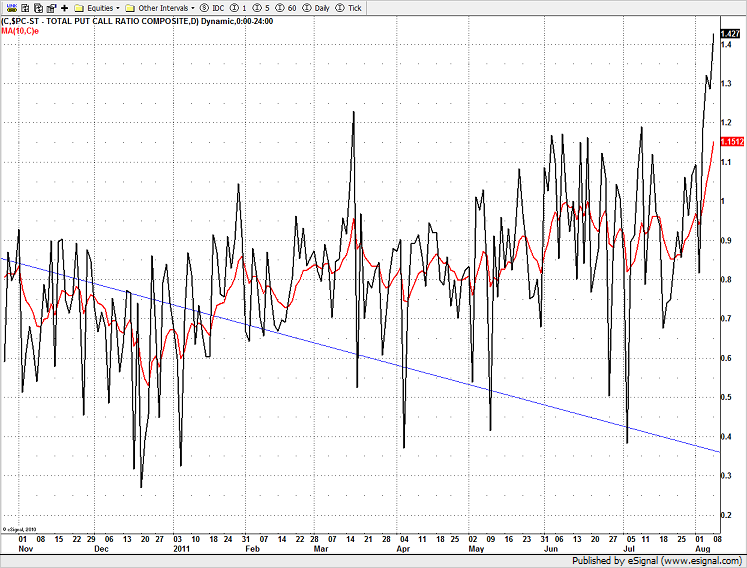

The put/call ratio closed at a super climatic reading of 1.42 as traders paid up for option protection. This is the highest close since 12/31/07.

The Dow/gold ratio closed at a new low on the move. Keep in mind that super-cycle financial crisis usually see a Dow/gold ratio under 2. To achieve this, even conservatively using the 2008 low of the Dow, gold would have to be >$3000 to get the ratio below 2.

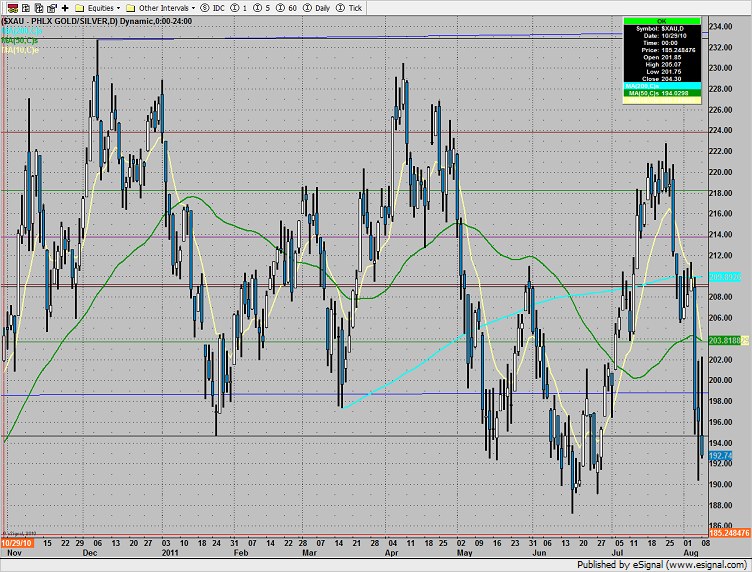

Even with gold up the most in dollar terms in a single day, the margin clerks used the XAU as a source of funds.

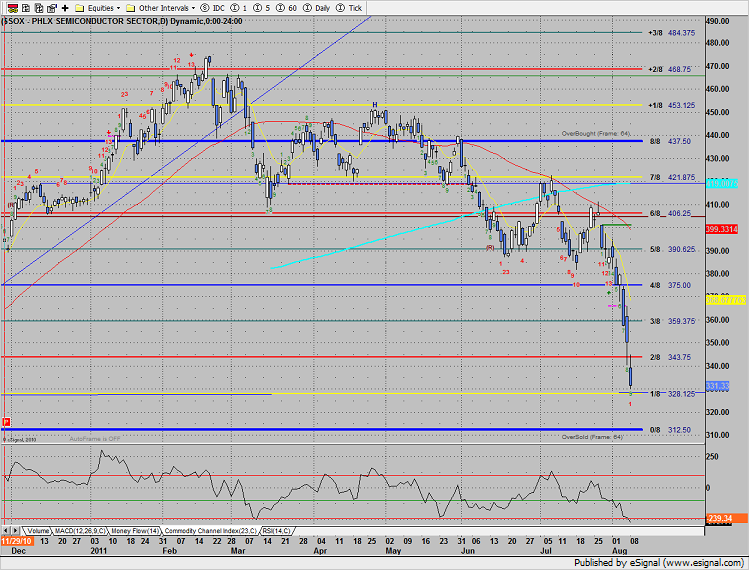

The SOX outperformed the Naz only losing 19 on the day. Support levels are 328 and 312.

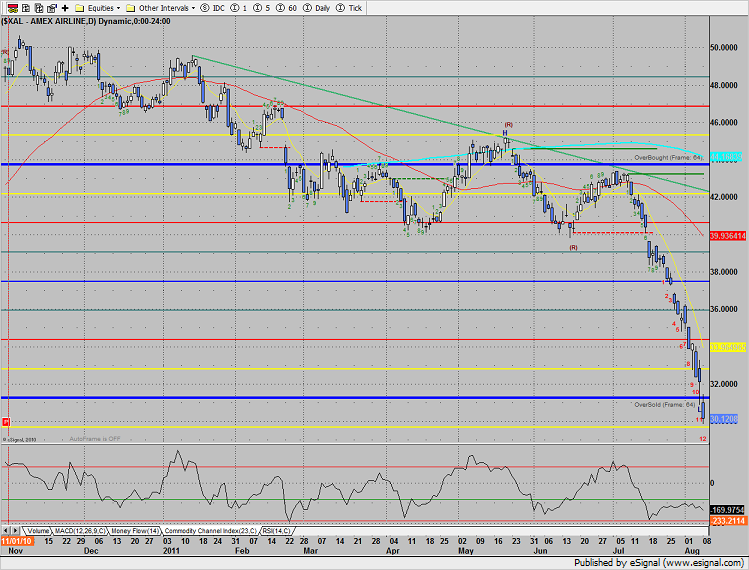

The XAL is in Gann oversold territory and is 12 days down in the Seeker count.

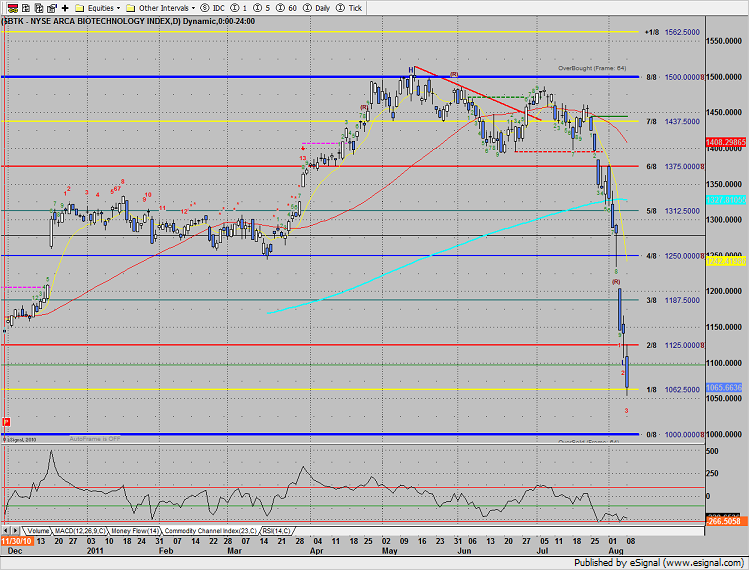

The BTK traded inline with the market—first support 1062, better support at 1k.

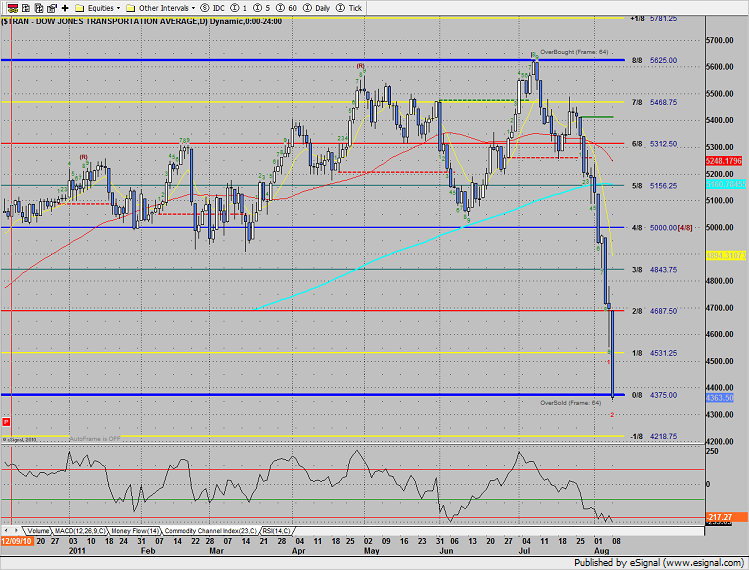

The Trans closed right on support at 4375, next support 4218.

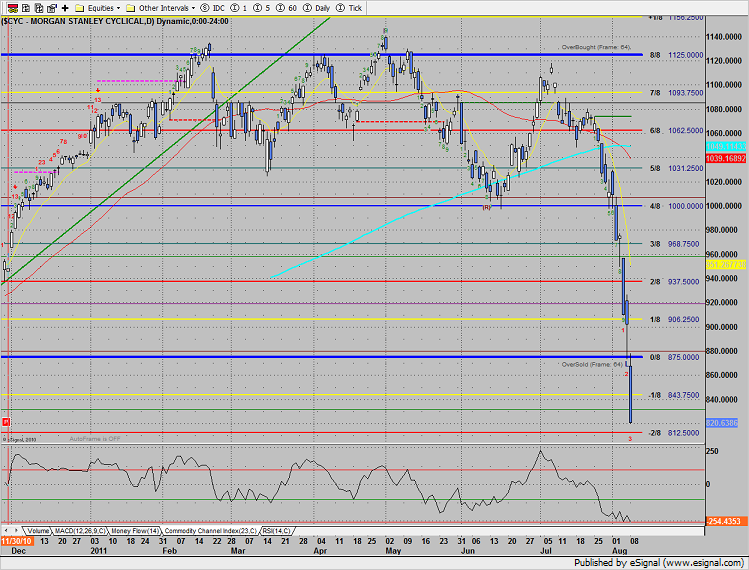

The CYC is just above last support before a frame shift.

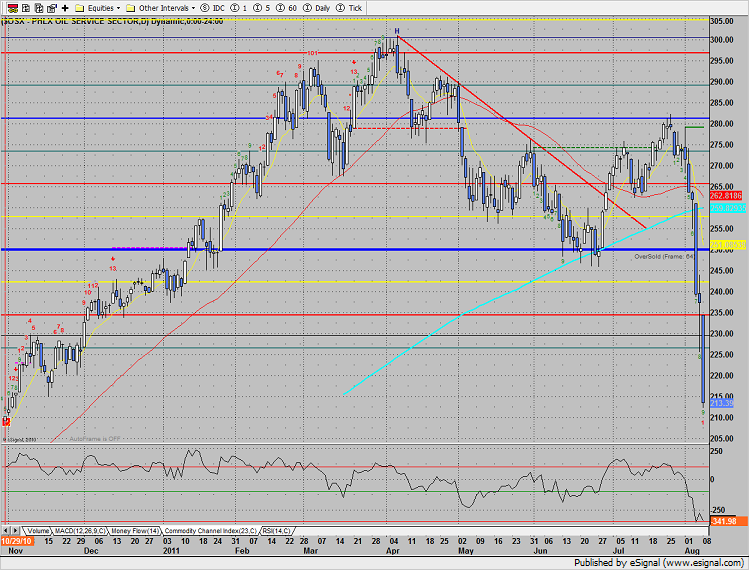

The OSX was much weaker than the broad market, down 10%. The Gann box will frame shift tomorrow, but the CCI is buried enough for some upside.

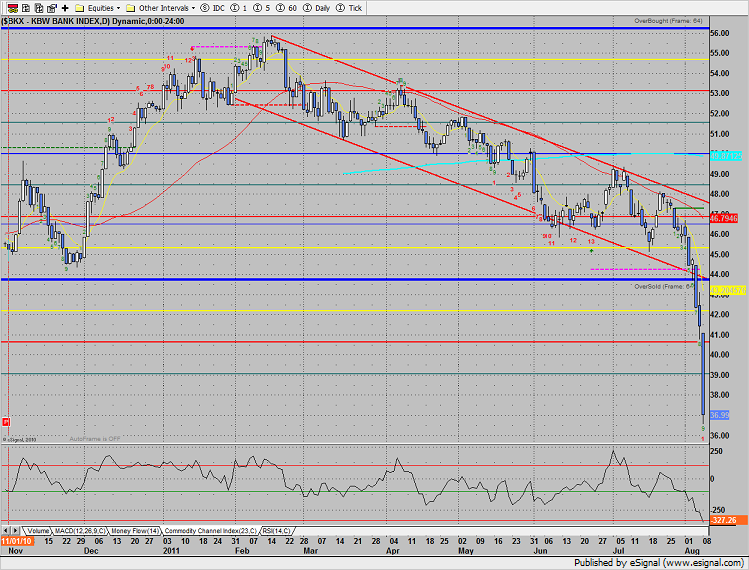

The BKX was the last laggard on the day, thumped 11%. Following the channel breakdown, the banks are currently very oversold with the CCI at -346! Note that the sector is 9 days down.

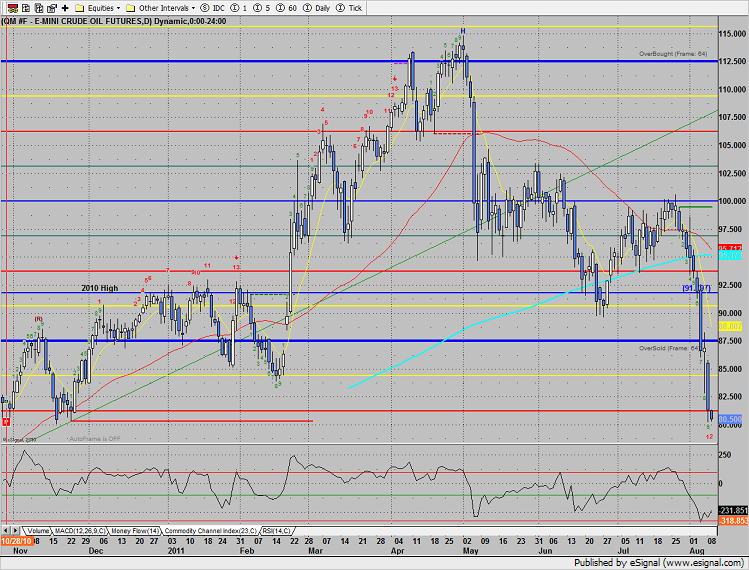

Oil was a source of funds and will frame shift tomorrow.

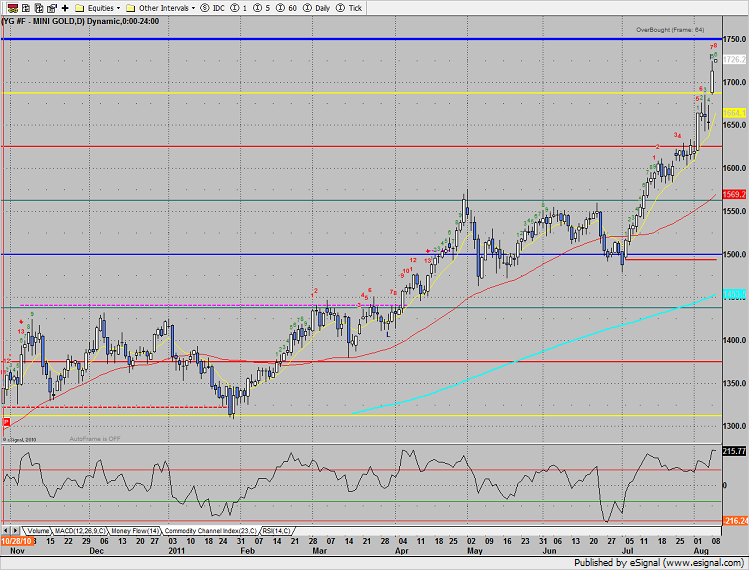

Gold was a place to park money and is getting close to the 1750 8/8 level.