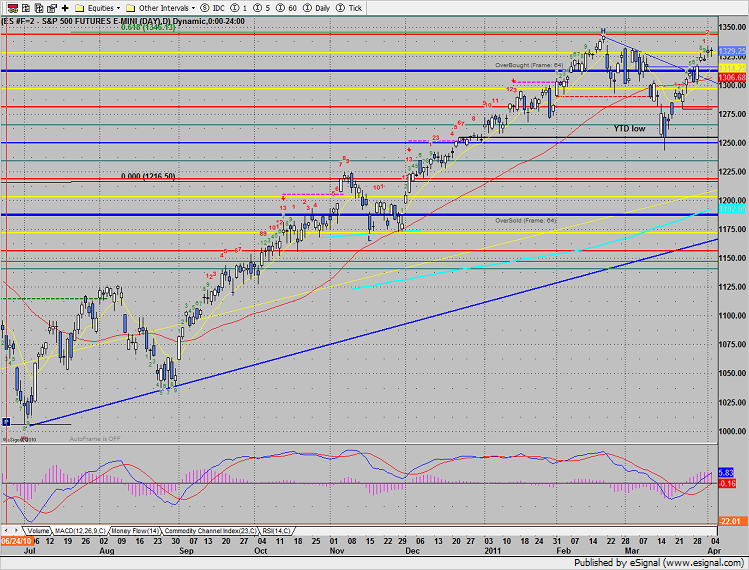

The SP posted a very narrow range inside candle on the day, almost mirroring the session from Friday. This means there is nothing new technically but the break out of the 2 day range could have some punch.

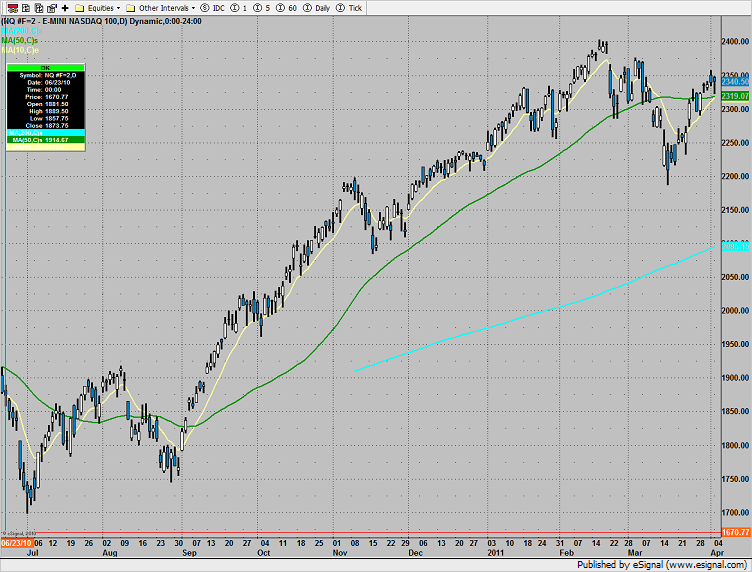

Naz was a bit weaker than the broad market until it recouped losses late in the session. Index heavyweight AAPL was weak but did not break price lower. Key support is just below where the 10 and 50dmas converge.

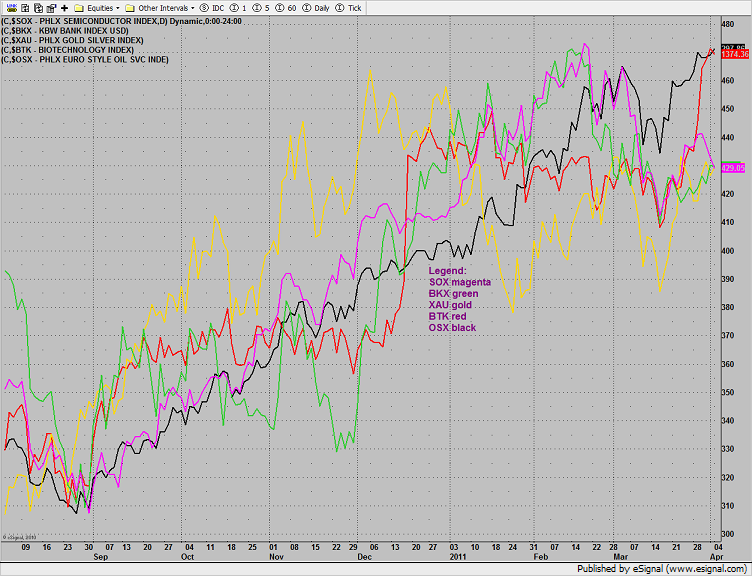

Multi sector daily chart:

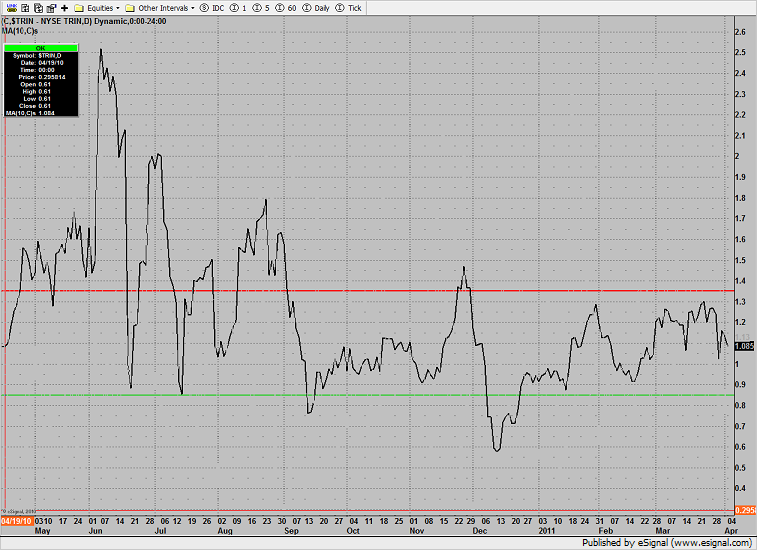

The 10-day Trin remains neutral, near the zero baseline.

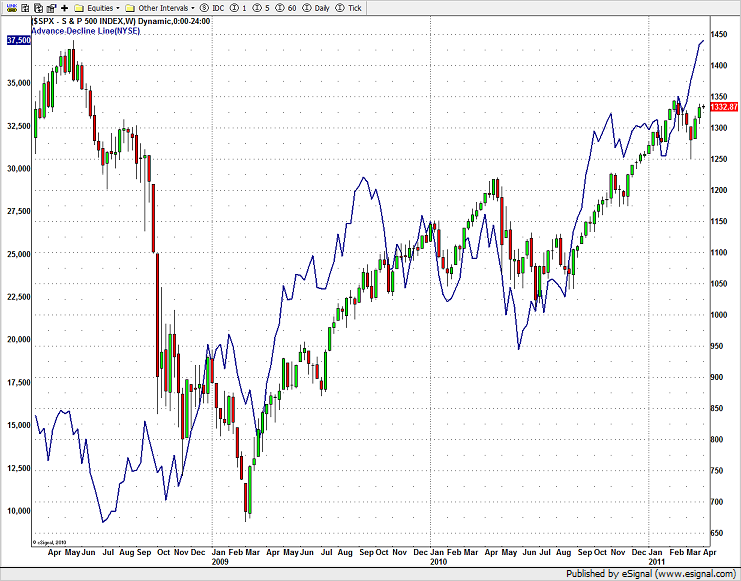

The weekly cumulative NYSE advance/decline line is still very healthy and leading price. This condition will keep a safety net under the market until the a/d line begins to underperform. Keep in mind that the cumulative a/d line almost always leads price which means that the a/d line will have to rollover before a sustained market break is probable.

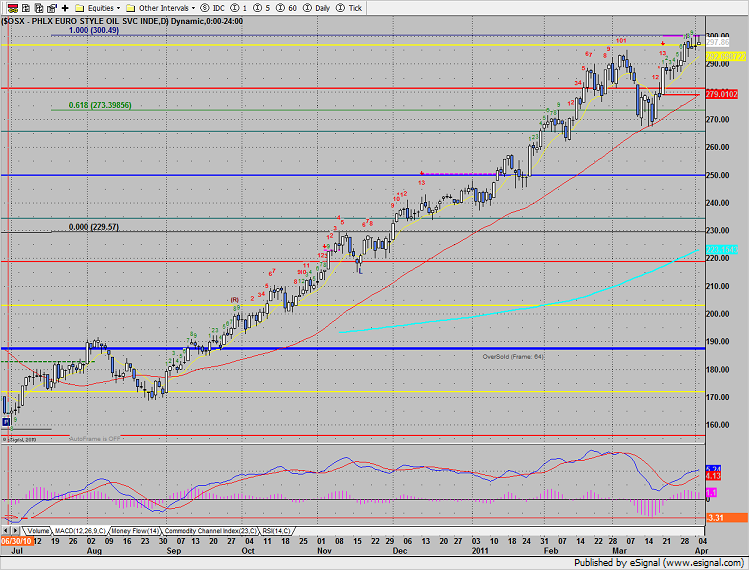

The OSX was top gun on the day and continues to have an active seeker exhaustion signal in play. The 100% Fibonacci extension remains resistance.

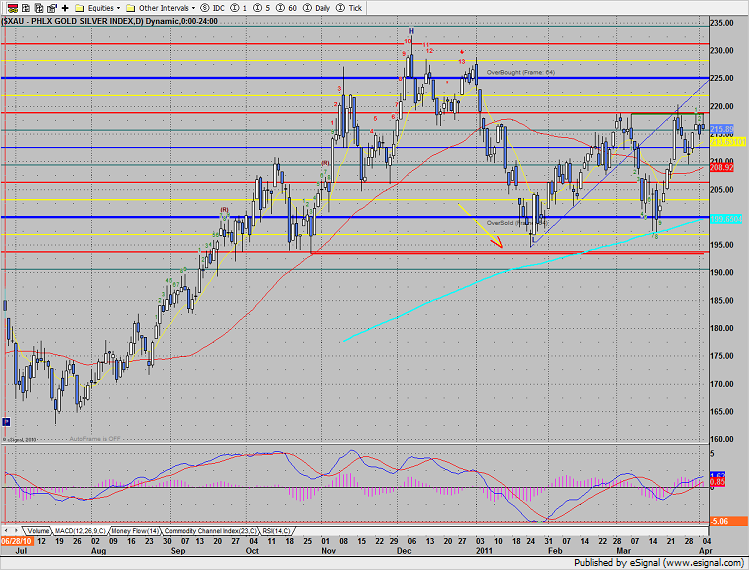

The XAU is still trapped under the active static trend line. A close above the 3/7/11 high puts 225 in play.

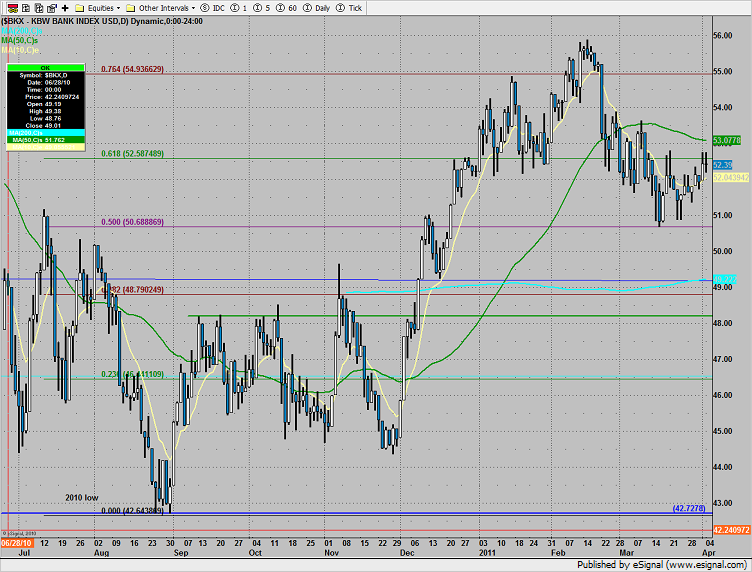

The BKX did very little closing unchanged.

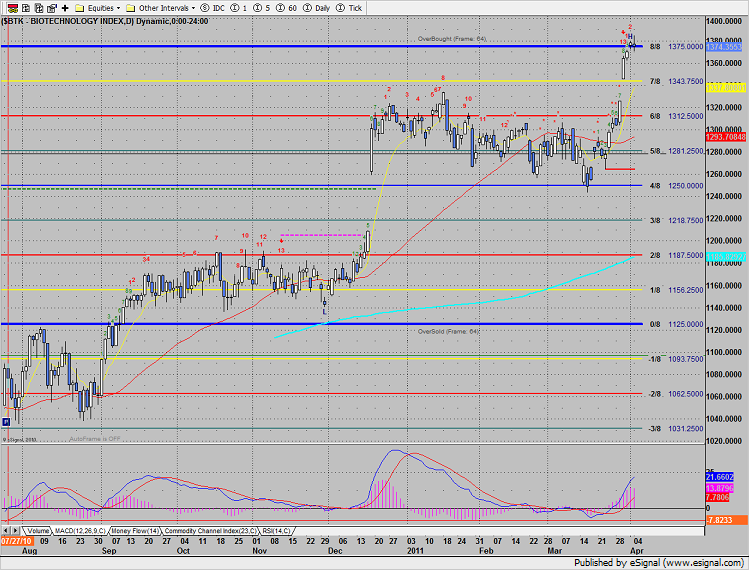

The Biotech index posted a sloppy candle, settling right at the 8/8 area. The next fib price projection is 1407.

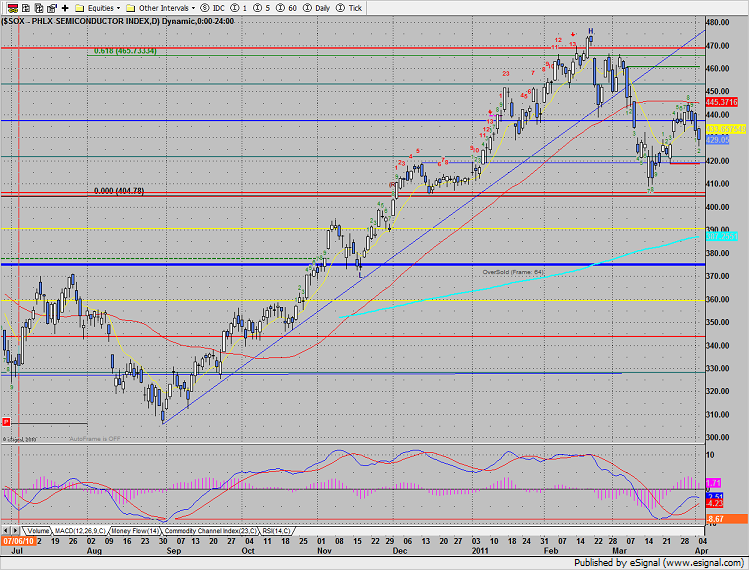

The SOX was very sloppy breaking down below the 10ema. Note that price is now counting down for a buy setup. After the bell there was a takeover announcement in the index so expect a gap up Tuesday.

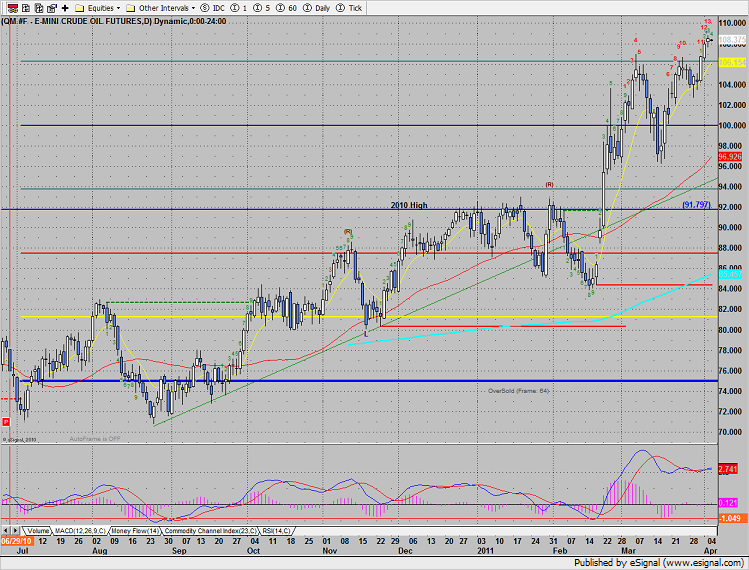

Oil was higher on the day and recorded a 13 exhaustion signal:

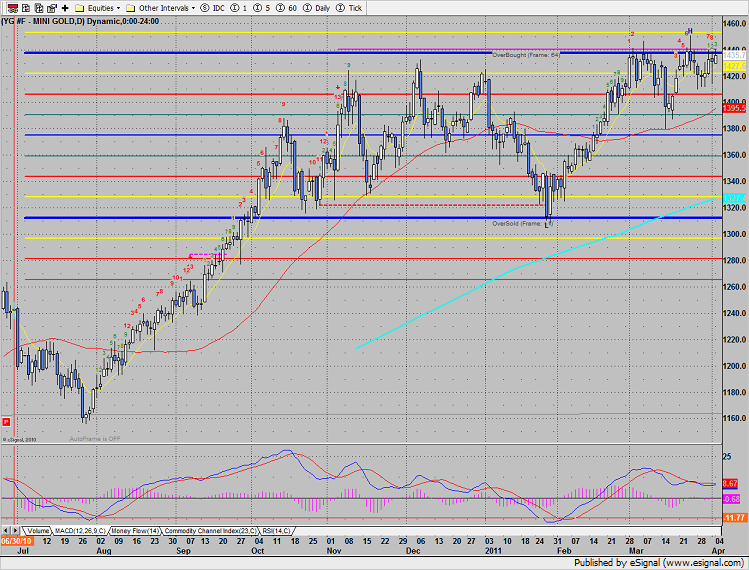

Gold was higher but didn’t produce a new high close on the move.