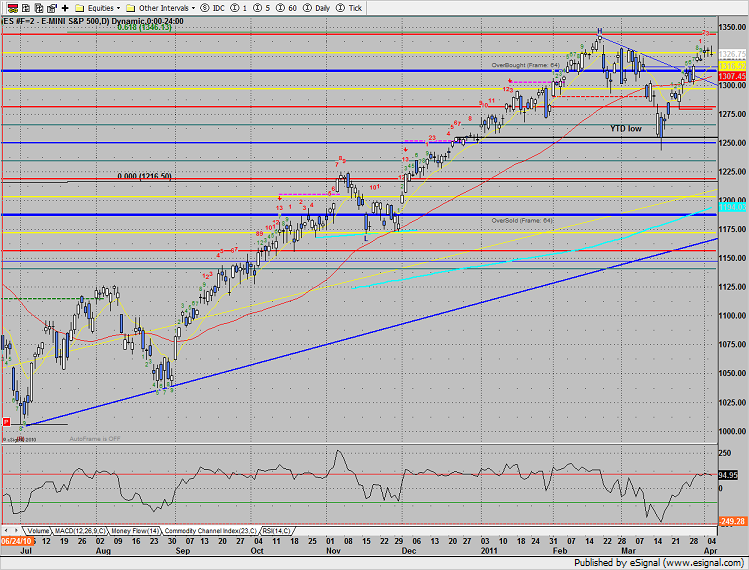

The SP remains trapped in the recent range. Intraday, price swept the prior high but settled 2 handles lower on the day. Noting decisive can be determined until price exits the mini-range on a closing basis.

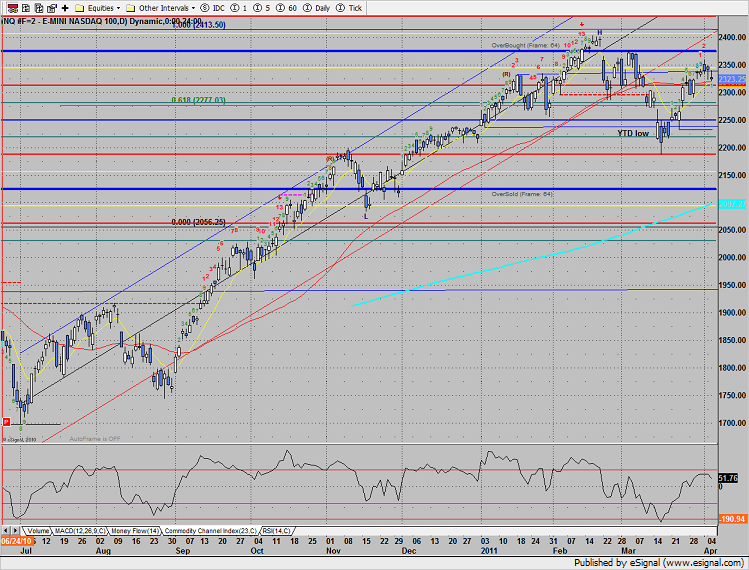

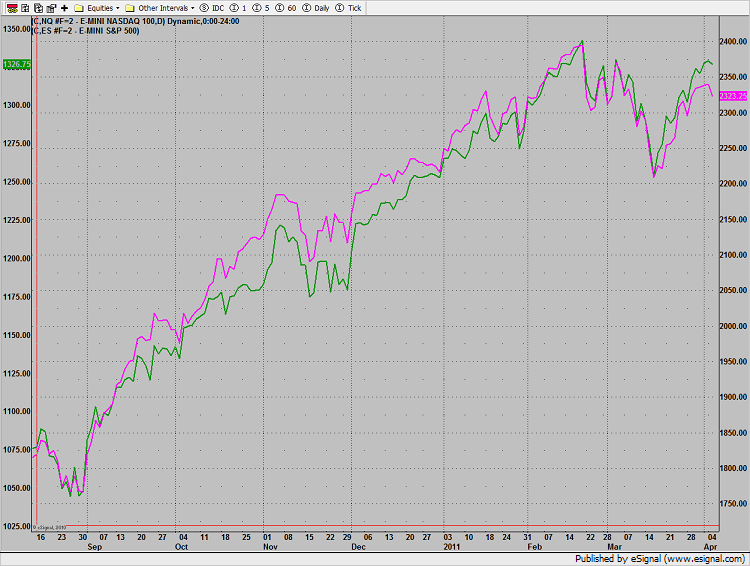

Naz was weaker by 17 on the day, settling right on the 10 and 50dmas. Note the relative weakness of the CCI on this bounce/retest. The relative weakness in the Naz vs. the SP is a problem for bull case in the market short term.

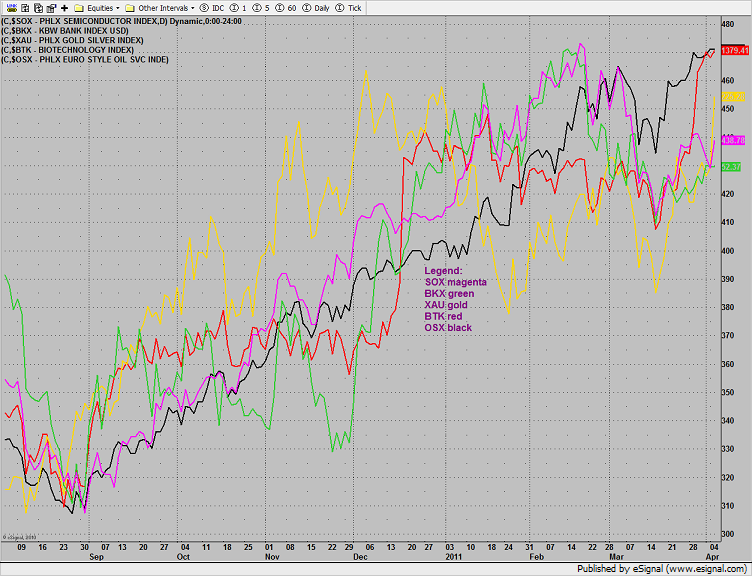

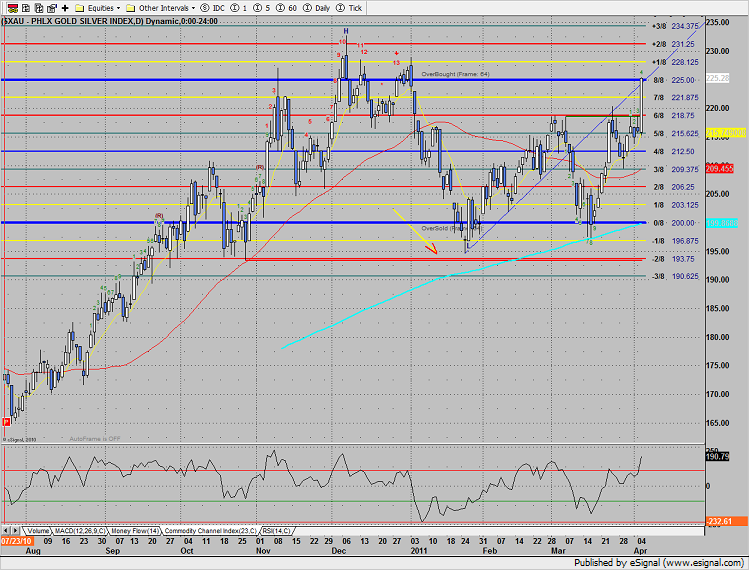

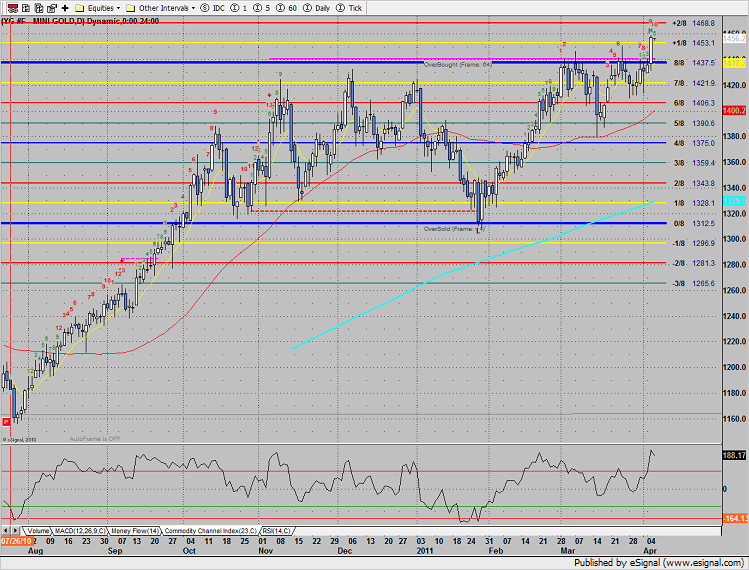

Multi sector daily chart shows the gold stocks coming on very strongly.

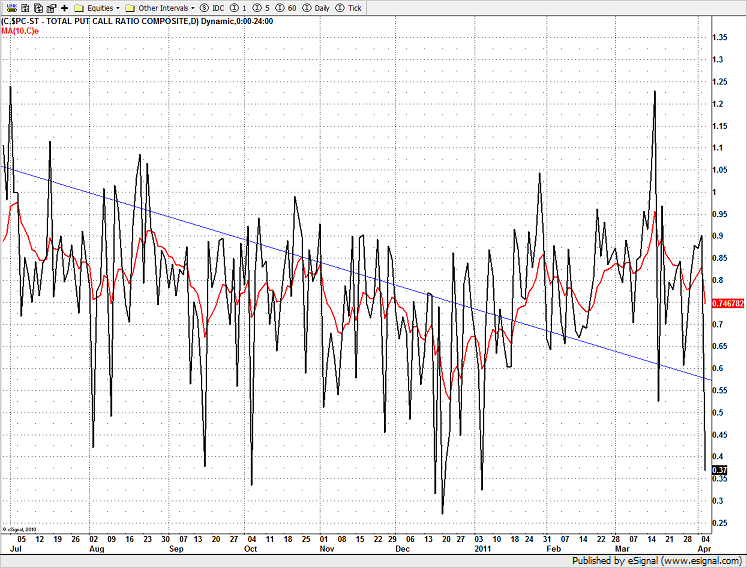

The put/call ratio took a decisive dive, implying extreme complacency.

Naz continues to underperform the SP which is always concerning for the bulls. Naz is illustrated in the chart below in magenta.

The XAU exploded through the static trend line to tag the 8/8 level. The gold shares were by far the strongest sector on the day. Such a strong impulse might need a measuring day before following through.

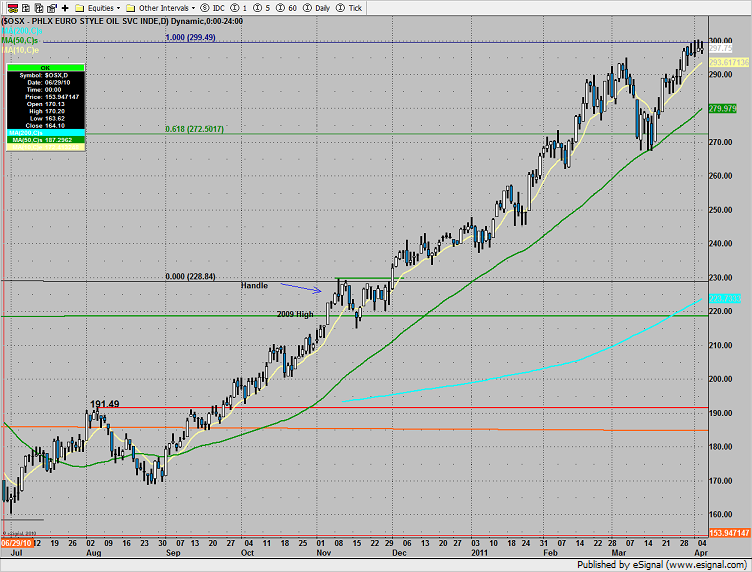

The SOX was the top gun of the “regular” sectors. Fueled by a takeover in the index, the semiconductors were higher but settled at the midpoint of the day.

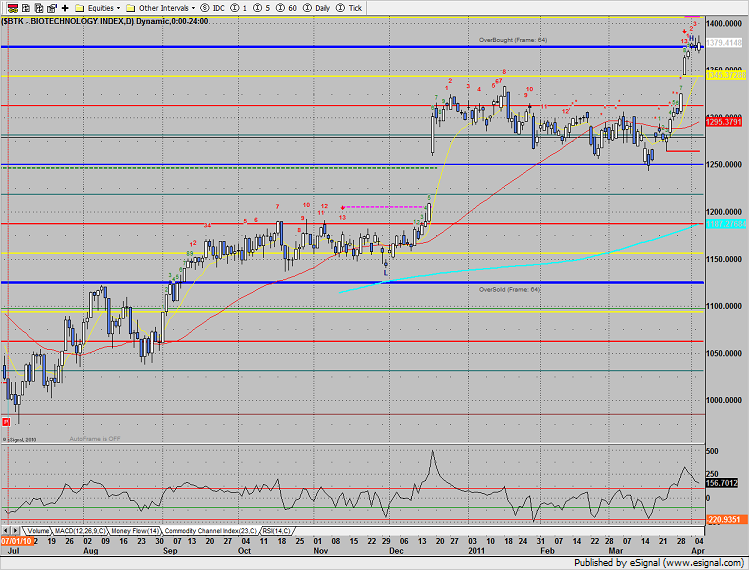

The BTK was higher on the day but couldn’t break free from the gravity of the 8/8 Gann level.

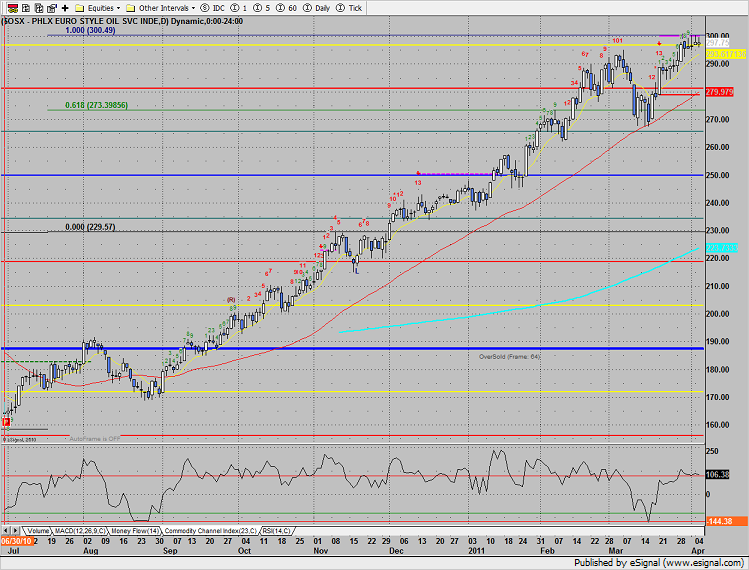

The OSX continues it’s tight trading range, still beneath the Seeker exhaustion risk level.

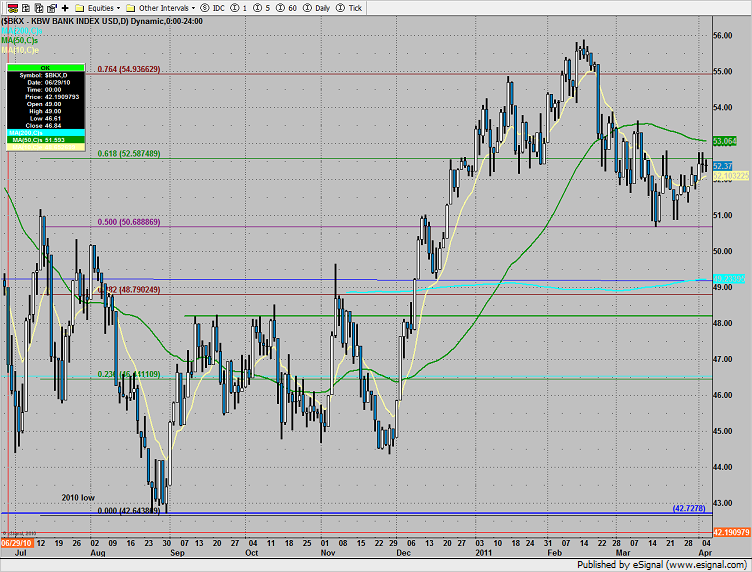

The BKX posted another indecisive candle on the chart, still below the down sloping 50dma.

Gold broke out to a new all-time high, the +2/8 level key resistance.

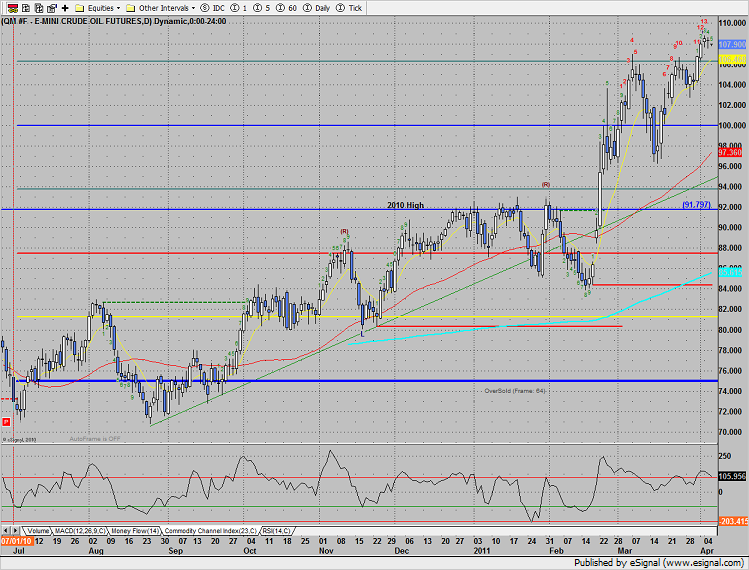

Oil was slightly lower on the day, the Seeker exhaustion signal is still active.