The ES was lower by one on the day but posted a range high distribution candle. This is 8 days up in the Seeker count so a disruption in trend should be expected in the next 48 hours.

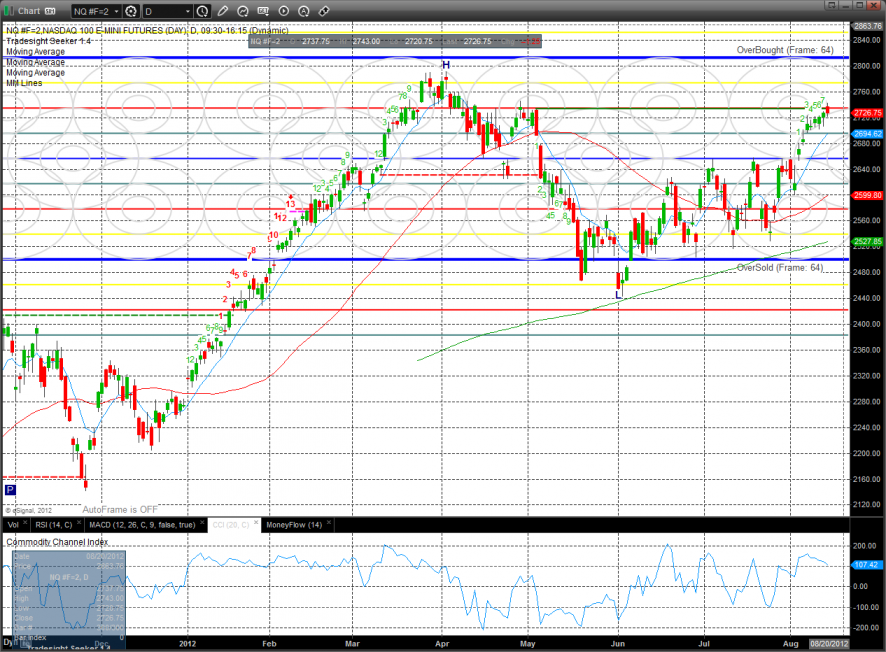

The NQ futures were stopped cold by the active static trend line and posted a bearish range high red candle. The first retracement objective will be the rising 10ema.

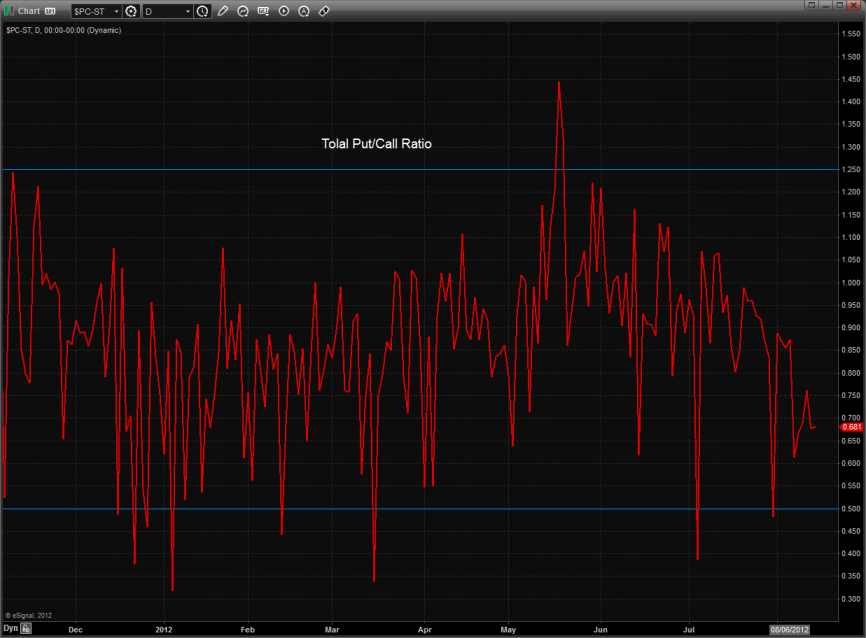

The total put/call ratio has as downward bias but hasn’t recorded a climatic reading yet.

10-day Trin:

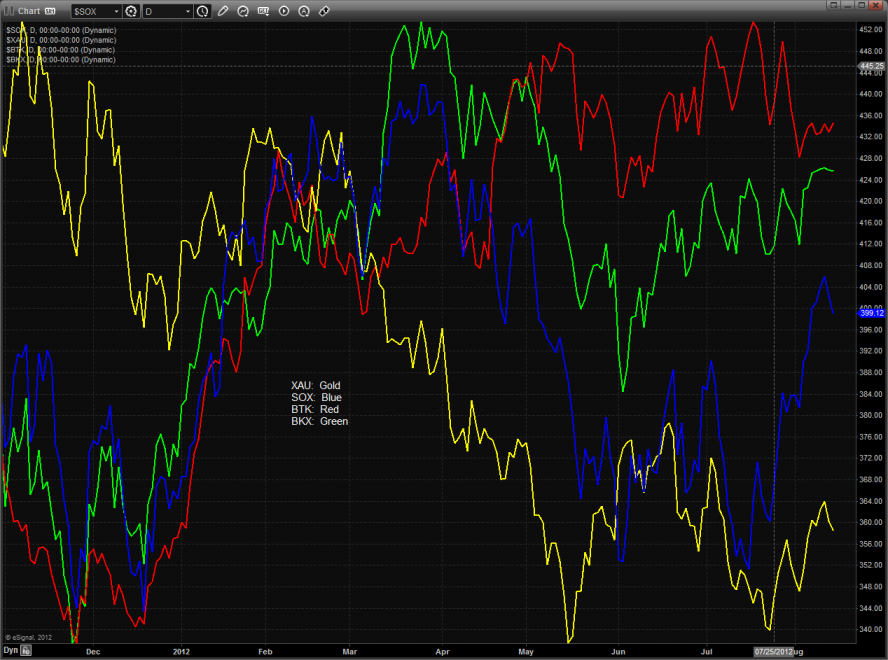

Multi sector daily chart:

The Dow/gold ratio is making slow progress but has yet to make a definitive break in favor of equities over hard the golden hard asset.

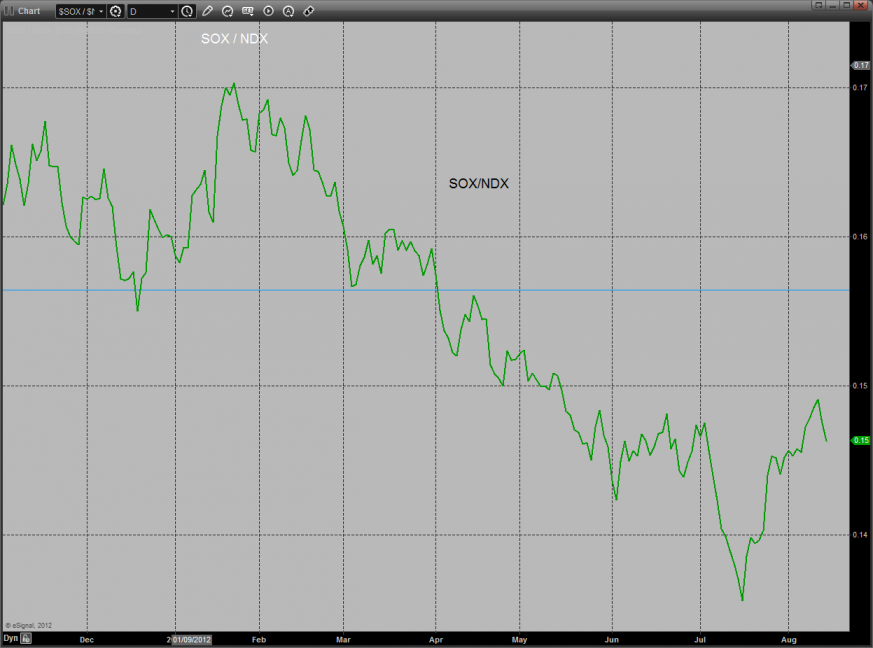

The SOX/NDX cross did not follow through on the breakout just yet.

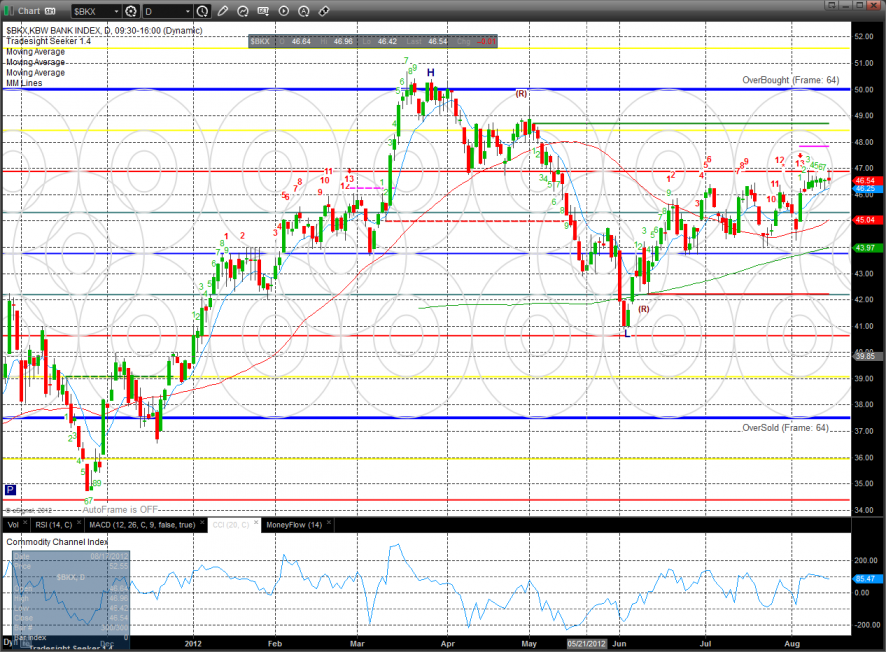

The BKX was flat on the day and hasn’t budged on a closing basis for days. When this range resolves, it should be very powerful.

The OSX was lower on the day and will turn short term negative if it loses the 10ema(blue).

The XAU is barely holding above the 10ema.

The SOX took a big hit and was much weaker than the Naz. The SOX usually leads the Naz and the Naz usually leads the SP.

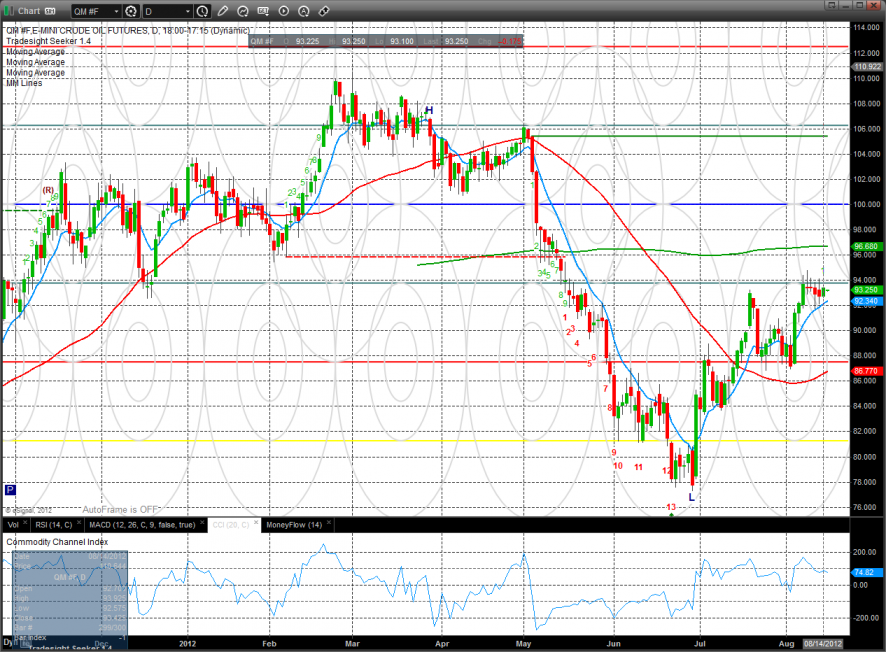

Oil:

Gold:

Silver:

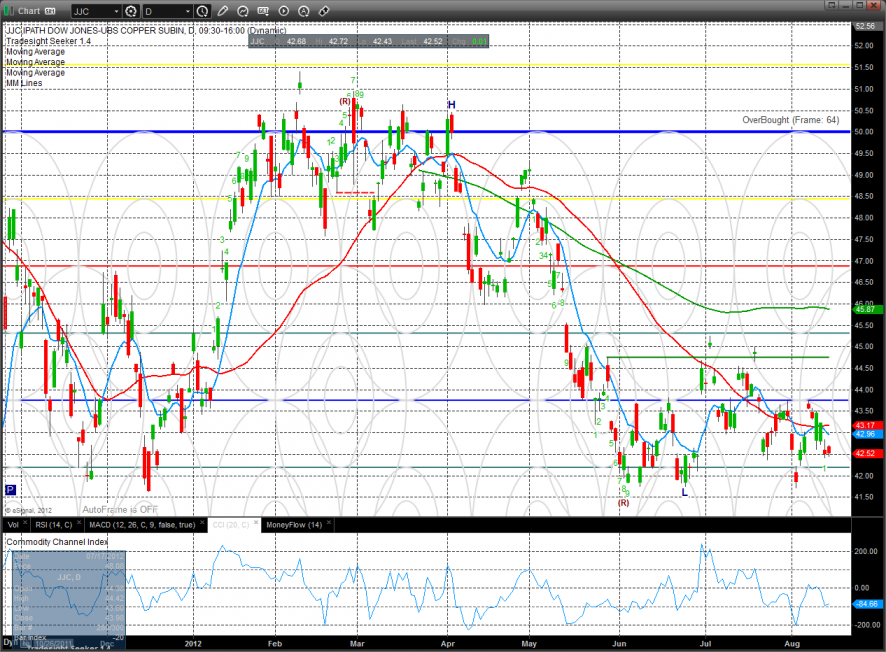

Copper: