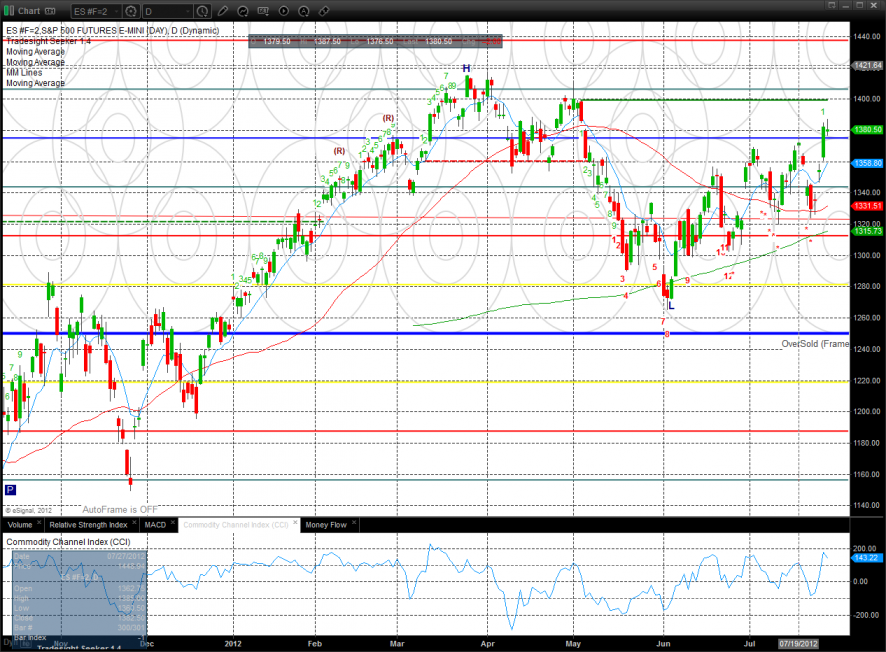

The ES lost 2 on the day posting a range high doji. Tradesight subscribers and Twitter followers got an early indication today that the VIX was signaling that there would be no net advance in the ES today. Since both the ES and the VIX were higher on the day there was a divergence between the two that never lasts a whole trading session. The VIX being more institutional in nature always wins the battle. Since the VIX was not supporting the higher prices in the futures they were doomed to fail. Tradesight subscribers benefitted from the Analysts’ short calls.

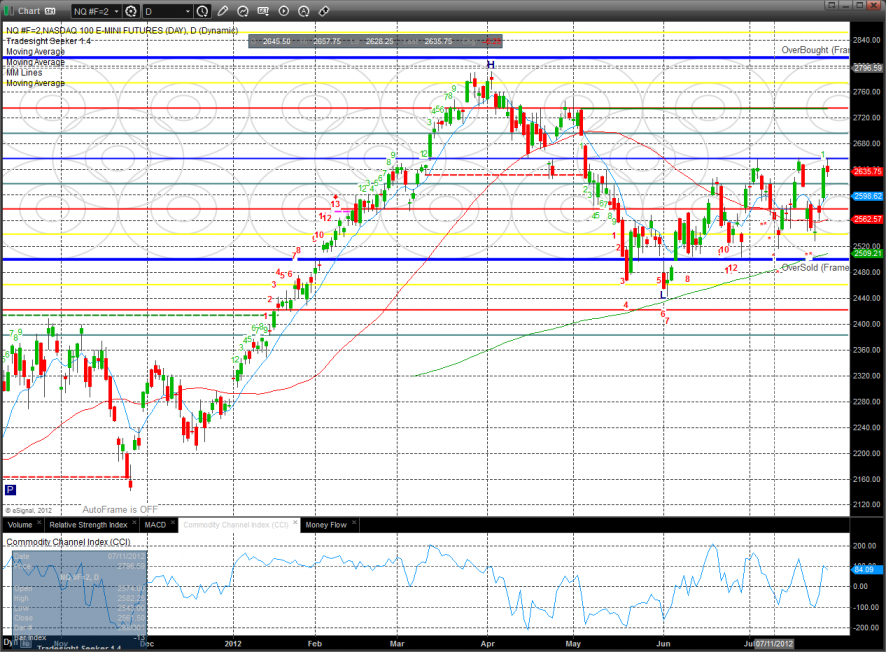

The NQ also posted a doji day and remains at the upper boundary of the positive trend channel.

The 10-day Trin is approaching the overbought level of 0.85 or lower. Close but no signal yet.

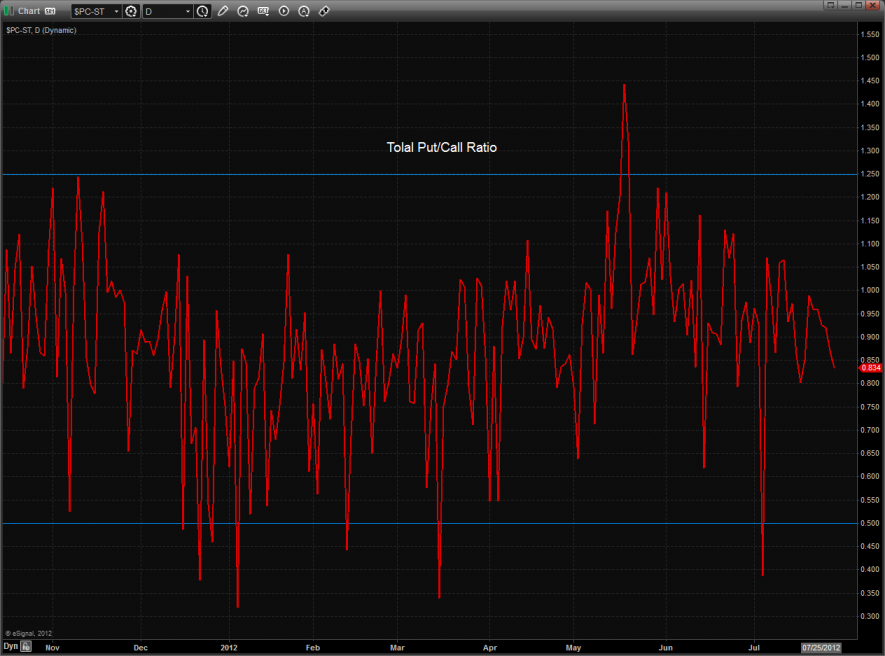

The total put/call ratio remains neutral.

Multi sector daily chart:

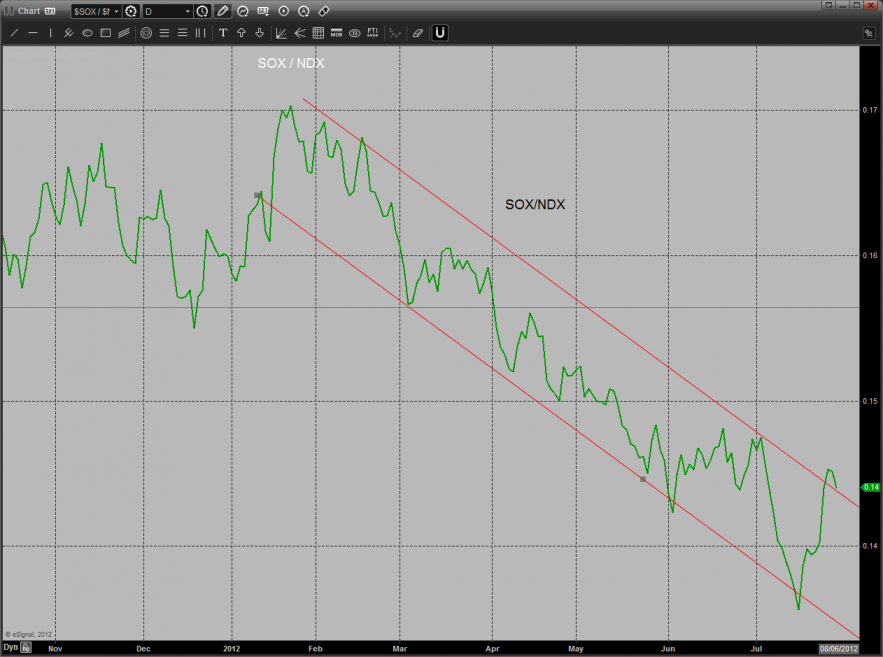

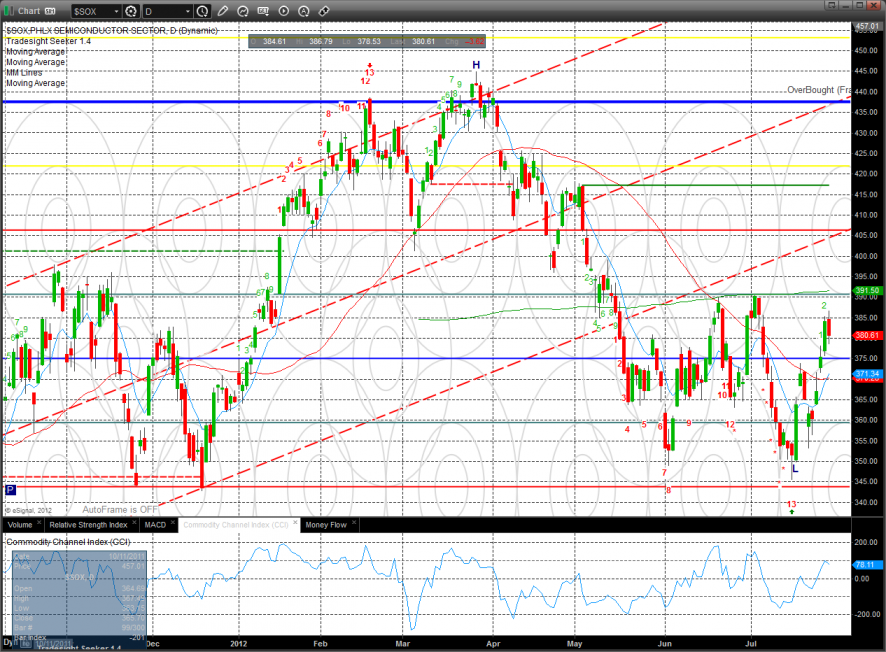

The SOX/NDX ratio is close to reversing but has not yet buttered the biscut.

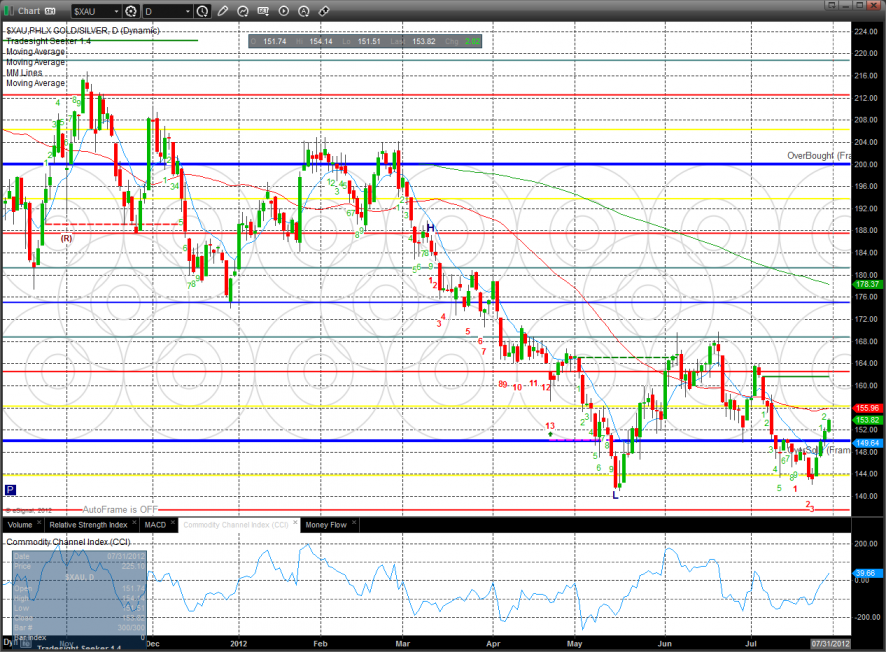

The defensive XAU was top gun on the day, still attempting to put in a double bottom on the daily chart.

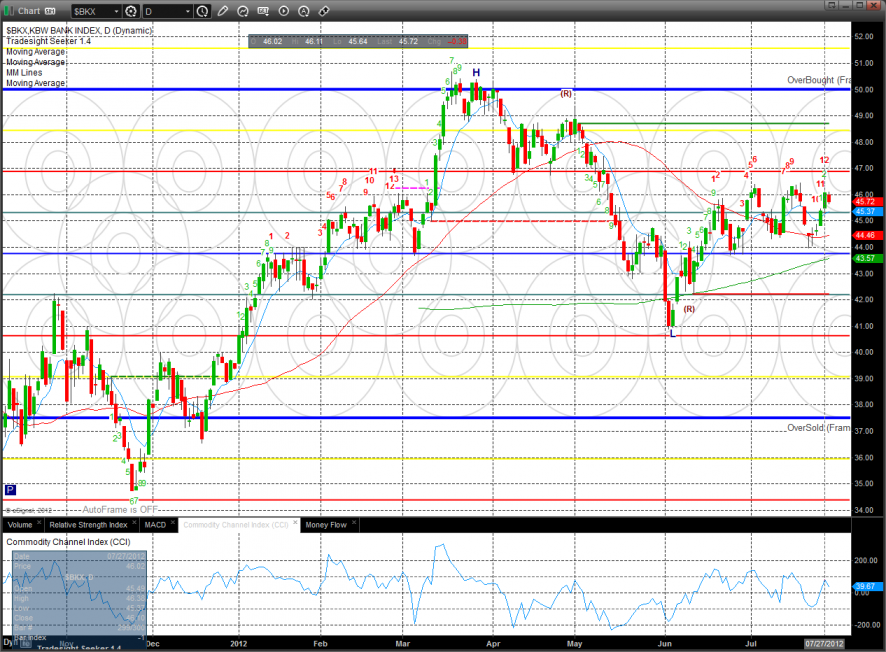

The BKX is now 12 days up and has a Seeker sell signal on deck,

The SOX still needs to clear 390 to break out of the recent range and turn the trend positive in all time frames.

The OSX was a poor performer still not able to break above the 200dma. The next price objective will be the measured move target off the reverse H&S reversal.

Oil:

Gold:

Silver