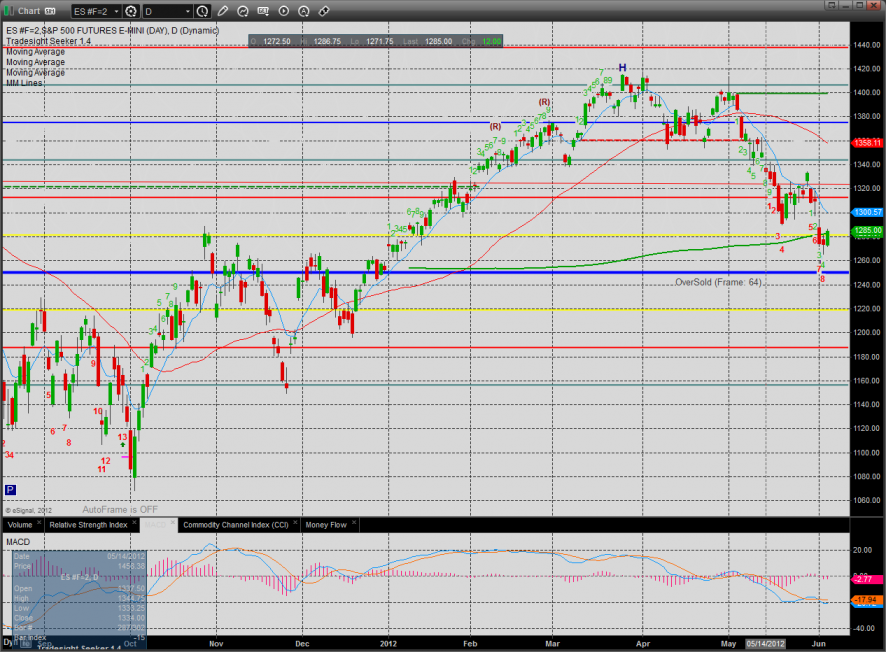

The ES was higher on the day gaining 12 handles. Price has come back to interact with the key 200dma which continues to be a draw. The next important area overhead will be the 10ema and the May lows which area approximately the same.

The NQ futures gained 20 on the day and are wedged between 2 of our moving averages. If price continues to wind up in this area it should have a powerful exit.

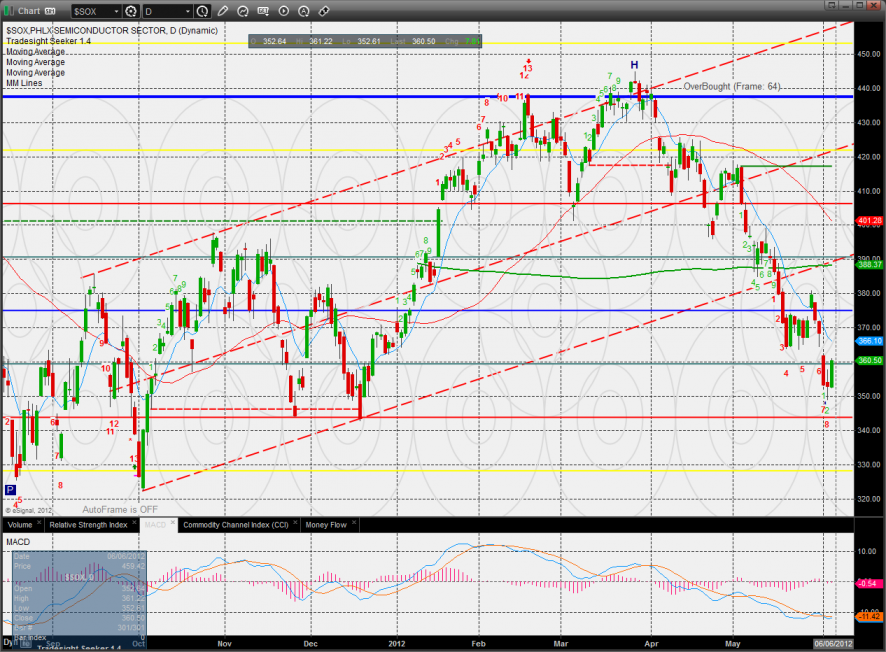

The SOX is tracing out reversal like action. Getting back above 365 would be the first indication that the bulls have changed the direction of the chart. The bias remains down until the 10ema is reclaimed.

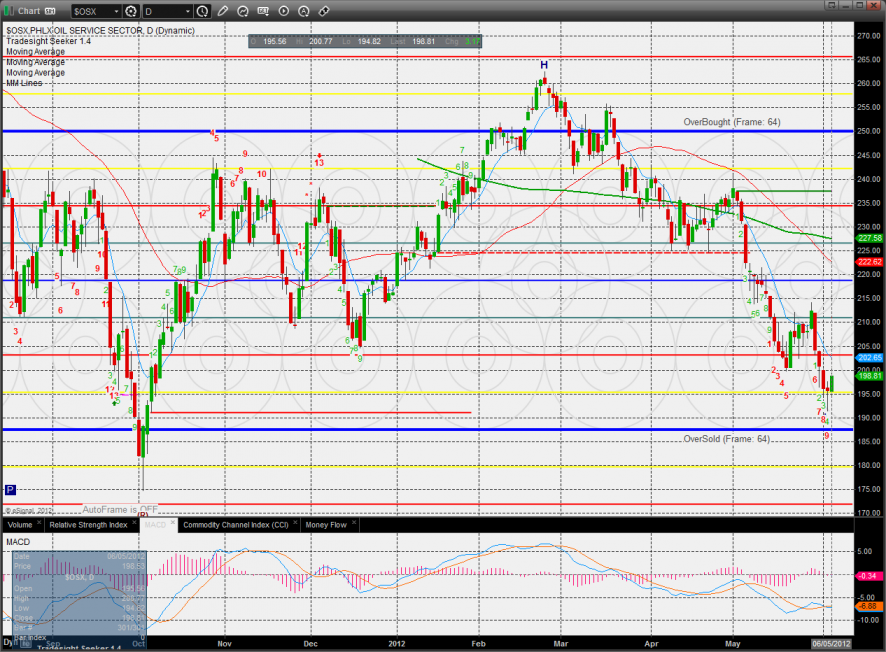

The OSX was stronger than the overall market and is still bearish but above key support at the 0/8 level.

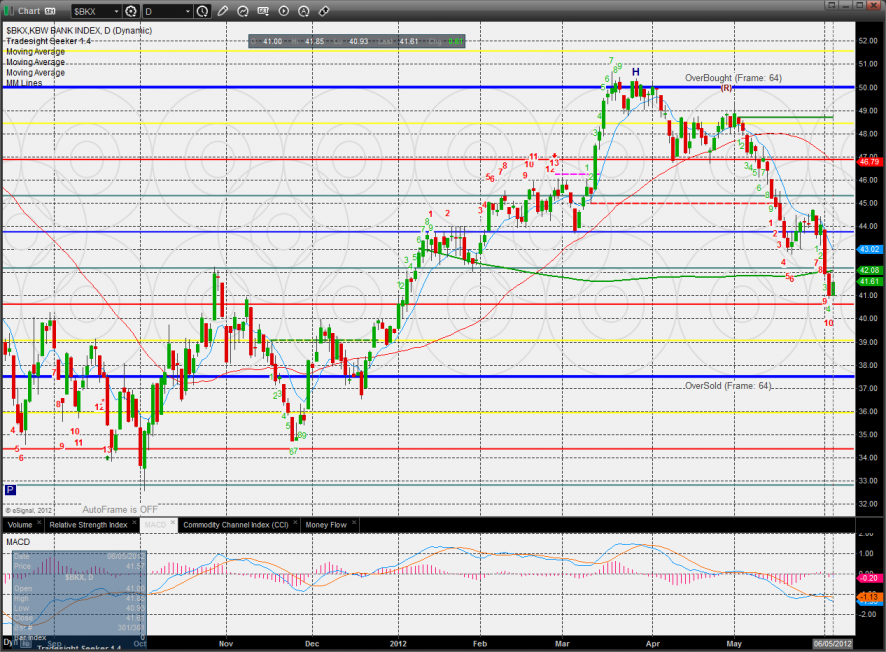

The BKX posted an inside day down is still fairly close to a completing a Seeker buy countdown.

The BTK bounced but is still below the prior breakout level and active static trend line.

The XAU is grinding below the active static trend line and looks ready to go. Price is now back above the 10 and 50dmas. This is the one chart that looks ready to continue.

10-day Tin:

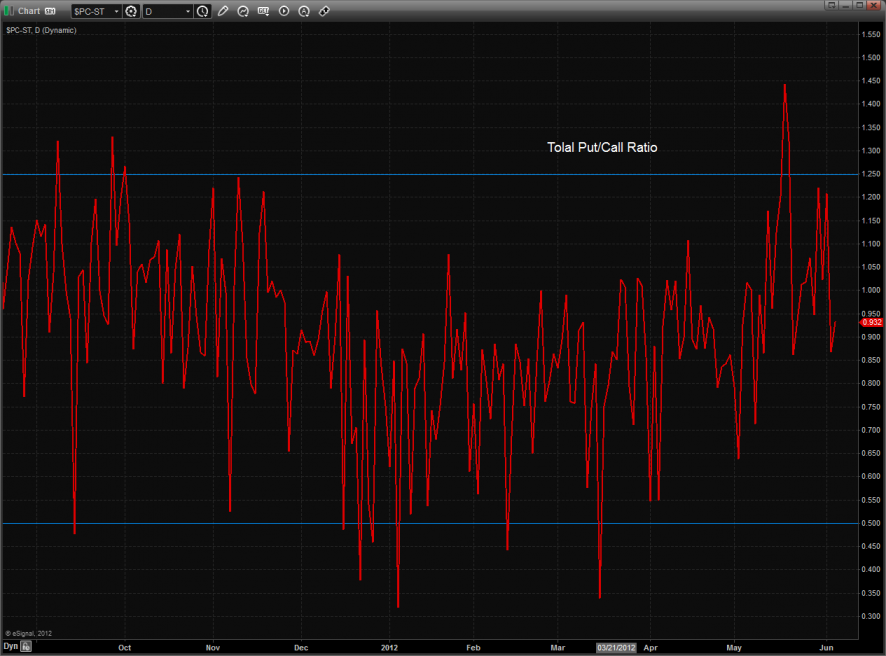

Total put/call ratio:

Multi sector daily chart:

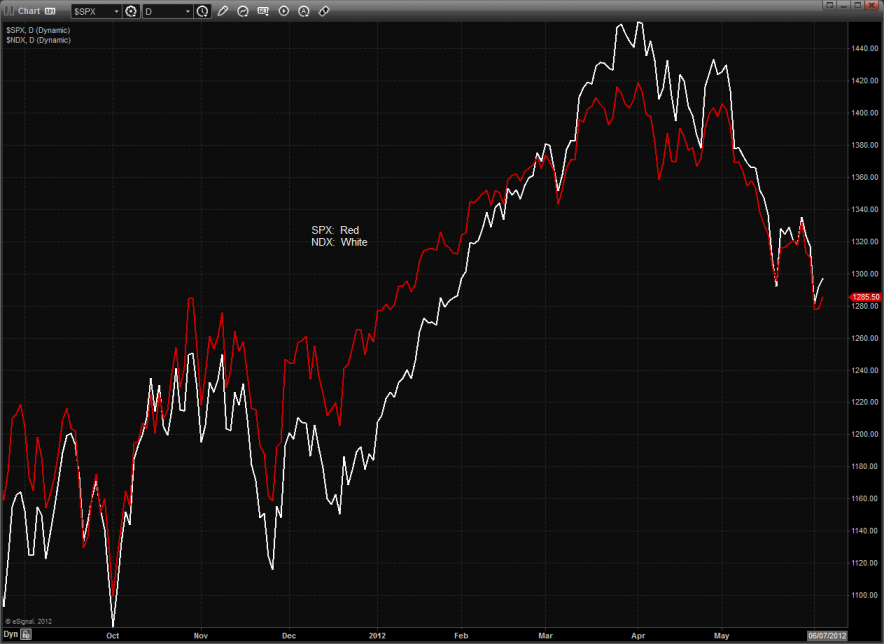

The NDX continues to bullishly keep some relative strength vs. the SPX.

Oil:

Gold:

Silver: