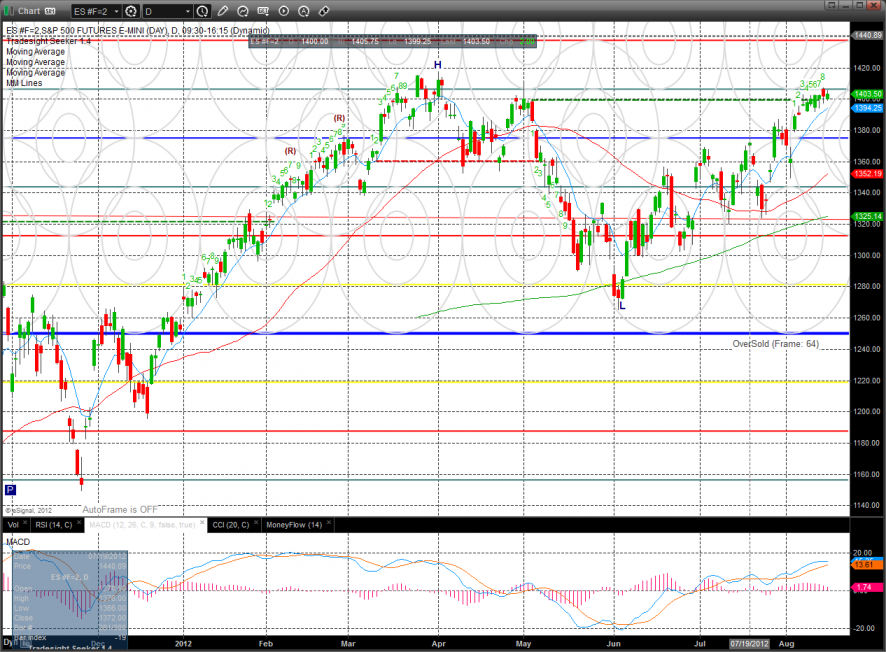

The ES was higher by 2 on the day and recorded 9 bars up in the Seeker count. Price remains lackluster and markets can fall of their own weight. There are no new technical developments but keep an eye on the MACD.

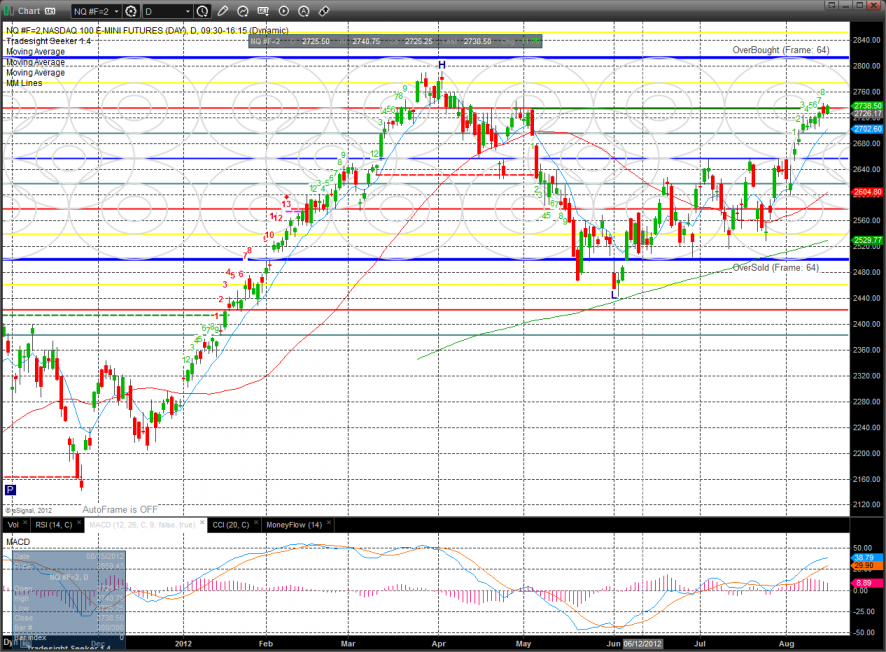

The NQ futures were relatively strong vs. the SP up 13 on the day. This is a new high close on the move and also completes the minimum Seeker 9 bar setup. Note that this chart has much more extension than the SP side which leaves more room for a retracement.

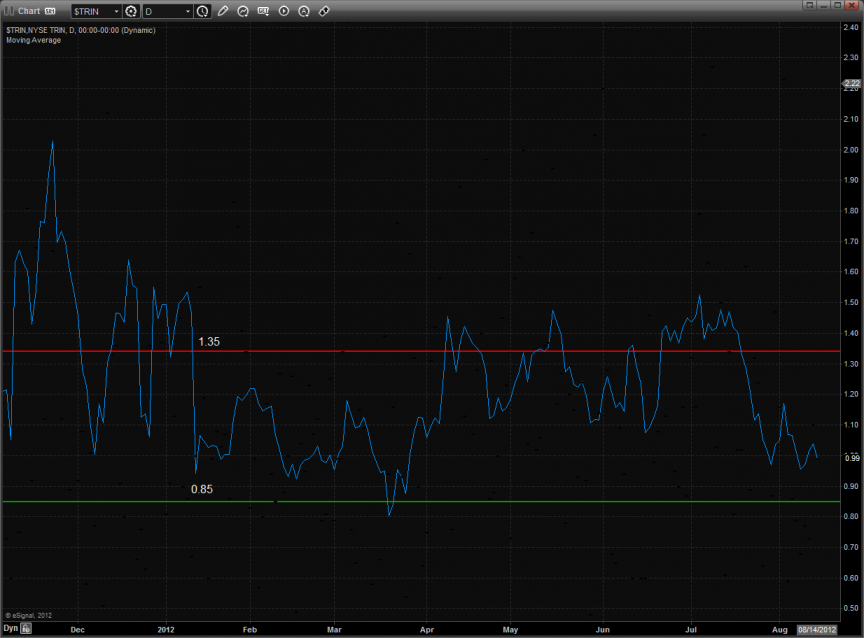

10-day Trin is still neutral:

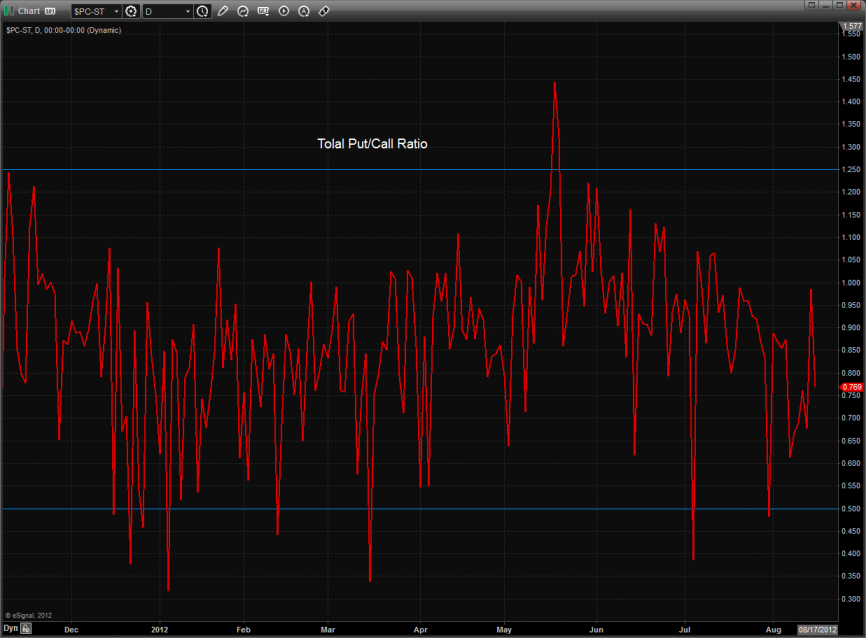

The put/call ratio is still in the comfort zone.

Multi sector daily chart:

The BTK was the top gun on the day by breaking above the recent range. The overhead open gap at 1487 is the next target then the 8/8 Murrey math level.

The SOX was strong but posted and inside day so nothing new technically.

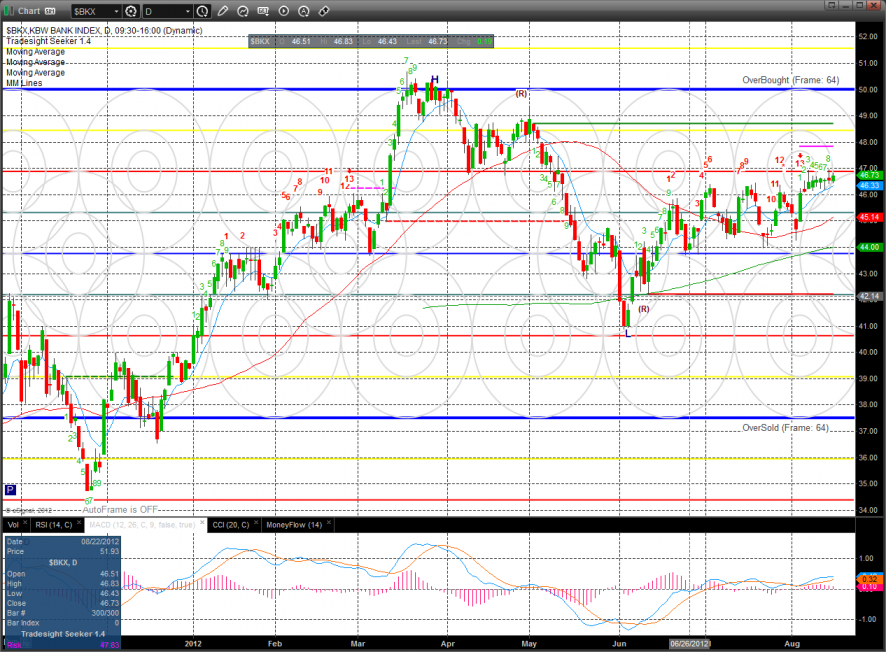

The BKX is still frustratingly stuck in the same range. This was a new high close if your eyes are good enough to spot it. The Seeker count is now 9 days up.

The XAU is still orphaned and was unchanged on the day. The potential higher low is still in place.

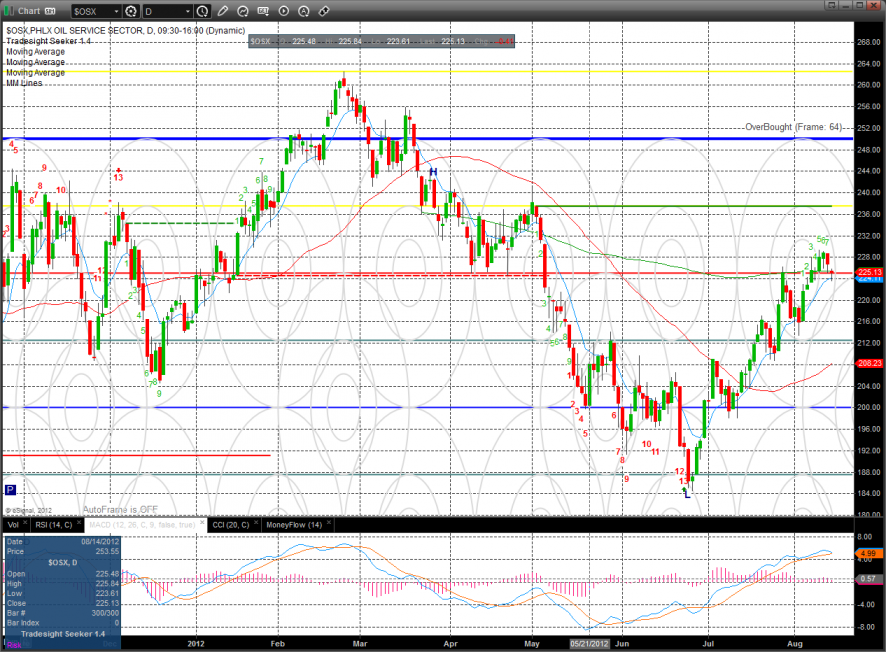

The OSX is stuck at the convergence of the 10ema and the 50sma. Price very subtly and bearishly closed below yesterday’s low.

Oil closed at a new high on the move and the 200dma is the next hurdle for the bulls.

Gold:

Silver:

The BKX continues to bearishly lag the broad market.

The NDX/SPX cross remains healthy with relative strength in the Naz side.