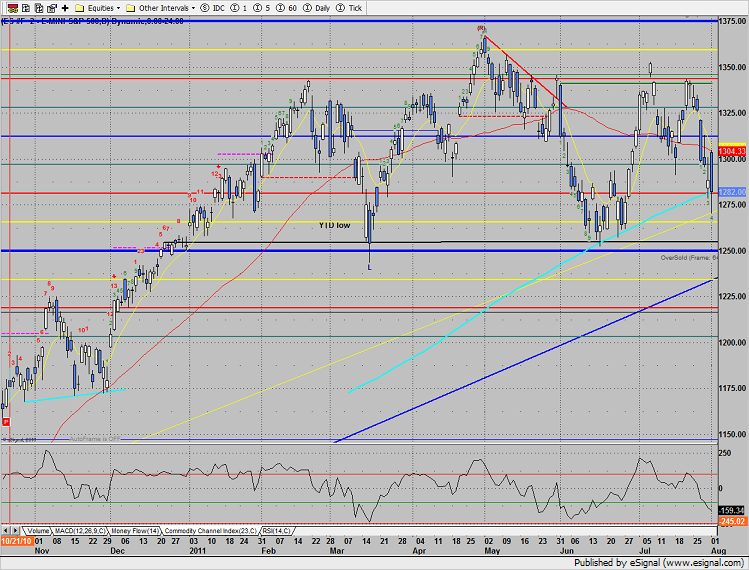

The SP lost 6 handles after a large gap up to close right at the 200dma. A loss of this area would likely kick in some institutional selling. Note on the chart that price was lower in June but held above the (then lower) 200dma.

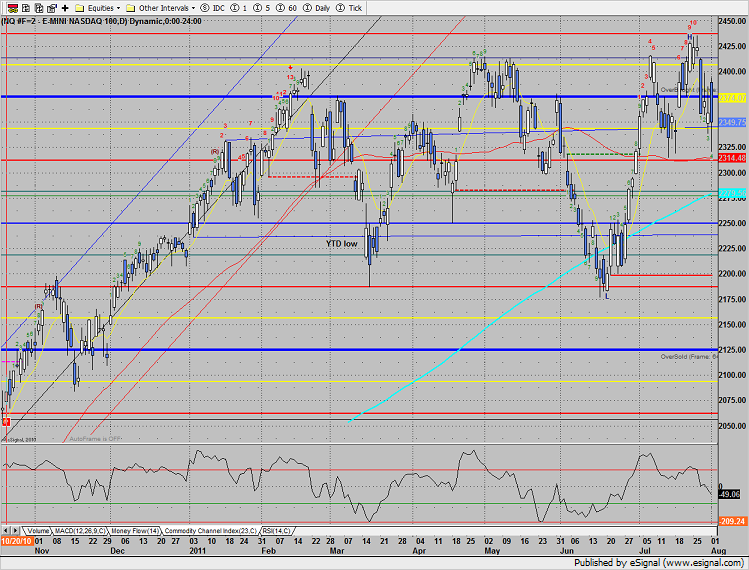

Naz was lower by 10 handles but is above both the 50 and 200dmas.

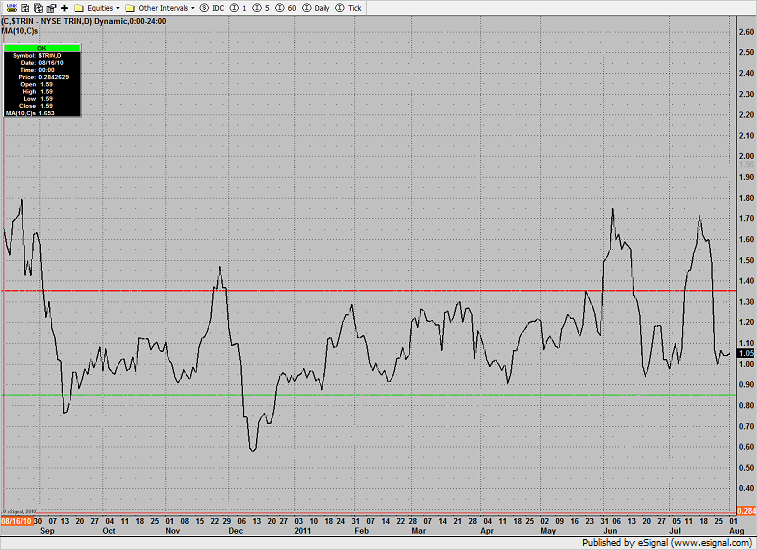

The 10-day Trin is neutral around the 1.00 baseline.

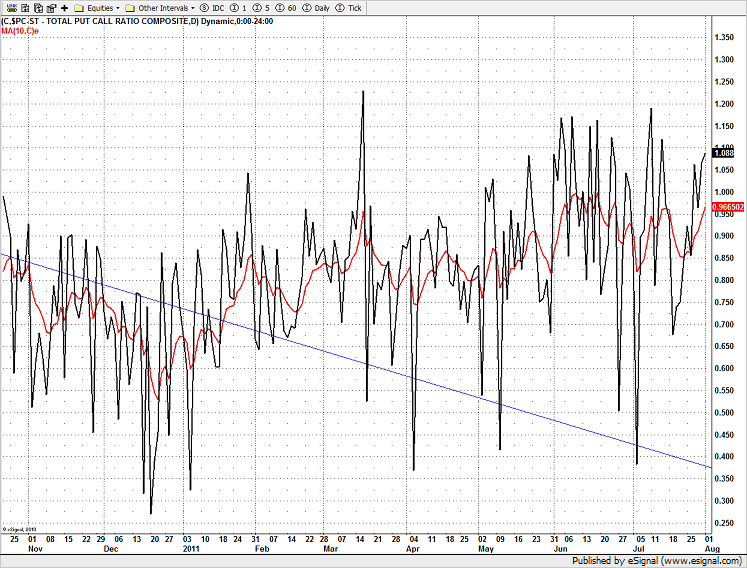

The put/call ratio is slightly elevated but below a climatic spike reading.

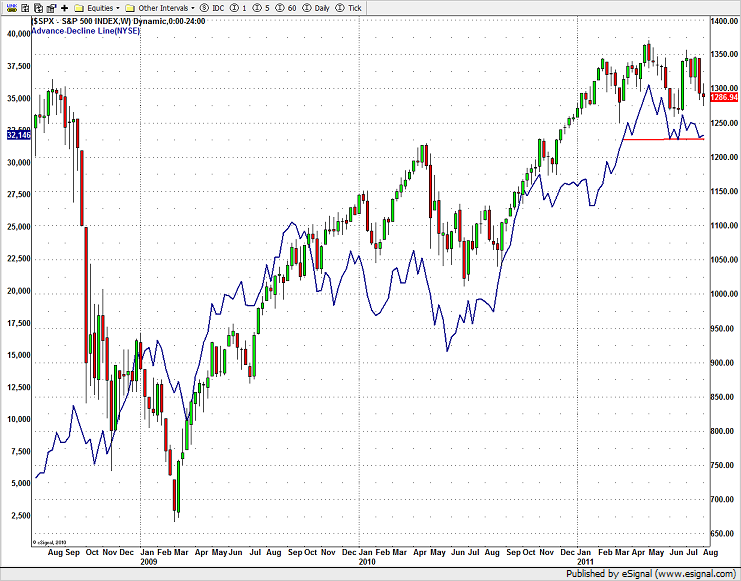

The NYSE cumulative A/D line is holding above key support. Keep in mind that this is a leading indicator.

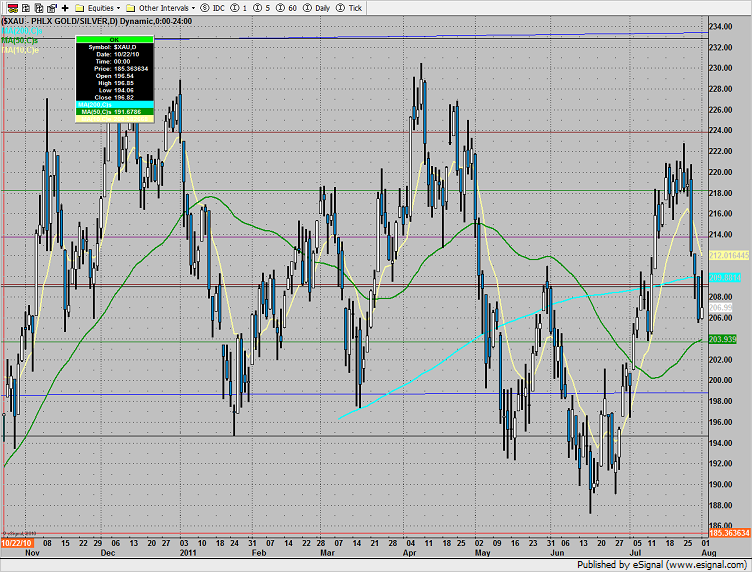

The XAU was top gun on the day and was the only positive major sector.

The SOX was relatively strong vs. both the Naz and the SP.

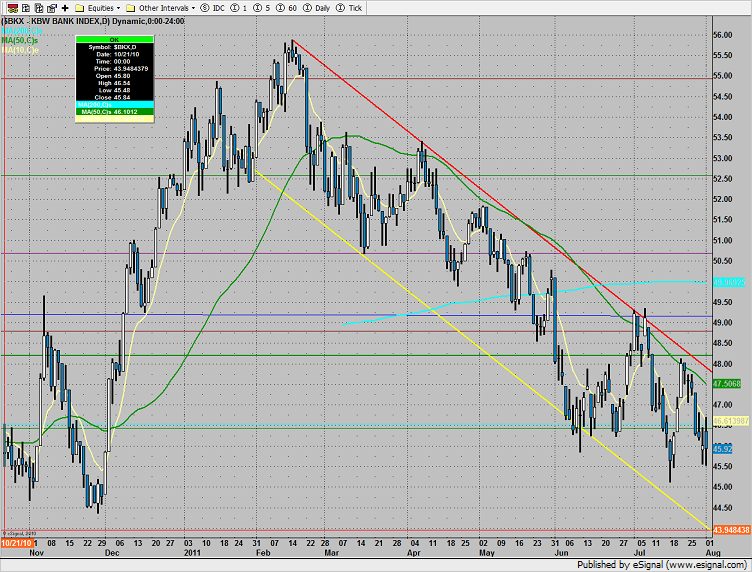

The BKX remains trapped in the down channel. There are no new technical features, price did not make a new low close on the move.

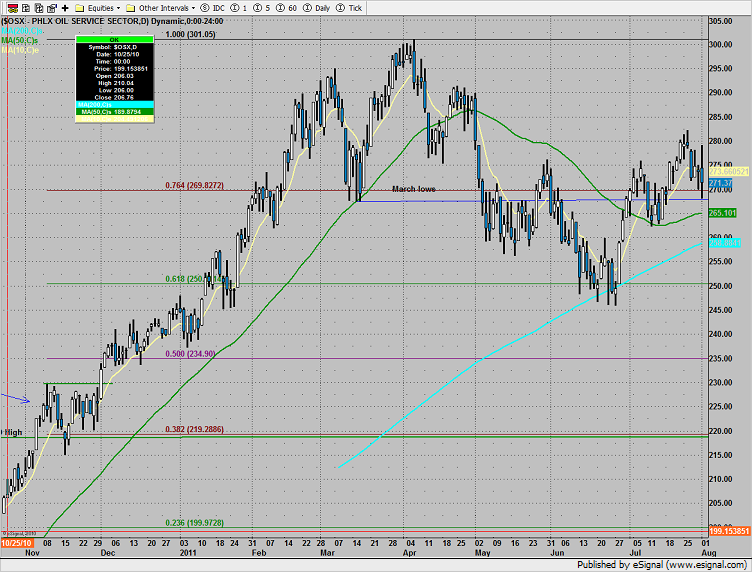

The OSX still has positive construction. Look to this sector for long ideas if the market pivots higher this week.

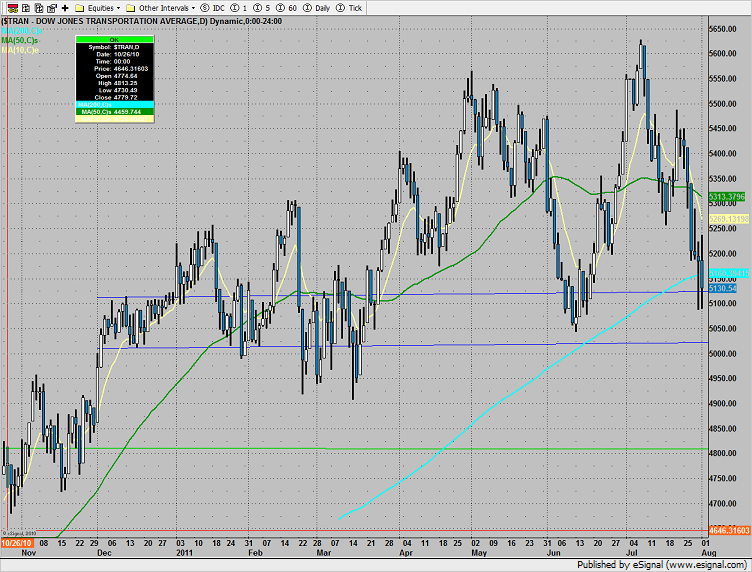

The transports closed below the 200dma for the first time this year. If the market is going to make a legitimate move higher, participation from this sector is important.

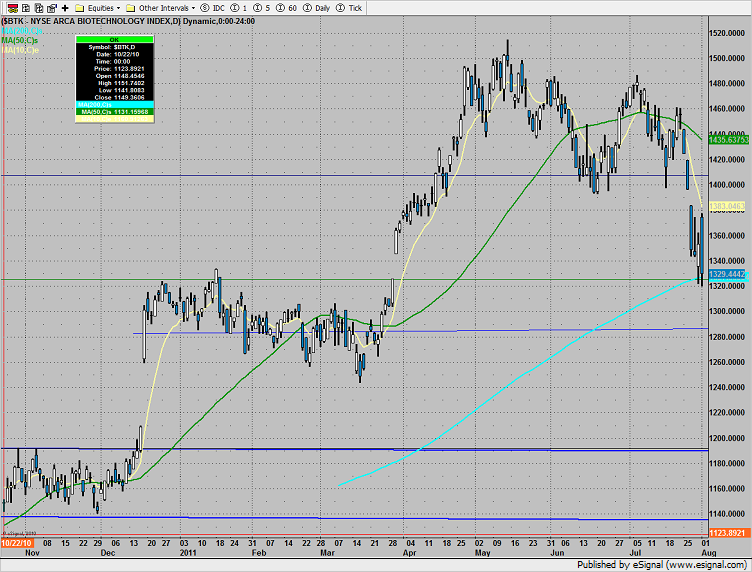

The BTK was last laggard. Very key support is at the 1320 level where the 200dma and 2010 highs converge.

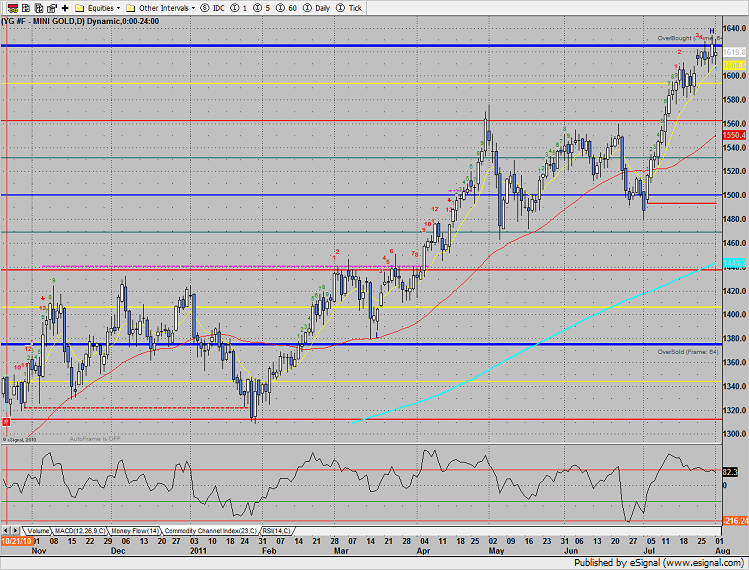

Gold is holding near the 8/8 Gann level:

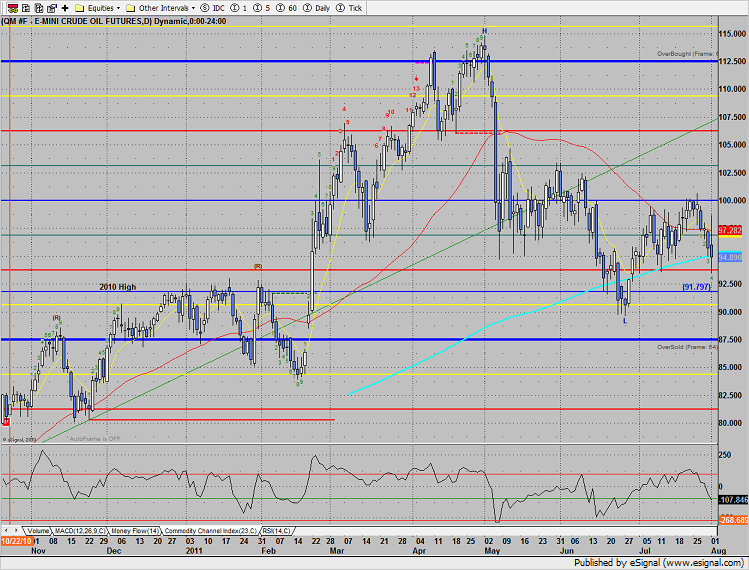

Oil settled right at the 200dma. If the May lows are considered a right shoulder and the June lows are a head, the futures could be tracing out a reverse head and shoulder formation.