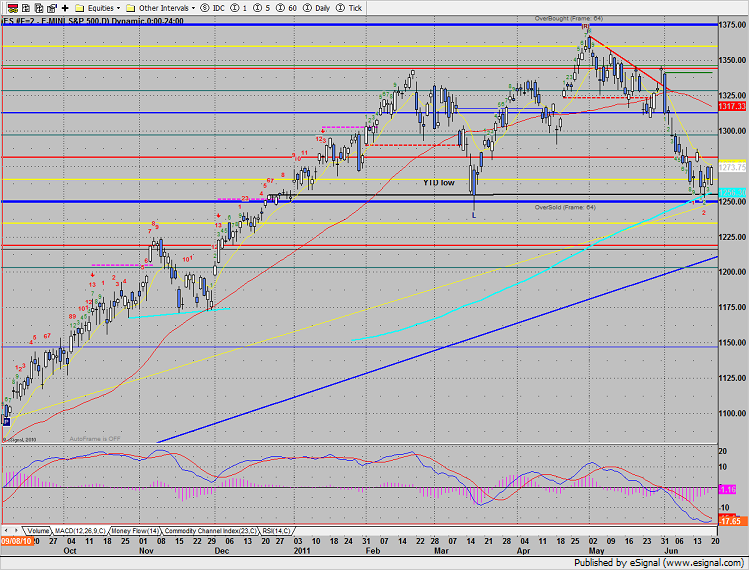

The SP gained 7 handles on the day settling at Friday’s high and the 10ema. A follow through tomorrow above both these levels would turn the chart short-term positive. Key support remains just below at the 200dma and Gann 0/8 level.

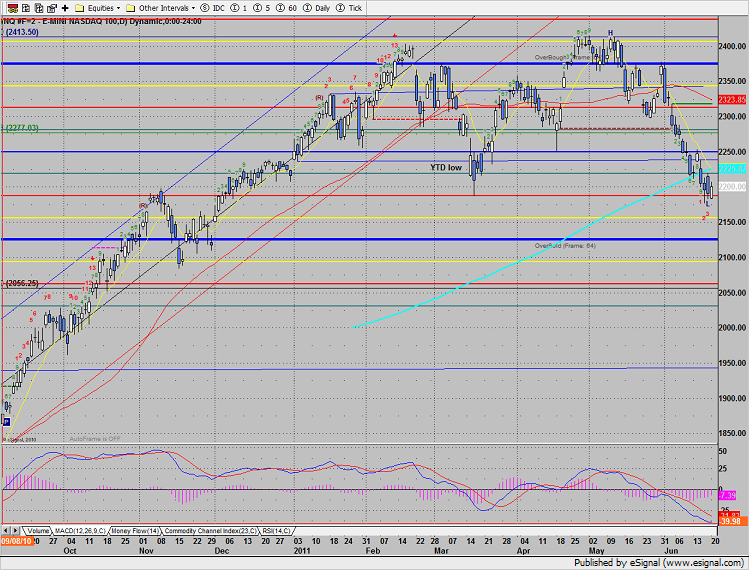

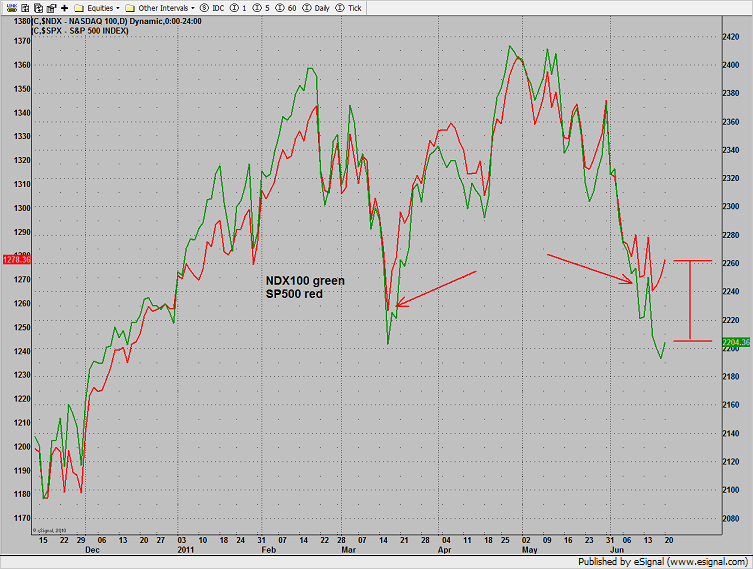

Naz was higher by 9 on the day but only managed to get back to the midpoint of Friday’s range. The trend remains down until the 200dma and the 10ema are reclaimed by the bulls. Note that for only the second time in the month of June price settled decently above the open. This could be something for the bull to build on.

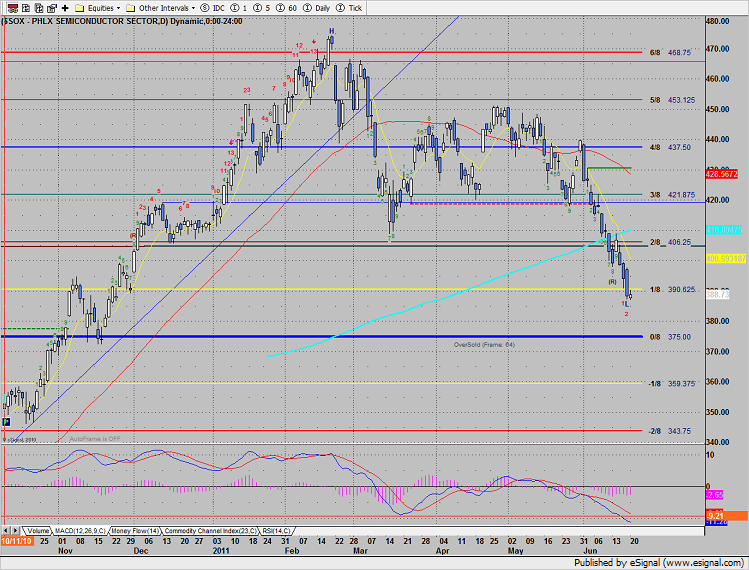

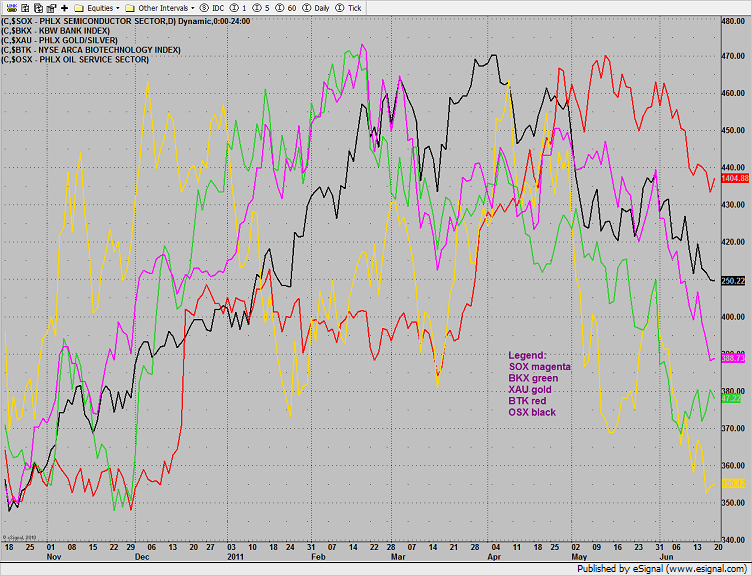

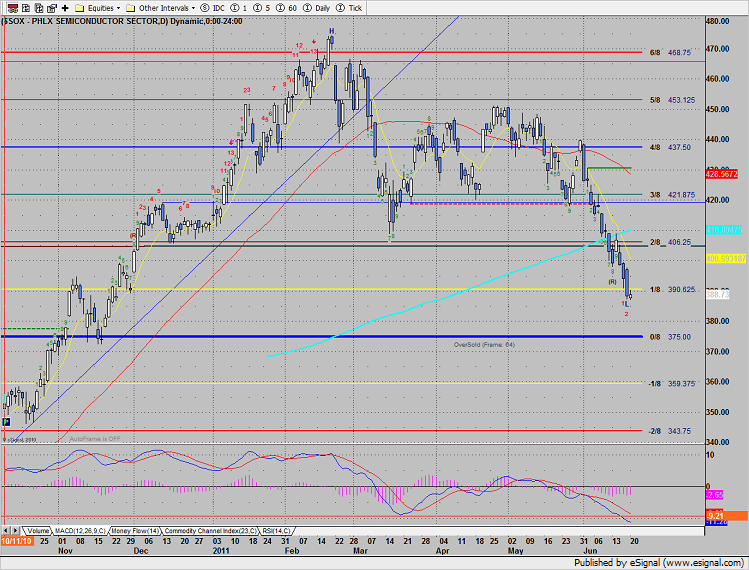

The market leading SOX continues to underperform the NDX which is a classic bearish divergence.

