The ES was unchanged on the day after recouping an early drop. There is nothing new technically other than the CCI has totally stagnated.

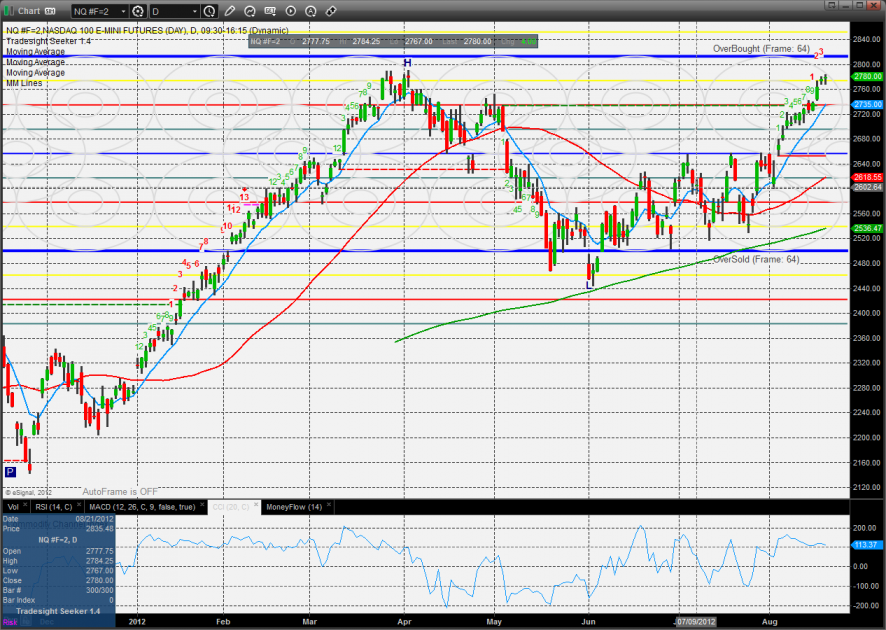

The NQ futures were higher by 4 on the day. The pattern has left price right in the area of the prior March high. Note that the Seeker countdown is still very immature and only 4 days up.

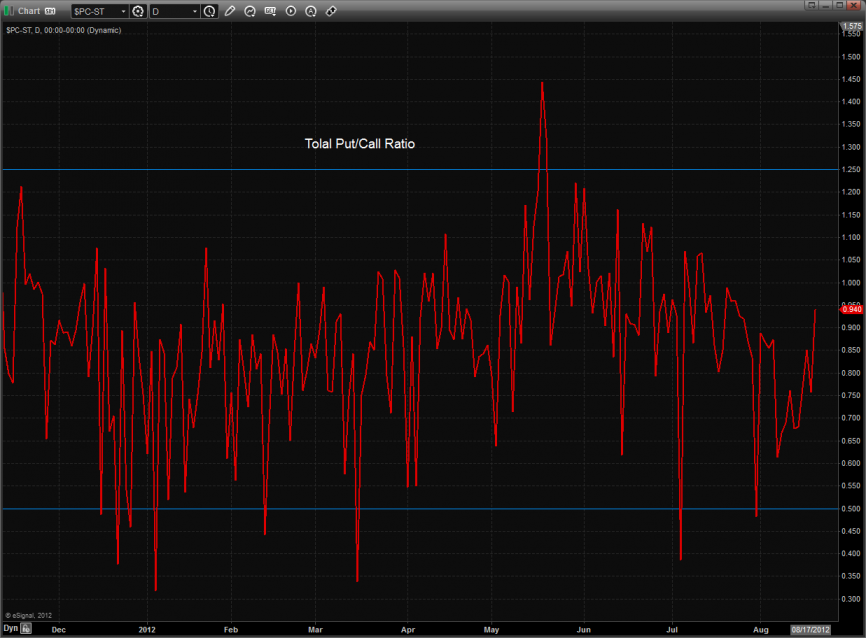

The total put/call ratio is still neutral:

Late last week, the 10-day Trin recorded the first overbought reading since March. If the market should choose to turn down, it has sufficient energy to cover some ground and begin a decent move.

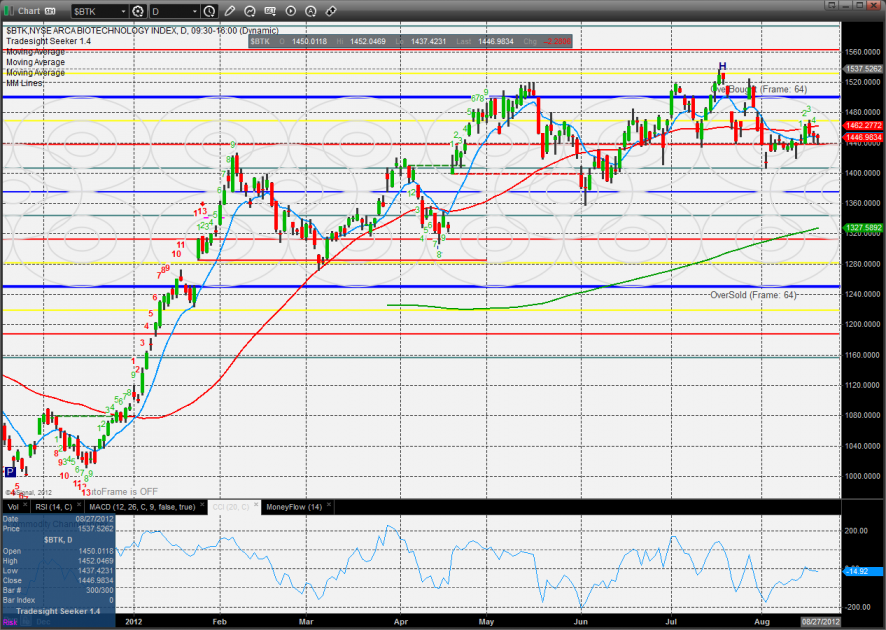

Multi sector daily chart:

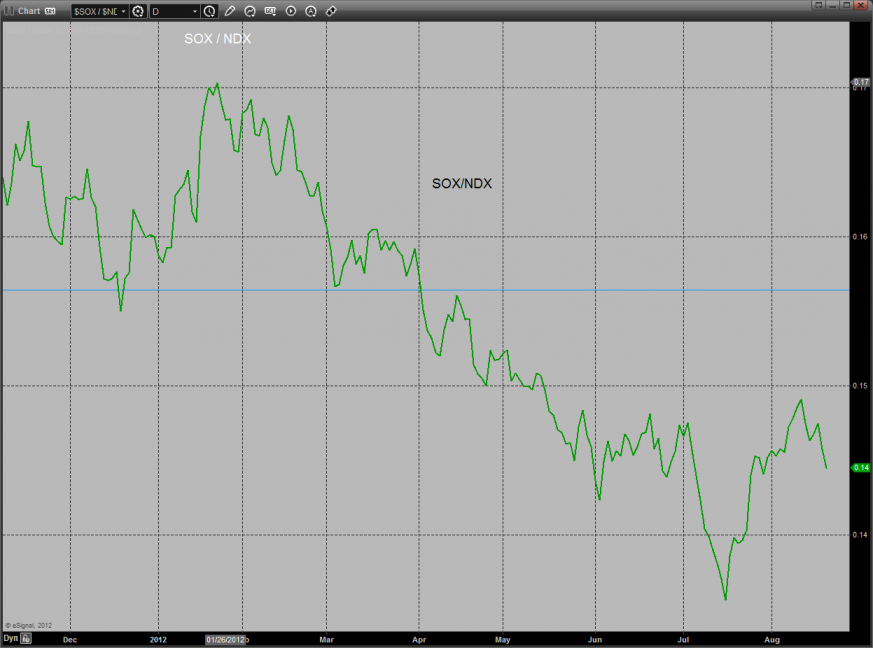

The budding reversal in the SOX/NDX cross has lost momentum and taken a bearish turn. A true failure here would be very bearish for the overall NDX.

Both the NDX and SPX are grappling with their prior highs and are double top until they breakout and qualify new highs.

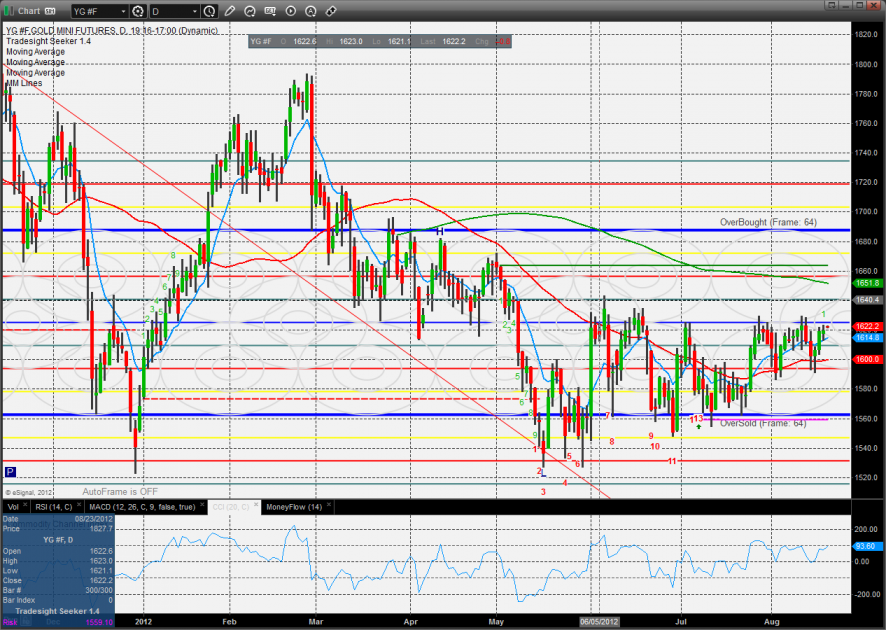

The defensive XAU was the top gun on the day closing right near the static trend line.

The BKX was higher on the day but still has an active Seeker sell signal in place until the risk line is broken.

The BTK treaded water and is showing relative weakness.

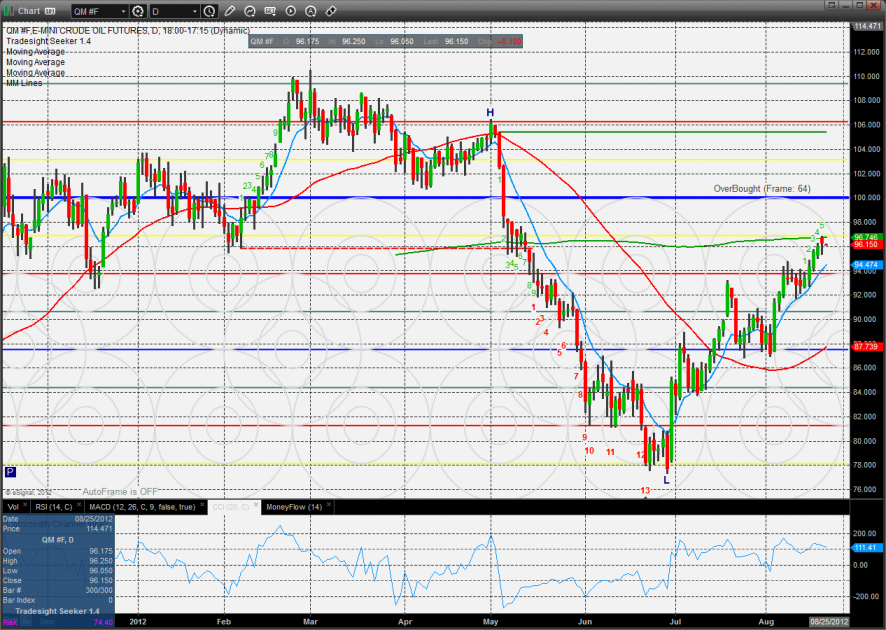

The OSX was weak all day and should be showing relative strength at this point in the “revovery”. Price remains above all the major moving averages. The next bull target will be the 7/8 Gann level which is exactly the active static trend line.

The SOX was the last laggard on the day and traded all the way down to one of the key MA’s. If the chart closes below the 10ema the pattern will turn short term negative.

Oil:

Gold:

Silver: