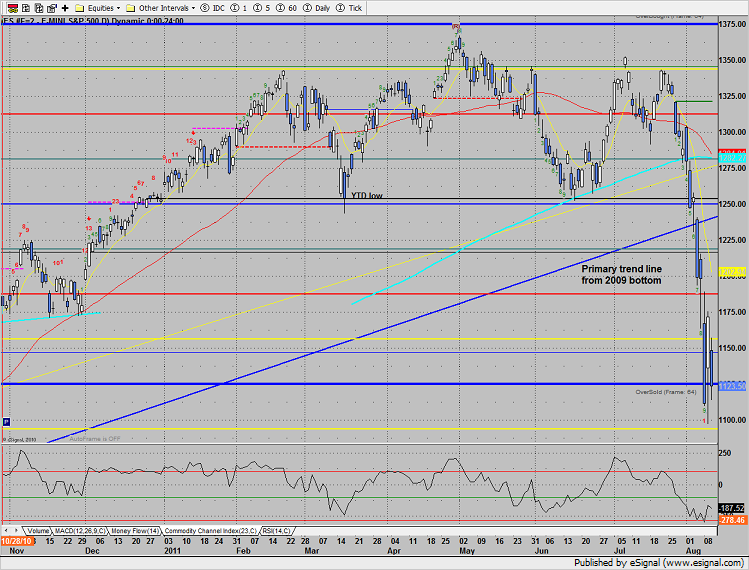

The SP lost 51 on the day but did some notable things in so doing. Price did not make a new low on the move nor did price make a new low close. This could be viewed as a retest or a wash out. Also, the overall pattern has completed a trend termination formation.

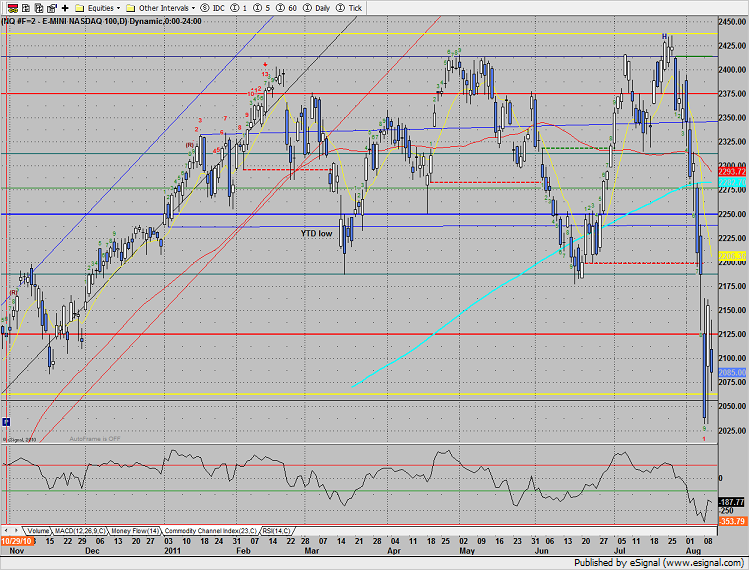

Naz lost 70 on the day and recorded an inside day. The resolution of the inside pattern should be explosive.

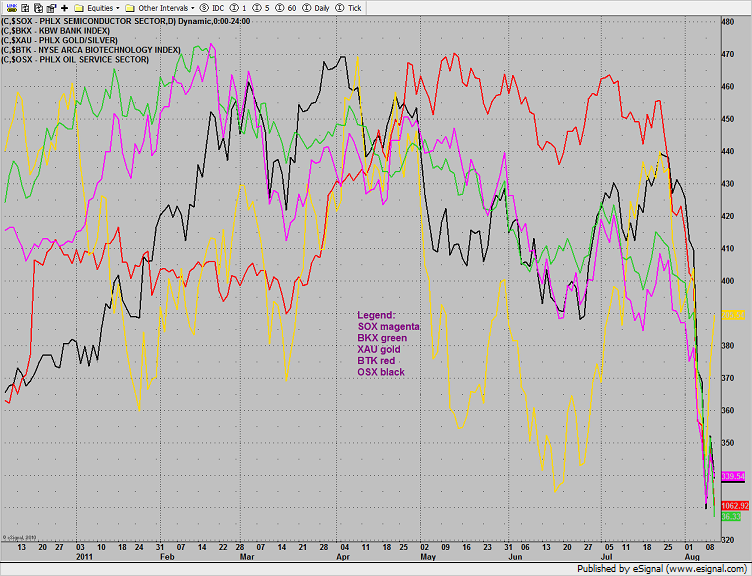

The multi sector daily chart shows weakness in the banks and strength in the gold miners.

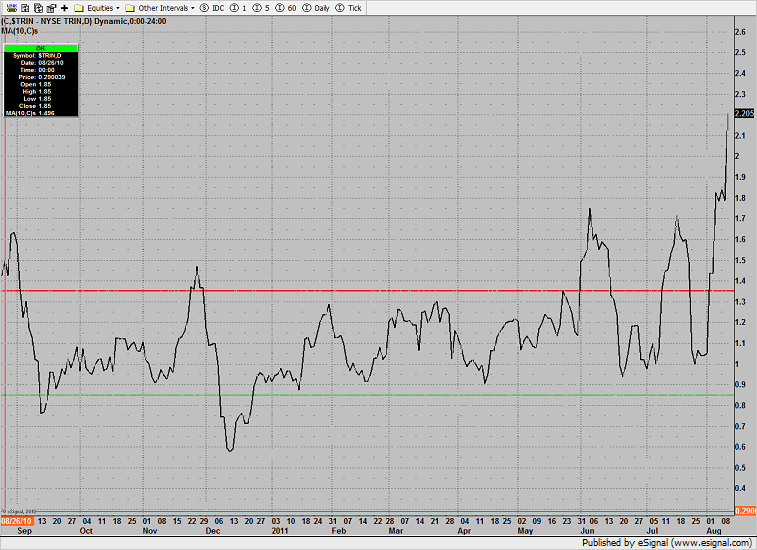

The NYSE Trin closed the day over 5 which elevated the 10-day Trin to 2.20 which is screaming oversold and loaded with potential upside energy.

The Dow/gold ratio broke below 6 for the first time of the bear market.

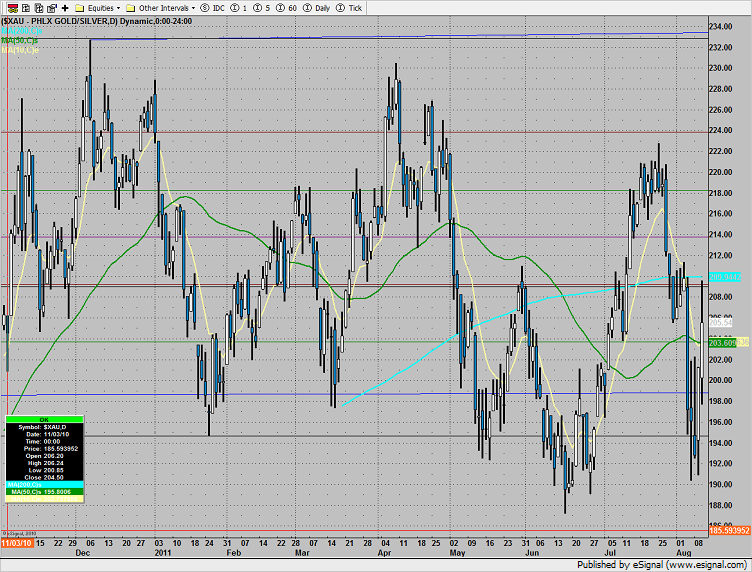

The XAU was top gun and the only sector up on the day.

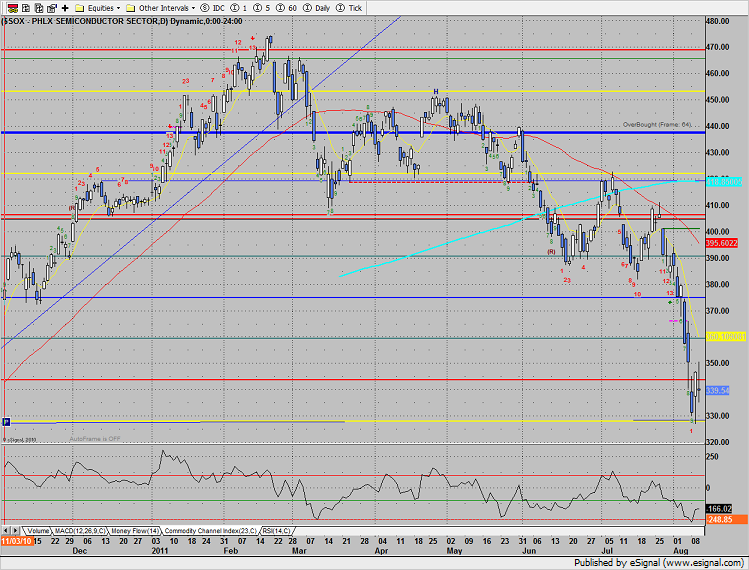

SOX was down less than half as much as the SP and the Naz showing relative strength.

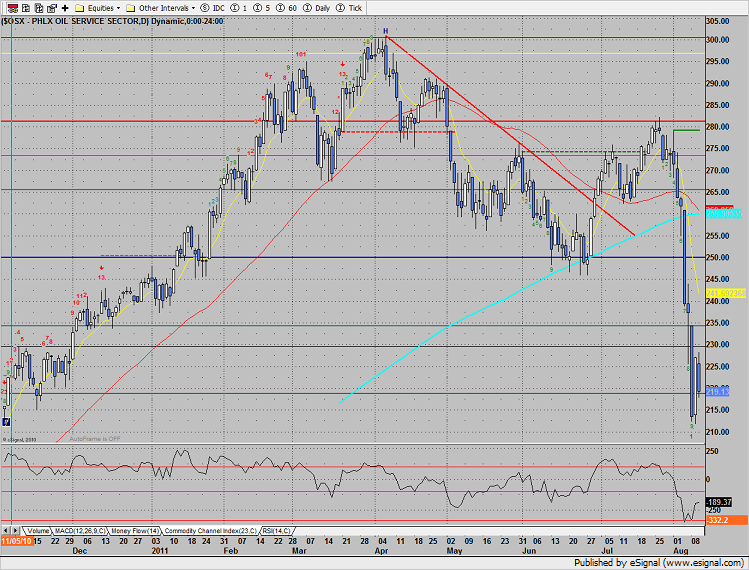

The OSX also slightly outperformed the market.

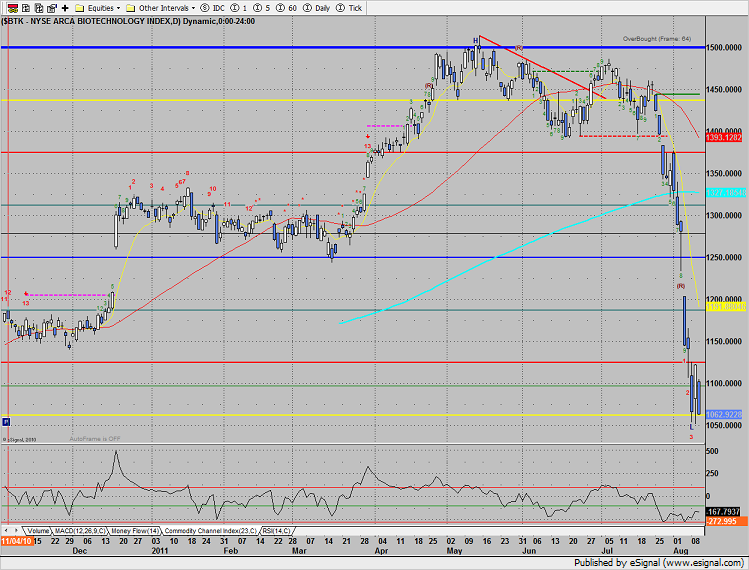

The BTK made a new low close in the move but like many of the major indexes has a trend termination formation in place.

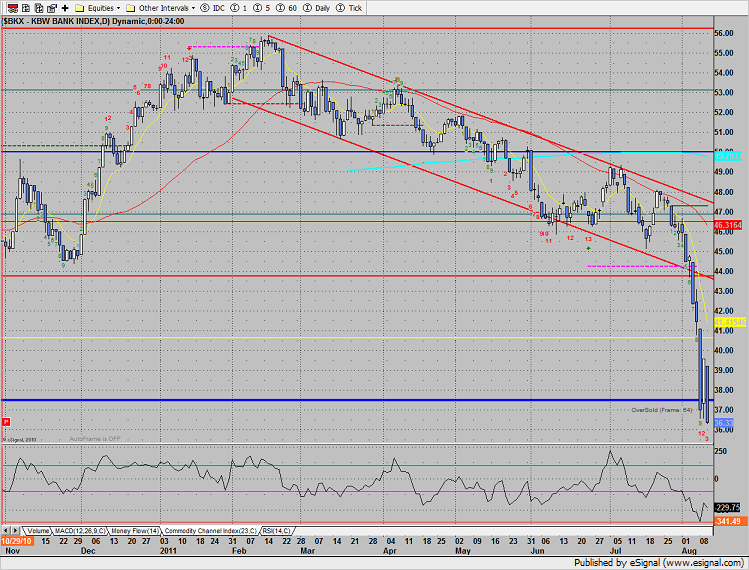

The BKX was the last laggard, making a new low on the move.

Oil was relatively strong:

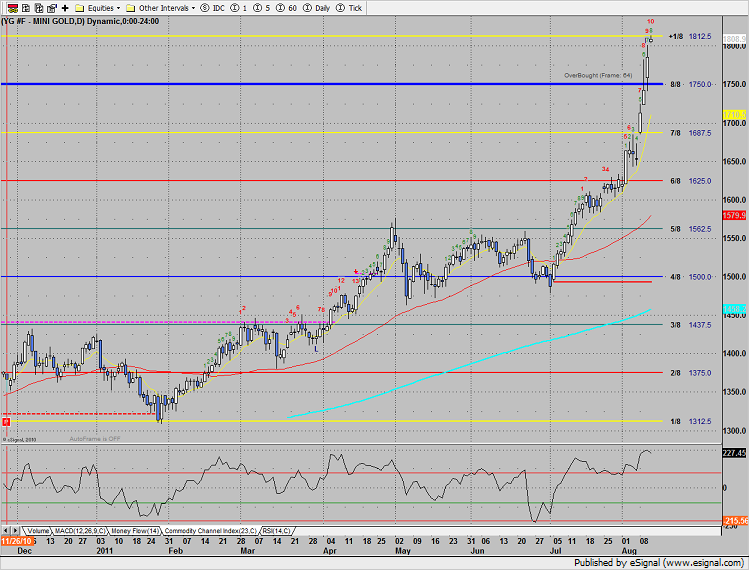

Gold made a new high touching 1800 into over bought territory in the Gann box.