Since the above condition exists it should be no surprise that the NDX is underperforming the SPX. While the Naz side broke below the March low the broad market side has not. If the NDX continues to underperform, probability suggests that the SPX will breakdown below the March low.

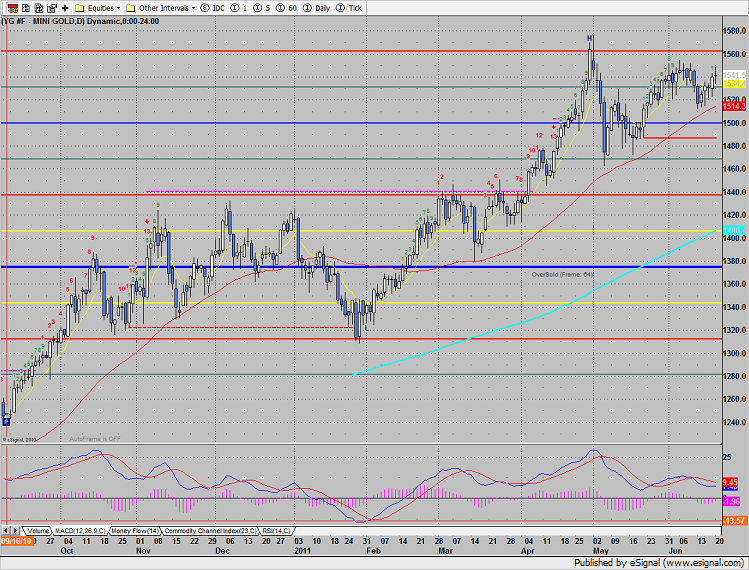

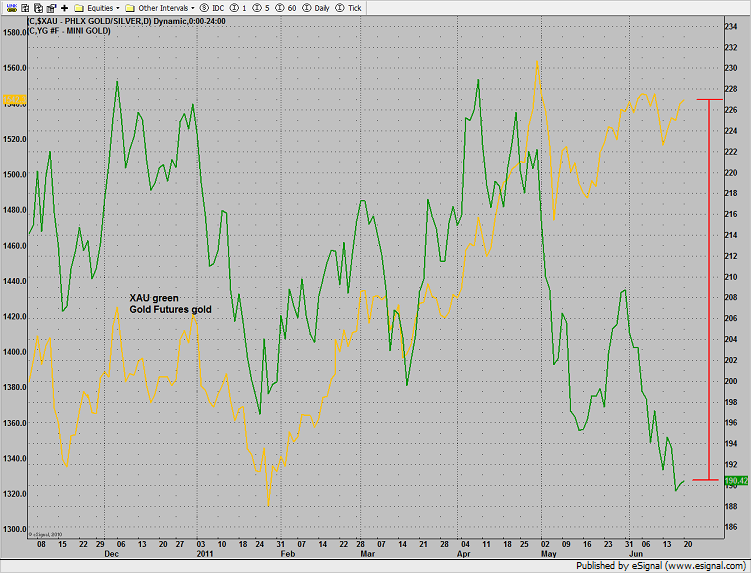

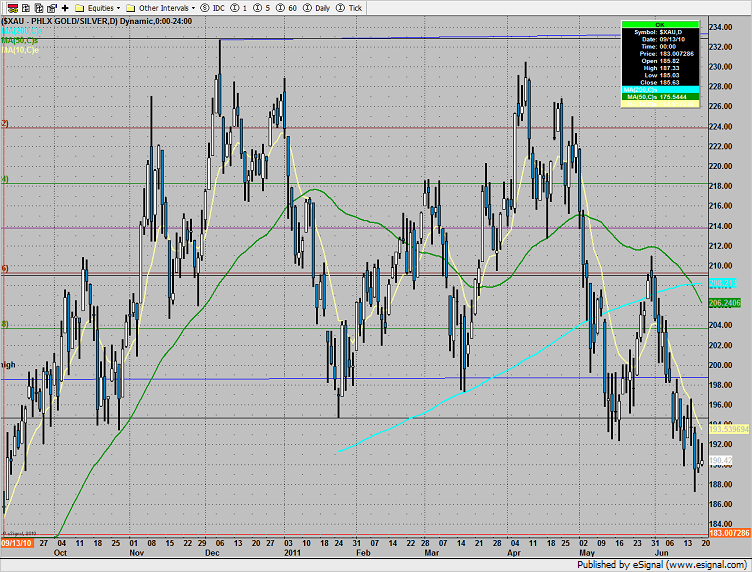

There continues to be a huge divergence between the gold futures and underlying XAU gold mining stocks. This is bearish for gold futures.

Multi sector daily chart:

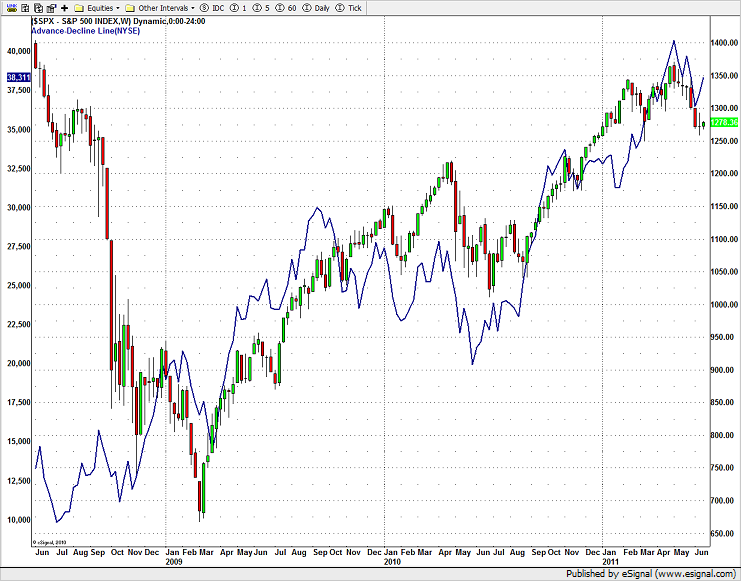

The NYSE cumulative A/D line showed good strength last week. This is very positive for the market and suggests that the current correction is a buying opportunity.

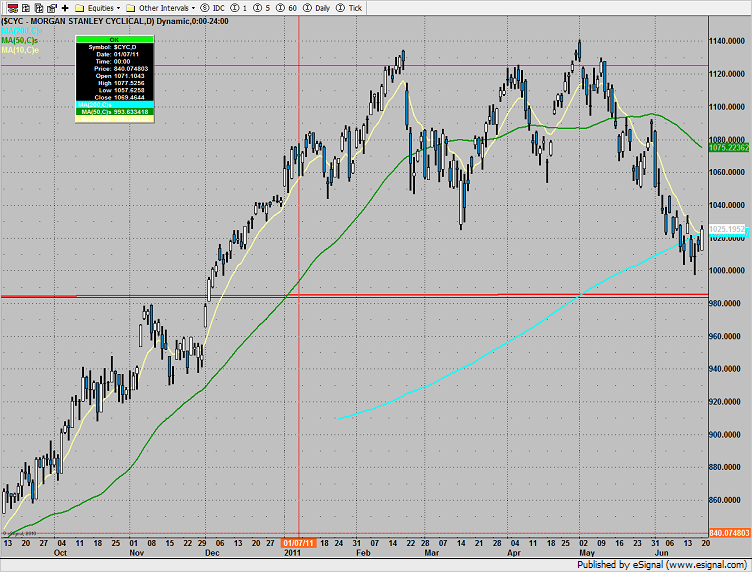

The leading cyclical index was the top gun on the day, breaking back above the 10 and 200 moving averages.

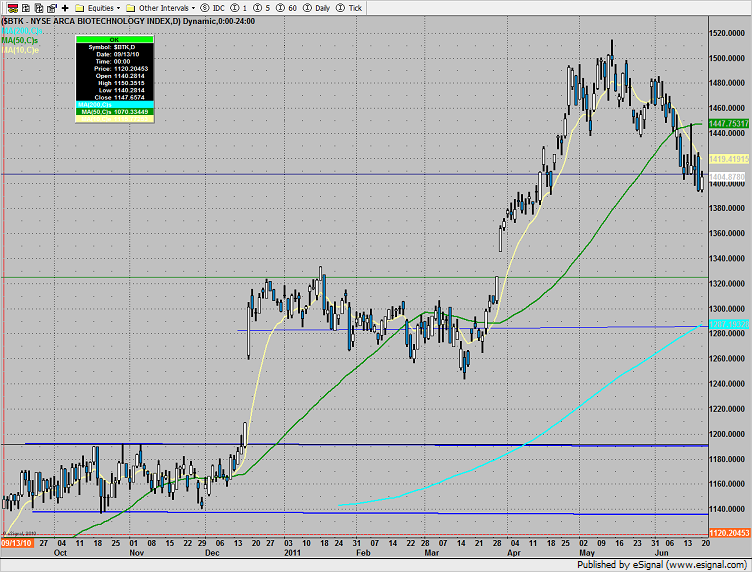

The BTK was higher by 10 on the day.

The XAU traded inside and left a tall tail on the chart.

The SOX underperformed both the Naz and SP Monday and could be a resting day before more range expansion.

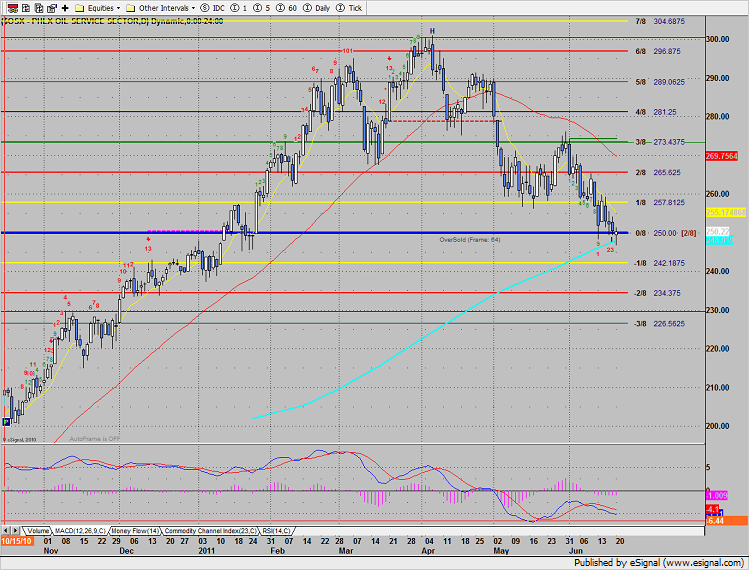

The OSX was red on the day. Key support is at the 200dma and Gann 0/8 level.

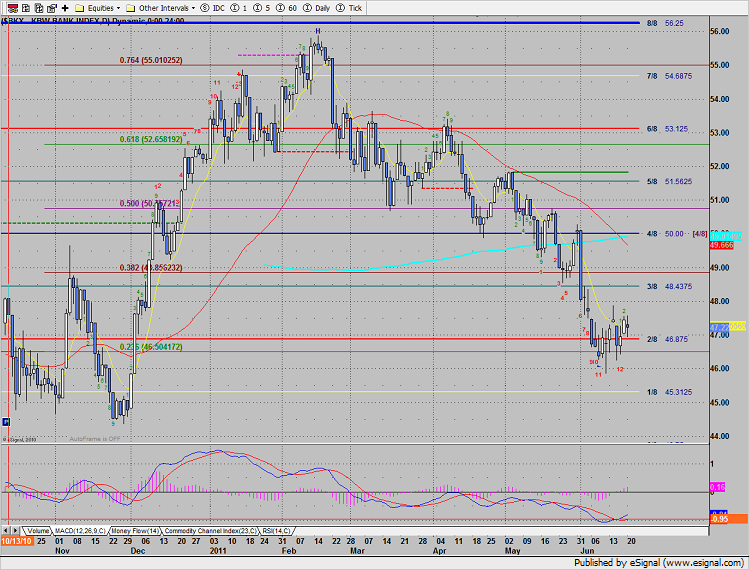

The BKX was the weakest sector on the day. Note that the Seeker is only one candle shy of a 13 exhaustion buy signal and also that the MACD has crossed over.

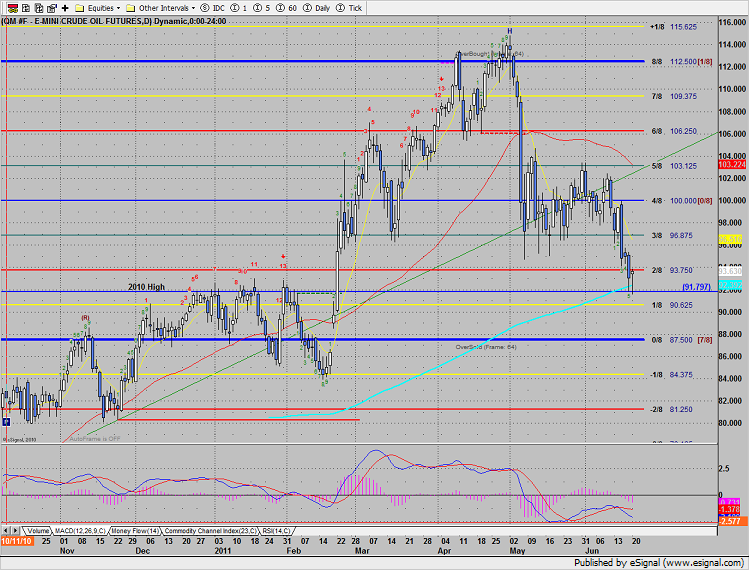

Oil bounced off key support:

Gold: