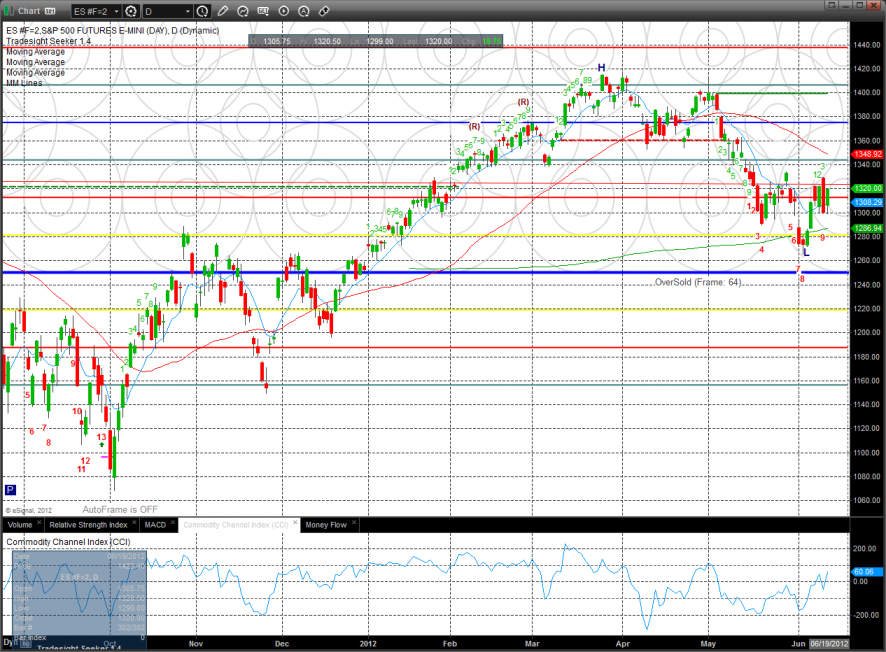

The ES was higher by 19 on the day trading inside the prior day’s large range. This means that there is nothing new technically. This marks the fourth day that price has been consolidating.

The NQ futures were higher by 35 on the cay but are still in a relative range just like the SP side. As you can see so far the futures offered below the 0/8 level has been gobbled up by the bulls.

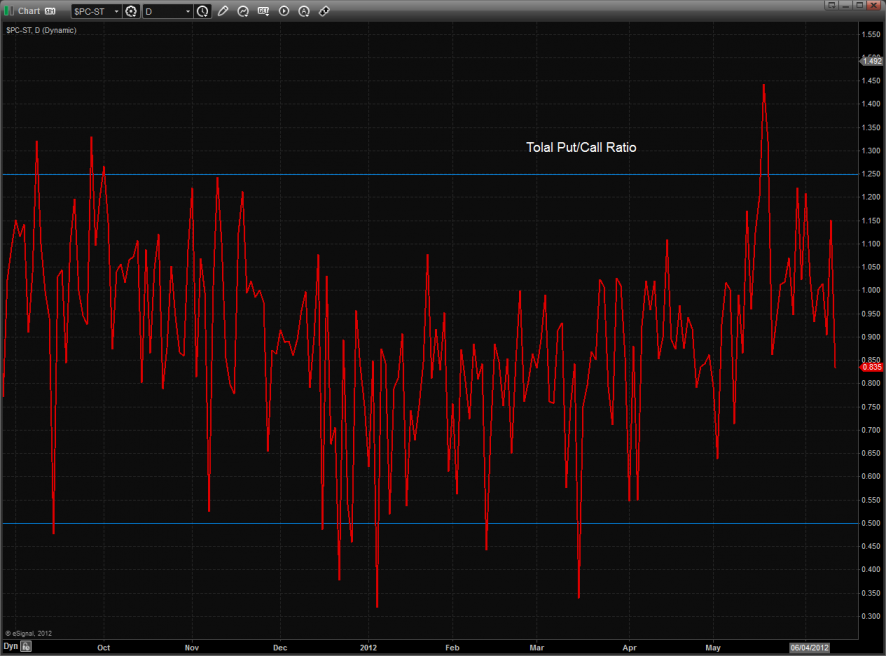

The total put/call ratio is neutral:

Multi sector daily chart:

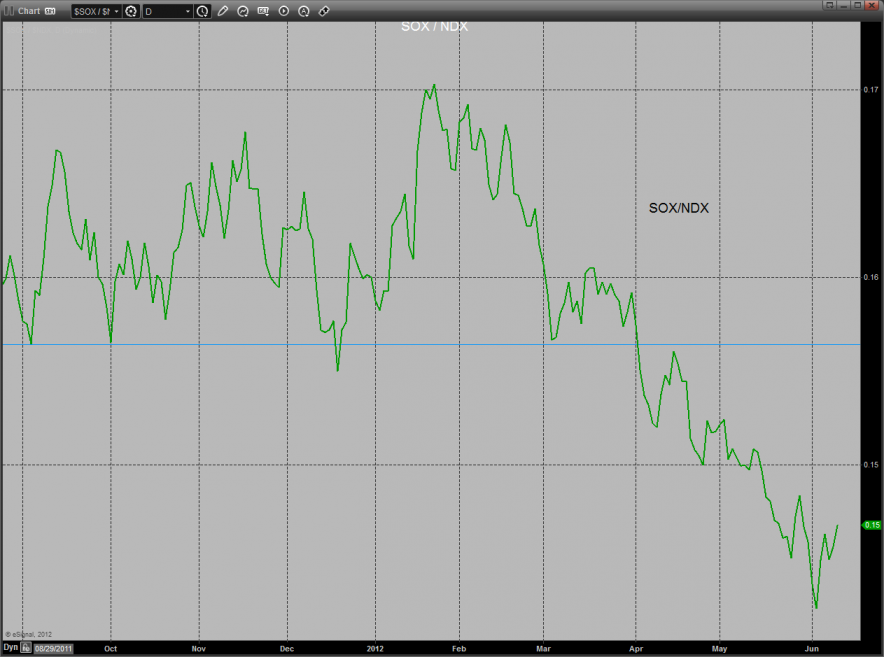

The SOX/NDX cross is setup to make a turn but needs to do some more work to turn bullish.

The Dow/gold ratio has yet to make a bullish breakout in favor of stocks over equities.

The NDX was bearishly weaker than the broader SPX:

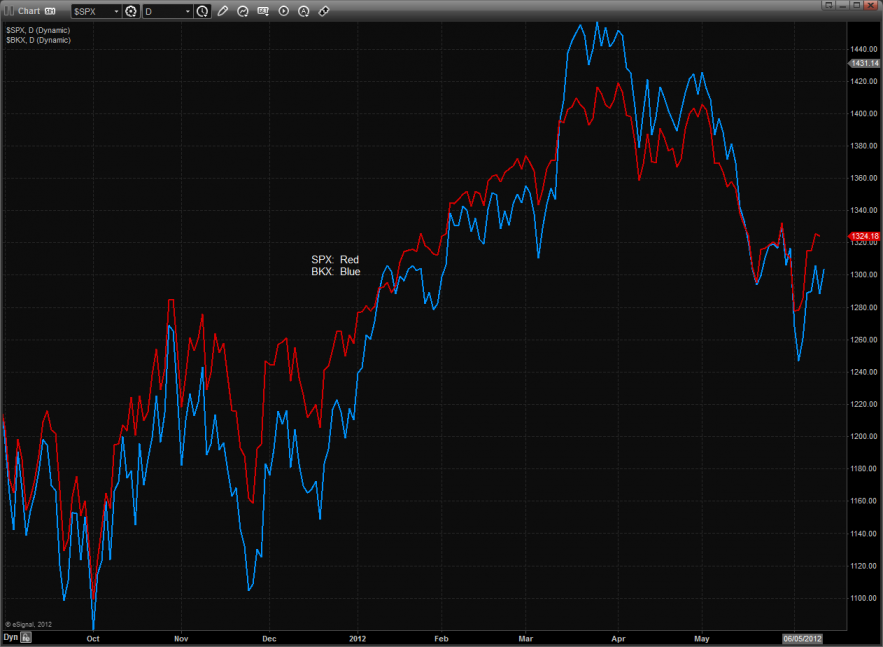

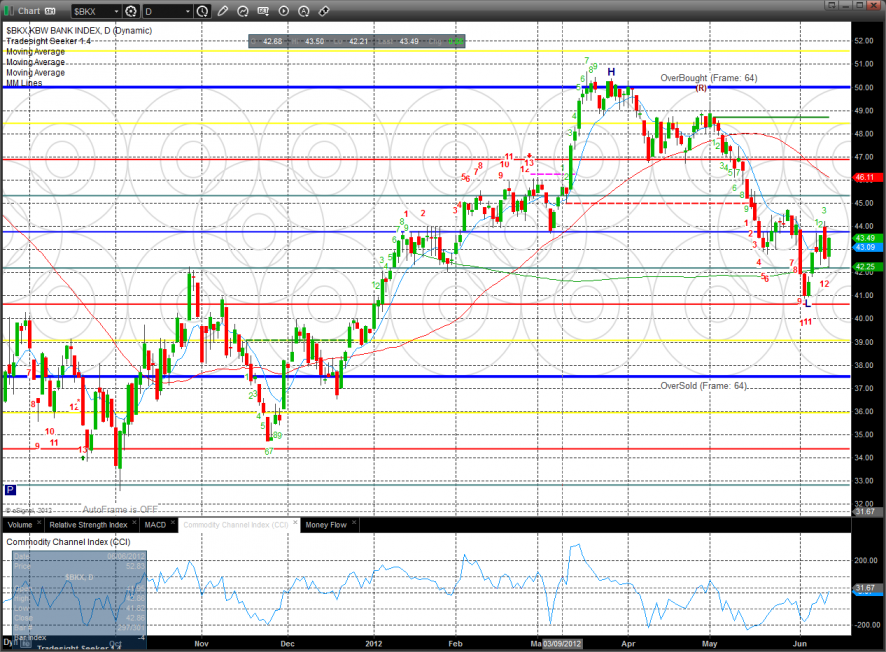

The BKX continues to bearishly lag the broad market SPX:

The SOX was the strongest sector on the day but remains boxed up. The near-term pattern could be tracing out a head and shoulders bottom.

The BKX was up a full 2% but has yet to really reverse price. Note that the Seeker countdown is 12 days down.

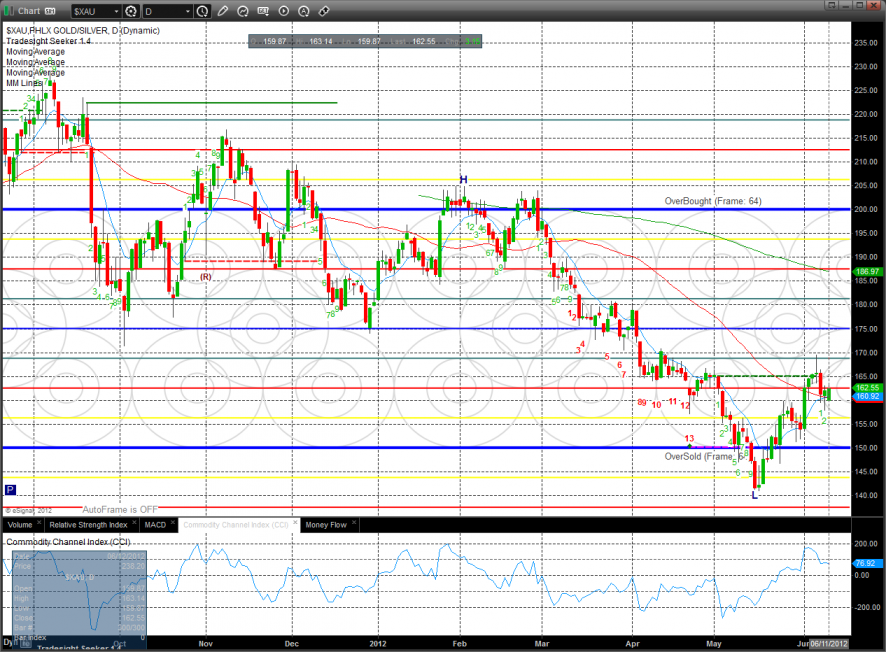

Watch the XAU for a long trade over the 2 day high.

The OSX was higher but unimpressive.

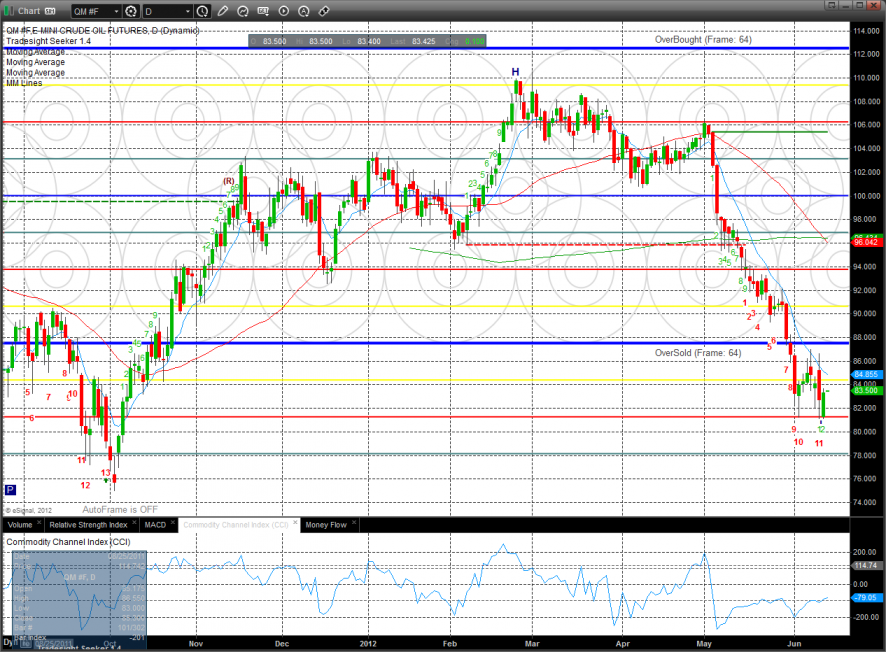

Oil used the -2/8 level for support and could reverse at any time.

Gold:

Silver: