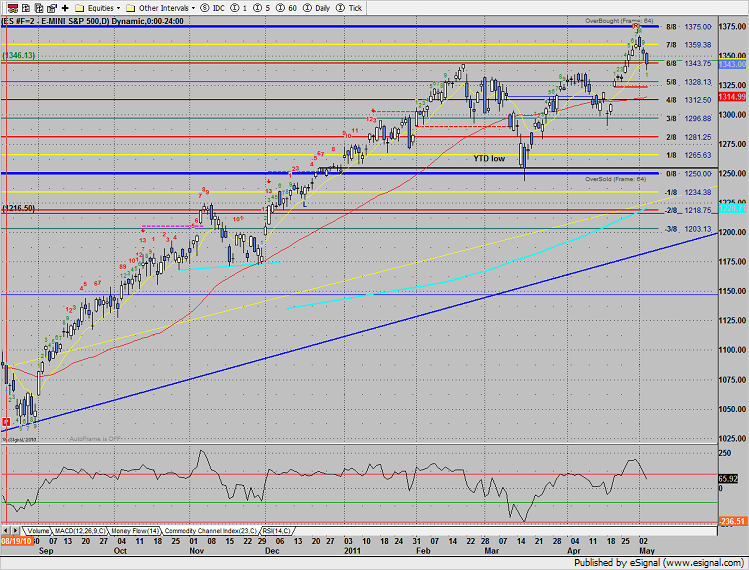

The SP saw more selling closing right at the February high and losing 9 on the day. Price has flipped where today’s close is lower than the close 4 days ago and printed day one of the Seeker buy setup. The February high and 1337 April consolidation level are the important near-term levels.

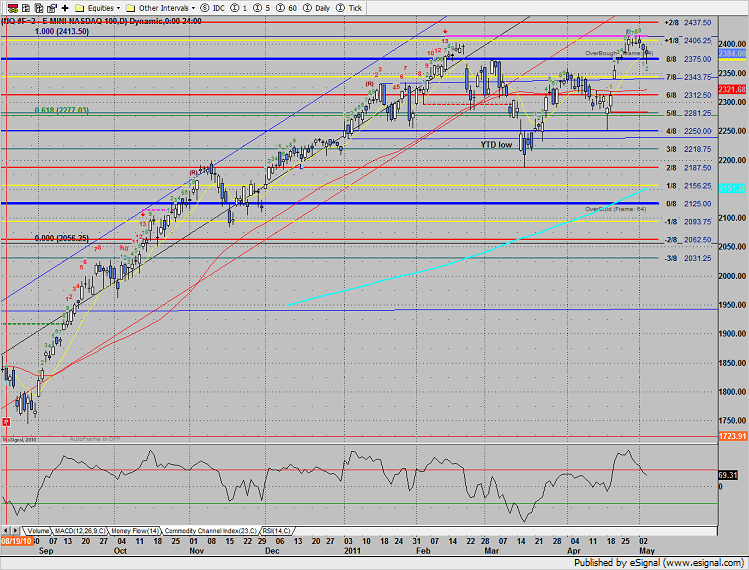

Naz was lower by 5 handles on the day but was relatively strong vs. the SP all session. This is a very important feature today and one of the few positive technical aspects.

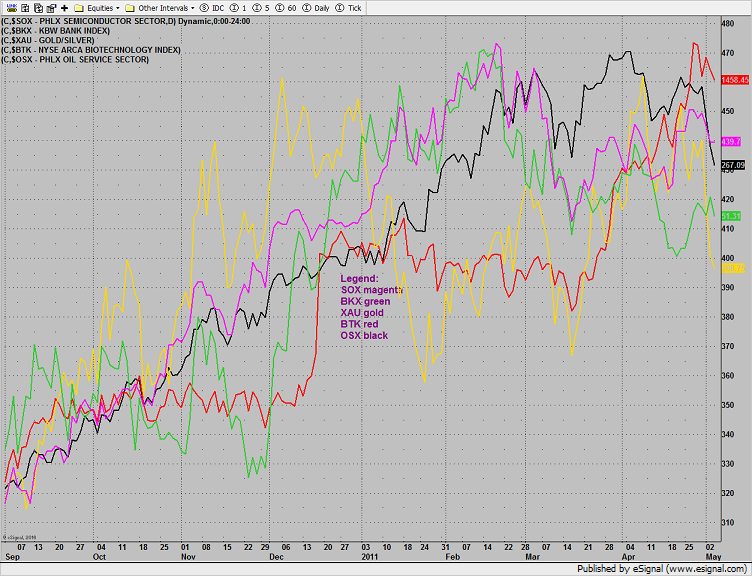

Multi sector daily chart:

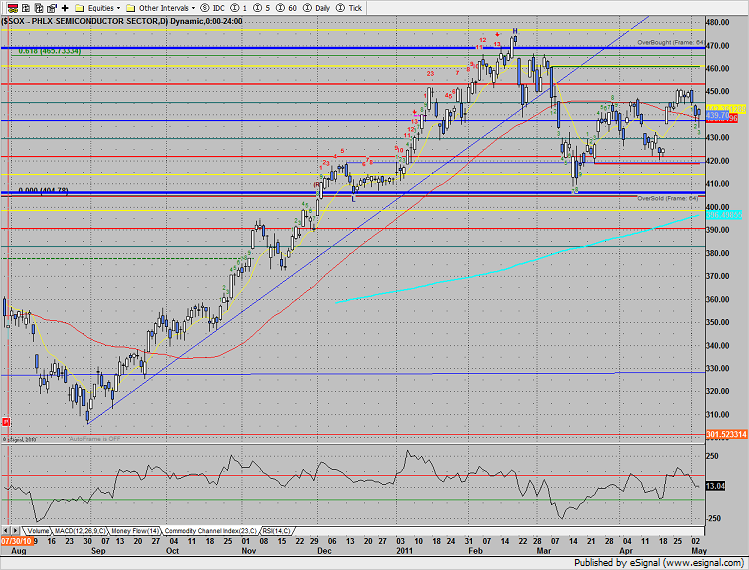

The SOX was the strongest major sector on the day. The index fought all day to keep the losses minimal and was able to close above the 50dma. Relative strength in the SOX and also relative strength in the Naz vs. SP will go a long way to minimize the losses in a broad market correction.

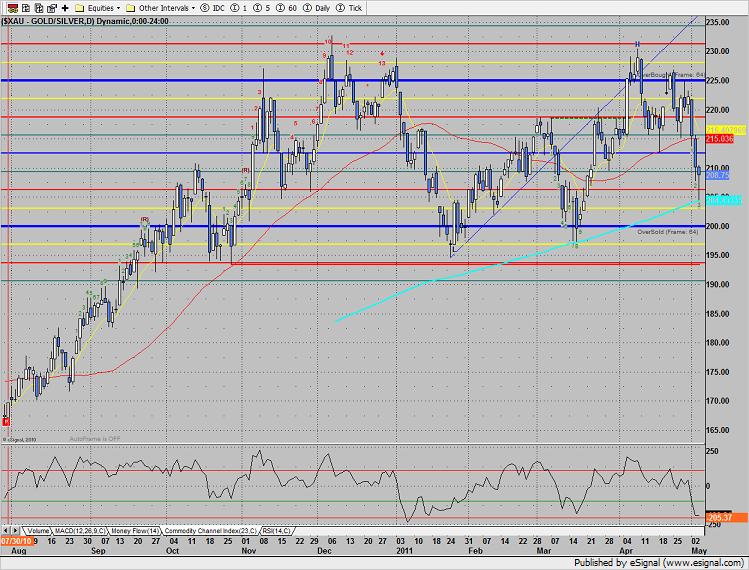

The XAU tested and found support at the 200dma. The 200 is a monster level with the current design of the chart. Be sure to set an alarm for a break under 204.30.

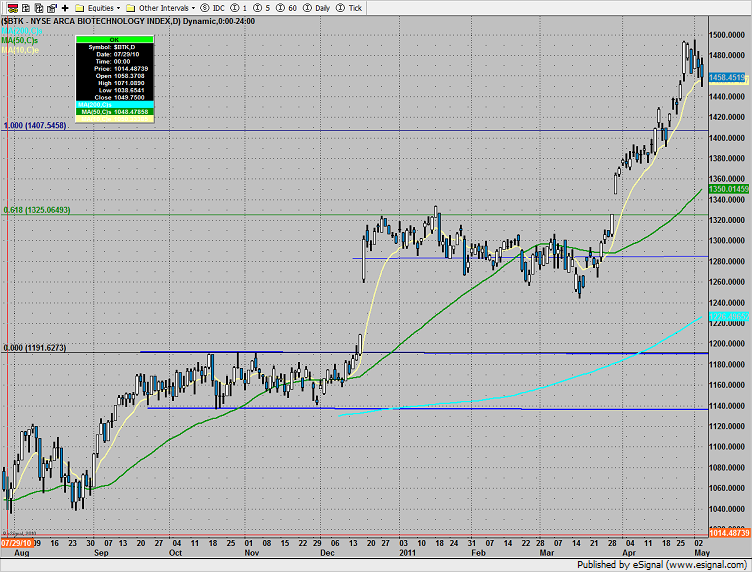

The BTK traded inline with the broad market, holding above the 10ema.

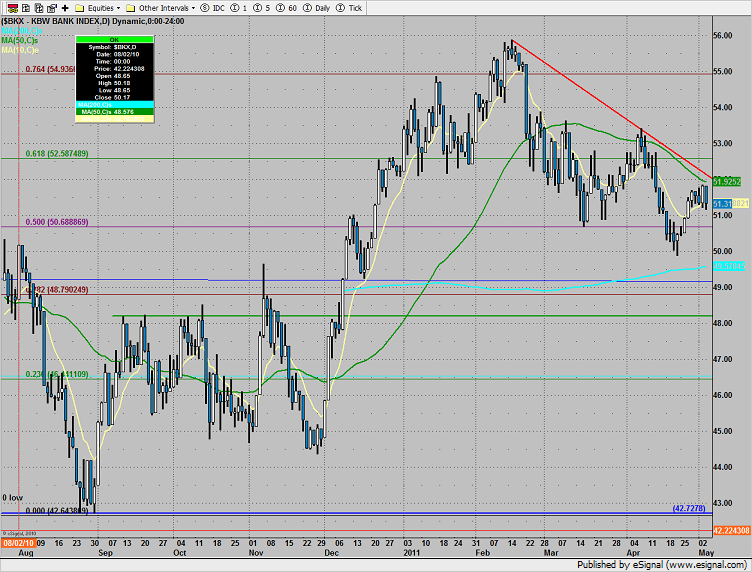

The financials were strong in the morning but faded quickly. Price remains below the declining 50dma and DTL.

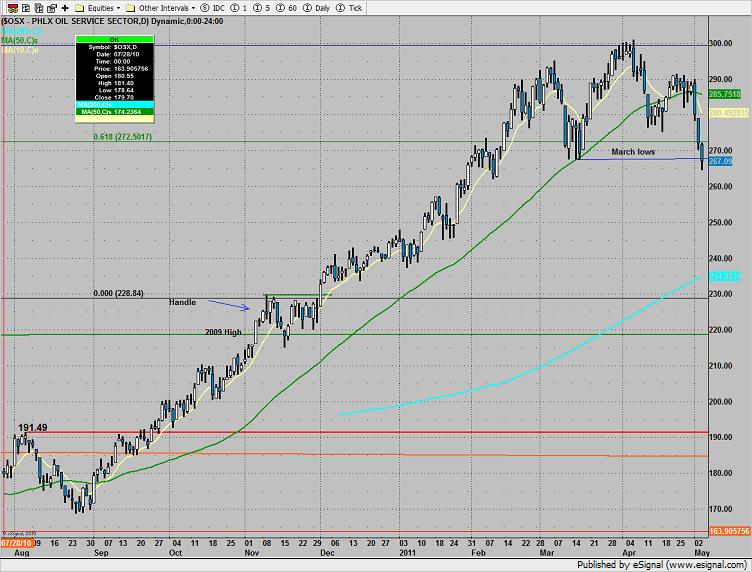

The OSX settled just below the March low which is a real negative on the chart. The chart is short-term oversold but breaking down. Notice the bearish “M” top that is now in place.

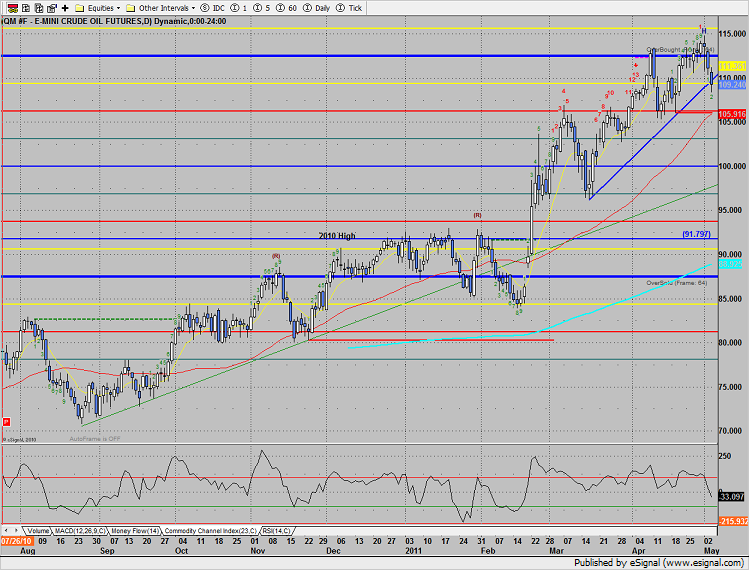

Oil broke the near-term DTL which puts the static trend line and rising 50dma in play.

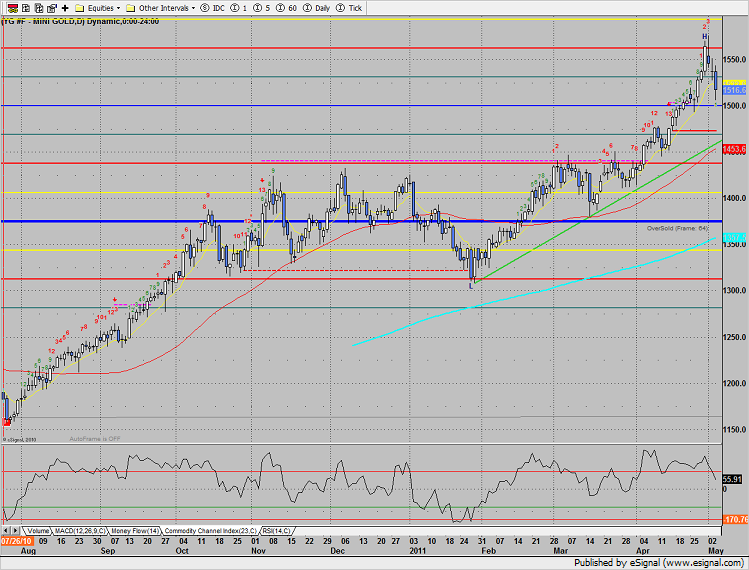

Gold broke to a new low on the week but held above 1500. Expect that with the media and gold bugs swarming, the 1.5k level is going to be big. But note on the chart, that even if gold goes below 1500, it will likely still be above the active DTL. Considering the weak intermarket relationship relative to the gold miners, gold rallies should be sold and wait for the DTL to look long.